Elecon Engineering Technical Analysis:

Elecon engineering share is in bullish momentum. On the daily chart, the script has formed a bullish flag pattern last week. Elecon engineering share has been trading above the 245 level for the last 5 days despite the downward trend in the broader market. Further, the stock is bouncing from 246 level on the daily chart and hence treated as a support level. The volume in the counter was recorded above its long and short moving average during last week. On the weekly chart, Elecon engineering share has strong support at 214 level trading with strong volume for the last four weeks. This shows the strength of the counter and it is ready to move up.

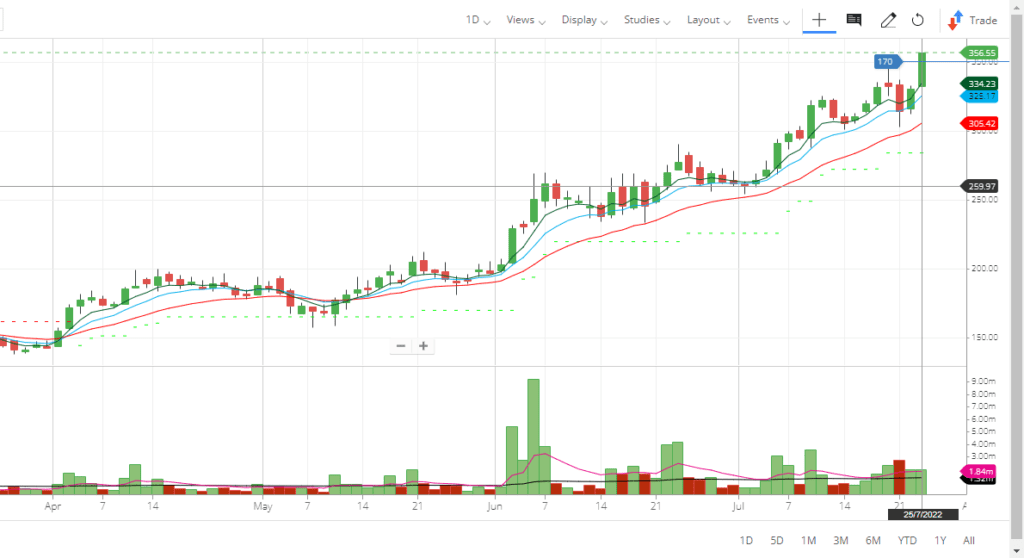

Elecon engineering share was identified at 277 level on 22-06-2022 as a momentum stock. The stock closed at 291 level on 07-07-2022 above its previous swing high of 290 level with strong volume. Elecon engineering share has formed a rounding bottom pattern and given breakout. This share is ready to move up further and can reach at least 320 level in the short term. Weekly trading volume is also strong with closing above its long-term average. Please note that these are momentum stocks for short terms.

Momentum indicators such as ADX and MACD look bullish in the daily chart. Elecon engineering share is looking strong both in the weekly and monthly chart and ready for an upward movement. The stock has crossed its 52-week high of 269 level strongly with strong volume. The counter can reach the 300 level within a short period. If broader market support, the stock may reach its all-time high of 340 level in 1 month. This counter is trading above all its moving averages.

Elecon Engineering Share Price Update after recommendation:

Elecon Engineering was recommended at level 291 to with a buy. If you look at the price level today on 25th July 2022, the price of the Elecon share has reached 358, more than 15% gain during this period which is a nice return in a month of time. Both the old chart and new and updated chart is given below for your reference.

Suggest Reading for 10 to 15 % gain – Gokex, GUJALKALI, and CARBORUNIV. All these shares can be referred to in the Momentum Stock section on the site.

Fundamental Analysis:

Elecon engineering is a pioneer in the manufacturing of Industrial Geared motors and Reducers, Material Handling Equipment, Mining equipment, casting processes, etc. It is one of the largest manufacturers of material handling equipment and industrial gear in Asia. The Indian government is pushing for infrastructure investment and the make-in-India concept. This will boost demand for equipment. Additionally, there is robust demand coming from steel, mining, and other industries from overseas. Opening of China with further boost demand for material handling equipment.

Elecon engineering is a small-cap company with a market cap of INR 2811 crores available at 20 PE and 2.68 prices to book value. The sector PE is 44.39 and PB is 4.95. The Company has been a consistent performer in terms of revenue. Over the last 5 years, the market share of Elecon engineering increased from 2.24% to 2.27%.

The company recorded total revenue of INR 1213.55 crores in FY 2022 from INR 1052.31 crores in FY 2021. Net income and EPS of Elecon engineering were recorded as more than double during this period. Net income has increased from INR 57 crores in FY 2021 to INR 140 crores in FY 2022. EPS has also increased from 5.14 to 12.52 during the same period. However, this is a cyclical play and hence can be a good bet for a short-term investment of 3 to 6 months.