VLCC healthcare IPO:

SEBI approved VLCC healthcare IPO in November 2021. VLCC healthcare was founded by Mrs. Vandana Luthra as a beauty and weight management services center in 1989. However, the company was incorporated in the year 1996, based in New Delhi, India. VLCC healthcare was among the first multi-outlet corporate operations in the Wellness & Beauty Industry.

VLCC healthcare operates twenty-six Subsidiaries, comprising two direct Subsidiaries and twenty-four step-down Subsidiaries. One of the direct subsidiaries is VLCC Personal Care Limited. VLCC Personal Care manufactures and sales personal care products such as talcum powder, face cream, face foundation, skin creams, hair dyes, shaving soaps, medicine soaps, lipsticks, eyeliner, hair remover, mascara, hair oils, sprays, perfumes, and other cosmetics in India as well as outside India.

The second direct subsidiary is VLCC International Inc. The company engaged in the business of investments, to acquire shares/ stocks/ debentures, as authorized under the objects clause of its memorandum of association.

VLCC Healthcare Products & Services:

The company offers products and services under the name of Wellness & Beauty clinics, personal care products, and skill development in beauty and nutrition. VLCC products and services can be categorized under the name of VLCC Wellness Clinics, VLCC Personal Care Products, and VLCC Institutes. Please refer to the VLCC Company profile section for more details.

Management team and Promoters:

Mrs. Vandana Luthra is one of the promoters of the company. She has over 31 years of experience in the beauty and wellness sector. Vandana Luthra is associated with the company since its incorporation in 1996. She is a recipient of the Padma Shri award for her contributions to trade and industry. Vandana was also the founding chairperson of the Beauty & Wellness Sector Skill Council. She has been featured in Femina magazine’s “Power List 2020”.

Mr. Mukesh Luthra is Chairman and Non-Executive Director of VLCC healthcare. He holds an advanced diploma in international business management from the Association of Business Managers & Administrators, United Kingdom. Mukesh Luthra has been with the company since its incorporation and has over 25 years of experience in the wellness sector. Mr. Mukesh Luthra is one of the promoters of the company.

Mr. Jayant Khosla is the Managing Director and Group Head of our Company. He holds a bachelor’s degree in mechanical engineering from the University of Delhi. He also holds a post-graduate diploma in management from the Indian Institute of Management, Ahmedabad. Jayant Khosla has had strong experience in the telecom, retail, and insurance sectors for several years. Before joining VLCC healthcare, he worked in various positions in different companies. He served as the Chief Executive Officer in reputed organizations such as Landmark Arabia, Landmark Retail, Bharti Airtel International (Netherlands) B.V., Future Generali India Life Insurance, and Essar Telecom Africa.

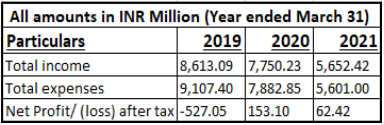

Financial snapshot:

The total revenue of VLCC healthcare is over INR 56.52 billion in 2021. The company recorded a profit of INR 62 million in the same year. The total income of the company has declined from INR 77.50 billion in the year 2020 to INR 56.52 billion in 2021 due to the luck down and subsequent impact of the COVID 19 pandemic. Now, the economy is opening up and the tourism sector is gaining momentum. The company is expecting strong growth in revenue as well as net profit over the next five years.

Initial public offering (IPO):

VLCC healthcare is coming up with an initial public offering of INR 300 crores of Fresh issues. The company is also offering for sale 8,922,672 Equity shares with a face value of INR 10. SEBI approved this IPO in November 2021. The proposed retail quota is 10% while QIB is 75% and HNI is 15%. The major portion of the net proceeds will be used for the expansion of the company and repaying the debt. The company proposes to use the net proceeds as follows.

Utilization of Net Proceeds:

1. The company is planning to set up VLCC Wellness Clinics in India and GCC Region. The company is also proposing to set up VLCC Institutes in India, and refurbishment of certain existing VLCC Wellness Clinics in India and the GCC Region. The total estimated cost for setting up wellness clinics will be around INR 832.37 million. The company is planning to set up 20 VLCC Wellness Clinics and 13 VLCC Institutes in India. In addition, the company is also setting up four VLCC Wellness Clinics in the GCC Region. A part of this amount will also be spent on to refurbishment of 25 VLCC Wellness Clinics in India and seven in the GCC Region.

2. VLCC is planning to repay and/ or pre-payment, in part or full, of certain borrowings availed by the Company and its Subsidiaries. The total estimated cost for this is about INR 660 million.

3. The company will also spend a part of the net proceeds on branding and promotion. The total estimated cost for this is INR 308 million.

4. Further, VLCC wants to invest in digital and information technology infrastructure to enhance its reach to customers. The total estimated cost for this is INR 400 million.

5. The company will also spend a certain amount of net proceeds on General corporate purposes. The amount is not disclosed by the company.

| VLCC Healthcare IPO Details | |

|---|---|

| Subscription Dates | Coming soon |

| Price Band | Coming soon |

| Fresh Issue | Up to INR 3000 million |

| Offer for Sales | Up to 8,922,672 Equity Shares |

| Equity Shares outstanding prior to the Offer | 37,668,283 Equity Shares |

| Minimum bid (lot size) | Coming soon |

| Face value | INR 10 per share |

| Listing on | BSE & NSE |