Zensar Best Company Insights

For investors who want to invest in the digital growth story of India as well as the global growth story, Zensar Technologies is one of the best investment opportunities in that segment. Despite the fall in the broader market of NSE and BSE, the Nifty IT index has given a monthly break out with a cup and handle pattern at 38,691 level and sustaining the breakout level.

Table of Contents

On the daily chart, the CNXIT index has been consolidating at the 42,000 level for some time. Once the broader market recovers, the CNXIT index will be the first to give a good return. This is not a recommendation but treat this as an analysis that supports your analysis.

Zensar Share Price Analysis

I’m bullish on Zensar Tech based on its relatively cheap valuation compared to its peers, strong forward guidance focused on sustainable growth, and leveraging its strengths in client-centricity, and innovation.

Let us analyze the company from its performance and future outlook.

Zensar Best Company Insights to Invest

Zensar Tech is one of the leading digital solutions and technology services companies with robust financial performance, strategic vision, and its position within the growing technology sector. Zensar Technologies is a part of the RPG Group, a global conglomerate with a diverse portfolio spanning various sectors. This gives comfort to investors looking to tap into a high-potential IT company.

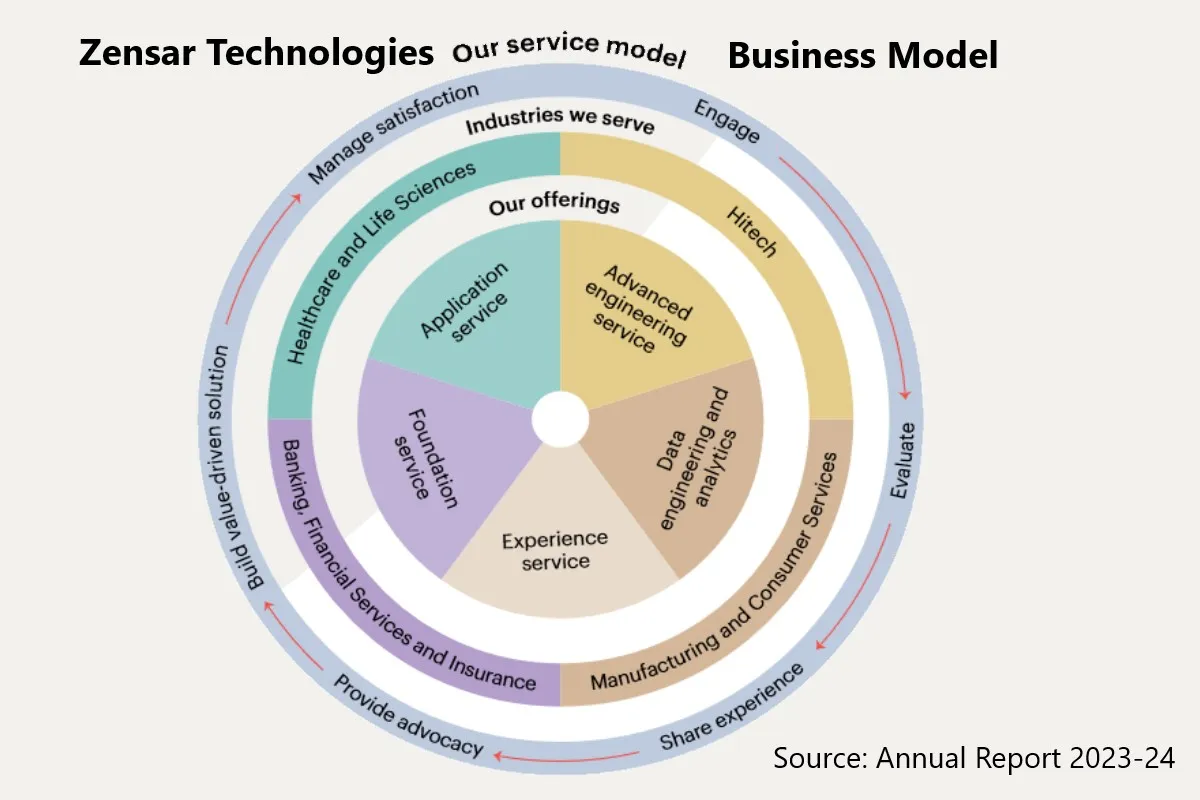

Zensar’s Business Segments

Zensar Technologies focuses on two business segments:

- Digital and Application Services (DAS): Digital Application Services constituted the largest portion at 79.7% of revenue in Q2 FY25. This was followed by Cloud Infrastructure and Security at 20.3%, indicating a growing focus on these areas.

- Digital Foundation Services (DFS): In FY24, DFS contributed INR 9,000 million to Zensar’s total revenue. This represents 18.4% of the company’s total revenue for that financial year.

- In terms of revenue by vertical, Banking and Financial Services (BFSI) constituted the largest segment at 40.9% in Q2 FY25. This suggests a strong reliance on the BFSI sector for Zensar’s revenue generation.

Digital Solutions and Technology Services Market Size

The global IT spending is expected to reach $5 trillion in 2024, representing a 6.8% increase from 2023. IT services will likely be the largest spending segment for the first time, reaching $1.5 trillion in 2024, with an 8.7% growth driven by the economic recovery of the U.S. and Europe.

The global AI market is projected to reach $320-380 billion by 2027. Generative AI (GenAI) is expected to contribute to about one-third of this market value.

The Indian fintech market is anticipated to reach USD 2.1 trillion by 2030. India’s AI market is predicted to grow at a compound annual growth rate (CAGR) of 25-35% until 2027, driven by a robust AI talent pool and investments.

In 2023, 70% of global enterprises allocated at least 20% of their technology budget to digital initiatives, a notable increase from 57% in 2022. This trend signifies the growing demand for digital solutions and technology services. This budget is expected to go up from 2025 to 2030 driven by AI and increasing digital services.

Zensar Tech Share Price Analysis

Let us discuss some key reasons why Zensar Technologies stands out as a prime investment choice.

Zensar Technologies Limited Performance Summary

- Zensar Technologies revenue for the year was Rs. 4,901 crore, a growth of 1% from the previous year. The company has done exceedingly well on the profitability front, driven by initiatives like improvement in resource utilization, rationalization of sourcing cost, pyramid optimization, and improved cost control.

- For Q1 FY25, the company had revenue of Rs. 1,288 crore, a 5% increase from Rs. 1,227 crore in Q1 FY24. The company’s net profit was close to Rs. 158 crore.

- Zensar is committed to long-term growth and plans to expand its reach, refine services, and build a stronger portfolio of innovative solutions.

- Zensar’s operations are primarily located in the United States, Europe, and South Africa. The company is pursuing cost optimization strategies across operations to ensure sustained growth and financial stability.

- Zensar has no outstanding debt. The company’s short-term credit rating was reaffirmed at A1+ and its long-term credit rating was reaffirmed at AA+ by ICRA.

- The company’s management has committed to ensuring sustainable margins. Zensar intends to manage its working capital effectively and enhance budgetary controls to achieve this.

Zensar Tech share price target

Instead of giving Zensar Tech share price target, I would prefer to do Zensar Tech share price analysis while analyzing the company’s performance from all angles so that you can decide on Zensar Tech share price target.

Zensar Technologies Revenue Growing Consistently

Zensar Technologies has demonstrated steady revenue growth over the years, despite facing macroeconomic challenges. For Q2 FY25, the company reported revenue of $156.2 million, reflecting a 4.0% year-over-year (YoY) growth in reported currency and 3.3% in constant currency.

This is a testament to the company’s resilience and its ability to navigate the complexities of the global IT services industry, providing continuous value to its stakeholders.

The company has also achieved strong sectoral growth, particularly in Banking, Financial Services & Insurance (BFSI), and Healthcare & Life Sciences, reporting YoY growth rates of 14.0% and 13.3%, respectively.

These sectors represent stable, high-demand industries, providing Zensar with a steady flow of business and long-term growth potential.

Strong Profitability and Operational Efficiency

Zensar’s profitability metrics are equally impressive, with the company achieving an EBITDA margin of 15.4% in Q2 FY25. Zensar has successfully implemented several initiatives, including optimizing its delivery model, which has helped in enhancing profitability.

In addition, Zensar’s profit after tax (PAT) stood at 11.9% in Q2 FY25, and the company’s disciplined approach to managing costs has resulted in a healthy balance sheet. With cash and cash equivalents of $255 million, the company is well-positioned to invest in future growth opportunities without compromising financial stability.

Zensar Share Price Valuation

Zensar Share Price Valuation is depending on the company’s market cap, financial performance, and future outlook. Let us discuss one by one.

Zensar Market Capitalization

- As of September 30, 2024, Zensar Technologies had a market capitalization of INR 15,311 crores, equivalent to approximately USD 1.86 billion using the current exchange rate (as of November 13, 2023).

- This market cap figure represents the total value of all outstanding shares of Zensar Technologies.

Zensar Technologies revenue

- Zensar’s financial performance can be used to assess its valuation.

- Revenue (FY24): INR 49,019 million (approximately USD 592.3 million).

- PAT (FY24): INR 8,030 million (approximately USD 80.3 million).

- EBITDA Margin (FY24): 17.8%.

- Revenue Growth (FY24): 1% YoY in USD terms.

- Order Book (Q2 FY25): Highest ever, indicating positive future revenue potential.

Zensar Shareholder Structure

- The promoter group holds a significant stake in Zensar Technologies, owning 49.1% of the outstanding shares as of September 30, 2024.

- This high promoter holding can indicate confidence in the company’s prospects.

Strong Order Book and Client Wins

One of the most encouraging signs of Zensar’s long-term growth prospects is its strong order book. Zensar Technologies has 15 clients that spend over $10 million annually. In Q2 FY25, the company secured significant new business wins, including:

- Application modernization for a global sustainable technology client.

- End-to-end IT operations transformation for a UK-based specialist banking company.

- Cloud transformation for one of the largest department stores in the USA.

- These strategic wins indicate Zensar’s ability to attract and retain large clients, positioning the company as a reliable partner for global enterprises.

- The company’s highest-ever order book in Q2 FY25 also signals continued momentum in its core business.

Innovative Solutions and Future-Ready Services

Zensar is committed to driving innovation through its digital offerings. The company is focused on delivering cutting-edge solutions across key service lines, such as cloud transformation, AI, and data engineering. Zensar offers a suite of services leveraging generative AI, including the development of custom AI models and tools. This allows clients to harness the power of generative AI for various applications.

Zensar provides comprehensive cloud transformation services, including migration, application modernization, and ongoing cloud management. Zensar’s focus on innovative solutions and future-ready services, particularly in areas like AI, cloud computing, and digital engineering, highlights its commitment to assisting clients in navigating the evolving digital landscape.

These offerings position Zensar as a strategic partner for businesses seeking to transform their operations and thrive in a technology-driven world.

Also Read: Anant Raj Limited: The Best Way to Invest in Data Center Stocks in India

Zensar Leadership

Zensar has an experienced leadership team with diverse skill sets. For example, Manish Tandon, the CEO and Managing Director, has extensive experience in the IT industry, and Harsh V. Goenka, the Chairman, brings a wealth of experience from leading RPG Enterprises. The Board of Directors comprises a mix of executive and independent directors with expertise in various areas. The company’s focus on building a client-centric organization, combined with operational excellence, has been instrumental in its recent successes.

Strategic Focus on High-Growth Sectors

- Zensar’s strategic focus on high-growth verticals, including BFSI, healthcare, and manufacturing, positions it well for future growth. The BFSI sector, in particular, has emerged as a strong revenue driver, grew by 9.3% contributing 37.7% of total revenue in FY24.

- Healthcare and Life Sciences (HLS): HLS has also shown consistent growth for Zensar. In Q2FY25, it recorded a sequential QoQ revenue growth of 8.8% and a YoY growth of 13.3%.

- The company’s geographic diversification, with a strong presence in North America, Europe, and Africa, further mitigates risks and provides access to a broad client base across key markets.

Geographical Presence of Zensar Technologies

- The US is Zensar’s largest market, contributing the majority of its revenue. In FY24, the US accounted for 67.2% of total revenue.

- Europe is Zensar’s second-largest market, generating 20.8% of total revenue in FY24. Zensar’s presence in Europe has grown, marked by wins across both existing and new clients.

- South Africa represents Zensar’s third-largest market, accounting for 12.0% of total revenue in FY24. Similar to Europe, Zensar has witnessed growth in South Africa, acquiring new clients and expanding its operations.

Service Line Expansion

Zensar aims to broaden its service offerings by adding new capabilities, especially in Enterprise-as-a-Service (EaaS) and Advanced Engineering Services (AES). These service lines are crucial for addressing the evolving needs of clients in areas like automation, cloud computing, and digital transformation.

The company is also focusing on Generative AI (GenAI) solutions and services. For example, Zensar focuses on VISCA – an image-based search solution leveraging GenAI to improve user experience. Zensar is also exploring the use of GenAI to create immersive banking experiences within virtual environments.

Final Words on Zensar Share Price

Zensar Technologies presents a strong investment opportunity, backed by its solid financial performance, commitment to innovation, and focus on sustainability. The company’s ability to secure large deals, expand its service offerings, and deliver consistent profitability makes it an attractive proposition for investors looking to benefit from the growth potential of the IT services sector.

With its strategic focus on key verticals, robust order book, and disciplined execution, Zensar is well-positioned to continue delivering value to shareholders in the coming years.