BIBA fashion IPO – BIBA Fashions got SEBI Approval For IPO. BIBA Fashion Limited DRHP filed with market regulator SEBI on April 11, 2022. BIBA fashion Limited is coming up with an Offer for Sale (OFS) of INR 2.77 Crore and a fresh issue of INR 90 Crore. The face value of each equity share will be INR 10 per equity share. Investors as well as promoters are selling part of their stakes in the company.

Utilization of Net Proceeds from BIBA fashion IPO

BIBA fashion Limited will not receive any amount from the offer for sale. However, the company will use the net proceeds from BIBA apparel IPO.

- The company will repay/ prepay, in full or part, itself and its subsidiaries’ borrowings with INR 70 Crore.

- The rest of the amount will be used for general corporate purposes.

BIBA fashion IPO – Company Overview

The company was incorporated as ‘‘BIBA Apparels Private Limited” in Maharashtra at Mumbai on July 10, 2002. The name again changed to “BIBA fashion Limited” on March 25, 2022, and a certificate of change of name was issued by the RoC.

- BIBA Fashion Limited is one of the largest lifestyle brands in the women’s Indian wear market in terms of market share.

- The company is an integrated company that develops designs, sources, markets and sells a wide portfolio.

- Biba Apparel mainly focuses on Indian wear for women and girls under the brand name BIBA, and Rangriti.

- The company’s presence is both online and offline as a sales platform.

- Biba Apparel caters to a broad range of Indian wear, ranging from casual wear, and occasionally wears to office wear.

- The company continuously expands its product range to meet a varied range of consumer needs.

- BIBA Fashion also has a presence in the jewelry, footwear, wallets, and fragrances categories.

- The company had 427 exclusive brand outlets across 27 states and 160 cities in India, 930 LFSs across 29 states and 267 cities in India, and 30 MBOs.

- Over 37% of its total revenue comes from online sales.

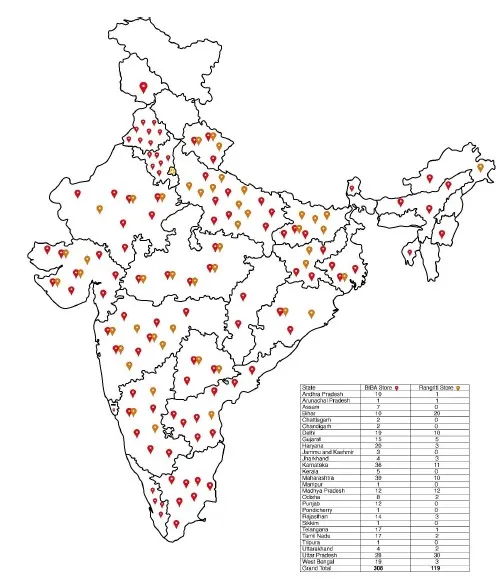

Biba Apparel Presence across India

BIBA apparel IPO – Company Founders and Leadership team

BIBA fashion is led by a highly experienced senior management team. Meena Bindra is the founder and Executive Director of BIBA fashion. She has been continuing to be a part of strategic planning, conceptualization, design, and product development.

Siddharath Bindra is one of the promoters and Managing Director of the company. He has been involved in the business for over 25 years, with extensive expertise in sourcing, designing, retailing, and establishing distribution channel partnerships.

Shradha Bindra is one of the promoters of BIBA Apparel. She holds a professional diploma in fashion design and technology from the London Centre for Fashion Studies. She has 26 years of experience in the fields of fashion and design.

Brand BIBA Financial Turnover

- The company’s financial performance over the years mentioned is not good.

- Revenue from the operation declined in FY20 and FY 21 due to the COVID situation and subsequent luck down in FY 2022.

- However, in comparison with other peers such as FabIndia, Neeru’s, and Ritu Kumar, HOAD – BIBA fashion performed better in ROCE and RONW.

- The average Revenue per sq. ft. per month of BIBA Fashion is INR 700-750 which is considered as good in comparison to peers.

BIBA fashion Limited IPO – Valuation Parameters

| All amounts in INR Million (Year ended March 31) | 2019 | 2020 | 2021 |

|---|---|---|---|

| Revenue Operation | 7,294.05 | 7,572.08 | 5,258.20 |

| Total Income | 7,357.37 | 7,661.46 | 5,691.79 |

| Total Borrowings | 1,034.47 | 1,441.60 | 1,097.81 |

| EBITDA | 1,297.07 | 1,352.78 | 623.11 |

| EBITDA Margin | 17.8% | 17.9% | 11.9% |

| Profit After Tax | 202.43 | 89.09 | (118.40) |

| Net Profit Margin | 2.78% | 1.18% | (2.25) % |

| Earnings Per Share-Diluted | 1.69 | 0.74 | (0.96) |

| Net Cash from Operating Activities | 1,101.39 | 759.71 | 608.45 |

| Net Debt/Equity | 34.17% | 49.96% | 33.89% |

| RoNW % | 7.31% | 3.07% | (3.74) % |

| ROCE (%) | 16.69% | 14.80% | 5.28% |

| NAV Per Share | 23.96 | 24.05 | 25.28 |

BIBA fashion IPO: Do you invest?

- Strong brand name with experienced promoters.

- The company is also expanding its operation in overseas markets.

- As of December 31, 2021, our products were available in stores in two overseas countries, Canada and Nepal.

- In January 2022, the company opened its first store in the United Arab Emirates.

- BIBA Fashion is also planning to open its outlets in the United States at the end of the first quarter of the financial year 2023.

- The strong presence of BIBA brand in ~308, Rangriti (~119) EBOs as against its closest peers Fabindia (309), W (333), Aurelia (231)

- A strong Indian economy and changing fashion towards ethnicity will help the company’s performance.

- Share of Ecommerce in Total Sales of Women’s Indian wear is expected to be ~21% in 2025 from ~12% in 2020 (Covid scenario)

- I would love to apply for the IPO of the company provided the valuation is affordable.

- The price band of each equity share has not been announced by the company yet. Let us wait to see the valuation before investing in the IPO.

BIBA Fashion Limited IPO Details

| BIBA Fashion Limited IPO Details | Details |

|---|---|

| BIBA Fashion Limited IPO Subscription Dates | Coming soon |

| BIBA Fashion Limited IPO Pricing band | Coming soon |

| BIBA Fashion Limited IPO Allotment date | Coming soon |

| Refunds Initiation date | Coming soon |

| Credit of Shares to Demat Account | Coming soon |

| BIBA Fashion Limited IPO Listing Date | Coming soon |

| BIBA Fashion Limited IPO Fresh Issue | INR 70 Crore |

| BIBA Fashion Limited IPO Offer for Sale | 27,762,010 Equity Shares |

| Equity Shares outstanding prior to the Offer | 125,062,833 Equity Shares |

| Minimum bid (lot size) | Coming soon |

| Face Value | INR 10 per share |

| Listing on | BSE & NSE |

Suggested Readings

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Here are some suggested readings on company insights Prasol Chemicals Limited, Concord Biotech Limited, Sah Polymers Company

BIBA Apparel IPO Contact Details and lead managers

| Contact Details | Lead Managers |

| BIBA Fashion Limited 13th Floor, Capital Cyber Scape Sector-59, Golf Course Extension Road Gurugram, Gurgaon – 122 102, Haryana Telephone: +91 124 5047000 Email: companysecretary@bibaindia.com www.biba.in | 1. JM Financial Limited 2. Ambit Private Limited 3. DAM Capital Advisors Limited (Formerly IDFC Securities Limited) 4. Equirus Capital Private Limited 5. HSBC Securities and Capital Markets (India) Private Limited |

BIBA fashion IPO Allotment Status

BIBA fashion IPO allotment will be available on Link Intime’s website. To know your allotment status, get ready with your PAN number and click on this link.