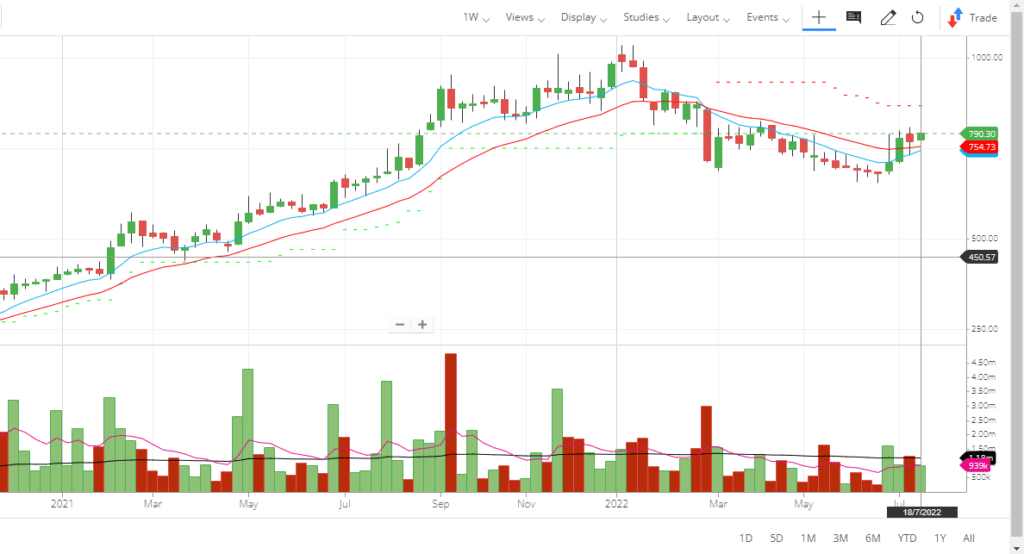

CARBORUNIV Share Price Technical Analysis:

Carborundum Universal Limited (CARBORUNIV) share price is expected to move up sharply with the support of the broader market. On the daily chart, the counter is trading above all its major moving averages with strong trading volume. The monthly and weekly average delivery trading volume is above 60%, which shows strong demand for this counter. The stock completed its correction and formed a double bottom at the 659 level. The counter faced resistance at 808 level and came down and traded at its support level. Once the stock starts trading up, it will quickly reach the 825 level which is again a resistance. One may invest at this level for 50 bps in a short period.

Momentum indicators ADX and MACD are looking bullish on the daily chart. Further, the stock has the potential to reach its 52-week high of 1035 level if the broader market supports it. CARBORUNIV share is trading at 43.6 Price to Earnings (PE) and available at 5.92 price-to-book (PB) value while sector PE is 45 PE and 4.95 PB. The debt-to-equity ratio of the company is at 0.09 times in FY22. The counter seems cheap in comparison to its sector valuation and debt-to-equity ratio. One can accumulate this stock at this level or on dips for long-term gain. The counter is in momentum.

Carborundum Universal Limited Fundamental Analysis:

Carborundum Universal Limited is a part of the Murugappa group. The company was founded in 1954 as a tripartite collaboration between the Murugappa Group, The Carborundum Co., USA, and the Universal Grinding Wheel Co. Ltd., U.K. Carborundum Universal is an integrated mine-to-market company. The Company manufactures Coated Abrasives and Bonded Abrasives in India. In addition, the company manufactures Super Refractories, Electro Minerals, Industrial Ceramics and Ceramic Fibres, and Composites. The company manufactures a range of over 20,000 varieties of Abrasives, Ceramics, Refractory products, and electro-minerals across several locations in and outside the country.

Carboruniv is internationally recognized as a manufacturer of quality abrasives and a provider of total grinding solutions. The company exported to more than 50 countries across North America, Europe, Australia, South Africa, and Asia. The company has a manufacturing plant presence in major countries such as India, the USA, South Africa, the US, etc.

Carborundum Universal Limited Financial Analysis:

CARBORUNIV recorded a growth of consolidated Revenue by 25% to reach INR 3384.88 Cr in FY22 from IMR 2688.71 Cr in FY21. EBITDA has gone up by 20% from INR 497.66 cr to INR 596.75 cr during the same period. The net income of the company has gone up by 17% from INR 284.31 cr in FY 2021 to INR 333.34 cr in FY 2022. EPS of the company has also increased from 15 in FY21 to 17.57 in FY22. However, with the growth in Indian GDP and manufacturing industry, the revenue of the company is likely to go up and hence the EPS.

Carborundum Universal Limited is a mid-cap company with a market cap of INR 14539 crores with a face value of INR 1. As per the company presentation, the company has an AA+ credit rating. The return on capital employed is 20% while the return on equity is 14 percent. This data supports a strong financial performance and higher margins with a strong valuation of this counter. Promoters have slightly declined their holdings from 41.96 in Dec 2021 to 41.94 percent in Mar 2022, almost remaining the same. FIIs have slightly reduced their holdings from 10.54% to 10.2% percent during this period. However, DII has increased its holdings in the company from 25.9% in Dec 2021 to 26.31 % in March 2022.

Suggested Reading – Read other momentum stocks CARBORUNIV, Jamna Auto Industries and, GOKEX

Management:

CARBORUNIV Limited is run by strong management and promoters. The company is part of the Murugappa group, known for its strong management. Mr. M M Murugappan is the Chairman of the company. He is an expert in chemical and environmental science. Mr. Sanjay Jayarathnavelu is an expert in Engineering and manufacturing industry.