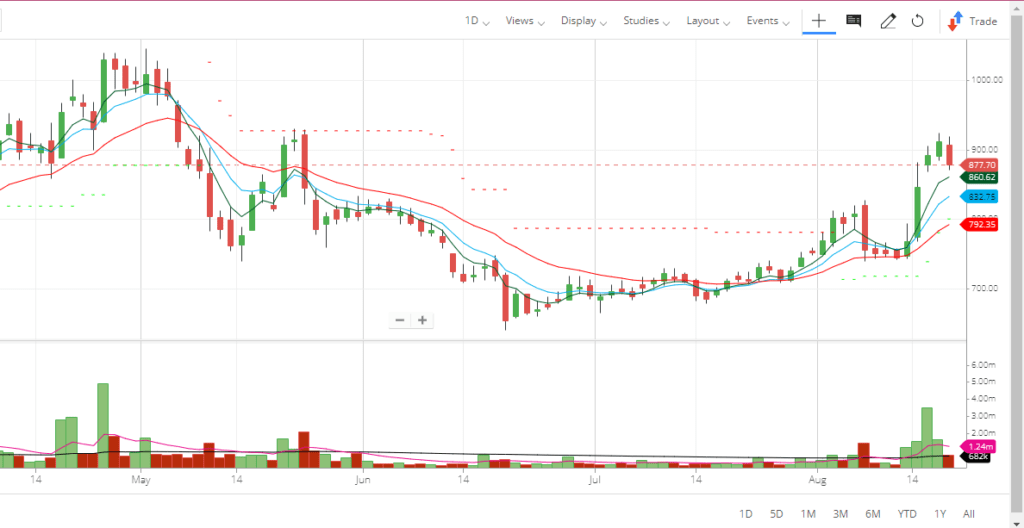

Updates after ~25 days the counter suggested

GUJALKALI share price still has potential to reach its all-time high of 1040. Gujarat Alkalies share is one of the best counters for momentum stocks. The company performed very well in the Jun 2022 quarter. The stock is expected to move up sharply to reach the 900 level. This counter was suggested at 730 level on 28th July and it reached 807 level on 4th August. The share price of Gujarat Alkalies and Chemicals reached 924 level on August 18 and corrected a bit.

- The gujalkali share price target will be 1250 in six months

- The stock has potential to go up again after reaching its all-time high of 1040 shortly if broader market supports.

- The volume has been strong for the last four days, which is above its long- and short-term moving average with an upward price movement.

- Weekly volume is also strong with an upward movement of price.

- It will reach its all-time high of 1040 and move beyond that withing short period of time.

- Global supply of Caustic soda may be down due to power crunch in Europe and China pollution mandates. This will act as a tail wind for this counter.

- FIIs have increased their holdings slightly from 1.82 percent to 2.05 percent from March 2022 to June 2022.

- FII holdings has doubled over the last year from 1.36 percent in June 2021 to 2.05 percent in June 2022.

GUJALKALI Share Price – Technical Analysis

Gujarat Alkalies and Chemicals Limited (Gujalkali) share price looking strong in its technical chart with strong trading volume. The trading volume of the script is above its 100 DMA volume. It seems the counter is ready to move up in the next 10 to 15 days. The stock completed its correction and formed a bottom at the 655 level, moving up.

On the daily chart, the GUJALKALI share has formed a strong base at a range of 655 to 700 level and closed above all the short and long-term moving averages (20 DMA and 200 DMA). GUJALKALI shares closed above their previous swing of 729 and trying to close above 50DMA. Once it closes above 50 DMA, the stock has the potential to move higher and reach the 780 level and eventually 800 level within a short period. The strong result of the last quarter will help this stock to move up sharply to reach the 900 level. Eventually, Gujarat Alkalies and Chemicals Limited share will reach its all-time high of 1033 level if broader market supports.

This is a clear signal of the momentum in the stock of GUJALKALI share price. Momentum indicators ADX and MACD are looking bullish on the daily chart. One may buy at this level or at dips for a 10 to 20% gain in the short term. Further, the stock has the potential to reach an all-time high of 1033 level if the broader market supports it.

GUJALKALI share price is trading at 9.3 Price to Earnings (PE) and available at 0.97 price-to-book (PB) value while sector PE is 12.11 PE and 2.59 PB. The debt-to-equity ratio of the company is at 0.1 times in FY22. The counter seems cheap in comparison to its sector with a low debt-to-equity ratio. It is a good stock to accumulate in correction. The average trading delivery percentage of the stock is above 30% for the last month. That reflects strong demand for this stock in the market.

GUJALKALI Share Fundamental Analysis

Headquartered in Vadodara, Gujarat, India, Gujarat Alkalies founded in the year 1973. The company is one of the largest producers of Caustic Soda in India with a production capacity of 1087 TPD. The company’s manufacturing spread over 2 complexes at Vadodara and Dahej. The location of both the plants ‘Vadodara’ and ‘Dahej’ has the dual advantage of proximity to the raw material suppliers and the end users. Gujarat Alkalies accredited with ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, and ISO 50001:2018. The company mainly engaged in the business of industrial chemical products.

GUJALKALI Share Financial Analysis

Gujarat Alkalies and Chemicals Limited (GUJALKALI) delivered a strong quarterly revenue. The total revenue from the operation has increased from INR 680 crores in Q3FY21 to INR 1148 crores in Q3FY22 which is an increase of 100% during the period. The annual revenue grew from INR 2497 crores in FY21 to INR 3805 crores in FY22 which is a growth of 52% YoY.

Profit has gone up by 536% from INR 34 crores in Q3FY21 to INR 221 crores in Q3FY22. Annual profit after tax has also gone up by 237% from INR 166 crores in FY21 to INR 560 crores in FY22. This reflects strong financial numbers at both top and bottom line. With the economy opening up, the company will likely register higher revenue. Hence, both from a short and long-term point of view, this counter is expected to do well in terms of stock performance.

GUJALKALI is a small-cap company with a market cap of INR 5213 crores with a face value of INR 10. In addition, return on capital employed is ~13.5 percent while return on equity is ~9.96 percent. This data supports a strong valuation of this counter. Promoters have not changed their holdings from Dec 2021 to June 2022 and they remained the same at 46.28 percent. However, DII has remained constant in its holdings in the company at 1.63% during this period. FIIs have increased their holdings slightly from 1.52 percent to 2.05 percent from Dec 2021 to June 2022.

Updates after ~25 days the counter suggested

The company performed very well in the Jun 2022 quarter. The stock is expected to move up sharply to reach the 900 level. This counter was suggested at 730 level on 28th July and it reached 807 level on 4th August. The share price of Gujarat Alkalies and Chemicals reached 924 level on August 18.

Suggested Reading – Read other momentum stocks CARBORUNIV, Jamna Auto Industries and, GOKEX

Company Management

The Government of Gujarat is the promoter of Gujarat Alkalies and Chemicals Limited (GUJALKALI). Hence, the company is professionally managed. On the board of directors, Pankaj Kumar is the chairman of the company. Shri M.K Das and Shri J.P Gupta are directors of the company. All are from Indian administrative services and hence are highly qualified to run the company.

Tired from daily activities, take a break for outing. Go on holiday, search for a destination here.