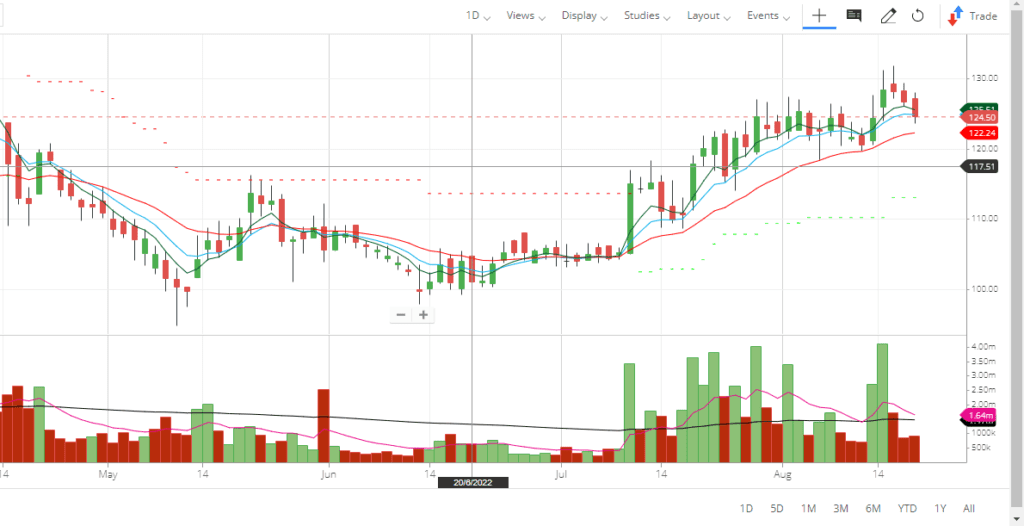

PCBL Share Price Technical Analysis

PCBL Share Price looks strong in its technical chart with a strong trading volume over the last 10 trading days in the weekly chart. The trading volume of the script is above 100 DMA over the last 8 trading days. It seems the counter is ready to move up in the next 10 to 15 days. PCBL share price completed its correction and formed a double bottom at the 100 level and is moving up.

On the daily chart, the PCBL share has formed a strong base at a range of 115 levels. Eventually, this level is the previous swing for this counter. The PCBL share price closed above all the short and long-term moving averages (20 DMA and 200 DMA). PCBL share price formed a golden cross-over at 120 level where 50 DMA crossed 200 DMA from below with strong volume. This share looks strong for both short- and long-term investments at this level.

Momentum indicators ADX and MACD are looking bullish on the daily chart. One may buy at this level or at dips for a 10 to 20% gain in the short term. Further, once it closed at the 132 level, PCBL share price has the potential to touch its all-time high of 140 level within a short period and higher in the medium term if broader market supports.

PCBL share price is trading at 10.65 Price to Earnings (PE) and available at 1.73 price-to-book (PB) value while sector PE is 12.19 PE and 2.58 PB. The debt-to-equity ratio of the company has been continuously declining from 0.5 times in FY18 to 0.26 times in FY22. The counter seems cheap in comparison to its sector PE with a low debt-to-equity ratio. It is a good stock to accumulate in correction. The average trading delivery percentage of the stock is above 40% for last month and last week. That reflects strong demand for this stock in the market. With the crude oil prices coming down and the auto sector opening up, that helps the company to go up very quickly.

PCBL Share Price Fundamental Analysis

Headquartered in Kolkata, India, PCBL is founded by Mr. K. P. Goenka in 1960 and started production at Durgapur with a production capacity of 14,000 MT per annum. The name of the Company has been changed from “Phillips Carbon Black Limited” to “PCBL Limited” from December 29, 2021. PCBL is a part of RP-Sanjiv Goenka Group, which is a well-known group in India. The company is the largest manufacturer of carbon black in India and one of the leading manufacturers globally. The company has a current production capacity of 6,03,000 MT per annum and generates 91 MW per hour of green power.

Apart from that PCBL has a strong customer base in over 45 countries across the globe. The company strategically located state-of-the-art plants at Durgapur (West Bengal), Palej (Gujarat), Mundra (Gujarat), and Kochi (Kerala). PCBL has also set up R&D centres at Palej (Gujarat) and Ghislenghien (Belgium).

PCBL Limited Financial Analysis

As per the latest investor presentation, PCBL limited delivered a strong annual revenue in FY22. The company operates in three segments – Tyres, Performance chemicals, and Speciality chemicals. The total income has increased from INR 2677 Crs in FY21 to INR 4475 Crs in FY22 which is an increase of more than 90%. The total profit has also increased from INR 314 Crores in FY21 to INR 427 in FY22. The EBITDA margin of the company has gone up by 15% from INR 526 Crores in FY21 to INR 660 Crores in FY22.

PCBL has been focusing on increasing the capacity of the specialty chemical segment. Revenue from the specialty segment has gone up from 6% of the total revenue in FY21 to 8% of total revenue in FY22. Revenue from the tires segment remains at the same at 65% while for the performance chemical segment, the revenue has declined from 29% in FY21 to 27% in FY22.

PCBL limited is a small-cap company with a market cap of INR 4535 crores with a face value of INR 1. Return on capital employed is ~18.2 percent while return on equity is ~18.4 percent. Promoters have not changed their holdings from December 2021 to June 2022 and they remained the same at 51.38 percent. DII has increased its holdings in the company from 3.44 % in June 2021 to 7.3% in June 2022. DII shareholding also increased from 6.41% in Mar 2022 to 7.3% in June 2022. FIIs have also increased their holdings from 9.46 percent in Mar 2022 to 10.18 percent in June 2022.This reflects strong demand for PCBL shares both for short- and long-term investment purposes.

Company Promoters and Management

PCBL limited is run by well-qualified and experienced professionals. Dr. Sanjiv Goenka is the Chairman of the company. The group is a well-known brand in India as well globally. The Group’s businesses spanning six sectors – Power & Natural Resources, Carbon Black, Retail, Media & Entertainment, and IT & Education, include flagship companies such as Phillips Carbon Black Ltd, CESC Limited, Firstsource Solutions Ltd and Saregama India Ltd. Dr. Sanjiv Goenka has over 20 years of experience in this group. He was a former President of the Confederation of Indian Industries (CII) as well as the All-India Management Institute (AIMA). Dr. Goenka is also a member of the Prime Minister’s Council on Trade & Industry.

Other board members of the company also have strong experience in their respective areas. Kaushik Roy is the Managing Director of the company. Preeti Goenka, Shashwat Goenka, Paras K Chowdhary, Pradip Roy, Rusha Mitra, R K Agarwal, T C Suseel Kumar, and K. Jairaj are other directors of the company.

Suggested Reading on Momentum stock section India Glycols and Gokex