India Glycols Share Price Technical Analysis

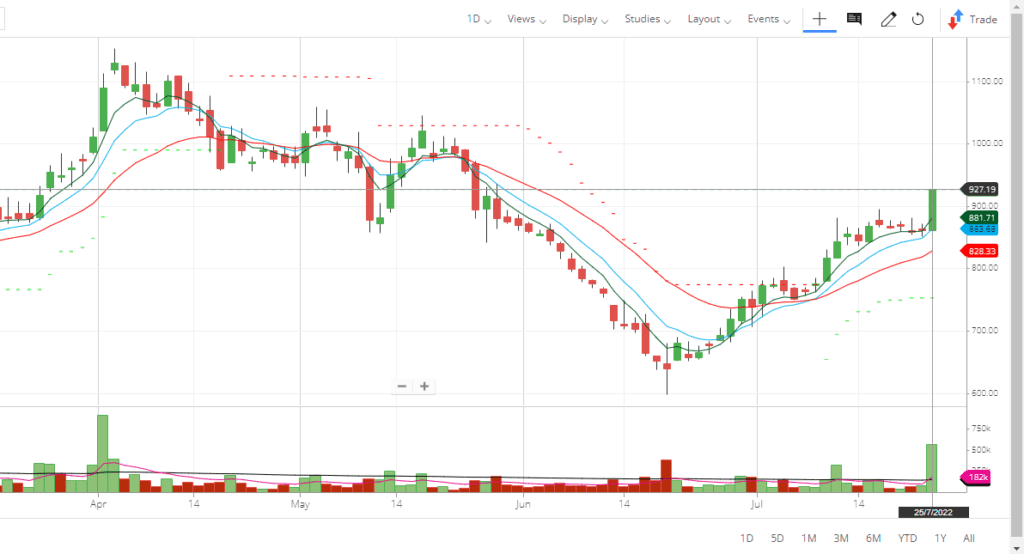

India Glycols share price looking strong in its technical chart with strong trading volume over the last 10 trading days. The trading volume of the script is above 100 DMA over the last 5 trading days. It seems the counter is ready to move up in the next 10 to 15 days. The stock completed its correction and formed a bottom at the 640 level, moving up. On the daily chart, the India Glycols share price has formed a strong base at a range of 840 to 896 level and closed above all the short and long-term moving averages (20 DMA and 200 DMA).

India Glycols share price has been closed above its previous swing of 895. The counter is moving towards 965 which can be resistant in the near term. India Glycols share price has formed a bullish cross over at 860 level where 50 DMA crossed 200 DMA from below. This crossover is considered a golden crossover technically. The share price may move to its all-time high very fast. See the volume of last two days on 26-08-2022.

Momentum indicators ADX and MACD are looking bullish on the daily chart. One may buy at this level or on dips for a 10 to 20% gain in the short term. Further, once it closed at 1020, India Glycols share share has the potential to touch its all-time high of 1152 level within a short period.

India Glycols share price is trading at 7.85 Price to Earnings (PE) and available at 2.28 price-to-book (PB) value while sector PE is 12.32 PE and 2.65 PB. The debt-to-equity ratio of the company is at 0.58 times in FY22 which has declined from 0.85 times in FY21. India Glycols share price seems cheap in comparison to its sector PE with a low debt-to-equity ratio.

It is a good stock to accumulate in correction. The average trading delivery percentage of the stock is above 40% for the last Week. That reflects strong demand for this stock in the market. With the crude oil prices coming down that helps the chemical industry as a whole, this counter is likely to go up very quickly.

India Glycols Share Price Fundamental Analysis

Headquartered in Noida, India, India Glycols is founded in the year 1983. The company has one of the leading manufacturers of glycols, ethoxylates and PEGs, performance chemicals, glycol ethers and acetates, natural gums, and potable alcohol. These products are manufactured in compliance with stringent global standards of plant operations, quality, and safety. The company’s chemicals division is manufacturing ethylene oxide and derivatives, using the molasses-ethylene ’green route’. This is the only one of its kind in the world.

Apart from chemicals, India Glycols has also a presence in the natural active pharmaceuticals and nutraceuticals space with Ennature Biopharma. India Glycols is also a presence in the natural gum division manufacturing guar gum and a variety of derivatives. The company also manufactures country and Indian-made foreign liquor adhering to the highest quality standards and is also a well-established player in the Indian sugar industry.

India Glycols share Price Financial Analysis

India Glycols delivered a strong annual revenue in FY22. The total revenue from the operation has increased from INR 5390 Crs in FY21 to INR 6596.33 Crs in FY22 which is an increase of 22% during the period. The total annual revenue grew from INR 5402 Crs in FY21 to INR 6626.86 Crs in FY22 which is a growth of 22.6% YoY. However, quarterly revenue has slightly declined from INR 1,767.98 Crs on Dec, 21 to INR 1,498.34 Crs on Mar 22 due to increasing prices of crude oil and other raw materials.

Annual profit has gone up by 200% from INR 84 Crs in FY21 to INR 285 Crs in FY22. However, quarterly profit after tax has slightly declined from INR 21.89 crores in FY21 to INR 19.02 crores in FY22. With the economy opening up, and crude oil prices going down, the company will likely register higher revenue and growth in profit in the next June 22 quarter. Hence, both from a short and long-term point of view, this counter is expected to do well in terms of stock performance.

India Glycols is a small-cap company with a market cap of INR 2666 crores with a face value of INR 10. Return on capital employed is ~8.85 percent while return on equity is ~10.4 percent. Promoters have not changed their holdings from June 2021 to June 2022 and they remained the same at 61.01 percent. DII has increased its holdings in the company from 0.02 % in June 2021 to 5.2% in June 2022. DII shareholding also increased from 4.62% in Mar 2022 to 5.2% in June 2022. However, FIIs have decreased their holdings from 2.18 percent in Mar 2022 to 1.31 percent in June 2022.

Suggested reading on the momentum share GOKEX and GUJALKALI

Company Management

India Glycols is run by well-qualified and experienced professionals. Mr. Rupark Sarswat is the Chief Executive Officer of the company. He is with the company for around 2 years. Mr. Rupark has over 27 years of experience in company operation in the chemical industry. Before joining India Glycols, he worked with Silox India Private Limited as a managing director.

He also worked with Croda – a chemical manufacturing company that creates and sells specialty chemicals – in a different position for over 13 years. Mr. Rupark holds a B Tech, in Chemical Engineering from the Indian Institute of Technology (Banaras Hindu University), Varanasi. He also completed the 3TP Senior Management Program, Business Administration and Management, from the Indian Institute of Management Ahmedabad.

Anand Singhal is the Chief Financial Officer of the company. He holds a Chartered Accountant degree and has been working with the company for over 14 years. Mr. Singhal has over 25 years of experience in the financial area and has strong knowledge of raising funds. Before taking this assignment, he worked with Abhihek Industries Limited for over 9 years in different positions.