BALAMINES Share Price Technical Analysis

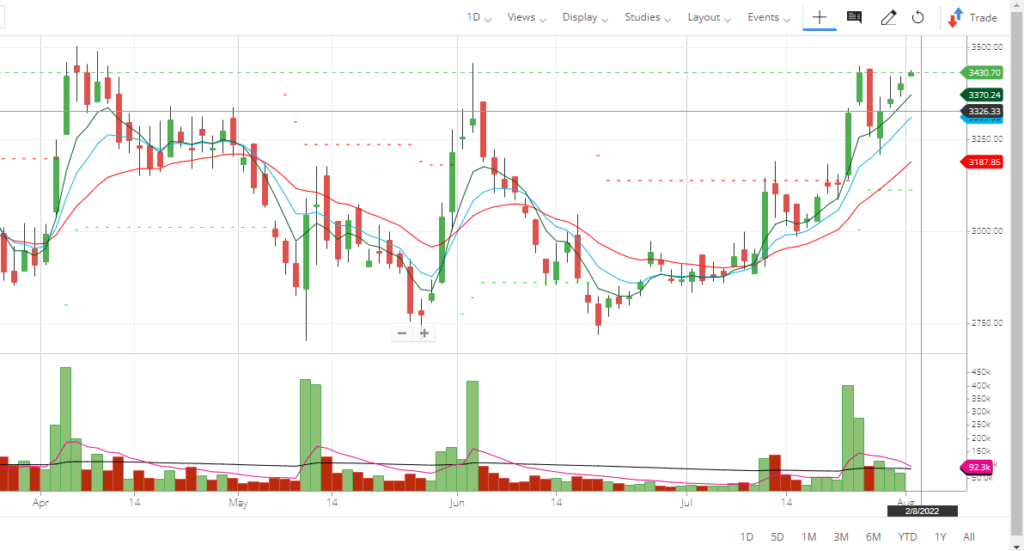

BALAMINES (Balaji Amines Ltd) share price looked strong in its technical chart with strong trading volume over the last 10 trading days. The trading volume of the script is above 100 DMA over the last 5 trading days. It seems the counter is ready to move up in the next 10 days. The stock has formed a golden cross when 50 EMA is crossed above its 200 EMA at the 3058 level.

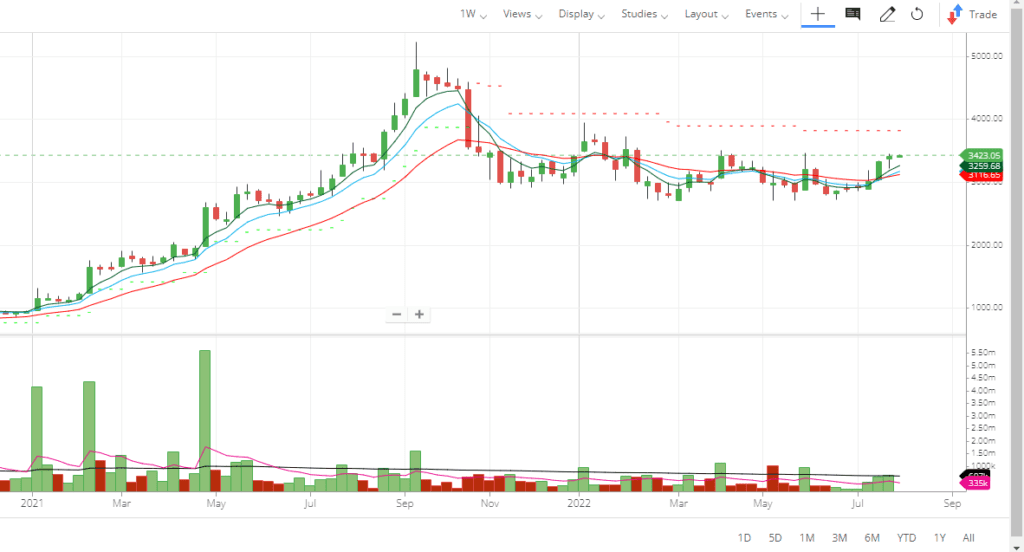

The stock completed its correction and formed a double bottom at the 2710 level and is moving up. BALAMINES’ share price is trading above all its short and long-term moving averages on the daily chart. The stock is also trading above its super trend. On the weekly chart, the share has formed a rounding bottom pattern and closed near its previous swing high of 3477 level. On the daily chart, the BALAMINES share has formed a strong base at a range of 3212 and 3321 levels.

Once the BALAMINES share price closes above its previous swing high of 3462, it will easily reach the 3800 level in the short term. The stock is forming higher highs for the last three trading days on 29 Jul. 22. BALAMINES share price has formed a “W” pattern on its daily chart and closed above it with strong volume. This share looks strong for both short- and long-term investments at this level.

BALAMINES Share Momentum Indicators

Momentum indicators ADX and MACD are looking bullish on the daily chart. One may buy at this level or at dips for a 10 to 20% gain in the short term. BALAMINES shares are trading at 29.9 Price to Earnings (PE) and available at 8.38 price-to-book (PB) value while sector PE is 12.7 PE and 2.66 PB. The debt-to-equity ratio of the company has been declining continuously from 0.11 times in FY21 to 0.6 in FY22. The counter seems expensive in comparison to its sector PE. However, the fundamentals of the company with a low debt-to-equity ratio make it attractive. It is a good stock to accumulate in correction.

Balaji Amines Ltd Fundamental Analysis

Fundamentally, Balaji Amines Ltd’s (BALAMINES) is a strong company. It is an ISO 9001: 2015 certified company that manufactures Methylamines, Ethylamines, Derivatives of Specialty Chemicals, and Pharma Excipients that cater to various Pharma and Pesticide industries. BALAMINES is one of the leading manufacturers of Aliphatic Amines in India. The company was set up in the year 1988 to cater to the growing requirements of value-based Specialty Chemicals.

BALAMINES has 5 manufacturing plants in India with a total capacity of 2,31,000 MT. The company mostly caters to the domestic needs of its product. BALAMINES has a manufacturing facility located at Tamalwadi Village, near Solapur, Maharashtra, India. It manufactures products that can be categorized as Amines, Derivatives, Specialty chemicals, and Pharma Excipients. The company’s presence in 23 countries across the region internationally. About 81% of the revenue comes from domestic sales and 19% of revenue comes from exports.

Balaji Amines Ltd Financial Analysis

As per the latest investor presentation, BALAMINES limited delivered a strong quarterly revenue with 87% growth YoY from INR 417 crores in Q4FY21 to INR 781.15 crores in Q4FY22. EBITDA is also has increased by 50% during the same period from INR 132 crores in Q4FY21 to INR 199 crores in Q4FY22. PAT (Profit after tax) has increased by 47% from INR 88.81 crores in Q4FY21 to INR 130.85 crores in Q4FY22.

The total annual revenue has increased by 76.6% from INR 1,317.53 Crs in FY21 to INR 2,327.60 Crs in FY22. The EBITDA of the company has gone up by 68% from INR 379.30 crores to INR 637.39 Crores in FY22. Profit after tax has gone up by 71% to reach INR 417.90 Crores in FY22 from INR 243.50 in FY21. The YoY EPS also has gone up by 54.67% from INR 73.5 in FY21 to reach INR113.71 in FY22. This reflects the strong financial performance of the company.

FII Confident on the Company

The CAPEX of the company has been completed and the company commences its operations by the end of May 2022. This plant will have the capacity to manufacture about 15,000 tons of DMC per annum & 15,000 tons of Propylene Glycol per annum. At peak capacity utilization, this plant will be able to generate revenue of Rs. 300 to 400 crore per annum. This will add to the top line of the company.

BALAMINES limited is a mid-cap company with a market cap of INR 11019 crores with a face value of INR 2. Return on capital employed is ~50.2 percent while return on equity is ~34.4 percent. Promoters have not changed their holdings from June 2021 to June 2022 and they remained the same at 53.7 percent. DII has increased its holdings in the company from 0.16 % in March 2022 to 0.19% in June 2022. However, FIIs have also increased their holdings from 3.99 percent in Mar 2022 to 4.51 percent in June 2022.This reflects that FIIs are confident about the company’s performance. Over the last year, FIIs have increased their shareholdings from 2.35 % in June 2021 to 4.51% in June 2022.

Balaji Amines Ltd Promoters and Management

BALAMINES is run by strong leadership. Mr. A. Pratap Reddy is the executive chairman of the company. He is a Civil Engineer by education. Mr. Pratap Reddy has been with the company since 1988. BAL’s continuing success is a testimony to his entrepreneurial skills.

Mr. D. Ram Reddy is the Managing Director of the company. He has over 35 years of experience across various businesses. Mr. Ram Reddy is focusing on establishing customer and supplier relationships with leading buyers and suppliers.

Mr. G. Hemanth Reddy is the Whole Time Director & CFO of the company. He has over 30 years of experience in corporate finance. Mr. Hemanth Reddy is responsible for finance, operations & administration along with Hyderabad Operations.

Suggested Reading on Momentum stock section India Glycols, Gokex, and PCBL