Best GCC companies in India that lead the way in Tech, Finance, Pharma, etc. for New GCC companies Entries and Announcements Across All Sectors in 2025 beyond

Share With Friends

Global Capability Centres in India (GCCs) have swiftly evolved beyond traditional back-office operations. Fueled by the 2025 spike in US H1-B visa costs, GCCs in India are now strategic command centers driving innovation, digital transformation, and global business leadership for multinational corporations. In the new era of cross-border talent mobility, India is not just riding the wave—it’s building it.

Table of Contents

The journey of GCCs began in the 1990s, paralleling India’s IT and outsourcing boom. Initial GCCs—set up by pioneers like Texas Instruments and Citibank—focused on cost optimization and support functions. Throughout the 2000s, India’s talent pool and technological scalability attracted banks, tech giants, and Fortune 500 firms. By 2015, hundreds of GCCs were already handling critical operations in IT, finance, and analytics.

A Structural Shift in Global Capability Centres in India: The Visa Policy Catalyst

In 2025, the Trump administration raised the H1-B visa fee to $100,000, fundamentally shifting the economics of global talent strategy. US companies, faced with skyrocketing visa and relocation costs, began relocating strategic projects and high-value roles to India’s GCCs—moving far beyond transactional outsourcing to embrace India as a central innovation headquarters.

Drivers of Transformation for GCCs in India

- Government Incentives and Policy Support: India’s proactive National GCC Policy, generous SEZ incentives, and targeted digital infrastructure investments laid the groundwork for this transformation. From streamlined approvals to localized industry-academia partnerships, government support accelerated GCC growth in both metro and emerging cities. SEZs offer not only regulatory relief but access to cutting-edge physical and digital infrastructure, making large-scale innovation possible.

- The Rise of Advanced Technology Mandates: Rapid adoption of AI, automation, cloud computing, and cybersecurity functions has turned GCCs into centers of excellence. Hybrid work models, robust telecom networks, and 5G rollout have enabled flexible yet high-impact collaboration with global HQs.

- Skills in Demand and Reverse Migration: AI engineers, cybersecurity analysts, data scientists, and design specialists are among the most sought-after professionals in GCCs. The 2025 visa hike also triggered a “reverse brain drain,” as experienced Indians return from abroad to lead innovation locally. India’s globally recognized universities, combined with government upskilling programs, continuously refresh the talent pipeline.

- Collaborative Ecosystem: Partnerships for Innovation: GCCs increasingly collaborate with local startups, global R&D centers, and academia—delivering co-developed IP, hosting open innovation labs, and contributing to digital public goods. This collaborative energy amplifies India’s value proposition well beyond cost savings.

Best GCC companies in India Lead the Way in Tech, Finance, Pharma, and Beyond

- Banking, Financial Services & Insurance (BFSI): Global financial titans—Citibank, JPMorgan, Goldman Sachs—have deepened investment in risk analytics, compliance, digital banking, and quant trading platforms from their India GCCs. Regulatory changes and labor risk in the US favor expanding core tech functions here.

- Technology Giants: Big Tech brands—Amazon, Microsoft, Google, Meta, Apple—have transitioned product development, AI labs, and cybersecurity mandates to India. These GCCs now lead in generative AI, cloud transformation, and digital product engineering, leveraging India’s vast and highly skilled developer ecosystem.

- Pharma & Life Sciences: Life sciences powerhouses like Bristol Myers Squibb ($100M innovation hub in Hyderabad) and Amgen ($200M AI-centric site) have made India the epicenter for digital health analytics, clinical research, and pipeline expansion. Nearly half the world’s top pharma majors operate flagship GCCs in the country.

- Retail, Consumer Goods & Engineering: Retail giants (Walmart, Target, Lowe’s) and engineering firms (Rolls-Royce, Honeywell) have launched GCCs for digital operations, supply chain analytics, and Industry 4.0 engineering—reflecting how diverse industries now rely on Indian centers for global competitiveness.

Key New GCC companies Entries and Announcements (2025)

- Bristol Myers Squibb launched a $100 million innovation hub in Hyderabad, focusing on drug development and digital capabilities.

- Amgen announced a $200 million investment in Hyderabad for a site specializing in AI, data science, and pharmaceutical pipeline expansion.

- Major US banks like Citigroup, JPMorgan Chase, and Goldman Sachs are ramping up their reliance on Indian GCCs, deepening their presence and increasing hiring plans.

- Several large tech companies, including Amazon, Microsoft, Google, Meta, and Apple, have signaled further workforce and innovation expansion in their India GCCs post-visa hike.

- India is witnessing the establishment of 2–3 new GCCs every week in 2025, translating to more than 120 new entries projected for the year.

- Mid-market US firms, particularly those exposed to US federal contracts or facing onshore hiring hurdles, are actively launching “in-house engines” in major Indian cities for financial, AI, and R&D functions.

- In the life sciences and pharma sector, 23 of the world’s top 50 firms now have Indian GCCs, with a notable uptick in new entries linked to the 2025 visa policy shift.

- Retail and consumer packaged goods companies such as Walmart, Target, and Lowe’s, as well as established tech companies like SAP Labs, have expanded or set up new large-scale GCC operations.

Related Articles

- Global Capability Centres in India: A Strategic Hub for Innovation

- Investing in Global Capability Centres in India

- H1-B Visa Shock – Leading GCC Companies in India 2025 Beyond

High-Profile Announcements for Global Capability Centres in India (2025)

| Company Name | Sector | City/State | Investment | Strategic Focus |

| Bristol Myers Squibb | Pharma/Life Sci | Hyderabad | $100 million | Drug development, digital platforms |

| Amgen | Pharma/Biotech | Hyderabad | $200 million | AI, data science, R&D |

| Citigroup, JPMorgan, Goldman Sachs | Financial Services | Mumbai, Hyderabad, Bengaluru | Multi-year expansion | Trading, risk, quant, tech |

| Amazon, Microsoft, Google, Meta, Apple | Technology | Pan-India | Ongoing expansions | Cloud, AI, product dev, innovation |

| Multiple mid-market US firms | Tech/BFSI/AI | Bengaluru, Pune, NCR | New launches | Compliance, analytics, R&D libraries |

| Walmart, Target, SAP Labs | Retail/IT/CPG | Bengaluru | Expanded facilities | Digital ops, retail analytics |

The Road of GCC companies in India to 2030

Analysts forecast the number of GCCs in India will cross 2,200 by 2030, with sector employment exceeding 2.8 million. Accelerated expansion into emerging tech, sustainability, and AI-first business models is expected. India’s trust dividend—policy stability, talent density, and ecosystem maturity—positions it as the world’s destination of choice for capability centers.

The sharp rise in US H1-B visa costs has reshaped the global capability landscape, with India’s GCCs now firmly at the helm of innovation, IP creation, and strategic business growth. Multinational firms view Indian centers as the optimal location for advanced, future-ready work. This “leadership pivot” signals India’s definitive elevation in global boardrooms—from a cost-effective support hub to a commanding engine of transformation.

Second Leaders of GCC companies in India

| Sr. No. | GCC companies in India | GCC Details | GCC Unit Location(s) |

|---|---|---|---|

| 55 | Bloom Consulting Services, Inc | Bloom Consulting Services – Development Center, Delivery Center | Nagpur, Bengaluru, Chennai |

| 56 | BMC Software | BMC Software R&D Center (Customer Experience Center) | Pune |

| 57 | BMW Group | BMW TechWorks India | Pune, Bengaluru, Chennai |

| 58 | Bombardier | Bombardier Global Engineering and Technology center | Hyderabad |

| 59 | Bosch Global Software Technologies | Center of Excellence | Hyderabad |

| 60 | Boston Consulting Group | Advanced Capabilities Center (ACC) | Gurugram, Bengaluru |

| 61 | Boston Scientific Corporation | Boston Scientific India – The research and development (R&D) center | Gurugram, Pune |

| 62 | Bridgestone | Satellite technology center | Pune |

| 63 | British telecom | British Telecom Cyber Security Operations center (Cyber SOC), British Telecom India Research center (BTIRC), Global Development center (GDC) | Bengaluru, Gurugram |

| 64 | Brocade Communication (Braodcom) | Broadcom R&D Center | Bengaluru |

| 65 | Brose Fahrzeugteile SE & Co. KG | Brose India Automotive Development & IT center | Pune |

| 66 | CA Technologies, Inc | India Technology center – CA Technologies | Hyderabad |

| 67 | Cadence Design Systems | R&D Center | Noida |

| 68 | Cambium Networks | Cambium Networks – Global wireless R&D center | Bengaluru |

| 69 | Capco (Wipro) | Global Capability Center | Bengaluru, Chennai, Gurugram, Hyderabad, Mumbai, Pune |

| 70 | Capgemini | Client Experience center, Applied Innovation Exchange | Navi Mumbai |

| 71 | Cargill | Global Capability center (GCC) | Bengaluru, Gurugram |

| 72 | Carraro | R&D Center | Pune |

| 73 | Case New Holland Construction | India Technology Center | Gurugram |

| 74 | Castlight Health | Castlight Health India Private Limited (R&D Center) | Hyderabad |

| 75 | Caterpillar Inc. | Caterpillar India Engineering Solutions Private Limited | Chennai |

| 76 | CGI | Global Delivery Centers of Excellence (GDCoE) | Bengaluru, Chennai, Hyderabad, Mumbai, Pune |

| 77 | ChainSys Corporation | Chain-Sys Software Exports Private Limited (Global Product Development Center, Global R&D center) | Chennai, Madurai |

| 78 | Chubb Limited | Business Services Center | Hyderabad, Bengaluru, Bhubaneswar |

| 79 | Cigniti Technologies | Offshore Delivery Center | Hyderabad |

| 80 | Citibank | Citi’s ‘Solution centers’ | Mumbai |

| 81 | Clariant International Limited | Regional Innovation Center | Navi Mumbai |

| 82 | CNH Industrial | India Technology Center (ITC) | Gurugram |

| 83 | Coca-Cola | Business Shared Services | Bengaluru |

| 84 | Cognizant | Global Capability Center (GCC) Service Line | Hyderabad |

| 85 | Colgate-Palmolive | Colgate India Global Technology and Design (IGTeD) Center | Mumbai |

| 86 | CommScope (ARRIS International | R&D and Operations center | Bengaluru |

| 87 | Commvault | Commvault Global Center of Excellence (COE), R&D Facility, Development center | Hyderabad, Pune, Bengaluru, Coimbatore |

| 88 | Concentrix Technologies | Center of Excellence | Gurugram |

| 89 | Conexant- Paxonet Communications | Conexant Systems Private Limited (Design Center) | Hyderbad, Noida, Pune, Bengaluru |

| 90 | Cookson Electronics | Cookson Electronics India Research center | Bengaluru |

| 91 | Cummins | Global Competency Center | Pune |

| 92 | Cytiva | Cytiva India Private Limited (Manufacturing Facility & Experience Center), Hyclone Life Sciences Solutions India Private Limited | Pune, Bengaluru |

| 93 | Danaher | R&D Center | Bengaluru |

| 94 | Dassault Systemes | Dassault Systemes Solutions Lab India center | Pune |

| 95 | Databricks | Databricks India Private Limited (R&D center) | Bengaluru |

| 96 | Datacore Software | Datacore Software India Pvt Ltd (R&D Center) | Bengaluru |

| 97 | Deloitte | Deloitte India Delivery Center | Hyderabad, Mumbai, Bengaluru, Pune, Chennai, Kolkata |

| 98 | Delphi Automotive PLC | Technical Center | Bengaluru, Chennai, Pune |

| 99 | Delta Airlines | Delta Airlines Global Technology Hub | Bengaluru |

| 100 | Dentsu | Dentsu Lab (R&D Lab) | Mumbai, Bengaluru |

What is a GCC in India?

A Global Capability Center (GCC) is a dedicated, wholly owned center set up by multinational firms in India to handle advanced functions—ranging from R&D and design to digital transformation and analytics.

How many GCCs are there in India?

As of mid-2025, India hosts over 1,700 GCCs, with projections exceeding 2,200 by 2030.

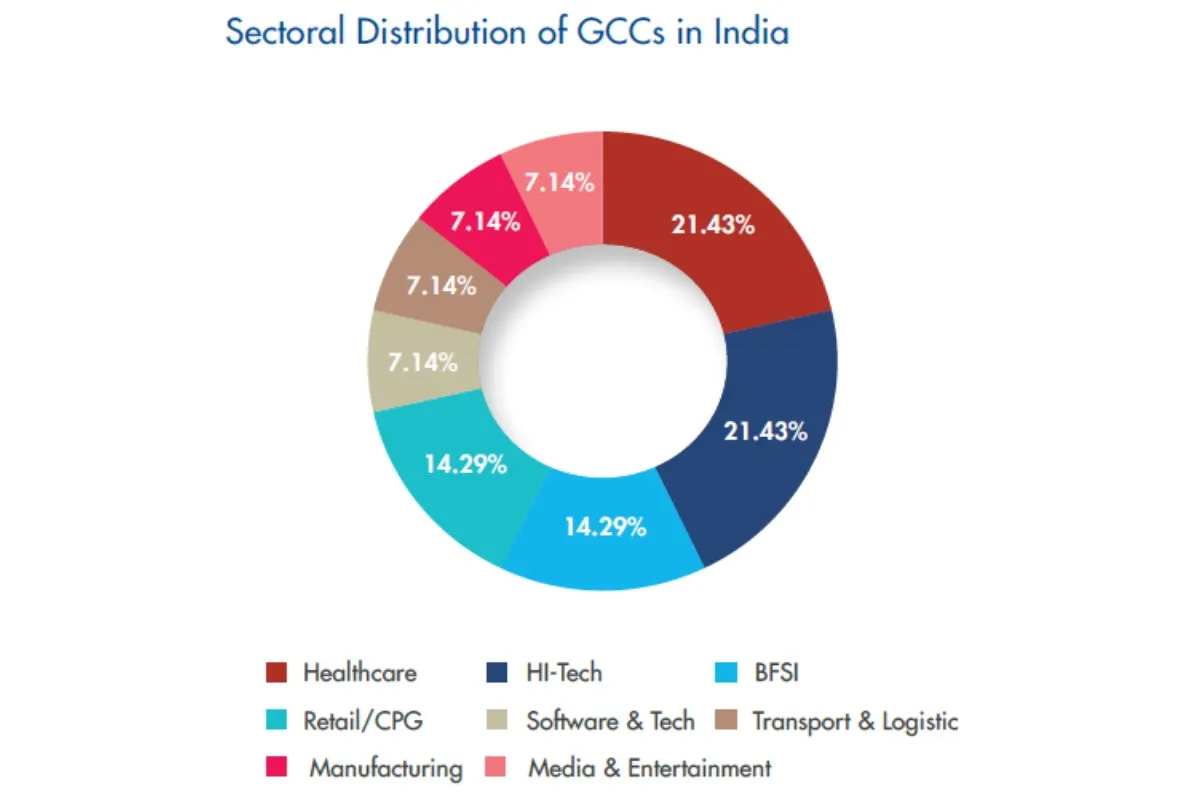

Which sectors are leading in GCC expansion?

Technology, banking/finance, healthcare, life sciences, retail, and engineering are top sectors.

Why are US companies expanding in India post-H1-B hike?

Rising visa costs and policy changes have made India the preferred location for strategic roles, innovation, and risk mitigation.

What is the future of GCCs in India?

GCCs will continue to grow rapidly, driving global innovation, employing millions, and shaping enterprise-wide strategies for multinational organizations.