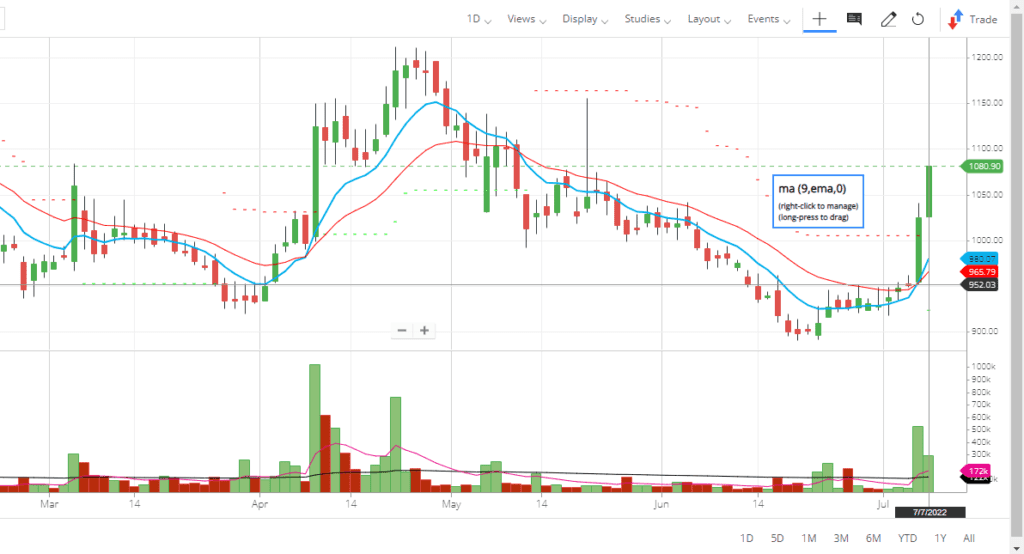

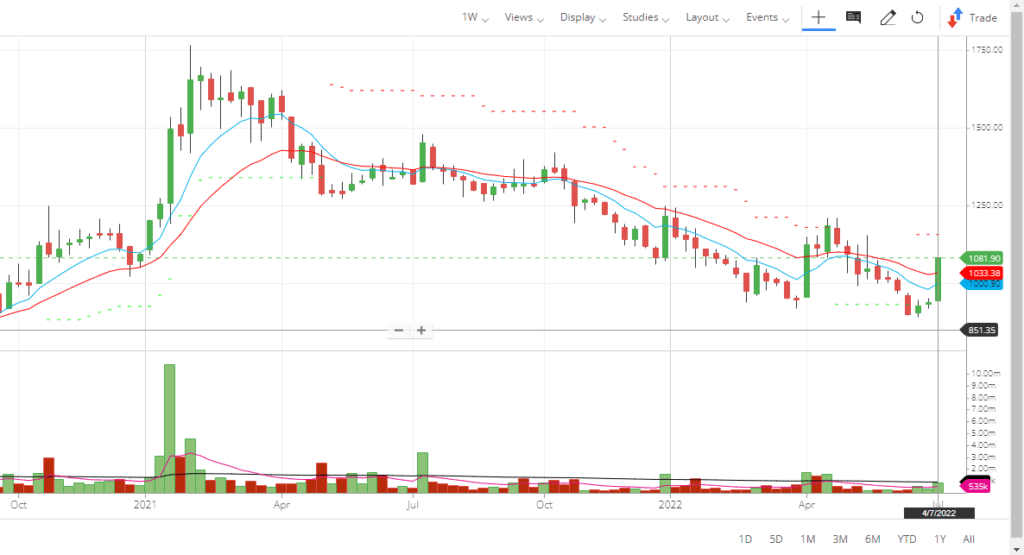

CEAT Limited Technical Analysis:

CEAT Limited’s (CEAT) share price looks strong in its technical chart with strong trading volume. The stock completed its correction and formed a bottom at the 897 level, moving up with strong volume. On the daily chart, the CEAT Limited shares closed above all their short-term moving averages (20 DMA and 50 DMA). The trading volume of the counter closes above its long-term moving average.

CEAT Limited share has given high and higher low for last two days after consolidating at 950 level for one week. Momentum indicators ADX and MACD are looking bullish on the daily chart. One may buy at this level or on dips for a 10 to 15% gain in the short term. Further, the stock has the potential to reach its 52-week high of 1500 level if the broader market supports it. Once it closed above 1100 level it will reach 1200 level within a short time.

CEAT Limited share is trading at 58.2 Price to Earning (PE) and available at 1.26 price-to-book (PB) value while sector PE is 129.72 PE and 5.78 PB. The debt-to-equity ratio of the company is at 0.63 times in FY22. The counter seems cheap in comparison to its sector valuation. The stock is trading at its resistance level at 1100.

CEAT Limited Fundamental Analysis

CEAT Limited became a part of the RPG group in the year 1982. The company has 7 manufacturing facilities in India and Srilanka. CEAT is one of the leading tire manufacturing companies in India with over 60 years of experience. The company has strong brand value across the globe. It has a presence in over 100 countries. CEAT has over 4600 touch points of dealers and channels and 300 plus distributors in over 600 districts across the country. The company has over 100 patent fillings to date.

CEAT manufactures its tire to cater to all segments such as Truck & Buses which contributes 30% of the revenue, 2/3 wheelers contribute 28%, passengers’ cars contribute 18%, FARM segment contributes 10%, LCV contributes 9%, and the Specialty segment contributes 4%. Considering the economy is opening up, government spending on infrastructure will go up further along with good monsoon in India will boost the demand for farm tires. All these factors will contribute to the growth of this industry as well as to the company in the short to medium term.

CEAT Limited Financial Analysis

CEAT recorded a growth of consolidated Revenue of 23% to reach INR 9403 Cr in FY22 on a YoY basis from IMR 7659 Cr in FY21. Quarterly net revenue also increased by 13.2% to reach INR 2592 Cr in Q4 FY 22 on a YoY basis. However, gross margin and EBITDA margin contracted by 847 bps, and 420 bps respectively due to higher raw material costs. Profit after tax also declined from INR 153 Crs in FY21 to INR 25 Crs in FY22, while raw material costs increased by 8% QoQ and 30% on a YoY basis.

EPS of the company has also declined from 106.8 in FY21 to 17.6 in FY22. However, with the growth in Indian GDP and auto industry, the revenue of the company is likely to go up and hence the EPS. Please note that these stocks are cyclical, so ride them carefully. Since we are talking about momentum stock here, we should consider it for short to medium-term investment.

CEAT Limited is a mid-cap company with a market cap of INR 4365 crores with a face value of INR 10. As per the company presentation return on capital employed was ~10.7 percent in FY20 increased to 13.5% in FY21, while the return on equity in FY20 was 13.2% and 14.1 percent in FY21. This data supports a strong valuation of this counter. Promoters have not changed their holdings from Dec 2021 to Mar 2022 and it remained the same at 47.11 percent. However, DII has reduced its holdings in the company from 12.72% in Dec 2021 to 11.67 % in March 2022. FIIs have not changed their holdings and they remained the same at ~22.7 percent during this period.

Management Team

Mr. Anant Goenka is the managing director of the company. He is a graduate in finance from The Wharton School and a Master of Business Administration (Management and Strategy) from Northwestern University – Kellogg School of Management. Before taking this assignment, he worked at KEC International as executive director and also worked in various other positions at CEAT. He has over 17 years of experience in this industry.

Mr. Arnanb Banerjee is the CEO of the company. He has done B.Tech from Indian Institute of Management, Kharagpur, and PGDM in marketing from Indian Institute of Management, Calcutta. Mr. Arnanb has also done Advanced Management Program (AMP 190), at Harvard Business School. Before taking this assignment, he worked with Berger Paints India and Marico Limited in different positions. He has over 21 years of experience in sales, operation, and marketing.

Suggestions: Also see Hero MotoCorp and JAMNAAUTO to capture the momentum in Auto industry move.

Disclaimer: This analysis is only for educational purposes, not advice for buying or selling of any stock.