Updates after ~50 days the counter suggested

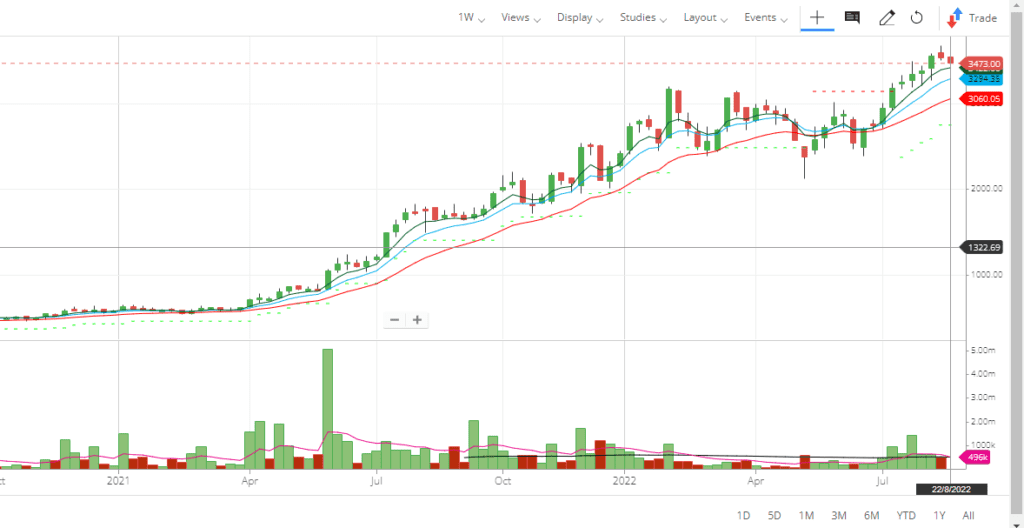

Gujarat Fluorochemicals’ share price still has potential to go long. FLUOROCHEM share is one of the best counters for momentum stocks. The company has a strong balance sheet. The stock is expected to move up sharply to reach the 3700 level after the correction. This counter was suggested at 2900 level on 6th July and it reached 3640 level on 16th August. Buy in dip or correction for long term gain. Refer below updated charts for weekly and daily levels and volume.

- The share has potential to reach an all-time high shortly if broader market supports.

- The volume has been strong for the last four days, which is above its long- and short-term moving average with an upward price movement.

- Weekly volume is also strong with an upward movement of price.

- Global Hydrogen Fluoride-Pyridine market to witness huge growth

- GFL reported a record June quarter with the highest-ever revenue of Rs1,334 crore which was up by 46.3%

- The operating profit of the company is Rs459 crore compared with Rs255 crore in the same quarter of the previous year.

- This shows the operational strength of the company. Buy in correction or dip

Gujarat Fluorochemicals Technical Analysis

Gujarat Fluorochemicals’ (FLUOROCHEM) share price looks strong in its technical chart with a strong trading volume. The stock completed its correction and formed a bottom at the 2433 level, moving up with strong volume. On the daily chart, the Gujarat Fluorochemicals shares closed above all their short-term moving averages (20 DMA and 50 DMA). The trading volume of the counter closes above its long-term moving average. Gujarat Fluorochemicals share has given flag pattern break out at 2815 level after consolidating at this level for one week.

Momentum indicators ADX and MACD are looking bullish on the daily chart. One may buy at this level or on dips for a 10% gain in short term. Further, the stock has the potential to reach a new all-time high if the broader market supports it. One can keep investing as SIP for a consistent return.

Gujarat Fluorochemicals’ share is trading at 40.48 Price to Earning (PE) and available at 9.16 price-to-book (PB) value while sector PE is 56.52 PE. The debt-to-equity ratio of the company is at 0.36 times in FY22. The counter seems cheap in comparison to its sector with a low debt-to-equity ratio. It is a good stock to accumulate in correction. The stock will quickly reach its all-time high of 3198 level when it closed above its previous swing high of 3000. The counter has strong support at 2430 levels. The average trading delivery percentage of the stock is above 70% for the last month. That reflects strong demand for this stock in the market.

Gujarat Fluorochemicals Fundamental Analysis

Heade quartered in Noida, India, Gujarat Fluorochemicals is founded in the year 1989. The company has one of the world’s most integrated facilities at Dahej, Gujarat, India. Gujarat Fluorochemicals has a diverse portfolio of Fluoropolymers comprising PTFE, PFA, FEP, FKM, PVDF, and Fluoropolymer Additives. The group has diversified business segments comprising Fluoropolymers, Specialty Chemicals, Wind Energy, and Renewables.

The company has three manufacturing facilities in India, a captive Fluorspar mine in Morrocco, and offices and warehouses in Europe and USA. In addition, the company also has a strong marketing network spread across the world.

Gujarat Fluorochemicals manufactures products in four segments Fluoropolymers, Fluorospecialities, Chemicals, and Refrigerants. The company is continuously focusing on product innovations to build a strong product portfolio. Fluoropolymers are used in a variety of household and commercial products. It is also used as lubricants, sealants, and leather conditioners.

The High-Performance Fluoropolymers (HPF) market was valued at US$ 3.1 billion in FY 2020-2021 and is projected to reach US$ 5.3 billion by 2028, at a CAGR of 7.21%. With the opening up of the economy in India and across the globe, the demand for this product will further improve.

Gujarat Fluorochemicals Financial Analysis

Gujarat Fluorochemicals recorded a growth of consolidated Revenue of 49% to reach INR 3954 Cr in FY22 on a YoY basis. Quarterly revenue also increased by 28% to reach INR 1074 Cr on a YoY basis. Consolidated EBIDTA was INR 1198 Cr up by 88% for FY22 and INR 331 Cr for Q4 FY 22 up by 70% on a YoY basis. Consolidated PAT was up by 118% to reach INR 775 Cr for FY22 and Q4 FY 22 was at Rs. 217 Cr up by 97% on a YoY basis. EPS of the company has also increased from a negative (-) 19.91 in FY21 to 70.63 in FY22 while EPS has increased from 17.87 in FY20 to 70.63 in FY22. This reflects the strong financial performance of the company.

Gujarat Fluorochemicals is a mid-cap company with a market cap of INR 31863 crores with a face value of INR 1. Return on capital employed is ~20.6 percent while return on equity is ~20 percent. This data supports a strong valuation of this counter. In addition, promoters have not changed their holdings from Dec 2021 to Mar 2022 and it remained the same at 66 percent. However, DII has increased its holdings in the company from 12.87% in Dec 2021 to 13.55 % in March 2022. FIIs have increased their holdings from 3.78 percent to 4.19 percent during this period.

Suggested Reading – Read other momentum stocks CARBORUNIV, GUJALKALI and, GOKEX

Management Team

Mr. Devendra Kumar Jain is the chairman of the company. He is a graduate in History (Hons.) from St. Stephens College, Delhi. He has over 61years of experience in business management and international trade. Mr. Devendra Kumar Jain has been a member of the Indian National Committee of the International Chamber of Commerce and has been an Associate Member of the World Economic Forum, Geneva, Switzerland.

Mr. Vivek Kumar has been the managing director of the company since its inception of the company. He is a graduate of Commerce from St Stephens College Delhi and also has a post-graduate degree in Business Administration from the Indian Institute of Management Ahmedabad. Mr. Vivek has over 43 years of rich business experience in setting up and managing several businesses.