Is Gold a Safe investment – This is a question that everyone is asking themselves. It may be an investors or a house wife or may be a layman who does not know where to invest. A conventional investor considers safety, liquidity, and profitable returns as important criteria for investment.

Investment in gold seems to fulfill these criteria. Everyone including policy makers consider gold as an investment for future. Again gold proves to be a safe investment during times of uncertainty for many investors. Whatever the rate of inflation may be, the returns on gold investment have always proven to be in line with it. In a nutshell, one can consider gold as an investment that beats inflation always. It has been demonstrated to be an effective portfolio diversifier. A major factor that calls gold as an investment is that it provides excellent liquidity to investors.

Table of Contents

Is Gold a Safe investment?

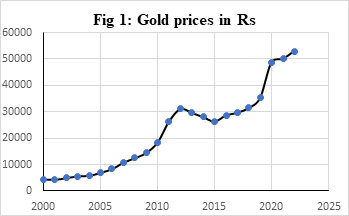

Gold is not a passive investment like bonds and stocks for dividends that provide a regular income in the form of interest and dividends. Fig.1 shows gold prices from the year 2000 to 2022. The price of gold has been rising considerably over the period. Within a span of ten years, from 2012 to 2022, the price of gold has increased from Rs 31,050 to Rs 52,950 (24K per 10 gms), an increase of 70.5% in price.

Other notable investment options other than gold which could be stated are real estate and shares of listed companies. Appreciation in real estate prices over time attracts investment and considers as a lucrative investment option. But it suffers from the risk of recession in the economy when the demand for housing shrinks. Again, investing in real estate is illiquid and most rigid in terms of salability.

Though the investment in the share market has the plus point of liquidity, it is affected by the volatility in the stock indices depending on various macro and micro factors. So, the return in the stock market on a particular day when needed may be loss-making due to fluctuation in stock indices on that particular day. In this scenario, gold fluctuates less in value and more liquid in redemption. As such, gold is more assured in value terms and earns a place as a commendable portfolio diversifier.

How can a retail investor invest in Gold?

There are some conventional methods as well as modern types of to invest in Gold. In conventional form, physical gold in the form of jewellery, coins, or artifacts is bought and hold for long term. However, now investors have more options to invest in gold such as gold ETF (Exchanged Traded Funds) and gold funds. Gold ETFs are similar to buying physical gold but the only difference is that one doesn’t buy the physical gold. Instead, the gold is bought and stored in Demat (paper) format. Whereas, gold funds deal with investing in gold mining companies. Below are various options and there benefits that a retail investor can invest in gold.

(a) Physical Gold

- No Demat account is needed.

- No hassles of paperwork.

- Risk of theft and burglary involved.

(b) Gold ETFs (Exchanged Traded Funds)

- Purchasing gold but not in physical form.

- Needs a Demat account.

- Include asset management and brokerage fees.

- No risk of theft or burglary.

- Paperwork is required.

(c) Gold Mutual funds

- The investment is made in the companies involved in gold mining.

- No Demat account is needed.

- A minimum charge is applied to manage the funds.

- No risk of theft or burglary.

- Paperwork required.

(d) Sovereign Gold Bonds?

These are the safest way to invest in Gold as they are issued by the Reserve Bank of India on behalf of the Government of India with an assured interest of 2.50% per annum. You can make a maximum investment up to 4 kg of Gold. These bonds have a minimum investment tenor of eight years with an exit option from the fifth year onward.

(e) Digital Gold Investment

When a person buys digital gold from a company, the company then purchases an equitable amount of physical gold and stores it in the customer’s name in secured vaults. Digital gold can be purchased online and is stored in insured vaults on behalf of the customer by the seller. Investment in digital gold can be done by using internet/mobile banking from several e-wallets such as Paytm, Google Pay, PhonePe, etc. Such apps provide platforms for metal trading companies such as SafeGold and MMTC PAMP. Banks such as Axis Bank facilitate payment for digital gold. Digital gold can be bought through Axis Bank Internet Banking or Axis Mobile.

Companies that are offering digital gold in India are:

- Augmont Gold Limited

- MMTC-PAMP India Pvt Ltd – a joint venture between MMTC Ltd and Swiss firm MKS PAMP

- Digital Gold India Pvt Ltd with its SafeGold brand.

The first step for a digital gold investment is to visit a platform such as PhonePe, Paytm, etc. Digital gold can be purchased according to the weight in grams or as per the worth in rupee terms. The next step is to decide upon the payment method. It could be either an account or a card or a wallet. One can sell the gold whenever one wishes to the platform itself. Alternatively, one can take a physical delivery of gold. The delivery of gold could even be sought at the doorstep in form of coins or bullion. But in that case delivery charges are applicable.

Benefits of digital gold investment

- Convenient and easy.

- Online available to buy or sell gold. Open for 24×7 – including weekends and public holidays.

- Gold is stored safely and is insured.

- Can be converted to physical jewellery, gold coins, or bullion.

- It is 24 Karat i.e., 99.5% for SafeGold and 999.9 in the case of MMTC PAMP purchases.

- Could be utilized as collateral for online loans

- One can access the facility of doorstep delivery of the purchased gold.

- It is highly liquid as one can easily buy/sell units anytime, anywhere.

Drawbacks of digital gold investment

- Most platforms permit a maximum limit of Rs 2 lakhs for gold purchases.

- These transactions are uncovered by a government regulating body such as RBI or SEBI.

- Physical delivery charges are applicable when opted for.

- In some instances, only a limited storage period is offered by the company, beyond which the customer either has to take a physical delivery or has to sell it off.

How is Digital Gold taxed?

Similar to buying physical gold, digital gold is also subject to capital gains tax. In case you sold the gold holdings within 36 months of investment/purchase, Short Term Capital Gain (STCG) tax will apply. The STCG gain will be added to the individual’s income, under “Income from Other Sources” and taxed as per the relevant income-tax slab.

On the other hand, when the gold holdings are for more than 36 months from the date of investment, it would be subject to a Long-Term Capital Gain (LTCG) tax @ 20% plus cess and surcharge.

Regulatory risk in digital gold

Since there is no regulator for investing in digital gold, the risk is higher for the investors. However, to verify the quantity and purity of gold, a trustee is appointed. Again, there are no regulators to monitor the activities of the trustee. In the case of gold ETF, SEBI acts as a regulator and in the case of sovereign gold bonds, RBI acts as a regulator. Digital gold providers charge a spread ranging between 2-3%, which provides for the expenses such as the cost of storage, insurance, and trustee fee.

There is a maximum term for holding digital gold after which the investor has to take delivery of the gold or sell it back. If one is unable to take the delivery of the gold, then the concerned person has to pay certain charges to hold the gold. Both SafeGold and MMTPC-PAMP put charges for storage beyond five years.

Final Words

Considering the risk of the absence of a regulator, charges, and long-term holding is not possible, it is better to explore Gold ETF (for long-term holding) or Sovereign Gold Bond Schemes rather than using the easy online Digital Gold investment. The bottom line is that the advantages of investing in gold usually outperform the disadvantages. In short, all those investors who don’t need the funds in the short term can opt for sovereign gold bonds, and investors who prioritize liquidity can opt for gold ETFs and funds.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment – 10 Best IPOs in 2022, Concord Bio IPO, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs.