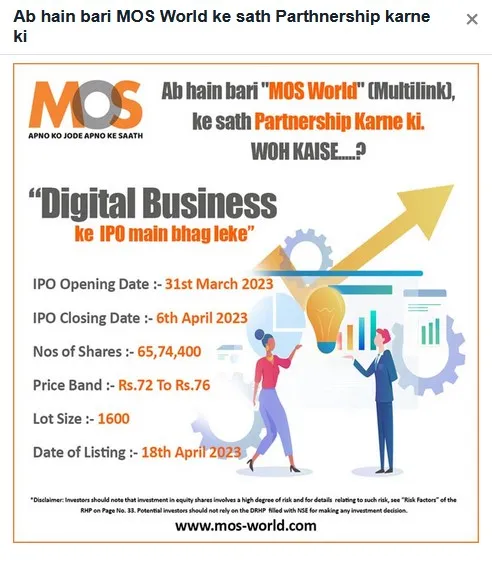

MOS Utility IPO subscription is opening up on 31st March 2023 till 6th April 2023. According to the prospectus, the IPO consists of a total of 6,574,400 shares aggregating up to ₹49.97 Cr, a fresh issue of 5,774,400 equity shares, and an offer for sale of 800,000 shares. The Equity Shares have a face value of Rs 10 each. The retail allocation is not less than 35% of the total size.

MOS Utility IPO – The Company Business Description

Incorporated on July 27, 2009, MOS Utility provider of digital products and services in the B2C, B2B, and financial technology arena through an integrated business model.

The company works under seven primary business segments, (i) banking, (ii) travel, (iii) insurance, (iv) utility services, (v) entertainment services, (vi) franchisee, and (vii) other services.

The company has a diversified exchange platform that allows harnessing synergies and provides cross-selling and upselling opportunities to both consumers and businesses

MOS Utility Limited Founders and Leadership team

Mr. Chirag Shah, Mr. Kurjibhai Rupareliya, and Sky Ocean Infrastructure Limited are promoters of this company.

MOS Utility Limited Revenue and Profit

MOS Utility is consistent in terms of revenue. The total revenue from the operation has declined from Rs. 8,819.34 lakh in FY2020 to Rs 6,766.39 lakh in FY2021, though it has increased to reach Rs. 7,734.01 lakh in FY 2022.

For the Period ended September 30, 2022, the company registered total revenue of Rs. 5,330.22 lakhs. The profit for the period reached Rs. 195.84 lakh on September 30, 2022, from Rs. 84.69 lakh in FY 2021.

However, the debt-to-equity ratio of the company has increased over the years from 0.89 in FY2020 to 1.53 in FY2022.

MOS Utility Limited SME IPO Review : Financial Snapshot

| All amounts in INR Lakhs (Year ended March 31) | FY 2020 | FY 2021 | FY 2022 | Half Year By Sept, 2022 |

| Revenue Operation | 8,819.34 | 6,766.39 | 7,734.01 | 5,330.22 |

| Total Income | 9,156.51 | 6,792.07 | 8,096.01 | 5,435.41 |

| Profit for the period | 128.59 | 84.69 | 157.67 | 195.84 |

| Earnings Per equity Share-Diluted | 0.32 | 0.46 | 0.86 | 1.07 |

| Net Cash from Operating Activities | (669.57) | 4.50 | 233.57 | 503.07 |

| Total Borrowings | 538.08 | 812.23 | 1296.32 | 878.59 |

| Net Worth | 602.42 | 687.11 | 844.78 | 1,940.63 |

| Net Asset Value/Book Value per Equity share | 3.30 | 3.77 | 4.63 | 10.63 |

Objective Behind the MOS Utility IPO

- To meet the working capital requirements, the company will use Rs 2,600 lakh.

- The rest will be used for General corporate purposes

MOS Utility IPO: Do you invest?

- Major revenue (Over 70%) comes from the utility services segment of the company.

- Digital India’s initiative to improve online infrastructure and increase internet accessibility among citizens will help this company to improve its bottom line.

- The Digital India initiative is expected to boost the country’s digital economy to US $ 1 trillion by 2025.

- The return on equity and return on capital employed are quite impressive.

- Net Cash Flow from Operating Activities has improved from Rs (669.57) lakh in FY2020 to Rs 233.57 lakh in FY2022.

- However, the debt-to-equity ratio is quite high for the company which is increasing over years.

MOS Utility IPO Details

| MOS Utility IPO Details | MOS Utility IPO Date, Price and other details |

| MOS Utility IPO Date | Mar 31, 2023 to Apr 6, 2023 |

| IPO Price | ₹72 to ₹76 per share |

| IPO Allotment date | Apr 12, 2023 |

| Refunds Initiation date | Apr 13, 2023 |

| Credit of Shares to Demat Account | Apr 17, 2023 |

| IPO Listing Date | Apr 18, 2023 |

| Offer for Sale | 800,000 Equity shares |

| Fresh Issue | 5,774,400 Equity Shares |

| IPO Issue Size (Fresh Issue) | 6,574,400 shares (aggregating up to ₹49.97 Cr) |

| Minimum bid (lot size) For retail investor | 1 lot of 1600 shares Investment of ₹121,600 |

| Maximum bid (lot size) For retail investor | 1 lot of 1600 shares Investment of ₹121,600 |

| Retail Shares Offered | Not less than 35% of the Net Offer |

| Minimum bid (lot size) HNI investor | 2 lot of 1600 shares (3200) Investment of ₹243,200 |

| NII (HNI) Shares Offered | Not less than 15% of the Net Offer |

| Face Value | INR 10 per share |

| Listing on | NSE SME |

| Promoters | Mr. Chirag Shah, Mr. Kurjibhai Rupareliya, and Sky Ocean Infrastructure Limited are the Promoter |

MOS Utility IPO: Lead Managers and Contact

| Contact Details | MOS Utility IPO Lead Managers |

| MOS Utility Limited 12th Floor, Atul First Avenue, Above Kia Motors Showroom, Goregaon – Mulund Link Rd, Malad West, Mumbai- 400064 Phone: +91 84337 24642 Email: secretarial@mos-world.com Website: https://www.mos-world.com/ | UNISTONE CAPITAL PRIVATE LIMITED A/305, Dynasty Business Park, Andheri Kurla Road, Andheri East, Mumbai 400059, Maharashtra Telephone: +91 98200 57533 Email: mb@unistonecapital.com |

MOS Utility IPO Allotment Status

MOS Utility IPO Allotment status will be available on SKYLINE FINANCIAL SERVICES. To know your allotment status, get ready with your PAN number and click on this link. You may also reach out to Phone: 011-40450193-197, Facsimile: 011-26812683 Email: ipo@skylinerta.com;

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO, India IPO Trends 2023, New Companies in the Indian share market 2023. To know more information about business overview of each company, here are some suggested readings on company insights for investment – 10 Best IPOs in 2022, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs.