Share With Friends

Waaree Energies IPO details: Key Facts

- Waaree Solar Company filed Draft Red Herring Prospectus (IREDA DRHP) for an initial public offering on December 28, 2023.

- Waaree Energy is one of the pioneer companies in renewable energy.

- The company claims to be one of the world’s largest solar energy manufacturers and largest solar module manufacturer outside of China.

- Waaree Energies IPO Date is yet to be announced: – October 21, 2024 to October 23, 2024

- Waaree IPO GMP on 18th October 2024 is ₹1330 and the IPO may be listed at ₹2833

- CRISIL has given BBB+/Positive for long-term rating while CARE has given a rating of A-; Stable

- Governments across the globe including India have been focusing on renewable energy and green hydrogen energy as a major source for future energy needs.

- The company has strong growth potential to excel in this segment despite competition.

Table of Contents

Waaree Energies DRHP filed on 28th December 2023 to float its Initial public offering. According to DRHP, Waree Energies Ltd is raising Rs 3,600 crore fresh equity at a face value of ₹10 each. Promoters of this company will also sell up to 3,200,000 Equity Shares as an offer for sale in this initial public offering issue.

The net proceeds from the Waaree Energies IPO from the Fresh Issue will be utilized towards the cost of establishing the 6GW of Ingot Wafer, Solar Cell, and Solar PV Module manufacturing facility in Odisha, India.

Waaree Energies IPO details

Now the big question is – do you invest in the Waaree Energies Ltd IPO? Let us find out details about the company and why you should consider investing in this company.

Waaree energies IPO Date Price Details

| Waaree energies ipo details | Waaree energies ipo details date, Price and other |

| Waaree energies IPO date | October 21, 2024 to October 23, 2024 |

| Waaree energies IPO Price band | ₹1427 to ₹1503 per share |

| IPO date of allotment | October 24, 2024 |

| Refunds Initiation date | October 25, 2024 |

| Credit of Shares to Demat Account | October 25, 2024 |

| Waaree energies IPO date of listing | October 28, 2024 |

| Total IPO size | 28,752,095 shares (aggregating up to ₹4,321.44 Cr) |

| Fresh Issue | 23,952,095 shares (aggregating up to ₹3,600.00 Cr) |

| Offer for Sale | 4,800,000 shares of ₹10 (aggregating up to ₹721.44 Cr) |

| Retail Application (Min) | 1 lot 9 shares ₹13,527 |

| Retail Application (Max) | 14 lot 126 shares ₹189,378 |

| Waaree energies share price Face Value | ₹ 10 per share |

| Waaree energies share price Listing on | BSE & NSE |

| Equity Shares outstanding prior to the Offer | 263,331,104 Equity Shares |

Waaree Energies IPO: Voice of Management

Management Interview Video

Company profile as Waaree Energies IPO DRHP

As of June 30, 2023, Waaree Energies Ltd is the largest manufacturer of solar PV modules in India with the largest aggregate installed capacity of 12GW. The company commenced operations in 2007 focusing on solar PV module manufacturing. Over the years, Waaree Energies Ltd has significantly expanded its aggregate installed capacity from 2 GW in Fiscal 2021 to 9 GW, as of March 31, 2023, which further increased to 12 GW as of June 30, 2023. The company sells its PV modules under the “Waaree” brand.

Waaree Energies IPO: Financial Strength

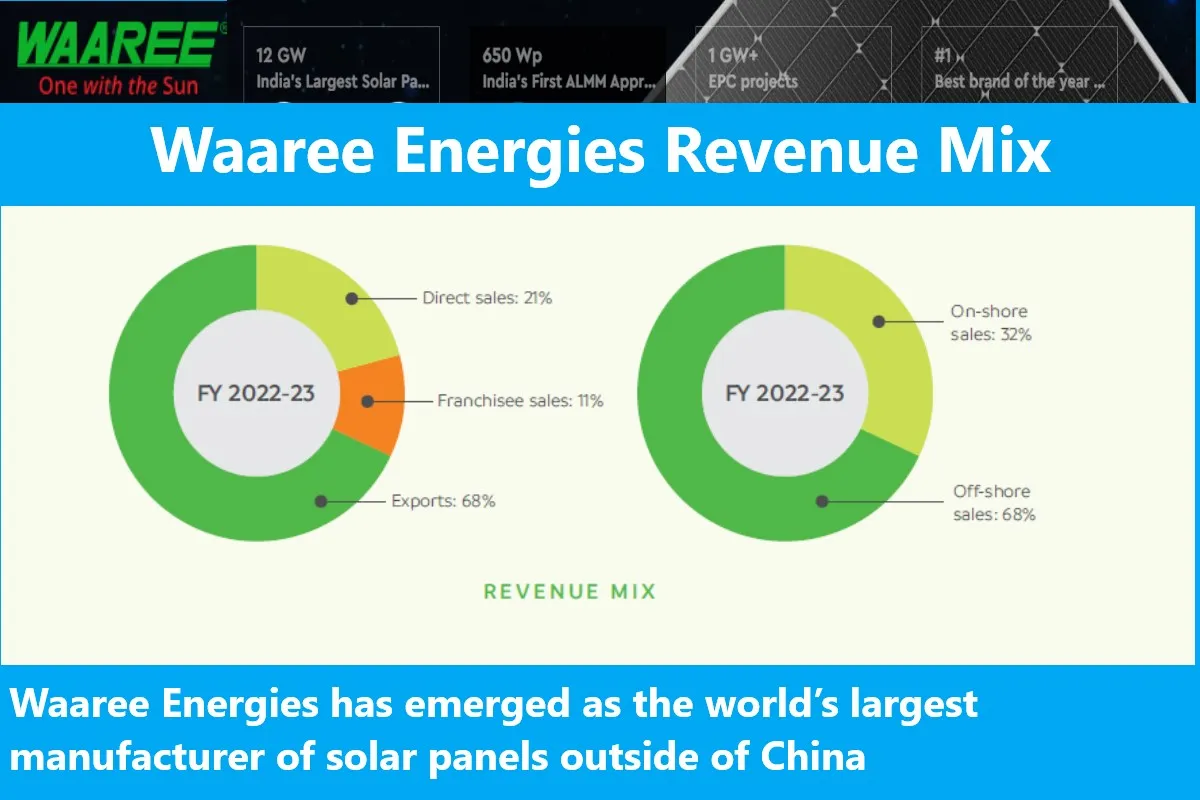

Waaree Energies Ltd has reported an increase in Export Sales from ₹ 4,809.10 million representing 24.62% of the total revenue from operations in Fiscal 2021 to to ₹ 46,165.39 million representing 68.38% of the revenue from operations in Fiscal 2023. The revenue from operation has also increased from ₹ 19,530.39 million in Fiscal 2021 to ₹67,508.73 million in fiscal 2023.

Waaree Energies Financial Snapshot

| Waaree Energies Financial Strength | FY2021 | FY2022 | FY2023 | Q1FY2024 |

|---|---|---|---|---|

| Revenue from Operation (Rs million) | 19,530 | 28,534 | 67,509 | 33,283 |

| Total Income (Rs million) | 19,830 | 29,459 | 68,604 | 34,150 |

| Profit of the Year (Rs million) | 456 | 797 | 5,003 | 3,383 |

| EBITDA (Rs million) | 1,257 | 2,025 | 9,441 | 5,543 |

| EBITDA Margin (%) | 6.34 | 6.88 | 13.76 | 16.23 |

| Debt to Equity Ratio | 0.79 | 0.72 | 0.18 | 0.08 |

| PAT Margin (%) | 2.3 | 2.7 | 7.29 | 9.91 |

| ROE (%) | 13.22 | 17.69 | 26.26 | 12.36 |

| ROCE (%) | 14.87 | 21.89 | 31.61 | 15.86 |

| Capacity (MW) | 2,000 | 4,000 | 9,000 | 12,000 |

Waaree Energies IPO GMP

| Date | IPO Price | Waaree IPO GMP | Estimated Listing Price |

|---|---|---|---|

| 18-10-2024 | ₹1503 | ₹1330 | ₹2833 |

| 17-10-2024 | ₹ 1503 | ₹1330 | ₹ 2833 |

| 16-10-2024 | ₹ 1503 | ₹ 1545 | ₹ 3048 |

Objective Behind the Waaree Energies IPO

- The company will not receive any proceeds from the Offer for sale. The promoter of the company will take the net proceeds from the OFS.

- The net proceeds from the fresh issue of Rs 2500 crore will be deployed in the Financial Years 2025 and 2026 to finance the cost of establishing the 6GW of Ingot Wafer, Solar Cell, and Solar PV Module manufacturing facility in Odisha, India.

- The rest of Rs 5000 crore will be used for general corporate purposes.

- The company will achieve the benefits of listing the Equity Shares on exchanges.

- This will also enhance the visibility and brand image of the company as well as provide a public market for Equity Shares in India.

Waaree Energies IPO review: Good or Bad?

- Waaree Energies is one of the largest Solar PV manufacturers globally and the largest in India with over 30 years of experience in the industry.

- Global renewable energy market size is expected to grow from USD 900 Billion in 2022 to USD 3200 Billion by 2030.

- India’s renewable energy market size is expected to be worth up to $80 billion by 2030 from around $20 billion in 2022.

- The Government of India has set a target to achieve a 500 GW renewables target before 2030 from around 180 GW in 2022.

- Foreign direct investment (FDI) in India’s renewable energy sector stood at $251 million/ Rs 20.5 billion in the third quarter (Q3) of the financial year (FY) 2023.

- There is a huge market to capture for this company.

- The company has recorded strong revenue growth over the years.

- Considering the above factors Waaree Energies has strong growth potential.

Also Read

Frequently Asked Questions (FAQs)

Where is Waaree energies Ltd HQ?

Registered and Corporate Office: 602, 6th Floor, Western Edge – I, Western Express Highway, Borivali (East), Mumbai – 400 066, Maharashtra, India; Telephone: +91 22 6644 4444;

Contact Person: Rajesh Ghanshyam Gaur, Company Secretary and Compliance Officer; Telephone: +91 22 6644 4415;

E-mail: investorrelations@waaree.com;

Website: www.waaree.com

Is Waaree Energies Ltd part of Waaree Group Companies?

Yes, Waaree Energies Ltd is a part of Waaree Group Companies

How can I invest in Waaree Energies’s IPO?

If you are interested in investing in Waaree Energies’s IPO, you will need to open a demat account and trading account with a broker. You can then apply for shares during the book-building process.

When is the Waaree Energies IPO date?

The Waaree Energies IPO date is October 21, 2024 to October 23, 2024.

What is the Waaree Energies IPO Price?

The Waaree Energies IPO Price is Rs 1503

What are the risks of investing in Waaree Energies’s IPO?

As with any investment, there are risks associated with investing in Waaree Energies’s IPO. These risks include:

1. The price of the shares may fall after the IPO.

2. The company may not perform as well as expected.

3. The company may face regulatory or legal challenges.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, 10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, AI Stocks in India.