Share With Friends

I have noticed that few websites have given IREDA share price target 2030 and some have given the target till 2050. In those articles, I did not find any logic behind the IREDA share price target to reach a certain level. Some sites have given targets for each month which is not simply possible. Here I am trying to give everything about IREDA that you want to know. This is not a recommendation for this share. You need to do your research before investing in the company. This is my effort to give real insights that will help you to understand the company so that you can make the right decision.

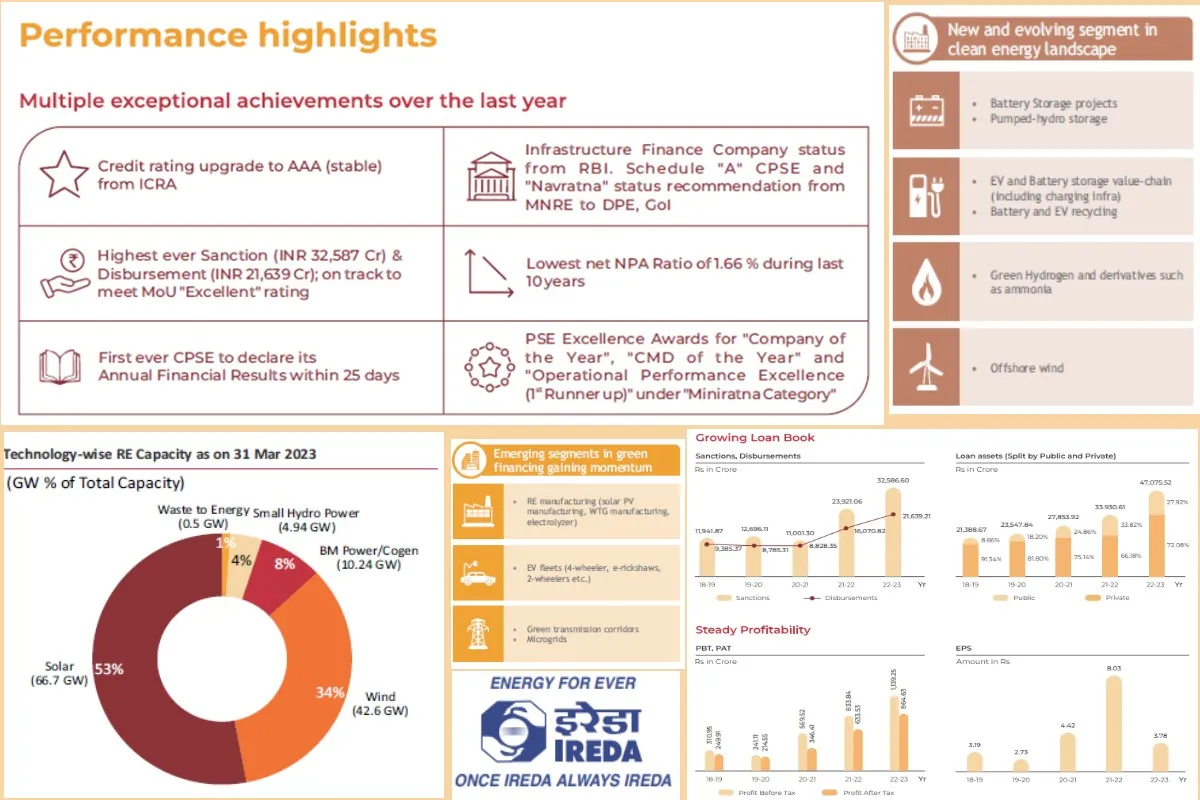

The full form of IREDA is the Indian Renewable Energy Development Agency which is under the Ministry of New and Renewable Energy. This is a non-banking financial institution engaged in promoting, developing, and extending financial assistance to companies engaged in the renewable energy segment for setting up projects related to new and renewable sources of energy and energy efficiency/conservation.

Table of Contents

IREDA Share Price Target

The government of India owned Indian Renewable Energy Development Agency (IREDA) listed in the stock exchanges on 29th November 2023, with its share prices listed over at 56 per cent premium at Rs 50 and closed at Rs61 on the listing day. Subsequently, IREDA share price zoomed over 4 times Rs 215 on 6th February 2024 to make a pick.

The IREDA share price multiplied 4 times within 3 months. Is the IREDA share price sustainable at a higher level so quickly? The stock is trading at 53 PE while ROE is 15.4% and ROCE is 8.17%. Now the most important question is what is the future of IREDA stock price. Many other sites have given IREDA share price target till 2050. However, with the market volatility, any long-term target is not sustainable.

Also Read

IREDA Performance in Q3 2024

State-owned IREDA reported a 67% rise in net profit to Rs 335.54 crore for the quarter ended in December 2023. The company also reported Rs 200.75 crore net profit during the October-December period as against the preceding 2022-23 fiscal.

The company posted a total income of Rs 1,253.19 crore in the third quarter of FY24 from Rs 868.97 crore a year ago, which is a very decent result in this segment. These results signal the promising trajectory of IREDA’s contributions to India’s energy transition and environmental sustainability.

The net worth of IREDA also rose by 45.49 percent to reach Rs 8,134.56 crore from Rs 5,591 crore in the year-ago period.

Key financial highlights for Q3, FY 2023-24 compared to Q3, FY 2022-23 are as follows:

- Profit After Tax: ₹ 335.54 crores as against ₹ 200.75 crores (up by 67.15%)

- Revenue from Operations: ₹ 1,253.20 crores as against ₹ 868.98 crores (up by 44.21%)

- Loan Book: ₹ 50,579.67 crores as against ₹ 37,887.69 crores (up by 33.50%)

- Net worth: ₹ 8,134.56 crores as against ₹ 5,591 crores (up by 45.49%)

- Net NPA: 1.52% as against 2.03% (reduction by 25% in percentage terms)

- Gross NPA: 2.90% as against 4.24% (reduction by 31.70% in percentage terms)

- Earnings Per Share: ₹ 1.38 as against ₹ 0.87 (up by 57.33%)

IREDA Share Price Target 2024

According to Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher (PL), IREDA has witnessed a tremendous rally within a short period. “Near-term support would be at around Rs 180 zone where it is expected to consolidate, and one can enter for the second round of momentum. Our view gets negated, only if a decisive breach below Rs 168 zone is confirmed with the trend getting weak,” he stated.

AR Ramachandran from Tips2trades said, “The stock price looks bearish and extremely overbought on daily charts with resistance near Rs 200.”

Jigar S Patel, Senior Manager – Technical Research Analyst at Anand Rathi Shares and Stock Brokers, also proposed Rs 200 as the resistance level.

Despite the strong quarterly result, the IREDA share price is falling due to higher valuation. The stock has moved up so fast that it becomes difficult to justify the result at such a high level. This suggests that the IREDA stock may continue to fall till its next support level of Rs 150 – 160. If the stock breaches this range the next strong support will be at Rs 125 level. If the stock reaches the Rs125 level, I will strongly enter into the stock for a strong bullish trend to retest its all-time high. Hence, for me, the IREDA share price target 2024 will be its recent high of Rs215 level.

IREDA Share Price Target 2025

In my view, IREDA Share price target 2025 would be Rs350 level conservatively. Look at the YoY growth of income from the operation. The revenue from operation was Rs 2860 Crore in FY2022 to Rs 3483 Crore in FY2023. PAT has also grown from Rs633 crore in FY2022 to Rs864 crore in FY2023 which is around 30% up.

National Electricity Plan (NEP), the Central Electricity Authority pushing for the increasing share of renewable energy in India’s power mix. The government of India is also emphasizing the importance of building energy storage capacity to effectively incorporate renewables with the grid. Based on this 10-year roadmap approximately 21 Lakh Crores will be required till FY 30 to meet the target of 500 GW energy from renewable energy sources.

A green hydrogen push from the government of India will also boost the performance of this company. In India, the government has already kick-started its green hydrogen journey in 2023 with the national launch of its National Hydrogen Mission with an investment plan of ~$2.39 billion. The country wants to transform itself into a global hub for green hydrogen production and export. Many small hydrogen producers are emerging to benefit from this PIL scheme. This will further boost the performance of this company and subsequently will impact the IREDA Share price target 2025.

IREDA Share Price Target 2030

The stock has good long-term potential but now it is trading at higher multiples. Looking at the data during the IREDA IPO time, Qualified institutional buyers (QIBs) and high net-worth individuals (HNIs) bought 104.57 times and 24.16 times their allotted quota of shares respectively. The retail portion was booked 7.73 times their allotted quota.

Oversubscription of IREDA IPO by QIB and HNI investors suggests that the IREDA share price has a strong future. Usually, QIB and HNI do proper due diligence before investing in any company. Usually, these institutions invest in any company for the long term. There is a significant role for QIB in IPO. If you look at the fundamentals of the company, this is a mini-ratna company of the government of India. The government of India is focusing on renewable energy to reduce its dependence on imported fossil fuels and to achieve carbon neutrality by 2030.

Hence, IREDA Share price target 2030 would be Rs550 level conservatively. However, the company must continue its performance QoQ and YoY.

Is IREDA Share a good buy Now?

Now the question – is IREDA share a good buy now?, is it for long term investment? Based on the performance of IREDA over the last three years, the company seems performing very strongly in terms of top line. Shri Pradip Kumar Das, Chairman & Managing Director of IREDA, expressed his happiness at the exceptional financial results following the company’s listing.

He said, “IREDA is unwavering in its commitment to expedite the adoption of renewable energy solutions in the country. For investors and stakeholders, these results signal the promising trajectory of IREDA’s contributions to India’s energy transition and environmental sustainability. These encouraging financial outcomes underscore IREDA’s steadfast dedication to fostering the expansion of the renewable energy sector in India.”

As per my analysis, IREDA is a good company for the long term. IREDA share price target 2025 is easily achievable. I would like to invest in the company if it reaches around Rs125 level. For the long term, IREDA Share price target 2030 is still intact with condition of strong company performance and supportive policy.

However, the only risk factor is that it is a state-owned company and any policy changes will affect this company badly. Hence, my advice is look for the company insight instead of IREDA share price target to achieve your long term goal. I hope I answered your query on is IREDA share a good buy now?

(Disclaimer: I am not a SEBI registered analyst. The above article is meant for informational purposes only, and should not be considered as any investment advice. We do not give any investment advice, we suggest our readers/audience consult their financial advisors before making any investment decisions.)

Share With Friends

Why IREDA Share Price is falling?

IREDA share price is falling due to profit booking and high run up so fast. Let is settle down before you start looking it again to invest.

What is IREDA Share Price Target?

Instead of trying to understand what IREDA Share Price target, it is important to understand the fundamentals of the company.

What is IREDA business model?

IREDA is define as “Public Financial Institution”. This is a mini ratna company of government of India.

IREDA is a financial institution offers financial assistance for new and renewable energy (“RE”) projects, and energy efficiency and conservation (“EEC”) projects.

Is IREDA a good buy?

Yes, this company is good to consider investment for long term. Government has focused on renewable energy. IREDA has monopoly business in financing renewable companies.

Is IREDA long term investment?

Yes, it is good to invest in IREDA for long term. But the risk of government changes or policy changes will always be there.

What is IREDA fair value?

As per my analysis, the IREDA fair value is around Rs 125-130 level. This is a good level to buy. But, in the bull run in broader market, one can start investing at current level in a staggered manner.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market in 2023. To know more information about company insights for investment, and business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, 10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO.

[…] IREDA Share Price Target: What Smart Investors Need to Know […]

[…] IREDA Share Price Target: What Smart Investors Need to Know […]

[…] IREDA Share Price Target […]

[…] IREDA Share Price Target […]