Table of Contents

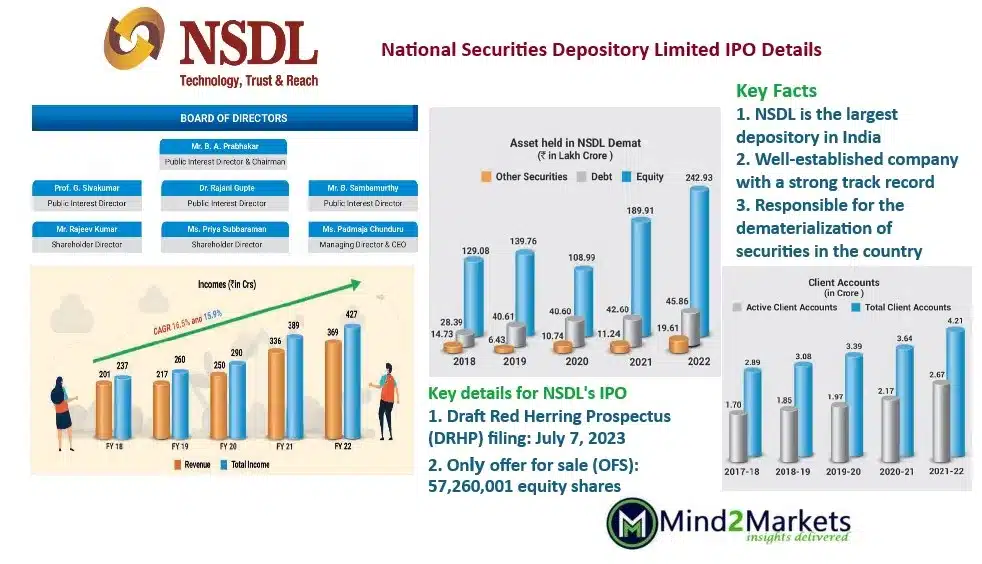

NSDL IPO details – Key Facts

- NSDL is the largest depository in India and is responsible for the dematerialization of securities in the country.

- Draft Red Herring Prospectus (DRHP) filing: July 7, 2023

- IPO opening: August 4, 2023 (tentative date)

- IPO consists of – OFS of 57.26 million shares

- Well-established company with a strong track record.

- Duopoly business – One of the two players in India in this business.

- Strong growth potential for this business in India and competition is low.

- Should I invest in the NSDL IPO during the IPO process?

NSDL IPO Review – National Securities Depository Limited (NSDL) filed DRHP on 7th July 2023 to float its Initial public offering. According to DRHP, NSDL IPO consists of an offer for the sale of 57,260,001 Equity Shares. There is no fresh issue in this offering. Promoter banks such as HDFC bank, IDBI bank, State Bank of India, Union Bank of India, Specified Undertaking of the Unit Trust of India (SUUTI), and National Stock Exchange are selling their stakes in this offering.

The net proceeds from NSDL IPO will not come to the company as it is a complete OFS. The promoter group entities will receive the net proceeds from this IPO. Now the big question is – Should I invest in the NSDL IPO? Let us find out details about the company and why you should consider investing in this company in below NSDL IPO details section.

What does NSDL do?

National Securities Depository Limited (NSDL) is the largest depository in India. The company was founded in 1996. NSDL is responsible for the dematerialization of securities in the country.

A security depository is a financial institution that facilitates the holding and trading of securities such as stocks, bonds, and mutual funds in an electronic or dematerialized form. Whenever you are purchasing any of these financial instruments such as shares or bonds through your DP (Demat account), these are recorded in an electronic format with NSDL or CDSL. These two institutions are responsible for the safekeeping, transfer, and settlement of securities.

Duopoly business: Two players in India – CDSL and NSDL

- National Securities Depositories Ltd (NSDL) and Central Securities Depositories Ltd (CDSL) both are depositories, responsible to hold your securities safely in dematerialized form and facilitate trading in stock exchanges.

- There is no significant difference between CDSL and NSDL.

- Both are regulated by SEBI and provide similar trading and investing services

- CDSL is operated by the Bombay Stock Exchange (BSE)

- NSDL is operated by National Stock Exchange (NSE)

- Promoters are different – NSDL is promoted by IDBI bank, UTI, NSE, HDFC, and SBI, while CDSL is promoted by BSE and was founded in December 1999.

- CDSL is a listed entity and is trading on both the exchanges – BSE and NSE

- NSDL is planning to come up with an IPO, maybe in 2023. DRHP document filed on 7th July 2023.

- The Demat Account (DP) will have 16 numeric digits with CDSL. The DP with – IN, followed by 14 digits with NSDL.

- As of March 31, 2023, there were a total of 114.46 million Demat accounts in India.

- Of these, 80.51 million were active Demat accounts with CDSL (70%) and 31.46 million were active demat accounts with NSDL (30%).

- As of March 31, 2023 – 283 active Depository Participants (DPs) in NSDL and 580 active DPs in CDSL.

- The fee structure in CDSL is lower than in NSDL.

- In terms of the number of issuers, number of active instruments, market share in demat value of settlement volume, and value of assets held under custody, NSDL holds a higher share compared to CDSL

NSDL IPO review – Business Description

Being a key player in the Indian financial markets, the National Securities Depository Limited IPO (NSDL) IPO is important for retail investors. It is a well-established company with a strong track record. Let’s discuss NSDL IPO benefits with its business description.

- Manages “Demat Accounts” held with it through depository participants.

- Deals with various asset classes namely equities, preference shares, warrants, funds (mutual funds, REITs, InvITs, and AIFs), debt instruments (corporate debt, commercial paper, certificate of deposit, pass-through certificate, security receipts, government securities, sovereign gold bonds, municipal debt, treasury bill) and electronic gold receipts.

- Facilitates the holders of securities to hold and transfer their securities in electronic form and enables settlement solutions of these securities.

- The company earns its revenue primarily through annual custody fees and transaction fees that the company charges issuers of securities and annual maintenance fees.

- Operates through NSDL and its subsidiaries – NSDL Database Management Limited (“NDML”) and NSDL Payments Bank Limited (“NPBL”).

NSDL IPO Review

NSDL filed DRHP with market regulator SEBI on 7th July 2023. This IPO is a complete offer for sale (OFS) where promoter groups are selling their stake in the process. The NSDL IPO will see sales of 57.26 million shares by its six shareholders.

As per the shareholding, IDBI Bank and National Stock Exchange (NSE) hold 26% and 24% stakes in the company, respectively. HDFC Bank (8.95%), State Bank of India (5%), Union Bank of India (2.8%), and Canara Bank (2.3%) are other key stakeholders.

HDFC Bank will sell 4 million shares (2% stake) in the initial public offering (IPO), National Stock Exchange will sell 18 million shares it owns in the depository while IDBI Bank will sell up to 22.2 million shares.

Union Bank of India will sell 5.62 million shares, and State Bank of India, and Administrator of the Specified Undertaking of the Unit Trust of India (SUUTI) will sell 4 million and 3.4 million shares, respectively.

National Securities Depository Limited (NSDL) Leadership team

Mr. Padmaja Chunduru is the Managing Director and Chief Executive Officer of the company. Mr. Parveen Kumar Gupta is the Chairman and Public Interest Director.

National Securities Depository Limited Revenue and Profit

The company has a track record of growth in revenue and profits. Between Financial Years 2021 and Financial Years 2023, the revenue from operations grew from ₹4,675.69 million to ₹10,219.88 million. The profit after tax grew from ₹1,885.65 million to ₹2,348.11 million. The EBITDA also grew at a CAGR of 11.41% from ₹2,644.62 million in the Financial Year 2021 to ₹3,282.50 million in the Financial Year 2023.

| Time Period Ended | 31-Mar-21 | 31-Mar-22 | 31-Mar-23 |

|---|---|---|---|

| Total Assets | 15,040.06 | 16,927.47 | 20,934.75 |

| Total Revenue | 5,261.24 | 8,212.92 | 10,998.14 |

| Profit After Tax | 1,885.65 | 2,125.94 | 2,348.10 |

| RoNW (%) | 18.50 | 17.55 | 16.43 |

| EPS (diluted in ₹) | 9.43 | 10.63 | 11.74 |

| NAV/ Equity Share (in ₹) | 50.96 | 60.58 | 71.44 |

Objective Behind the NSDL IPO

- The company will not receive any proceeds from the Offer.

- The net proceeds from this NSDL IPO will go to the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholder as part of the Offer.

- The company will achieve the benefits of listing the Equity Shares on BSE

- This will also enhance the visibility and brand image of the company as well as provide a public market for Equity Shares in India.

Should I invest in the NSDL IPO?

- NSDL is the country’s largest security depositor promoted by the National stock exchange (NSE).

- The depository market in India is a duopoly with high barriers to entry.

- Capital market participation in India is rising and there is huge potential for this industry in India due to higher economic growth potential, and higher youth population in comparison to developed countries.

- Penetration of mutual funds and equity participants is lower in India compared to other developed countries

- The number of new demat accounts opened with depository participants in India in the Financial Year 2023 was 24.78 million as compared to 4.96 million in the Financial Year 2020.

- The company has recorded strong revenue growth over the years.

- Considering the above factors NSDL is a strong company to invest in.

- To answer the question – Should I invest in the NSDL IPO?

- Yes, I would love to invest in NSDL IPO both for listing gain and long-term investment.

NSDL IPO listing date and Other details

| NSDL IPO Details | NSDL IPO Listing date, Price and other details |

| IPO Date | – |

| IPO Price band | – |

| IPO Allotment date | – |

| Refunds Initiation date | – |

| Credit of Shares to Demat Account | – |

| NSDL IPO Listing Date | – |

| Fresh Issue | Nil |

| Offer for Sale | 57.26 million shares |

| Maximum bid (lot size) For retail investor | 1 lot of – shares Total Investment of ₹- |

| Minimum bid (lot size) For retail investor | 1 lot of – shares Total Investment of ₹- |

| NSDL Share Face Value | INR 2 per share |

| NSDL Share Listing on | BSE, NSE Exchange |

Frequently Asked Questions (FAQs) on NSDL IPO details

- NSDL Filed DRHP?

- Yes, here is the NSDL IPO DRHP document for your reference

- How can I invest in NSDL IPO?

- If you are interested in investing in NSDL IPO, you need to open a Demat account and trading account with a broker. You can then apply for shares during the IPO opening period.

- When is the NSDL IPO listing date?

- The NSDL IPO listing date is not yet announced. However, it may be open for subscription in August 2023.

- What is the NSDL IPO Price?

- The NSDL IPO Price has not yet been announced

- What are the risks of investing in NSDL IPO?

- As with any investment, there are risks associated with investing in NSDL IPO. These risks may include as below.

- There may be regulatory changes in the country.

- The company may not perform well as expected.

- The company may face regulatory or legal challenges from market regulator.

- There may be economic slow down which will have negative impact on capital market.

- What is the NSDL IPO Size

- The NSDL IPO is complete OFS. The offer size is up to 57,260,001 shares, which represents 28.63% of the post-issue equity share capital of NSDL.

- The anchor investors’ portion is 25% of the offer size, or up to 14,315,000 shares.

- Should I Invest in the NSDL IPO?

- The NSDL IPO is expected to be a hotly-contested issue. Keep an eye on the subscription date and price to invest in it for long term.

NSDL IPO Lead Managers & Registrar

| Lead Manager | Registrar |

| ICICI Securities Limited Axis Capital Limited HSBC Securities and Capital Markets (India) Private Limited IDBI Capital Markets & Securities Limited Motilal Oswal Investment Advisors Limited SBI Capital Markets Limited | Link Intime India Private Limited Telephone: +91 810 811 4949 E-mail: nsdl.ipo@linkintime.co.in |

National Securities Depository Limited Company Contact Information

| National Securities Depository Limited Trade World, ‘A’ Wing, 4th Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel (West), Mumbai – 400 013, Maharashtra, India E-mail: cs_nsdl@nsdl.com Telephone: +91 22 2499 4200 https://nsdl.co.in |

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO.

mind2markets is in news

Feedstop has mentioned mind2markets website as one of the best site to provide stock analysis and insights about the company to invest in. Keep in touch.

[…] The company filed DRHP on 7th July 2023 to float its Initial public offering. According to DRHP, NSDL IPO consists of an offer for the sale of 57,260,001 Equity Shares. There is no fresh issue in this […]