Should I invest in SBFC Finance IPO, this is an important question to answer itself in the current market condition. Is it the right time to invest in NBFCs in India?

SBFC Finance IPO Review

SBFC IPO is opening from Aug 3, 2023, to Aug 7, 2023, with a total IPO issue size of ₹1025 crore. The company is coming up with a fresh issue of ₹600 crore and an offer for sale of ₹425 crore. The face value of the SBFC Finance share will be ₹10 per share. The stock will be traded in BSE and NSE.

The company has filed a preliminary paper with SEBI to float the IPO on November 5, 2022. You can find the company DRHP document with market regulator SEBI here. The company came up with a revised IPO issue in the RHP document and the IPO size has been reduced from ₹1600 crore to ₹1025 crore in its RHP which was filed on July 26, 2023.

SBFC IPO – Business Description

Incorporated as ‘MAPE Finserve Private Limited’ in Mumbai, India, in January 2008, SBFC Finance is a non-deposit-taking non-banking finance company (“NBFC-ND-SI”). The company offers Secured MSME Loans and Loans against Gold, with a majority of its borrowers being entrepreneurs, small business owners, self-employed individuals, salaried and working-class individuals.

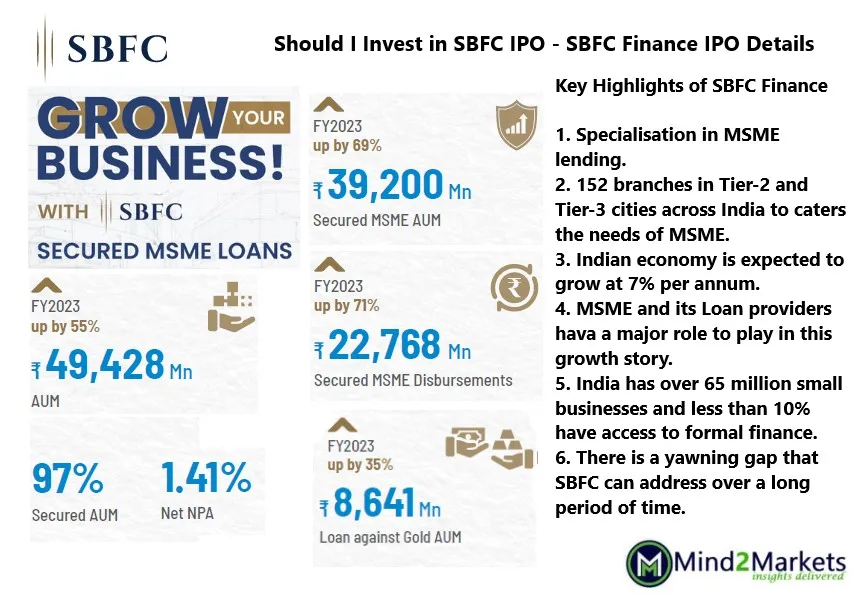

SBFC is one of the leading NBFCs in India that focused on MSME business loans. The NBFC is one of the highest assets under management (“AUM”) growth, at a CAGR of 44% in the period from Fiscal 2019 to Fiscal 2023.

The company also witnessed healthy disbursement growth, at a CAGR of 40% between Fiscal 2021 and Fiscal 2023. As of March 31, 2023, the Gross NPA to AUM ratio for ticket sizes between ₹ 0.50 million and ₹ 3.00 million was 1.97%.

SBFC Finance presents across 105 cities, spanning 16 Indian states and two union territories, as of 31 December 2022. The company has 152 branches with a strong customer base of 1,02,722 as of March 2023. Its AUM was diversified across India, with 30.89% in the North, 38.16% in the South, and 30.95% in the West.

As of 31 March 2021, 31 March 2022, and 31 March 2022, SBFC Finance had provided loans to 56,587, 72,816, and 102,722 customers, and the Gross NPA ratio was 3.16%, 2.74%, and 2.43%, respectively, while the Net NPA ratio was 1.95%, 1.63%, and 1.41%, respectively (Refer to RHP document).

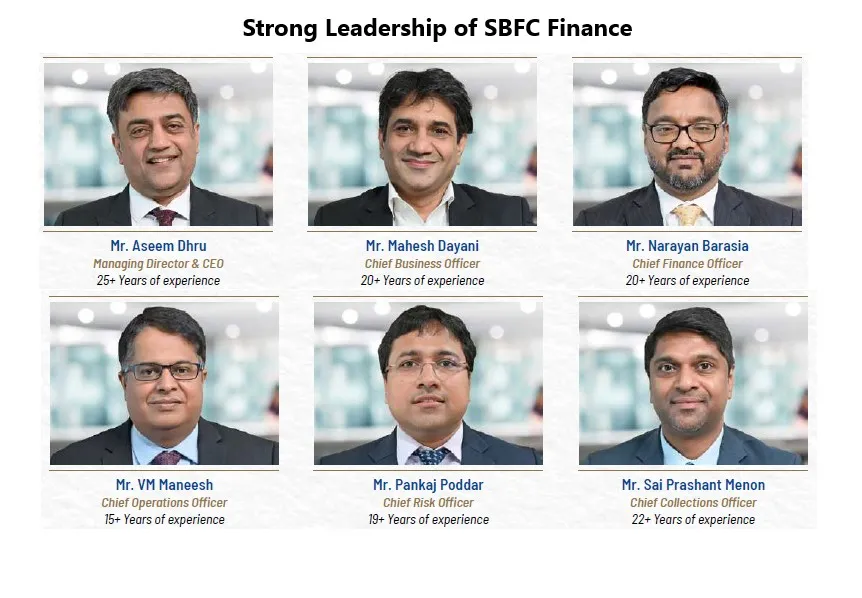

SBFC Finance IPO: Leadership

SBFC Holdings PTE. Ltd., Clermont Financial PTE. Ltd., Arpwood Partners Investment Advisors LLP, Arpwood Capital Private Limited, and Eight45 Services LLP., are the Promoters of SBFC Finance.

SBFC Finance has a strong management team with an average experience of over 20 years.

SBFC IPO: Revenue and Profit

SBFC posted total income and net profit of Rs 7,403.61 million and Rs 1,497.96 million respectively for the FY ended 31 March 2023, as against Rs 5,307.02 million and Rs 645.21 million respectively for the previous financial year ended31 March 2022.

The Loan against Gold grew by 35% & continues to be the focus area with an AUM of 864 Cr contributing 18% of the total AUM of 4943 Cr. The Gross NPA ratio for Loans against the Gold portfolio for FY23 was 1.21% as compared to 1.71% for FY22.

The AUM of the company grew from 3192 Cr as of fiscal year 2022 to 4943 Cr for FY 23 thereby registering a growth of 55%.

SBFC Finance IPO Review – Financial Snapshot

| Period Ended | 31 Mar 2020 | 31 Mar 2021 | 31 Mar 2022 | 31 December 2022 | 31 Mar 2023 |

| Assets | 4,207.99 | 4,231.19 | 4,515.03 | 5,334.82 | 5,746.44 |

| Revenue | 444.85 | 511.53 | 530.70 | 531.69 | 740.36 |

| Profit After Tax | 35.50 | 85.01 | 64.52 | 107.03 | 149.74 |

| Net Worth | 752.09 | 944.72 | 1,026.78 | 1421.63 | 1,466.88 |

| Total Borrowing | 3,056.38 | 2,772.55 | 2,948.82 | 3,409.48 | 3,745.83 |

Objective Behind the SBFC IPO

- The Net Proceeds will be utilized towards augmenting the Company’s capital base to meet their future capital requirements arising out of the growth of the business and assets.

- SBFC will temporarily invest the Net Proceeds in deposits in one or more scheduled commercial banks included in the Second Schedule of the Reserve Bank of India Act, 1934 as may be approved by the Board.

- This will also enhance the visibility and brand image as well as provide a public market for Equity Shares in India.

Should I Invest in SBFC Finance IPO?

- SBFC Finance has a strong track record of growth and profitability.

- It has a strong management team with a proven track record in the financial services industry.

- Indian economy is expected to grow at an annual average rate of 7%. MSMEs are the backbone of economic growth.

- Banks and NBFCs are the bloodlines of these MSMEs.

- As of June 20, 2023, only 16.9 million MSMEs have registered on UDYAM, of the estimated 70 million MSMEs in India.

- This leaves a large number of MSMEs without access to organized finance owing to their unregistered status.

- As of March 2022, less than 15% of MSMEs have access to credit in any manner and traditional institutions have historically refrained from providing credit to under-served or un-served MSMEs and self-employed individuals

- Hence, there is a huge potential for the growth of NBFCs in this segment in India.

- SBFC finance is present in over 16 states including Union territories.

- However, the company is facing increasing competition from other non-banking financial companies (NBFCs).

- I would like to invest in the SBFC IPO for both listing gain as well as long-term gain.

SBFC finance IPO Details

| SBFC IPO Details | SBFC IPO Listing date, Price and other details |

| SBFC IPO Date | Aug 3, 2023 to Aug 7, 2023 |

| SBFC Finance IPO price range | ₹54 to ₹57 per share |

| IPO Allotment date | 10 August 2023 |

| Refunds Initiation date | 11 August 2023 |

| Credit of Shares to Demat Account | 14 August 2023 |

| SBFC IPO Listing Date | 16 August 2023 |

| Fresh Issue | ₹600.00 Cr |

| Offer for Sale | ₹425.00 Cr |

| SBFC finance IPO lot size Minimum bid For retail investor | 1 lot of 260 shares Total Investment of ₹14,820 |

| SBFC finance IPO lot size Maximum bid For retail investor | 13 lot of 3380 shares Total Investment of ₹192,660 |

| SBFC Share Face Value | INR 10 per share |

| SBFC Share Listing on | BSE, NSE Exchange |

SBFC IPO Lead Managers & Registrar

| Lead Manager | Registrar |

| ICICI Securities Limited Axis Capital Limited Kotak Mahindra Capital Company Limited | Kfin Technologies Limited Phone: 04067162222, 04079611000 Email: Sbfc.ipo@kfintech.com Website: https://kosmic.kfintech.com/ipostatus/ |

SBFC Finance Company Contact Information

| SBFC Finance Limited 103, 1st Floor, C&B Square, Sangam Complex, Andheri Kurla Road, Village Chakala, Andheri (East), Mumbai – 400 059 Phone: 022 6787 5344 Email: complianceofficer@sbfc.com Website: http://www.sbfc.com/ |

SBFC Finance IPO GMP

Grey Market is an unregulated market where the upcoming IPO applications and IPO shares trade before listing of the stock. An investor may get an idea of the IPO GMP just to understand the post listing position of the IPO share. Thia may be used to estimate the listing gain on the IPO share. GMP or Grey Market Premium adding to issue price gives the estimated listing price of the IPO share or the under current price of that IPO. This should not be treated as a criteria to value or decide a company for the IPO to invest in.

The SBFC Finance IPO GMP is Rs 40 and the IPO price of SBFC IPO is Rs 57. That reflects the SBFC finance IPO share is likely to be listed at Rs 97 per equity share. However, SBFC Finance IPO GMP is just an indicator of the price, the actual price may vary on the listing day.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO.

mind2markets is in news

Feedstop has mentioned mind2markets website as one of the best site to provide stock analysis and insights about the company to invest in. Keep in touch.

Please comment for any suggestion on the above article.