Vatech Wabag share price is in bullish momentum Key Insights. Wabag Share price target 2024 may be 1200 to 1500.

Share With Friends

Table of Contents

- Key highlights on Va tech Wabag Stock Price Forecast Key details (Earlier I invested at 275 level) – see below for current technical analysis

- Technically, the Va Tech Wabag stock has given a golden cross over at 275 level on Nov 22, 2022

- The stock again consolidated for a long time in a range of 307 to 340 level.

- Again on 04-05-2023, the VaTech Wabag share price has given break out at 390 level with strong volume.

- In a long term chart, the stock is heading towards 500 level. This will give 25% from this level.

- Fundamentally, this is a good company to invest in now or at lower level.

- World’s 3rd largest private water operator

- In March 2023, va tech wabag won Rs4,400 crore project from Chennai Metro water to build desalination plant.

- Invest for long term at least for one year or 500 level which come first.

Wabag Share Price Technical Analysis (16-04-2024)

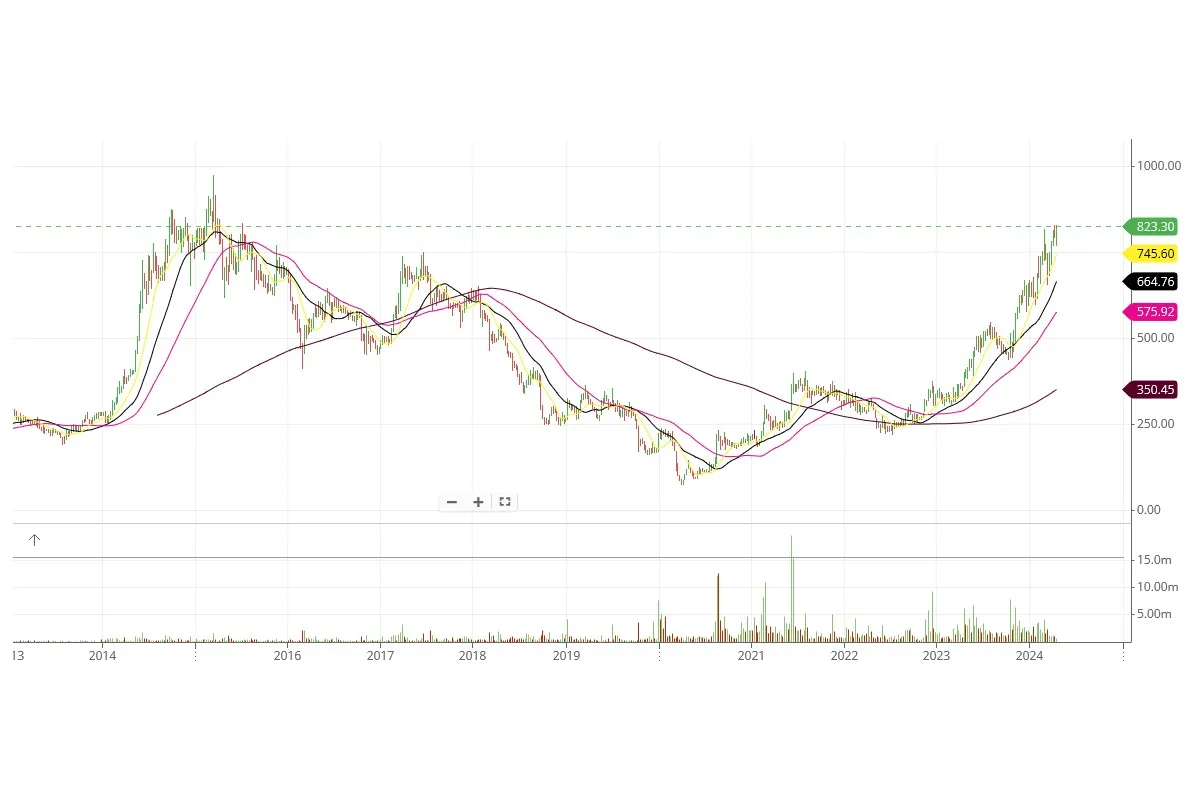

- Wabag Share price has given a breakout at 820 level.

- The most important about this break out is, it is the breakout of about 9 years.

- See the weekly chart, the previous all time high of Wabag share price is around 900 level.

- Wabag share price is moving towards this level.

- Once the wabag share price closed above 900 level, the counter can easily reach 1200 to 1500 level in 2024.

- So, I will keep holding this stock in my portfolio for another 6 months.

- Wabag share price target for 2024 will be 1200 to 1500.

- See for the fundamentals below.

Wabag share price is in bullish momentum and given a breakout with strong volume. Invest in it now for a target of 486 for the short to medium term. Wabag share price NSE is showing bullish chart patterns. Va tech wabag is one of the best companies to invest in right now. Technical analysis of the stock is reflecting bullish price momentum with strong volume. Fundamentally, it is a good company to invest in for the medium to long-term.

The stock has given a break out from with a cup and handles pattern in the daily chart. Wabag share price is also given a golden crossover on the daily chart at the 300 level which is eventually its previous swing high. The share price of wabag is trading above the previous swing high and ready to move up for a 25% move.

Wabag share price is in bullish momentum – Technical Analysis

Va tech WABAG share price (WABAG) looks strong in its technical chart with strong trading volume over the last few trading sessions. The trading volume of the script is above 100 DMA during this period. It seems the counter is ready to move up sharply. Va tech wabag share price nse is crossed above its previous swing high at 300 level. Eventually, Va tech wabag share price has given a golden crossover at the same level.

Once Wabag share price crossed the previous swing high at the 300 level with strong volume, it will reach its all-time high. Again, Va tech wabag share price is trading above all its short and long-term moving averages on the daily chart. Buy at this level or on Dip for long-term gain.

Va tech wabag share price prediction

On the weekly chart, Va tech wabag share price looks strong in the weekly chart with strong volume over the last weeks. Wabag share price looks strong for both short- and long-term investments at this level. The stock is just above its weekly previous swing high of 317 level. Once it closes above it, for the short to medium term, Wabag share price target in 2023 can be above 500.

Momentum indicators RSI, ADX, and MACD of Va tech WABAG share is looking bullish on the daily chart. One may buy on dips for a 10 to 20% gain in the short term. WABAG stock is trading at 12.1 Price to Earnings (PE). The stock has 13.3% ROCE and 8.56% ROE. Zero-debt company with a debt-to-equity ratio is 0.28 in FY22. The fundamentals of the company with a low debt-to-equity ratio make it attractive.

vatechwabag FundamentalAnalysis

Va tech wabag Business Description

The company is a leading Water Treatment Solution Provider globally. Headquartered in Chennai, India, the company was founded in Breslau, Germany in 1924. Deutsche Babcock became the majority shareholder of Wabag in 1973. Eventually, Deutsche Babcock took over the entire company.

The company is one of the fastest-growing multinational companies present in over 30 countries across the globe.

- Wabag offers water solutions to municipalities and industries. The services include Water Treatment, Desalination, Wastewater Treatment, Water Reclamation, Sludge Treatment, etc.

- The company caters to all industries such as Oil and Gas, Power Plants, Steel Industry, Fertilizer Industry, Food & Beverage, Water Reclamation, Industrial Parks, and Others.

- The company has over 98 years of experience in the industry with a highly experienced team with an average of 30 years of experience in the water sector.

- Ranked 4th Globally by Global Water Intelligence (‘GWI’), United Kingdom for ensuring water & sanitation for over 71 Mn people.

- The company mainly focuses on Government funded projects. One of its major projects in India is Namami Gange Project to clean the water of the river Ganga.

- Strong order book – Order Book of over Rs. 103 Bn including Framework Orders while order Intake of ~Rs. 15 Bn by Q2FY23.

- As per the latest presentation, Va Tech Wabag reported strong YoY revenue growth from INR 684 crore in Q2FY2022 to INR 750 crore in Q2FY2023.

- EBIDTA margin of the company has increased from 8.3% to 9.8% during the same period.

- Operating margins continued to improve driven by the increase in international EP projects and execution pace.

- Profit after tax has doubled from INR 26.2 crore in Q2FY2022 to INR 46.7 crore in Q2FY2023. This is due to a reduction in borrowing costs through actions on debt control.

- However, Net cash generated from operations is negative during the above period.

- QoQ EPS of the company has also gone up from 4.4 in June 2022 to 6.37 in September 2022. YOY EPS was also higher in FY2022 reaching 21.21 from 18.83 in FY2021.

- However, Promoter shareholdings declined from 21.7% in June 2022 to 19.13% in September 2022.

- DIIs have also decreased their stakes from 3.28% to 3.25% during the same time.

- However, FIIs decreased their stake from 15.35% to 14.42% during the same time.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. To know more information about business overview of each company, here are some suggested readings on company insights India Glycols, Gokex, Elgi Equipments, and PCBL. Company profile mamaearth, Lumaxtech share price.