Why are FIIs selling in India

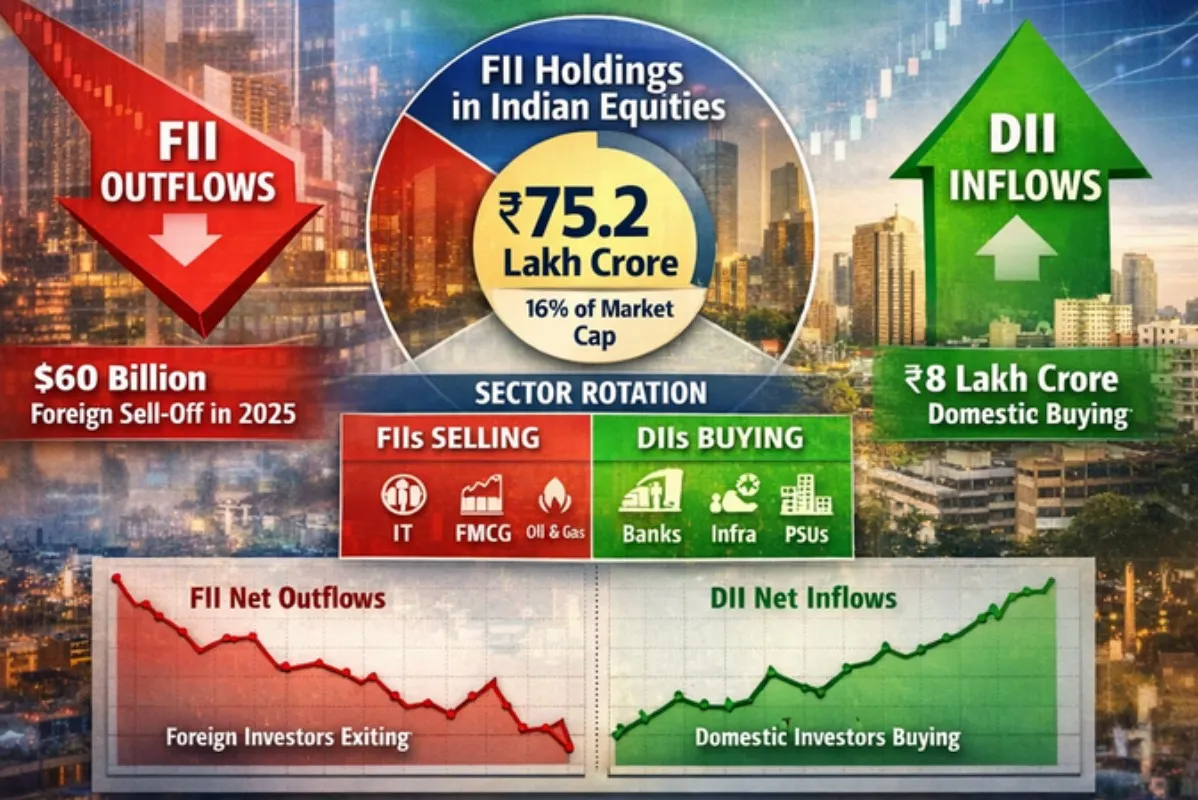

Between February 2025 and February 2026, the Indian equity market experienced one of the most significant structural shifts in its modern history. Foreign Institutional Investors (FIIs), historically the dominant force in Indian equities, turned sustained net sellers. In contrast, Domestic Institutional Investors (DIIs) deployed record capital, stabilizing the market and redefining ownership dynamics.

Table of Contents

Why are FIIs selling in India ?

This period marks a transition from a foreign-liquidity-driven market to a domestically anchored equity cycle. While global macro pressures triggered FII withdrawals, India’s internal capital formation absorbed supply, preventing systemic disruption.

The divergence marked a shift from a foreign-funded equity regime to a domestically anchored capital cycle.

Despite cumulative foreign outflows exceeding ₹4.5–5.0 lakh crore (≈ $55–60 billion) across 2025–early 2026, Indian benchmark indices remained resilient. Domestic flows—driven by mutual funds, insurance, pensions, and retail financialization—more than offset foreign selling.

Capital Flow Divergence: The Defining Trend of 2025–26

The most defining characteristic of India’s equity market over the past year has been the divergence between foreign and domestic flows.

Capital Flow Snapshot (Feb 2025 – Feb 2026)

| Category | Net Trend | Market Impact |

| FIIs | Sustained Net Sellers | Increased volatility, large-cap pressure |

| DIIs | Record Net Buyers | Market stability, mid-cap resilience |

| Retail/SIP | Structurally Strong | Liquidity cushion |

Despite persistent FII selling, benchmark indices avoided deep corrections. Domestic capital absorbed supply, highlighting a structural shift in market funding.

Monthly FII vs DII Equity Flows (India)

FII inflows and outflows Period: Jan 2025 – Jan 2026

(All values ₹ crore; Equity cash segment)

| Month | FII Net Flow | DII Net Flow | Market Context |

| Jan-25 | -87,374 | +86,592 | Global risk-off, US yields spike |

| Feb-25 | -58,988 | +64,853 | Valuation concerns India |

| Mar-25 | +2,014 | +37,586 | Short FII comeback |

| Apr-25 | +2,735 | +28,228 | Election optimism |

| May-25 | +19,860 | +67,642 | Peak FII inflow 2025 |

| Jun-25 | +7,489 | +72,674 | Stable global liquidity |

| Jul-25 | -47,667 | +60,939 | China rebound trade |

| Aug-25 | -46,903 | +94,829 | EM rotation |

| Sep-25 | -35,301 | +78,500 | USD strength |

| Oct-25 | -114,445 | +82,000 | Biggest FII exit |

| Nov-25 | -45,974 | +70,000 | Continued selling |

| Dec-25 | -29,000 | +65,000 | Year-end repositioning |

| Jan-26* | -13,707 | +43,301 | Selling moderating |

- Total FII Outflow (2025–early 2026)

- ≈ ₹4.5–5.0 lakh crore net equity selling

- Largest exits:

- Oct 2025: ₹1.14 lakh cr

- Jan 2025: ₹87k cr

- Feb 2025: ₹59k cr

- 2025 was one of the largest FII exit years from India since 2008 taper-tantrum phase.

- Total DII inflow (same period):

- ≈ ₹7–8 lakh crore

- What Drives this:

- SIP monthly flows ~₹17k–20k cr

- Insurance + PF allocations

- Pension reforms

- Domestic financialisation

Why Are FIIs Selling in India?

Foreign investors reallocate capital cyclically. India’s long-term structural story remains intact, but five factors drove the recent outflows.

Elevated Valuations Relative to Emerging Markets

India currently trades at a substantial premium compared to other emerging markets.

Valuation Comparison (Forward P/E)

| Market | Forward P/E |

| India | 20–22× |

| Emerging Market Average | 12–14× |

| Developed Markets | 17–19× |

India’s premium of 50–70% became difficult to justify as earnings momentum slowed.

Earnings Growth Moderation

From 2020–2023, India experienced a strong profit recovery cycle. By 2025:

- EPS growth slowed to high single digits

- Margin pressures emerged in IT, consumer, chemicals

- Export-linked sectors faced global demand uncertainty

Foreign capital typically favors accelerating earnings environments. The slowdown reduced India’s relative attractiveness.

Global Interest Rate Environment

The global monetary cycle significantly influences emerging-market allocations.

When U.S. rates remain elevated:

- U.S. bond yields become attractive

- The dollar strengthens

- Emerging-market equity allocations decline

The prolonged higher-rate environment in 2025 constrained foreign appetite for risk assets.

Currency and Dollar Strength

Emerging-market returns are currency-sensitive. Even modest depreciation in the rupee reduces foreign equity returns.

A firm dollar environment during 2025 reinforced risk aversion toward EM assets, including India.

Global Risk Sentiment

Additional headwinds included:

- Slowing global growth forecasts

- Trade-policy uncertainty

- Commodity volatility

- Geopolitical tensions

FIIs tend to reduce EM exposure during periods of global macro uncertainty.

FII inflows and outflows in Sectors

Foreign flows were not uniformly negative. Instead, capital rotated selectively.

Sector Rotation Matrix (FII Perspective)

FII inflows and outflows in Sectors (2025–26)

| Sector | FII Trend | Rationale |

| Private Banks | Inflow | Credit growth, strong ROE |

| NBFCs | Mixed | Selective accumulation |

| Capital Goods | Inflow | Capex cycle optimism |

| Telecom | Inflow | 5G monetization |

| Defence | Inflow | Domestic manufacturing push |

| FMCG | Outflow | Valuation compression |

| IT Services | Outflow | Global demand slowdown |

| Oil & Gas | Outflow | Margin uncertainty |

| Metals | Outflow | Commodity volatility |

This rotation reflects a shift toward domestic growth themes and away from export-sensitive sectors.

Asset-Class Reallocation by Foreign Investors

FIIs did not fully exit India—they rebalanced across asset classes.

FII inflows and outflows in Asset Allocation

| Asset Class | Allocation Trend |

| Indian Equities | Reduced |

| Indian Government Bonds | Increased |

| Global Fixed Income | Increased |

| Gold / Safe Assets | Increased |

This behavior aligns with late-cycle global macro positioning—reducing equity risk while increasing defensive exposure.

The Rise of Domestic Institutional Dominance

India’s equity market has entered a new liquidity regime.

Structural Drivers of DII Growth

- Record SIP inflows

- Pension and insurance allocations

- Rising retail financialization

- Digital brokerage penetration

Domestic flows have now structurally exceeded foreign flows in magnitude.

Ownership Shift

For the first time in modern history:

- Domestic institutional ownership approaches or exceeds foreign ownership in several major indices

- Household savings increasingly channel into equities

- Corrections remained shallow

- Mid-cap and small-cap segments strengthened

India has transitioned from foreign-driven to domestically anchored equity funding.

Can Indian Equities Sustain Without FIIs?

The answer is increasingly yes—but with qualifications.

What Domestic Flows Can Sustain

- Gradual bull market trends

- Valuation stability

- Reduced crash probability

- Mid- and small-cap resilience

What Still Requires FIIs

- Large-cap re-rating

- Sharp bull market expansions

- Global capital rotation phases

- Momentum-driven rallies

Domestic capital now anchors trend; foreign capital amplifies cycles.

Scenario Analysis: If FII Absence Persists

If foreign flows remain muted:

| Likely Outcome | Market Impact |

| Range-bound large caps | Limited index expansion |

| Earnings-driven returns | Stock selection critical |

| Mid-cap outperformance | Domestic participation focus |

| Gradual valuation normalization | Premium compression |

The 2025–26 market already reflects aspects of this pattern.

When Will FIIs Return to Indian Equities?

Foreign capital historically returns when macro, valuation, and earnings cycles align.

Key Triggers for FII Re-Entry

- Earnings Re-Acceleration: EPS growth exceeding 15% historically attracts strong inflows.

- Valuation Rationalization: Either price correction or earnings catch-up.

- U.S. Rate-Cut Cycle: EM inflows typically begin 6–9 months after rate peaks.

- Dollar Weakening Phase: A sustained USD downtrend boosts EM attractiveness.

- Global Risk-On Environment: Improved growth outlook and geopolitical stability.

If global monetary easing begins may be towards Late 2026 to 2027 emerges as the likely window for sustained FII re-entry.

FII holding in Indian stock market in 2026

Despite record selling through 2024–2025, foreign institutional investors remain deeply embedded in India’s equity markets. As of late-2025, FII holding in Indian stock market is approximately ₹75.2 lakh crore (about $900 billion) in Indian equities, representing roughly 16–18 percent of total NSE market capitalization.

However, FII holding in Indian stock market has fallen to a 13-year low, with domestic institutional investors now holding about 18.7 percent — overtaking foreign investors for the first time in India’s market history.

This shift does not indicate a structural exit by global capital but rather a reallocation cycle. Even after selling nearly ₹2 lakh crore in 2025, FII holding in Indian stock market still remain the largest non-promoter equity ownership in India and remain dominant in large-cap sectors such as banking, IT, and energy.

The data suggests that global investors are reducing overweight positions rather than abandoning the India growth story — a distinction critical for assessing long-term market stability.

GCCs India Related Stories

- Growth of GCC companies in Indian Metros and Tier-II Cities 2025 Beyond

- H1-B Visa Shock – Leading GCC Companies in India 2025 Beyond

- Global Capability Centres in India: A Strategic Hub for Innovation and Excellence

- How India’s Best GCC companies Lead the Way in Tech, Finance, Pharma, and Beyond

- Investing in Global Capability Centres in India with Best-Listed Companies

Current FII Holding in Indian Stock Market

Latest available data (FY25–FY26):

| Metric | Value | Source |

|---|---|---|

| FII equity holdings (₹) | ₹75.2 lakh crore | NSE |

| FII share of NSE equities | ≈16.7%–18.4% | Economic Survey / brokers |

| DII share of NSE equities | ≈18.7% | Economic Survey |

| FII holdings in Nifty-500 | ≈$867 billion | Motilal Oswal |

| FII share in Nifty-50 | ≈24.3% | Motilal Oswal |

FII Equity Position — Before vs After Selling Cycle

| Period | FII Holdings | Change |

|---|---|---|

| 2021 peak | ~21% ownership | — |

| 2023 | ~18–19% | ↓ |

| 2025 | ~16–18% | ↓ |

| 2026 | ~16–17% | Stable low |

Indian equity market outlook Through 2030

India stands at a capital-market inflection point.

Short Term (2026):

- Market stability supported by DIIs

- Earnings cycle monitoring critical

- Large caps await foreign trigger

Medium Term (2027+):

- If global rates decline and earnings improve, FII re-entry likely

- Financials, IT, and industrials to lead

- Premium valuations may expand again

Long Term:

- Domestic liquidity becomes permanent market anchor

- India evolves into a self-sustaining equity ecosystem

- Lower crash risk compared to prior decades

The FII-DII divergence of 2025–26 does not signal foreign abandonment of India. Rather, it reflects a cyclical pause amid global macro uncertainty and valuation recalibration.

What makes this cycle different is India’s ability to withstand foreign selling without structural damage. Domestic capital has emerged as the stabilizing force, reshaping ownership patterns and strengthening market resilience.

India’s equity story is no longer dependent solely on global capital flows. It is increasingly powered by its own savings cycle.