Ahasolar Technologies IPO Details: Subscription for this SME IPO is opening from 10 July 2023 to 13 July 2023. According to Ahasolar Technologies DRHP, the IPO consists of a fresh issue of 818,400 shares aggregating up to ₹12.84 Cr. There is no offer for sales in the IPO issue. The Equity Shares have a face value of Rs 10 each. The retail allocation offered is 50% of the total size. This SME IPO will be listed on the BSE SME exchange.

Ahasolar Technologies IPO Details – The Company Business Description

Ahasolar Technologies was incorporated dated July 28, 2017, under the leadership of Mr. Piyushkumar Vasantlal Bhatt, Mr. Pulkit Dhingra, Mr. Shatrughan Harinarayan Yadav, and Mr. Vipin Sharma. The promoters have a combined experience of more than 48 years in the Renewable Energy and Information Technology Industry.

Ahasolar Technologies is engaged in the business of CleanTech enabling Energy Transition through Digital Transformation. This helps stakeholders to adopt renewable energy. The Company is a DPIIT-recognized startup. The core idea of AHAsolar is to work in the space of Climate Change, Renewable, and Digital space.

The primary focus of the company caters to the solar industry through an AI-based intelligent Solar Digital Platform. The company has developed Software as a Service (SaaS) products for solar companies to streamline the processes, design PV, do project management, and monitor generation along with an integrated Marketplace to connect the demand & supply digitally.

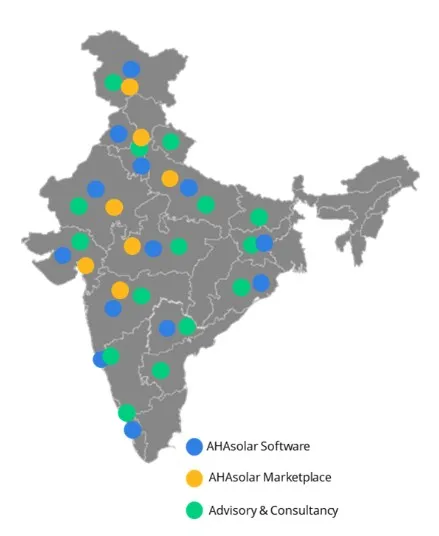

The core business of Ahasolar Tech can be divided into the following categories:

- Solar Software Service

- Solar Marketplace

- Solar Advisory and Consultancy Service

The company has been rendering its services to Solar EPC Companies and Corporate Consultancy Firms on Solar Project Management and Solar Plant Audits.

Ahasolar has two major SaaS products

- AHAsolar Unified Portal for Government Agencies

- AHAsolar Helper and Sun Analyzer for Solar Companies

Ahasolar Tech Limited Founders and Leadership team

The Promoters of the company are Mr. Piyushkumar Vasantlal Bhatt, Mr. Pulkit Dhingra, Mr. Shatrughan Harinarayan Yadav, and Mr. Vipin Sharma. Mr. Pulkit Dhingra and Mr. Vipin Sharma were subscribers to the memorandum.

The promoters have a combined experience of more than 48 years in the Renewable Energy and Information Technology Industry.

Ahasolar Tech Revenue and Profit

The total revenue of the company went up from INR 128.70 lakh in March 2020 to INR 1,714.64 lakhs in March 2022. The Profit After Tax also increased from INR 2.07 lakh in March 2022 and INR 68.63 lakhs in March 2022.

| Time Period Ended | 31-Mar-20 | 31-Mar-21 | 31-Mar-22 | 31-Sept-22 |

|---|---|---|---|---|

| Total Assets | 138.63 | 85.47 | 237.37 | 316.69 |

| Total Revenue | 128.70 | 187.73 | 1,714.64 | 1001.50 |

| Profit After Tax | 2.07 | 7.91 | 68.63 | 27.10 |

| Net Worth | 2.16 | 10.08 | 78.71 | 135.80 |

| Reserves and Surplus | 1.16 | 9.08 | 77.71 | 17.53 |

| Total Borrowing | 23.04 | 24.24 | 58.18 | 58.18 |

Objective Behind the Ahasolar Technologies IPO Details

- The company intends to utilize INR 705 lakhs out of the net proceeds to develop Solar PV Plant

- About Rs. 32.5 lakhs will be utilized to set up Electric Vehicle Charging Infrastructure

- Around Rs. 9 lakhs will be used to Purchase of Electric Vehicles

- The company will use Rs 240 lakhs to Meet Working Capital Requirements

Ahasolar Technologies IPO Review: Do you invest?

- Governments worldwide are focusing on renewable energy and this is the future.

- The company is into AI-based platforms that cater to Solar energy only.

- This is low margin business and New age business.

- There is a low entry barrier in this industry. With the AI boom, other companies can easily enter the industry and take the market share from this company.

- Again, any disruption or failure of this technology system will also negatively impact this company.

- Looking at the financials and factors mentioned above, I would prefer to avoid this SME IPO at the moment.

Ahasolar Technologies IPO Details

| Ahasolar Tech IPO Details | Ahasolar Technologies IPO Price and other details |

| IPO Date | Jul 10, 2023 to Jul 13, 2023 |

| IPO Price band | ₹157 per share |

| IPO Allotment date | Tuesday, 18 July 2023 |

| Refunds Initiation date | Wednesday, 19 July 2023 |

| Credit of Shares to Demat Account | Thursday, 20 July 2023 |

| Ahasolar Technologies IPO Listing Date | Friday, 21 July 2023 |

| Fresh Issue | 818,400 shares (aggregating up to ₹12.84 Cr) |

| Offer for Sale | Nil |

| Maximum bid (lot size) For retail investor | 1 lot of 800 shares Total Investment of ₹125,600 |

| Minimum bid (lot size) For retail investor | 1 lot of 800 shares Total Investment of ₹125,600 |

| Face Value | INR 10 per share |

| Listing on | BSE SME Exchange |

Ahasolar Technologies IPO Lead Managers & Registrar

| Lead Manager | Registrar |

| Beeline Capital Advisors Pvt Ltd | Kfin Technologies Limited Phone: 04067162222, 04079611000 Email: ahasolar.ipo@kfintech.com Website: https://ris.kfintech.com/ipostatus/ |

Ahasolar Technologies Contact Information

| Ahasolar Technologies Limited Office No. 207, Kalasagar Shopping Hub, Opp. Saibaba Temple, Sattadhar Cross Road, Ghatlodiya, Ahmedabad– 380061 Phone: 079-40394029 Email: compliance@ahasolar.in Website: http://www.ahasolar.in/ |

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, Is fine organics a good buy now.

mind2markets is in news

Feedstop has mentioned mind2markets website as one of the best site to provide stock analysis and insights about the company to invest in. Keep in touch.