Technical Textile Companies in India

Share With Friends

What are Technical Textiles?

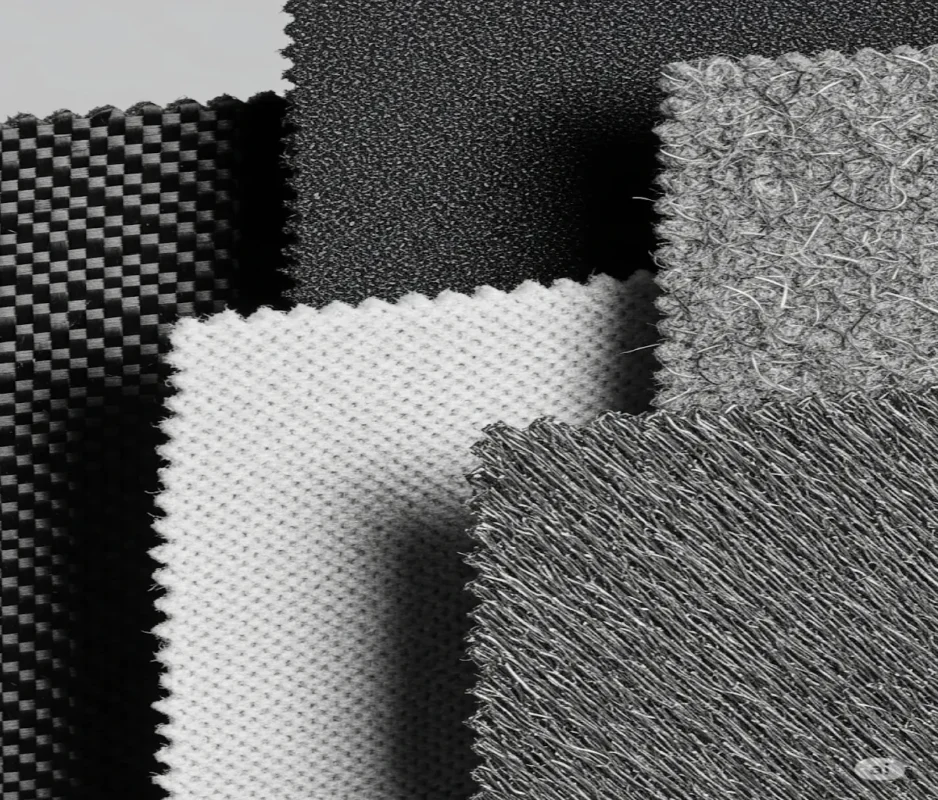

Technical textiles are textile materials and products manufactured primarily for their technical performance and functional properties rather than aesthetic or decorative characteristics.

These textiles are engineered for specific applications such as protection, reinforcement, filtration, medical use, or geotechnical performance. They often incorporate advanced fibers, coatings, or composites.

Table of Contents

Technical Textiles Applications

| Segment | Use Area Example |

| Agrotech | Crop covers, shade nets, mulch mats |

| Buildtech | Concrete reinforcement, facade membranes |

| Clothtech | Interlinings, sewing threads, insulation |

| Geotech | Road stabilization, landfills, and drainage |

| Hometech | Upholstery, mattress components, blinds |

| Indutech | Conveyor belts, filtration fabrics, and insulation |

| Meditech | Surgical gowns, wound dressings, masks |

| Mobiltech | Seat belts, airbags, and interior trims |

| Oekotech | Oil spill control, filtration, and pollution control |

| Packtech | Flexible packaging, FIBC bags, wrappings |

| Protech | Fire-retardant suits, bulletproof vests |

| Sportech | Parachutes, sportswear, tents |

India’s Technical Textiles Industry

India’s technical textiles industry is undergoing a silent revolution, propelled by rising global demand, strategic government interventions, and evolving trade partnerships. Once a niche sector confined to industrial applications, technical textiles have now emerged as a high-potential, innovation-driven market poised to play a key role in India’s $1 trillion manufacturing ambition.

Data Center Related Articles

- Anant Raj Limited: The Best Way to Invest in Data Center Stocks in India

- Data Center in India – Best Data Center Stocks in India to Invest

- NSE listed data center companies in India

- Explore Best Data Center Companies in India

- Opportunities in the Indian Data Center Market

- Fast Growing data center player Nxtra Data Limited Achieved Unicorn status: Learn actionable insights

- Best 5 Top Electronics Companies in India

Market Size & Growth Potential

Globally, the technical textile market stood at USD 220–240 billion in 2023 and is expected to grow at a CAGR of 5.5–6.2%, reaching USD 320–340 billion by 2030. These textiles are increasingly being adopted across sectors like healthcare, automotive, infrastructure, agriculture, defense, and sports, owing to their superior performance characteristics—strength, durability, heat resistance, filtration, and antimicrobial properties.

India’s market is growing faster than the global average, currently valued at USD 22–23 billion in 2023, and projected to grow at a CAGR of 9–10%. The government has set an ambitious target of USD 40–50 billion by 2030, driven by both domestic consumption and exports.

| Metric | Value |

| Current Market Size (2023) | USD 22–23 billion |

| Projected Size (2030) | USD 40–50 billion |

| CAGR | 9–10% |

| Export Value (2023) | USD 2.5–3 billion |

| Key Export Segments | Packtech, Meditech, Agrotech |

National Technical Textiles Mission (NTTM)

National technical textiles mission launched in February 2020 with and budget outlay of Rs 1480 crore. The objective of this mission was to position India as a global leader in technical textiles by increasing domestic consumption and exports, reducing dependency on imports of high-performance specialty fibers, promoting R&D, innovation, and skilling in technical textiles, and standardizing product categories through BIS certification.

Recognizing the sector’s strategic importance, the Government of India launched a Production Linked Incentive (PLI) scheme in 2021 with an outlay of ₹10,683 crore to boost the domestic manufacturing of high-value technical textiles and specialty fibers.

PLI Scheme Features:

- Covers 40+ advanced product categories such as anti-microbial fibers, aramid yarns, carbon composites, etc.

- Encourages investment in functional fabrics, nonwovens, and coated textiles.

- Provides financial incentives based on incremental sales over 5 years.

- Focused on import substitution, R&D, and job creation.

PM MITRA Parks:

To further catalyze scale and innovation, the government has also announced seven PM MITRA (Mega Integrated Textile Region and Apparel) parks across key textile-producing states. These parks offer:

- Plug-and-play manufacturing infrastructure

- Common facilities, logistics, testing labs, and incubation centers

- Attractiveness for FDI and technology transfer

India’s active pursuit of Free Trade Agreements (FTAs) with major developed markets like the UK and the USA is expected to open new export channels for technical textile players.

UK-India FTA (Expected 2025):

- Technical textiles are identified as a sunrise sector under discussion.

- India aims to gain preferential access for Packtech, Agrotech, and Protective clothing.

- UK buyers are increasingly looking for China+1 alternatives, giving Indian firms a strategic edge.

USA-India Trade Cooperation:

- The USA is among the top 3 importers of high-performance Meditech and Indutech products.

- Indian firms can benefit from relaxed import duties, technology collaboration, and sourcing tie-ups.

- The Indo-Pacific Economic Framework (IPEF) may further integrate India into global PPE and defense textile supply chains.

Historically, India imported most of its high-performance fabrics and specialty fibers. But the landscape is changing rapidly:

- Over 90% of India’s PPE demand (Personal Protective Equipment. Refers to protective garments and accessories made using advanced textile materials, often categorized under the Meditech and Protech segments, and is now met through domestic production.

- Indian technical textile exports have expanded to over 80 countries, with strong traction in the Middle East, Africa, and Southeast Asia.

- With PLI-backed production, MITRA parks, and global market access via FTAs, India is well-positioned to become a top 5 global player by 2030.

Technical Textile companies in India

Let us analyse the technical textile companies in India that are changing the shape of this industry. Below are top 6 technical textile manufacturers in India that are shaping this segment.

Garware Technical Fibres

GTFL is a leading Indian manufacturer of technical textiles with global leadership in aquaculture solutions, fishing nets, and a growing presence in geosynthetics. The company exports to over 75 countries and delivers high-margin, value-added, custom-engineered fiber-based products.

Garware is part of the Protech, Agrotech, and Geotech categories in technical textiles. Though the company is not covered under the PLI scheme directly because of its focus currently on high-value synthetic fiber production, it is well-aligned with the National Technical Textile Mission (NTTM) due to its application in infrastructure, aquaculture, and environment-related segments, such as PM Gati Shakti and Bharatmala etc.

Key Growth Triggers & Timeline

| Growth Trigger | Key Details | Timeline | Impact |

| Margin Expansion | Significant shift toward value-added products across geosynthetics and aquaculture. Strong pricing power from innovative, customized solutions. EBITDA margin improved by 22% YoY. | FY 2023–24 | Higher profitability with PAT crossing ₹200 crore |

| Capacity Expansion | While not explicitly detailed in numbers, the company hints at expanding domestic and export-oriented product lines, especially in geosynthetics and sports segments. | Ongoing | Supports increased product range and volume growth. |

| Domestic Market Refocus | Re-emphasis on the Indian market via reservoir lining, landfill capping, and erosion control. Targeting margins and market share from local suppliers. | FY 2023–24 onwards | Improves utilization of domestic demand, insulation from global volatility |

| Geographical Expansion | Strengthened footprint in Southern Europe, Central America, and South America. Export-led demand continues to dominate, with ~70% of revenue from exports. | FY 2023–25 | Enhances global market share and foreign currency earnings |

| Process Efficiency | Continued optimization in manufacturing—lower costs, better turnaround times, and automation. | FY 2023–24 | Improved margins and cash flow |

Financial Snapshot (FY 2023–24)

| Metric | Value | Growth |

| Revenue | ₹1,325 crore | +2% YoY |

| EBITDA | ₹315 crore | +22% YoY |

| PBT | ₹272 crore | +22% YoY |

| PAT | > ₹200 crore | Milestone achieved |

| Dividend | ₹3.00/share | 30% payout |

Banswara Syntex Ltd

Banswara Syntex Ltd is a vertically integrated textile company with operations spanning spinning, weaving, dyeing, and garmenting. It has a strong presence in polyester-viscose blends, suiting fabrics, and technical textiles (fire-retardant fabrics, performance wear), serving domestic and export markets (notably Europe and the US).

Banswara Syntex Ltd is transitioning from a commodity textile player to a high-margin technical and performance textile exporter, backed by vertical integration, disciplined capex, and cost efficiency through renewable energy adoption. Continued focus on garmenting and functional textiles makes it a strong candidate for margin-led growth over FY25–FY27.

Growth Trigger Analysis (FY24–FY25)

| Growth Trigger | Observation | Timeline | Impact |

| Margin Expansion | Focus on value-added products (performance fabrics, technical textiles, functional garments). Increasing share of garments in the product mix | Ongoing | Positive impact on EBITDA margin |

| Capacity Expansion | Added new machines in weaving and dyeing, expanding garmenting capacity | FY24–FY26 | Supports higher volume and value-added product scale |

| Deleveraging | Reduced debt and improved interest coverage; debt-to-equity improved from 1.35x (FY23) to below 1.20x (FY25 target) | FY24–FY25 | Improves cash flow & creditworthiness |

| Capex | Ongoing capex of ₹90–100 Cr for machinery automation, garment unit expansion, and renewable energy | FY24–FY26 | Enhances scale, reduces energy cost |

| Geographical Expansion | Strengthened presence in the US and Europe for high-value functional wear | Ongoing | Increased exports & brand visibility |

| Backward Integration | In-house yarn and fabric production; solar energy investment to cut power costs | Solar: FY24–FY25 | Cost optimization, sustainability |

Sanrhea Technical Textiles Ltd

Sanrhea Technical Textiles Ltd is a specialized manufacturer of industrial fabrics, with a focus on chafer fabrics, flame-retardant fabrics, para-aramid reinforcement fabrics, and liner fabrics primarily used in tyre manufacturing, rubber hoses, conveyor belts, and defense applications. It has carved a niche in high-performance woven fabrics catering to global technical textile applications.

Sanrhea is a highly focused, niche technical textile company with specialization in reinforcement and flame-retardant fabrics for the tyre, rubber, and defense industries. Despite FY24 challenges, its product positioning, low debt, and technical know-how make it a stable, albeit small, candidate for export-led recovery in FY25–FY27.

Growth Trigger Analysis (FY23–24)

| Growth Trigger | Observation | Timeline | Impact |

| Margin Expansion | Improved product mix (from base chafer to high-value reinforcement fabrics), but the margin was under pressure due to input cost volatility and global demand slump. | Partially visible in FY24 | Medium-term margin uptick expected as exports revive |

| Capacity Expansion | No major greenfield or brownfield expansion reported; focus on modernization and quality enhancement. | Ongoing | Focus on efficiency, not volume expansion |

| Deleveraging | The company remains conservatively leveraged with limited long-term debt; short-term borrowing is aligned with working capital. | FY24 | Maintains financial stability |

| Capex | Limited capex focused on process modernization, energy efficiency, and product R&D | FY23–24 | Enhances operating performance rather than top-line expansion |

| Geographical Expansion | Exports were sluggish in FY24 due to macro headwinds; the company remains focused on the defense sector, overseas tyre manufacturers, and rubber industry clients. | Exports to recover FY25+ | Rebound expected from Europe and the US in FY25. |

Strategic Turning Points

| Year | Event |

| FY22–FY23 | Focus began shifting toward high-value flame-retardant and defense-grade fabrics. |

| FY23–FY24 | Slowdown in exports and margin pressure highlighted the need to stabilize input costs. |

| FY25 (Expected) | Export market revival + potential order pickup from defense/Rubber OEMs |

Financial Snapshot – FY 2023–24

| Metric | Value |

| Revenue | ₹43.45 Cr |

| PAT | ₹1.35 Cr (down from ₹2.79 Cr YoY) |

| EBITDA Margin | Under pressure (input cost volatility) |

| Debt | Low, manageable working capital limits |

Arvind Limited

Arvind Limited, traditionally known for its denim and apparel fabric legacy, is rapidly reshaping its identity through focused investment in technical textiles under its Advanced Materials Division (AMD). The company is positioning itself at the intersection of high-performance materials, sustainability, and industry-specific innovation—with applications spanning defense, automotive, industrial protection, and infrastructure.

Arvind Limited’s Advanced Materials Division (AMD) generated ₹580 crore in FY25, with plans to scale it to ₹1,000+ crore over the next five years. Backed by a ₹400–500 crore capex plan, a strong push into defense, industrial, and sustainable technical textiles, and the circular fiber JV with PurFi, AMD is evolving into a high-growth, high-margin pillar of Arvind’s long-term strategy.

Capex-Backed Growth

Arvind is investing ₹400–500 crore to expand the AMD, aiming to cater to sectors such as defense textiles, aerospace, and industrial filtration. The focus is on proprietary, application-specific innovations—a key differentiator in India’s technical textile landscape.

Circularity and Backward Integration

A critical strategic move is the joint venture with PurFi Global, aimed at producing 3,500 MT of circular, regenerated fibers annually from post-consumer waste. The plant in Gujarat is designed to scale over four years, ensuring raw material resilience and aligning with sustainability mandates from global buyers.

Future growth potential

· In FY 2024–25, the AMD contributed ~₹580 crore, representing about 9.3% of Arvind Limited’s total revenues.

· The segment has grown steadily at ~10–12% CAGR over the last few years, despite macroeconomic volatility.

· Gross margins are significantly higher than traditional textiles due to customized, high-performance applications.

Welspun Living Limited

Welspun Living Limited is fast emerging as a focused player in the technical textiles segment, which is a key part of its “Emerging Businesses” portfolio. In FY24, advanced textiles contributed ~5% of total revenues, reaching ₹449 crore, with 29% YoY growth, signaling strong momentum.

Core Capabilities & Applications

Welspun’s technical textiles are largely non-wovens, leveraging technologies such as:

- Spunlace (27,729 MT capacity) – Used in hygiene, wipes, and medical disposables.

- Needlepunch (3,026 MT) – For filtration, protective apparel, and auto components.

- Wet Wipes (100 million packs) – Sold under B2B and private label models.

The segment services high-value export markets such as the US, Europe, and the Middle East, with Welspun being India’s largest Spunlace exporter.

Welspun is strategically focusing on scaling B2B technical textile sales and expanding into protective wear, filtration, and wellness fabrics. With a strong manufacturing backbone and ESG-compliant practices, it is well-placed to benefit from the global shift toward sustainable, high-performance textiles.

Segment Snapshot (FY24)

- Technologies: Spunlace (27,729 MT), Needlepunch (3,026 MT), and Wet Wipes (100 Mn packs)

- Utilization: 59% for Spunlace, 48% for Needlepunch, 21% for Wipes — indicating ample headroom for scale-up

Welspun is strategically focusing on scaling B2B technical textile sales and expanding into protective wear, filtration, and wellness fabrics. With a strong manufacturing backbone and ESG-compliant practices, it is well-placed to benefit from the global shift toward sustainable, high-performance textiles.

Vardhman Textiles

Vardhman Textiles Ltd, a major integrated textile manufacturer known for its yarns and fabrics, is gradually building a foundation for entry into technical textiles, particularly in the performance fabrics and value-added processing space. Though not yet a dominant revenue driver, technical textiles are emerging as part of its medium- to long-term diversification strategy.

Vardhman is in the early stages of evolving from a commodity-focused textile major to a value-added solution provider, with technical and performance textiles as part of its future roadmap. With the right capex already underway and a strong reputation in quality and scale, Vardhman is laying the groundwork for its technical textile ambitions over the next 3–5 years.

Capex & Capability Alignment

- A large capex plan (~₹1,300 crore) was announced in FY22 for yarn and fabric expansion.

- A portion of this investment is going into modernizing processing and finishing technologies, especially relevant to technical textiles.

- While the report does not break out a revenue figure for technical textiles, there is growing emphasis on product customization and R&D, which are stepping stones toward functional textiles.

Final words on Technical Textiles

India’s technical textiles sector is no longer a niche—it’s fast becoming a backbone of the country’s industrial and export ecosystem. Backed by strong policy support through the National Technical Textiles Mission, PLI schemes, and PM MITRA parks, the industry is on track to more than double its market size by 2030. What sets this growth apart is the quality of momentum—driven not just by volume, but by margin-rich, high-performance applications across defense, infrastructure, and sustainability. With leaders like Garware, Arvind, and Welspun scaling up value-added products and exports, and newcomers like Sanrhea and Banswara sharpening their focus, India is positioned to emerge as a global powerhouse in technical textiles—competing on innovation, not just cost.