Avanse Financial Services IPO Details 2025

Share With Friends

Avanse Financial Services Limited, a rising force in India’s education financing sector, is preparing to go public with a ₹3,500 crore IPO. The offer consists of a ₹1,000 crore fresh issue and ₹2,500 crore offer-for-sale by existing shareholders like Olive Vine Investment Ltd, IFC, and Kedaara Capital. As India’s second-largest non-banking financial company (NBFC) in the education loan space, Avanse commands a significant presence in the high-growth overseas education financing market.

This article analyzes the company’s financial track record, growth strategy, risk profile, and competitive positioning to help you make an informed decision about investing in the Avanse Financial Services Services IPO.

Table of Contents

Avanse Financial Services IPO Analysis

Financial Performance (FY2020–FY2024)

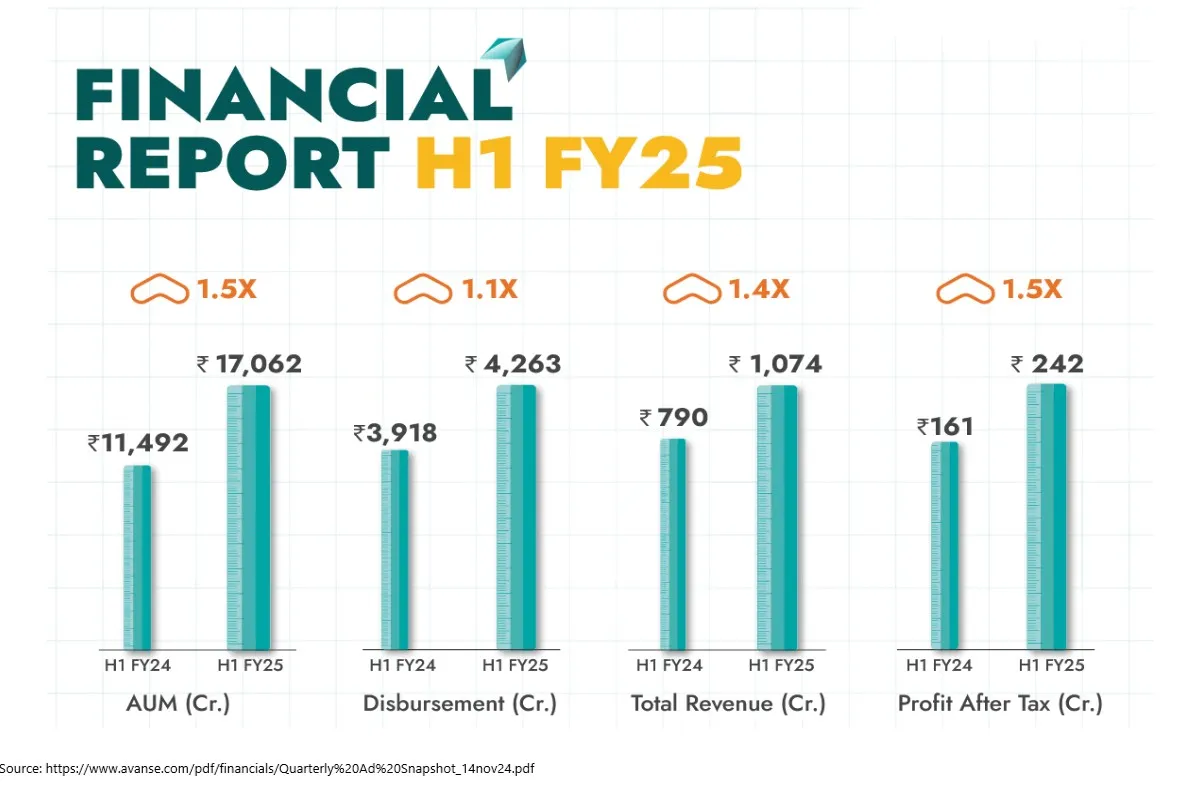

Over the past five years, Avanse has demonstrated consistent growth across core metrics:

- Assets Under Management (AUM): Grew from ₹2,993 crore in FY20 to ₹ ₹13,303 crore in FY24 — over 4.5x increase.

- Disbursements: Increased from ₹1,060 crore in FY20 to ₹6,335 crore in FY24.

- Revenue (Total Income): Jumped from ₹ 508.8 crore in FY22 to ₹ 1,728.8crore in FY24, a CAGR of ~39%.

- Net Profit: Rose from ₹63.2 crore in FY22 to ₹ 342.4 crore in FY24.

The bulk of AUM is in student loans for international education, which comprised 78% of the book by FY24. These loans are typically unsecured, longer-tenured, and involve a moratorium — making underwriting quality and borrower outcomes critical.

Key Financial Ratios and Industry Comparison

- Gross Stage 3 (GS3) loans: Reduced from 1.29% in FY22 to just 0.43% in FY24.

- Net Stage 3 (NS3) loans: Down to 0.13% in FY24.

- Return on Assets (ROA): Rose to 2.8% in FY24.

- Return on Equity (ROE): Improved to 11.75%.

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 508.8 | 989.6 | 1,728.8 |

| Expenses | 423.08 | 778.91 | 1,269.51 |

| Net Profit | 63.21 | 157.71 | 342.4 |

| Margin (%) | 12.44 | 15.94 | 19.83 |

| Loan Book | 4,790.00 | 8,463.64 | 12,520.86 |

| GNPA (%) | 1.7 | 1.4 | 1.2 |

| Net Worth | 1,009.66 | 2,149.72 | 3,676.72 |

Compared to other financial services peers:

- Bajaj Finance: ROE ~24%, GNPA < 1.2%

- HDFC Credila (now merging into HDFC Bank): ROE ~13–14%, similar GNPA

- Muthoot Finance: ROE ~20%, but focused on secured lending

Avanse financial services limited’s ROE of 11.75% is impressive for an NBFC focused on unsecured, long-tenure education loans. It’s capital adequacy and asset quality are significantly stronger than most non-prime lenders.

Earnings Per Share (EPS)

Avanse financial services limited’s EPS over the past few years (approximate figures):

- FY22: ~₹8.8 per share

- FY23: ~₹12.5 per share

- FY24: ~₹14.4 per share

This consistent upward trend reflects operating efficiency, growing book, and control costs. With the Avanse Financial Services IPO set to bring in ₹1,000 crore in fresh equity, EPS may temporarily dilute, but the capital will likely fuel AUM growth and further ROE expansion, helping sustain EPS trajectory over time.

Data Source for Avanse financial services Limited Latest update

Data Center Related Articles

- Anant Raj Limited: The Best Way to Invest in Data Center Stocks in India

- Data Center in India – Best Data Center Stocks in India to Invest

- NSE listed data center companies in India

- Explore Best Data Center Companies in India

- Opportunities in the Indian Data Center Market

- Fast Growing data center player Nxtra Data Limited Achieved Unicorn status: Learn actionable insights

- Best 5 Top Electronics Companies in India

Avanse Financial Services IPO Details

| Avanse Financial Services IPO date | |

| Listing Date | |

| Face Value | |

| Issue Price Band | |

| Lot Size | |

| Avanse Financial Services IPO Size | |

| Fresh Issue | |

| Offer for Sale | |

| IPO Open Date | |

| IPO Close Date | |

| Tentative Allotment | |

| Initiation of Refunds | |

| Credit of Shares to Demat | |

| Tentative Listing Date |

Use of Avanse Financial Services IPO Proceeds and Strategic Alignment

According to the DRHP, the ₹1,000 crore fresh issue will be used for:

- Augmenting capital base for lending (primary purpose)

- Improving capital adequacy for regulatory compliance

- General corporate purposes

This directly aligns with Avanse’s growth strategy:

- Expand lending to high-potential overseas students.

- Deepen reach into education infrastructure loans.

- Continue scaling through branch and partnership models.

Given their low NPA track record and increasing demand for international education loans, this capital infusion positions Avanse financial services limited to scale sustainably.

Avanse Financial Services IPO Analysis Key Risks

Operational Risks

- Heavy concentration in unsecured, long-tenure loans with moratoriums.

- Low portfolio seasoning (newer loans are yet to see full repayment cycles).

Regulatory Risks

- NBFCs are subject to RBI regulations that may evolve.

- Any adverse move on interest rate caps, provisioning norms, or capital requirements could impact operations.

Competitive Risks

- Banks like SBI and ICICI and NBFCs like InCred and Prodigy Finance compete in the same space.

- Fintech-led disbursement models may erode market share.

Geopolitical Risks

- 91% of the international education loan book is exposed to the US, UK, and Canada — any visa, policy, or employment disruptions in these countries can affect repayment.

Additionally:

- Currency Exposure: While loans are in INR, students repay based on earnings in foreign currency. A sudden devaluation of INR may stress repayment capacity if jobs abroad are delayed or denied.

- AI & EdTech Disruption: A shift toward remote, shorter-duration online courses may change the loan profile and reduce average ticket sizes.

- Over-concentration on the International Market: Though profitable, an over-reliance on global education trends (which are susceptible to policy and macro shocks) reduces diversification.

Industry Overview: India’s Booming Education Loan Market

India’s education financing landscape is undergoing a profound transformation. Fueled by rising aspirations for global education and supported by NBFCs like Avanse, the education loan segment is poised for accelerated growth. This transformation is set against the backdrop of one of the fastest-growing economies in the world, with India’s GDP projected to grow at 6.8% in FY2025, outpacing global peers.

Education Loan Market Size and Growth

The Indian education loan market is expanding rapidly, driven by strong demand for higher education — particularly overseas. As of FY2024:

- Education loans outstanding stood at ₹1.07 lakh crore.

- Non-Banking Financial Companies (NBFCs) are playing a growing role, with a CAGR of 34% in their loan book over the last five years.

- The overseas education loan segment alone is expected to grow 2.5x by FY2031, reaching approximately ₹1.6 lakh crore from ₹65,000 crore in FY2024.

NBFCs like Avanse, which specialize in unsecured loans for overseas education, are uniquely positioned in this fast-expanding niche, offering differentiated risk underwriting models based on future employability, course outcomes, and university profiles.

Avanse financial services limited has built a database of over 3,000 universities and courses globally, enhancing underwriting precision. This sector-specific expertise has allowed NBFCs to capture a 35%+ share in the overseas education loans segment — a trend expected to strengthen.

Regulatory and Market Tailwinds

Several macro and policy trends are supporting the sector:

- The Government’s National Education Policy 2020 emphasizes gross enrollment expansion and skill development.

- RBI’s focus on digital lending has improved access and compliance.

- Rising household incomes and middle-class growth are broadening the customer base.

- Increasing acceptance of co-lending models and capital markets access for NBFCs enhances scalability.

Challenges in the Sector

Despite the optimistic outlook, the education loan segment faces some structural risks:

- The unsecured nature of loans increases default potential, particularly in economic downturns.

- Limited portfolio seasoning, especially in newer disbursements, leaves credit quality untested over longer cycles.

- Geopolitical risk tied to visa policy changes and international relations.

Final Words on Avanse Financial Services IPO

Strengths

- Fast-growing, high-ROE business in a niche but expanding segment.

- Excellent asset quality metrics and credit underwriting standards.

- Aligned growth strategy with capital-efficient expansion model.

- Backed by credible investors: Warburg Pincus, IFC, Kedaara, and Mubadala.

Risks

- Geopolitical exposure in the loan book.

- Longer-term NPA trends are untested for recent disbursements.

- New capital may slightly dilute EPS in the short term.

If the Avanse financial services IPO is priced within a P/B of ~2.5x or P/E of ~20–22x, this is a strong long-term opportunity. It offers access to a well-managed, high-growth NBFC in an under-penetrated, education-focused credit market — a rare find.

Avanse Financial Services Head Office

Corporate and Registered Office Address

Avanse Financial Services Limited

4th Floor, E Wing, Times Square,

Andheri – Kurla Rd, Gamdevi,

Marol, Andheri East,

Mumbai, Maharashtra 400059

Administrative Office

Avanse Financial Services Ltd.

5th Floor, Unit Part C, VKG Corporate Centre,

Marol Pipeline Rd, Ajit Nagar,

J B Nagar, Andheri- East

Mumbai 400059, Maharashtra