EMS IPO Review: Key Facts

- EMS Limited provides services in water and wastewater collection, treatment, and disposal.

- Draft Red Herring Prospectus (DRHP) filing: March 28, 2023

- IPO opens from Friday, September 8, 2023 to Tuesday, September 12, 2023

- IPO listing date Thursday, September 21, 2023

- EMS IPO Price: ₹200 to ₹211 per share

- Face value of EMS IPO share price: Rs 10

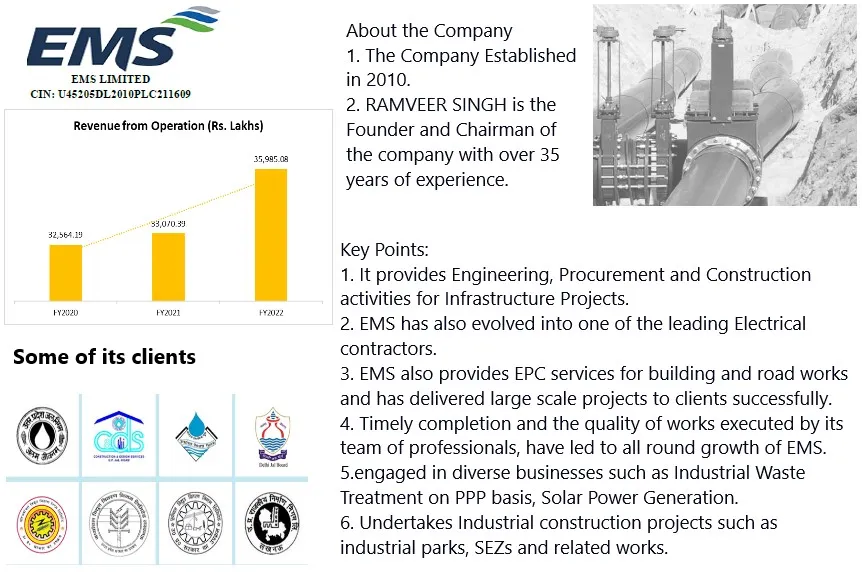

- Strong revenue track record over the last two years. Revenue from operation has increased from Rs35991 lakh in FY2022 to Rs 53186 lakh in FY2023.

- The company has a presence across India.

- The major clients such as Toshiba, NBCC, urban bodies to state and central governments across India that EMS has worked with on various projects.

EMS Limited IPO Details

| EMS Limited IPO Details | EMS IPO dates, Price and other details |

| EMS IPO Dates | September 8, 2023 to September 12, 2023 |

| EMS IPO price range | ₹200 to ₹211 per share |

| EMS IPO Allotment date | Friday, September 15, 2023 |

| Refunds Initiation date | Monday, September 18, 2023 |

| Credit of Shares to Demat Account | Wednesday, September 20, 2023 |

| EMS IPO share listing date | Thursday, September 21, 2023 |

| EMS IPO Fresh Issue | ₹146.24 Cr |

| EMS IPO Offer for Sale | ₹175.00 Cr |

| EMS IPO lot size Minimum bid For retail investor | 1 lot of 71 shares Total Investment of ₹ 14981 |

| EMS IPO Share Face Value | INR 10 per share |

| EMS Share Listing on | BSE, NSE Exchange |

EMS IPO allotment status

EMS Limited filed DRHP for an initial public offering on March 28, 2023. According to DRHP, this IPO consists of a fresh issue of Rs. 18,000.00 Lakhs and an offer for the sale of 82,94,118 Equity Shares. Promoter Mr. Ramveer Singh is selling a part of his stake in the OFS.

Should I invest in the EMS Limited IPO? Before deciding, it is important to understand the company and its business model to get a clear idea to make an investment decision.

EMS Limited IPO Business Description

EMS Limited provides Sewerage solutions, water supply systems, water and waste treatment plants, electrical transmission and distribution, road and allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

- The company bids for tenders issued by CPWD, State Governments, and Urban Local Bodies (“ULBs”) for developing WWSPs and WSSPs on an EPC or HAM basis.

- The company has an in-house team for designing, engineering, and construction.

- As of March 24, 2023, the company is operating and maintaining 13 projects including WWSPs, WSSPs, STPs & HAM.

- The company has completed more than 50 projects since 2010.

- EMS Limited has its civil construction team and employs over 57 engineers, supported by third-party consultants and industry experts.

- Almost all of its projects are World Bank-funded through local state government bodies. This is the main reason for its robust cash flows/timely payments, and no bad debts.

EMS Limited Leadership team

Mr. Ramveer Singh is the Promoter, Chairman cum Executive Director of the company. He was appointed as the First Director on the Board of our Company at the time of incorporation of our Company on December 21, 2010. He has more than Thirty-five years of experience in civil, construction industry, and business development.

Mr. Ashish Tomar is also the founding Promoter of the company. He is currently designated as Managing Director of the Company. He was appointed as the First Director on the Board of our Company at the time of incorporation of our Company on December 21, 2010.

EMS Limited Peer Analysis

CARE Edge has considered infrastructure companies operating under various business segments similar to EMS Limited.

- Other competitors of the company that compete under the Water supply and wastewater treatment segment are VA Tech Wabag Ltd and JWIL Infra Limited.

- Competitors under the Roads, Urban Infrastructure, Power and Railway sector segment are Simplex Infrastructures Limited, RPP Infra Projects Limited, and IVRCL Infrastructures & Projects Limited.

EMS Limited Revenue and Profit

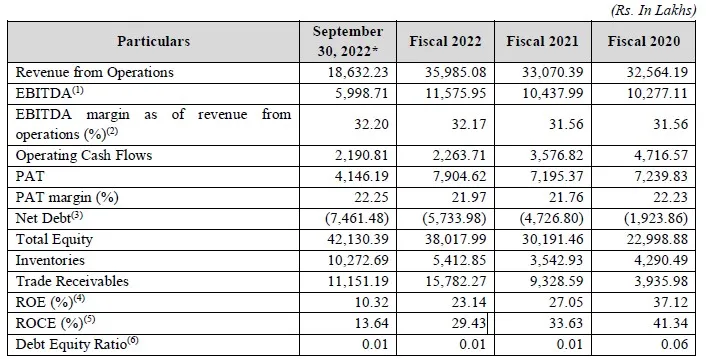

The company has a track record of growth in revenue and profits. Between Financial Years 2020 and Financial Years 2022, the revenue from operations grew from ₹ 32,564 lakhs to ₹ 35,985 lakhs. The profit after tax grew from ₹ 7,239 lakhs to ₹ 7,904 lakhs. The EBITDA also grew from ₹ 10,277 lakhs in the Financial Year 2020 to ₹ 11,575 lakhs in the Financial Year 2022.

The company has a diversified customer base signifies our non-dependence on any single customer and thereby hedges our business operations from potential customer-specific risk. The return on equity remains over 20% from 37.12% in FY2020 to 23.14% in FY2022 while the return on capital employed was 41.34% in FY2020 to 29.43% in FY2022.

EMS Limited IPO Financial Snapshot

| Period Ended | 31 Mar 2020 | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 308.08 | 378.31 | 502.55 | 641.41 |

| Revenue | 332.36 | 336.18 | 363.10 | 543.28 |

| Profit After Tax | 72.43 | 71.91 | 78.93 | 108.85 |

| Net Worth | 229.99 | 301.91 | 380.18 | |

| Reserves and Surplus | 218.24 | 290.16 | 368.43 | 443.45 |

| Total Borrowing | 14.80 | 3.16 | 3.71 |

Objective Behind the EMS IPO share price

- The company will not receive any proceeds from the Offer for sale.

- EMS IPO will raise the gross proceeds of Rs 18,000 lakhs from the Fresh Issue

- About Rs13,500 from the net proceeds from the fresh issue will be used to fund the working capital requirements of the Company.

- The rest amount will be used for General corporate purposes

EMS IPO share price: Do you invest?

- EMS LIMITED has Experienced Promoters and a senior management team.

- The company has a Robust Order Book.

- Scalable and Asset Light Business Model supported by our Strong Financial Position

- The company is seeking opportunities to further increase the size of our projects.

- Strong revenue growth rate over the years with strong tailwinds through government policies and rising urban areas.

- The metropolitan cities of India are seeing major expansion as a result of economic expansions and reforms.

- It is expected that by 2050, about 1450 km3 of water will be required out of which approx. 75% will be used in agriculture, ~7% for drinking water, ~4% in industries, and ~9% for energy generation.

- There are good opportunities for the company to play a strong role in Indian economic growth for the next decade.

EMS Limited IPO Lead Managers & Registrar

| Lead Manager | Registrar |

| KHAMBATTA SECURITIES LIMITED | Kfin Technologies Limited Phone: 04067162222, 04079611000 Email: ems.ipo@kfintech.com Website: https://kosmic.kfintech.com/ipostatus/ |

EMS Limited Company Contact Information

| EMS Limited 701, DLF Tower A, Jasola New Delhi-110025 Phone: +91 8826696627 Email: cs@ems.co.in Website: https://ems.co.in/# |

EMS Limited IPO GMP

Grey Market is an unregulated market where the upcoming IPO applications and IPO shares trade before listing of the stock. An investor may get an idea of the IPO GMP just to understand the post listing position of the IPO share. Thia may be used to estimate the listing gain on the IPO share. GMP or Grey Market Premium adding to issue price gives the estimated listing price of the IPO share or the under current price of that IPO. This should not be treated as a criteria to value or decide a company for the IPO to invest in.

The EMS Limited IPO GMP is Rs 115 and the IPO price of EMS limited IPO is Rs 211. That reflects the EMS IPO share is likely to be listed at Rs 326 per equity share. However, EMS Limited IPO GMP is just an indicator of the price, the actual price may vary on the listing day.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO.

mind2markets is in news

Feedstop has mentioned mind2markets website as one of the best site to provide stock analysis and insights about the company to invest in. Keep in touch.

Please comment for any suggestion on the above article.