Identify good companies to invest in – The stock market is always unknown. The more you learn, the more you experience, still, there will be a lot to learn. Coming to stock market investment, it is always challenging to identify the best buying stocks. There is ‘N’ number of stocks listed in the exchanges. It can be overwhelming at times to decide the right stocks to invest in. However, there are a few ways to find the right companies to invest in. You can use both traditional methods as well as platforms or tools to find the right stocks to invest in.

As I already discussed the “importance of Company insights before investing in stocks” in another post that one needs to understand before buying a stock. Just to brief you about that, pick up the industry you are interested in or the industry that is likely to move up in the upcoming years. Select the stocks or companies within that industry.

Table of Contents

The starting point of stock market investment

As a beginner in the market, the most important part of your work is to identify companies that have been doing good over the last couple of years. The stock market is always risky. As a beginner in the stock market, one should take a low risk. Though there will be low returns associated with low-risk stocks, it is important to protect your capital at the initial stage of your investment in the stock market. Hence, I suggest large-cap or mid-cap companies start with as best buying stocks.

Applying certain criteria to filter companies out of the listed companies in the exchanges is the best way to narrow down the selection. Once you finalized which industry and segment (Large or mid-cap) to invest in, it is important to start applying the filters. To identify which filter to apply, you can refer to my previous post on “all-important Company insights before investing in stocks”.

In addition, keep track of the news related to the current global financial news as well as of respective countries. Particularly to those countries whose economies influence global economic conditions. Such as the economic and political condition of the US, China, European Countries, and Emerging countries such as India. News related to the companies to be invested in also carries a lot of importance.

Identify good companies to invest in

Investing in stocks means maximizing profit while you sleep. That is the reason everyone talks about the unlimited potential of the share market. The first step in the process is to identify good companies to invest in.

I would suggest starting your investment journey with the top nifty50 companies list or Nifty 50 stocks. The top nifty50 companies list is available online. Find the top nifty50 companies list on the NSE website here. These companies are large-cap companies with strong fundamentals. While choosing the top nifty50 companies list does not need fundamental analysis, as these companies are fundamentally strong.

Continuing with identifying best buying stocks, companies that are part of other indices such as Nifty Next 50, Nifty Midcap 50, Nifty 500 companies, etc. can also be considered. It is important to note that companies that are part of sector indices such as Nifty Auto, Nifty Bank, Nifty IT, etc. may also be useful. These are a few best techniques to identify the best buying stocks to invest in for a beginner.

Doing research on the best mutual fund house is another way to identify the best buying stocks. You may follow their steps to invest directly in those stocks.

Identify good companies to invest in using free platforms or tools

It is essential to compare stocks and companies before investing in them. Of course, it needs some experience before you see success in the long run. If you are not sure about investing in the stock market, you should start observing the stock movement first. Platforms like Zerodha, Tickertape will help you in observing stock movement along with their fundamental and technical indicators. This will further help you to find the right strategy before actual investment.

Initially, I was also concerned about identifying good companies to invest in and how easily I could do that. However, I found a few online sites where I learned more about the tools or platforms that can help me in identifying the best buying stocks. With little effort, I learned how to deal with these platforms and get the required output. I am sharing two platforms that I have been using for quite some time now.

There are a few free platforms that help to identify good companies to invest in. Platforms like Screener.in and Chartink.com helped me to select the best buying stocks based on certain criteria. Another platform, Stockedge, can also be useful to learn and get the desired output as a beginner. However, you need to take the pro version of the stockedge to get full advantage of the platform. To begin with, I would recommend you to try the free version of these platforms to have a hands-on experience.

How to work on Screener.in Platform

Screener.in is a popular platform to scrutinize stocks based on fundamental or technical parameters. There are some in-built screeners available on the platform to choose from. The free version of the platform is good enough for a beginner.

The user needs to register on the platform before writing any query. Once you registered and logged in to the platform – click “Screens” on the menu bar and “Create New screen”. Write the query within the box provided there and hit “run the query”.

Let me share a sample query below. The query below is self-explanatory. I considered all the companies with a market cap of more than INR 1000 Crore. That is further scrutinized based on other criteria such as PE, ROCE, etc. My goal is to identify the best buying stocks using the platform and certain criteria. The query may be as below.

- Market capitalization > 1000 AND

- Price to earning < 15 AND

- Return on capital employed > 22% AND

- YOY Quarterly sales growth > 40 AND

- YOY Quarterly profit growth > 40 AND

- Average return on capital employed 3Years >30

How to work on Chartlink Platform

Similarly, Chartlink is a platform to scrutinize stocks based on certain criteria. Before jumping to write a query, understand the parameters that help in scrutinizing stocks on the platform. Apply those parameters to get the best buying stocks you may want to invest in.

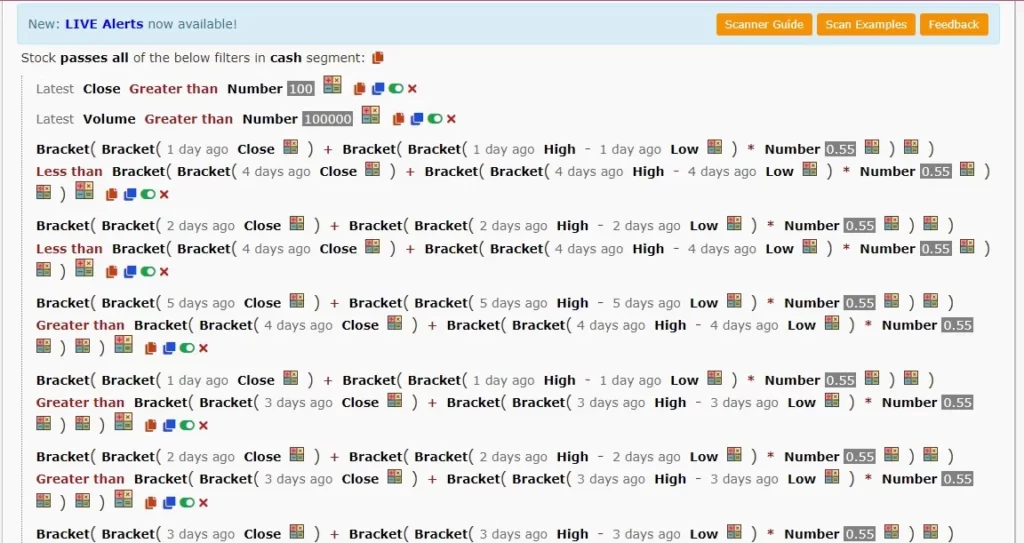

Sharing a few samples may help you. Let us take an example – I am here considering all the Nifty 500 companies to identify good companies to invest in. Below is one such query for your reference. You may use the same or similar parameters on the platform while writing the query.

Go to the platform Chartlink and click on Screener. Create your screener and write the query below on the screener. Click on the Green + symbol to add the criteria to the query. Once you click on the + symbol a box appears to write the query. Put a few letters and choose the parameter from the drop-down. Steps are as below.

- Stock Passes all of the below filter in Nifty 500 segment:

- Market Cap Greater Than Number 1000

- Latest close Greater than number 100

- Latest Volume Greater than Number 200000

- Yearly Debt Equity ratio less than number 1

- Yearly Return on Capital employed Percentage Greater than Number 15

- Yearly PE ratio less than number 40

The user may also add more fundamental as well as technical parameters to the list. The platform contains a few built-in queries that may fit your requirement with little changes.

Final words

While investors can choose potential stocks using fundamental analysis, it can be further narrowed down with technical analysis. Both fundamental and technical analysis can be used on the platform which helps to further scrutinize stocks.

It is worth mentioning some widely accepted technical parameters. The parameters such as RSI (Relative Strength Index), price movement, Strength of volume, Fibonacci retracement, Price to earnings ratio, and Moving Averages can be used on the above platform to identify good companies to invest in. Understanding these aspects of the stock market is crucial to make use of the information that these platforms provide.

More from across the Site

We endeavor to help you to identify good companies to invest in. Again, we review all upcoming IPOs before you invest in the company’s IPO. Here are some suggested readings on upcoming IPOs or best buying stocks. BIBA Fashion Limited IPO, Landmark Cars IPO, Mankind Pharma IPO, Upcoming IPOs.

[…] an investor in the equity market, the most important part of your work is to identify companies that have been doing good over the last 5 years or so. In the case of Pre-IPO companies, the risk […]