IREDA IPO Review

IREDA IPO Details: Key Facts

- IREDA is a pioneering financial institution in the field of promoting, developing, and extending financial assistance for setting up projects relating to new and renewable sources of energy, energy efficiency & conservation in India.

- The company filed a Draft Red Herring Prospectus (IREDA DRHP) filing: September 7, 2023

- IPO opening: November 21, 2023 to November 23, 2023

- IREDA IPO Price: ₹30 to ₹32

- Only government company that finances and supports renewable resources companies. Well-established company with a strong track record.

- Monopoly business – MiniRatna company of Indian government.

- Lowest net NPA Ratio of 1.66 % during last 10 years

- AAA (Stable) credit rating from ICRA

- Strong growth potential for this business in India and competition is low.

- I would invest in the company during the IPO process.

Table of Contents

IREDA DRHP filed on 7th September 2023 to float its Initial public offering. According to DRHP, this IPO consists of an offer for the sale of 268,776,471 Equity Shares and a fresh issue of 403,164,706 shares. Promoter “The President of India, acting through the Ministry of New and Renewable Energy, Government of India” is selling stake as OFS.

The net proceeds from this IPO from the Fresh Issue will be utilized towards augmenting our capital base to meet future capital requirements and onward lending.

IREDA IPO Details

| IREDA IPO Details | IREDA IPO date Price and other details |

| IREDA IPO date | November 21 – 23, 2023 |

| IPO Price band | ₹30 to ₹32 per share |

| IPO date of allotment | Wednesday, November 29, 2023 |

| Refunds Initiation date | Thursday, November 30, 2023 |

| Credit of Shares to Demat Account | Friday, December 1, 2023 |

| IREDA IPO date of listing | Monday, December 4, 2023 |

| Total IPO size | 671,941,177 shares (aggregating up to ₹2,150.21 Cr) |

| Fresh Issue | 403,164,706 equity shares (aggregating up to ₹1,290.13 Cr) |

| Offer for Sale | 268,776,471 equity shares (aggregating up to ₹860.08 Cr) |

| Share holding pre issue | 2,284,600,000 |

| Retail (Min lot size) | 1 lot of 460 shares Investment of ₹14,720 |

| Retail (Max lot size) | 13 lot of 5980 shares Investment of ₹191,360 |

| Retail Allocation | 35% |

| IREDA share price Face Value | ₹ 10 per share |

| IREDA share price Listing on | BSE & NSE |

Now the big question is – do you invest in the Indian Renewable Energy Development Agency IPO? Let us find out details about the company and why you should consider investing in this company.

IREDA IPO GMP

| GMP Date | IPO Price | GMP | Estimated Listing Price |

|---|---|---|---|

| 14-11-2023 | ₹ 32 | ₹ 3 | ₹ 35 |

| 13-11-2023 | ₹ – | ₹ 3 | ₹ – |

| – | ₹ – | ₹ – | ₹ – |

IREDA IPO Share Price for retail investors: What does IREDA do?

IREDA full form is Indian Renewable Energy Development Agency Limited. IREDA wholly owned Government of India (“GoI”) enterprise under the administrative control of the Ministry of New and Renewable Energy. The company was founded on October 17, 1995, and is responsible for financing new and renewable energy companies in the country.

IREDA has been consistently rated ‘Excellent’ by the MNRE in the course of evaluation of our performance in achieving key targets since Fiscal 2021. The company financed projects across multiple Renewable Energy (RE) sectors such as solar power, wind power, hydropower, transmission, biomass including bagasse and industrial co-generation, waste-to-energy, ethanol, compressed biogas, hybrid RE, EEC, and green-mobility.

The company also offers financial products and schemes for new and emerging RE technologies such as biofuel, green hydrogen and its derivatives, battery energy storage systems, fuel cells, and hybrid RE projects.

Being a key player in the Indian financial markets, the Indian Renewable Energy Development Agency Limited (IREDA) IPO is important for retail investors. It is a well-established company with a strong track record.

IREDA IPO Share Price Financial Strength

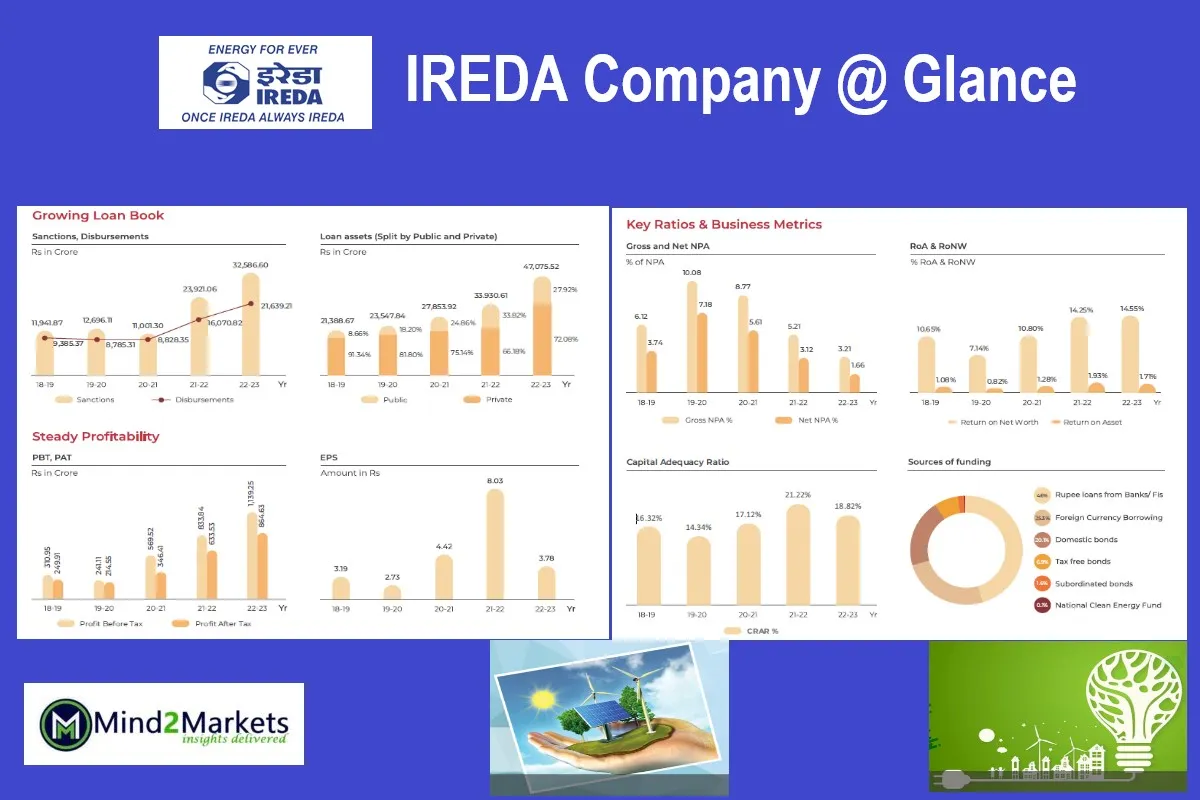

The company has a track record of growth in revenue and profits. During FY 23, the revenue from operations increased to INR 3,481.97 Crore, registering a growth of 21.75% over the previous year’s revenue of INR 2,859.90 Crore.

Profit Before Tax (PBT) increased to an all-time high of INR 1,139.25 Crore which is a 36.63% increase over last year and Profit After Tax (PAT) increased to an all-time high of INR 864.63 Crore which is 36.48% increase over last year at the end of FY 23.

Loan disbursed during FY 23 increased to INR 21,639.21 Crore, registering an increase of 34.65% over the previous year’s disbursed amount of INR 16,070.82 Crore, which is the highest ever annual disbursement in the Company’s history.

Indian Renewable Energy Development Agency Financial Snapshot

| Some Statistics/ Year Ended | March 31 | March 31 | March 31 |

| Year | 2021 | 2022 | 2023 |

| Total Revenue | 2,657.74 | 2,874.16 | 3,483.04 |

| Profit After Tax | 346.38 | 633.53 | 864.63 |

| Reserves and Surplus | 1,386.12 | 1,776.05 | 2,310.96 |

| Total Assets | 30,293.39 | 36,708.41 | 50,446.98 |

| Total Borrowings | 24,000.00 | 27,613.07 | 40,165.23 |

| Net Worth | 2,995.60 | 5,268.11 | 5,935.17 |

Objective Behind the IREDA IPO

- The company will not receive any proceeds from the Offer for sale. Government of India, the promoter of the company will take the net proceeds from the OFS.

- The net proceeds from the fresh issue will be deployed in the Financial Years 2024 and 2025. The net proceeds will be utilized for future capital requirements and onward lending.

- The company will achieve the benefits of listing the Equity Shares on exchanges.

- This will also enhance the visibility and brand image of the company as well as provide a public market for Equity Shares in India.

IREDA IPO review: Do you invest?

- IREDA is a pioneer in promoting, financing and developing renewable energy organizations in India with over 36 years of experience in the industry.

- Global renewable energy market size is expected to grow from USD 900 Billion in 2022 to USD 3200 Billion by 2030.

- India’s renewable energy market size is expected to be worth up to $80 billion by 2030 from around $20 billion in 2022.

- The Government of India has set a target to achieve a 500 GW renewables target before 2030 from around 180 GW in 2022.

- Foreign direct investment (FDI) in India’s renewable energy sector stood at $251 million/ Rs 20.5 billion in the third quarter (Q3) of the financial year (FY) 2023.

- There is a huge market to capture for this company.

- The company has recorded strong revenue growth over the years.

- The Gross and net NPA of the company has decreased from 10.08% and 7.18% in 2019-20 to 3.21% and 1.66% in 2022-23 respectively.

- Considering the above factors IREDA is a strong company to invest in.

- I would like to invest in its IPO both for listing gain and long-term investment.

IREDA Contact Details

| Indian Renewable Energy Development Agency Limited India Habitat Centre East Court, Core 4A, 1stFloor, Lodhi Road, New Delhi–110003 Phone: +91 11 24682206 Email: equityinvestor2023@ireda.in Website: https://www.ireda.in/ |

IREDA IPO Registrar

| Link Intime India Private Ltd Phone: +91-22-4918 6270 Email: indianrenergy@linkintime.co.in Website: https://linkintime.co.in/mipo/ipoallotment.html |

IREDA IPO Lead Manager(s)

| 1. Idbi Capital Market Services Limited 2. Bob Capital Markets Limited 3. SBI Capital Markets Limited |

Frequently Asked Questions (FAQs)

Q. IREDA Filed DRHP?

And: Yes, here is the IREDA IPO on 7th September 2023 to float its Initial public offering

Q. What is IREDA full form

Ans: IREDA full form is Indian Renewable Energy Development Agency Limited.

Q. Is IREDA a Government organization

Ans: Yes, IREDA which is the short form of Indian Renewable Energy Development Agency Limited is a government organization. It is also one of the mini Ratna of India. The honorable president of India is the promoter of the company.

Q. Where is IREDE HQ

Ans: IREDA’s headquarters is in Delhi. The Registered Office: India Habitat Centre, East Court, Core 4A, 1st Floor, Lodhi Road, New Delhi – 110 003, India; Telephone: +91 11 2468 2214

Corporate Office: 3rd Floor, August Kranti Bhavan, Bhikaji Cama Place, New Delhi – 110 066, India; Telephone: +91 11 2671 7400 / 2671 7412

Q. How can I invest in IREDA IPO?

Ans: If you are interested in investing in IREDA’s IPO, you will need to open a demat account and trading account with a broker. You can then apply for shares during the book-building process.

Q. When is the IREDA IPO date?

Ans: The IREDA IPO date is not yet announced. However, it may be open for subscription in November 2023.

Q. What is the IREDA IPO Price

Ans: The IREDA IPO Price has not yet been announced

Q. What are the risks of investing in IREDA’s IPO?

Ans: As with any investment, there are risks associated with investing in IREDA’s IPO. These risks include:

- The price of the shares may fall after the IPO.

- The company may not perform as well as expected.

- The company may face regulatory or legal challenges.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend paying stocks, 5 best upcoming IPOs in India.