Kaka Industries IPO Details at a Glance

- Kaka Industries IPO Details

- Subscription for this SME IPO is opens – 10 July to 12 July 2023.

- The IPO consists of a fresh issue of 3,660,000 shares (aggregating up to ₹21.23 Cr)

- IPO Price range – Rs 55 to Rs 58

- There is no offer for sales in the IPO issue.

- The Equity Shares have a face value of Rs 10 each.

- The retail allocation is not less than 31.52% of the total size.

- This SME IPO will be listed in BSE SME exchange.

Kaka Industries IPO Details – Subscription for this SME IPO is opening from Jul 10, 2023 to Jul 12, 2023. According to the prospectus, the IPO consists of a fresh issue of 36,60,000 shares. There is no offer for sales in the IPO issue. The Equity Shares have a face value of Rs 10 each. The retail allocation is not less than 31.52% of the total size. This SME IPO will be listed on the BSE SME exchange.

Kaka Industries IPO Review – The Company Business Description

Headquartered in Ahmedabad, Gujarat, Kaka Industries was incorporated in 2019 under the leadership of Mr. Rajeshbhai Gondaliya. Kaka Industries Limited is a leading manufacturer of PVC products in India. The company has a manufacturing facility with a capacity of 10,000 metric tons per annum.

The company’s product range includes PVC doors, PVC foam sheets, PVC sections, frames, kitchen furniture, PVC furniture, upvc fencing and tree guard, prefab house, uPVC window, WPC foam board, PVC false ceiling, wall paneling, and more. Kaka Industries’ products are available in a wide range of colors and finishes and are exported to countries all over the world.

Kaka Industries Business verticals can be segmented into

- PVC Doors, Kitchen Cabinet, and Furniture

- UPVC Window Profile

- WPC (Wood Polymer Composite)

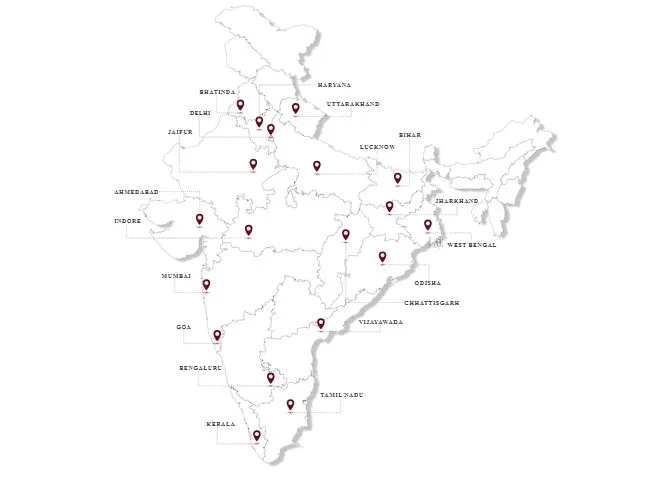

The major portion of the revenue comes from the state of Gujarat (64.47%), followed by Telangana (9.03%), Maharashtra (6.18%), Karnataka (4.50%), and the remaining 15.81% from other 19 states & union territories.

The Kaka Industries Founders and Leadership team

Mr. Rajesh Dhirubhai Gondaliya has more than 20 years of experience in the field of PVC profiles and related products.

The Kaka Industries Revenue and Profit

The total income of the Company stood at ₹ 116.76 Cr., ₹ 117.10 Cr., ₹ 78.79 Cr. and ₹ 41.49 Cr. for the nine months ended Dec.’22 and fiscal ended 2022, 2021, and 2020 respectively.

The PAT for the nine months ended Dec.2022 and fiscal ended 2022, 2021, and 2020 stood at ₹ 3.85 Cr., ₹4.98 Cr., ₹ 3.03 Cr. and ₹ 1.41 Cr. respectively.

| Time Period Ended | 31-Mar-20 | 31-Mar-21 | 31-Mar-22 | 31-Mar-23 |

|---|---|---|---|---|

| Total Assets | 2,190.68 | 3,568.02 | 4,614.76 | 6,767.00 |

| Total Revenue | 4,148.74 | 7,879.00 | 11,709.98 | 15,887.70 |

| Profit After Tax | 141.14 | 302.51 | 497.66 | 718.50 |

| Net Worth | 142.14 | 743.65 | 1,241.31 | 1,956.88 |

| Reserves and Surplus | 141.14 | 493.65 | 991.31 | 956.88 |

| Total Borrowing | 830.50 | 1,999.00 | 2,735.55 | 4,013.66 |

Objective Behind the Kaka Industries IPO

- The company intends to utilize ₹730 Lakhs of the net proceeds to repay and/or pre-pay, in full or part, of certain borrowings.

- The rest of the net proceeds will be utilized to meet the Working Capital requirements and General Corporate Purpose.

Peers of Kaka Industries

Some of the major competitors in the organized segment are

- Dhabriya Polywood Limited,

- Sintex Plastics Technology Limited

- Fenesta Building Systems – (A division of DCM Shriram Limited)

Kaka Industries IPO Details: Do you invest?

- The plastics industry is currently home to about 50,000 industries, most of which are micro, small, and medium-sized enterprises (MSMEs).

- The Construction industry in India is expected to do well in the next decade due to growth in the Indian economy.

- Financially, the company is doing good in terms of revenue. The revenue from the operation has doubled from FY2020 to FY2021.

- However, the company does have financial records for more than five years to understand the long-term growth.

- The entry barrier in this industry is easy. It is easy for new competitors to enter and exist in this industry. That may reduce the demand for its Products.

- The company is highly concentrated in the state of Gujarat. The company earns 64.47% of its revenue from Gujarat.

- Looking at the financials and factors mentioned above, I would prefer to avoid investing in this SME IPO at the moment.

kaka Industries IPO Price and Other details

| kaka Industries IPO Details | kaka Industries IPO Price and other details |

| IPO Date | Jul 10, 2023 to Jul 12, 2023 |

| IPO Price band | ₹55 to ₹58 per share |

| IPO Allotment date | Monday, 17 July 2023 |

| Refunds Initiation date | Tuesday, 18 July 2023 |

| Credit of Shares to Demat Account | Wednesday, 19 July 2023 |

| Kaka Industries IPO Listing Date | Thursday, 20 July 2023 |

| Fresh Issue | 3,660,000 shares (aggregating up to ₹21.23 Cr) |

| Offer for Sale | Nil |

| Maximum bid (lot size) For retail investor | 1 lot of 2000 shares Total Investment of ₹116,000 |

| Minimum bid (lot size) For retail investor | 1 lot of 2000 shares Total Investment of ₹116,000 |

| Face Value | INR 10 per share |

| Listing on | BSE SME Exchange |

Kaka Industries IPO Lead Managers & Registrar

| Lead Manager | Registrar |

| Hem Securities Limited | Bigshare Services Pvt Ltd Phone: +91-22-6263 8200 Email: ipo@bigshareonline.com Website: https://www.bigshareonline.com/ |

kaka Industries Company Contact Information

| Kaka Industries Limited Plot No. 67, Bhagwati Nagar, Opp Nilkanth Arcade, Opp. Kathwada GIDC, Kuha-Kanbha Road Ahmedabad -382415 Phone: +91-80004-46524 Email: investors@kakaprofile.com Website: https://kakaprofile.com/ |

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, Is fine organics a good buy now.

mind2markets is in news

Feedstop has mentioned mind2markets website as one of the best site to provide stock analysis and insights about the company to invest in. Keep in touch.