Ather Energy IPO 2025

Share With Friends

Ather Energy, one of India’s pioneering electric two-wheeler manufacturers, is set to launch its Initial Public Offering (IPO) with a revised valuation of up to $1.4 billion, a significant 44% reduction from its earlier target. The company aims to raise approximately ₹3,000 crore, making it the third-largest public share sale in India for 2025. This IPO comprises a fresh issue of ₹ 2,626crore and an offer for sale (OFS) of 1.1 crore equity shares by existing shareholders, including founders and early investors.

Table of Contents

As Ather prepares to enter the public markets, investors are keen to understand the company’s financial health, growth prospects, and the risks involved. This analysis delves into Ather’s historical financial performance, key financial ratios, earnings trends, utilization of IPO proceeds, and risk factors, and provides an investment recommendation. Let us do a detailed Ather Energy IPO analysis.

Ather Energy IPO analysis

Financial Performance (FY2022–FY2024)

Ather Energy has demonstrated impressive revenue growth over the past three fiscal years:

- FY2022: ₹1,309 million

- FY2023: ₹5,078 million

- FY2024: ₹18,353 million

This trajectory reflects a compound annual growth rate (CAGR) of over 200%, underscoring the company’s rapid market expansion.

However, profitability remains elusive:

- Gross Margin: Improved from 2% in FY2022 to 9% in FY2023 but declined to 7% in FY2024.

- Operating Losses: Widened to ₹10,597 million in FY2024.

- Net Losses: Consistently high, with a net loss margin of -60.42% in FY2024.

- Cash Flow: Negative operating cash flows across all three years, indicating substantial cash burn.

While the revenue growth is commendable, the persistent losses highlight the challenges Ather faces in achieving operational efficiency and profitability.

Key Financial Ratios and Industry Comparison

Analyzing Ather’s financial ratios provides deeper insights into its financial health:

- Debt-to-Equity Ratio: 0.88 in FY2024, down from 1.09 in FY2023, indicating a reduction in leverage.

- Current Ratio: 1.14 in FY2024, suggesting moderate liquidity.

- Net Profit Margin: -60.42% in FY2024, reflecting significant net losses.

- Return on Equity (ROE): -183% in FY2024, indicating negative returns for shareholders.

Compared to industry peers like Ola Electric, TVS Motor, and Bajaj Auto, Ather lags in profitability and return metrics. For instance, TVS Motor reported a net profit margin of approximately 7% and an ROE of around 20% in the same period.

Earnings Per Share (EPS)

Ather’s EPS has remained negative over the past three years:

- FY2022: ₹(27)

- FY2023: ₹(48)

- FY2024: ₹(47)

The lack of improvement in EPS, despite revenue growth, suggests that increased sales have not translated into profitability. This trend raises concerns about the company’s scalability and cost management strategies.

Ather Energy IPO Details

| Ather energy IPO date | April 28, 2025 to April 30, 2025 |

| Listing Date | |

| Face Value | ₹1 per share |

| Issue Price Band | ₹304 to ₹321 per share |

| Lot Size | 46 Shares |

| Ather energy IPO Size | 9,28,58,599 shares (aggregating up to ₹2,980.76 Cr) |

| Fresh Issue | 8,18,06,853 shares (aggregating up to ₹2,626.00 Cr) |

| Offer for Sale | 1,10,51,746 shares of ₹1 (aggregating up to ₹354.76 Cr) |

| IPO Open Date | Mon, Apr 28, 2025 |

| IPO Close Date | Wed, Apr 30, 2025 |

| Tentative Allotment | Fri, May 2, 2025 |

| Initiation of Refunds | Mon, May 5, 2025 |

| Credit of Shares to Demat | Mon, May 5, 2025 |

| Tentative Listing Date | Tue, May 6, 2025 |

Utilization of Ather Energy IPO Proceeds

According to the Ather Energy IPO prospectus, Ather plans to allocate the ₹ 2,626crore from the fresh issue as follows:

- ₹927.2 crore: Establishment of a new electric two-wheeler manufacturing facility in Maharashtra.

- ₹40 crore: Repayment or pre-payment of certain borrowings.

- ₹750 crore: Investment in research and development over five years.

- ₹300 crore: Marketing and branding initiatives over three years.

- Remaining Funds: General corporate purposes.

This allocation aligns with Ather’s growth strategy to expand manufacturing capacity, enhance technological capabilities, and strengthen market presence.

Data Center Related Articles

- Anant Raj Limited: The Best Way to Invest in Data Center Stocks in India

- Data Center in India – Best Data Center Stocks in India to Invest

- NSE listed data center companies in India

- Explore Best Data Center Companies in India

- Opportunities in the Indian Data Center Market

- Fast Growing data center player Nxtra Data Limited Achieved Unicorn status: Learn actionable insights

- Best 5 Top Electronics Companies in India

Risk Factors of Ather Energy IPO 2025

- Operational Risks: Dependence on the adoption rate of electric vehicles in India and potential manufacturing disruptions.

- Regulatory Risks: Changes in government policies, such as modifications to the FAME II incentives, could impact profitability.

- Financial Risks: Continued losses and negative cash flows may necessitate additional funding.

- Market Risks: Intense competition from established players like Ola Electric, TVS Motor, and Bajaj Auto.

- Reputational Risks: Past issues, such as the off-board charger refunds, highlight potential compliance challenges.

Additionally:

- Customer Concentration: Heavy reliance on a few models, such as the 450X, could pose risks if demand shifts.

- Price Sensitivity: Premium pricing may limit market share in a price-sensitive market.

- Technological Obsolescence: Rapid advancements by competitors could render Ather’s products outdated.

- Execution Risks: Challenges in scaling operations while maintaining quality and managing costs.

Ather Energy IPO Investment Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 46 | ₹14,766 |

| Retail (Max) | 13 | 598 | ₹1,91,958 |

| S-HNI (Min) | 14 | 644 | ₹2,06,724 |

| S-HNI (Max) | 67 | 3,082 | ₹9,89,322 |

Industry Overview

Electric Two-Wheeler Market in India

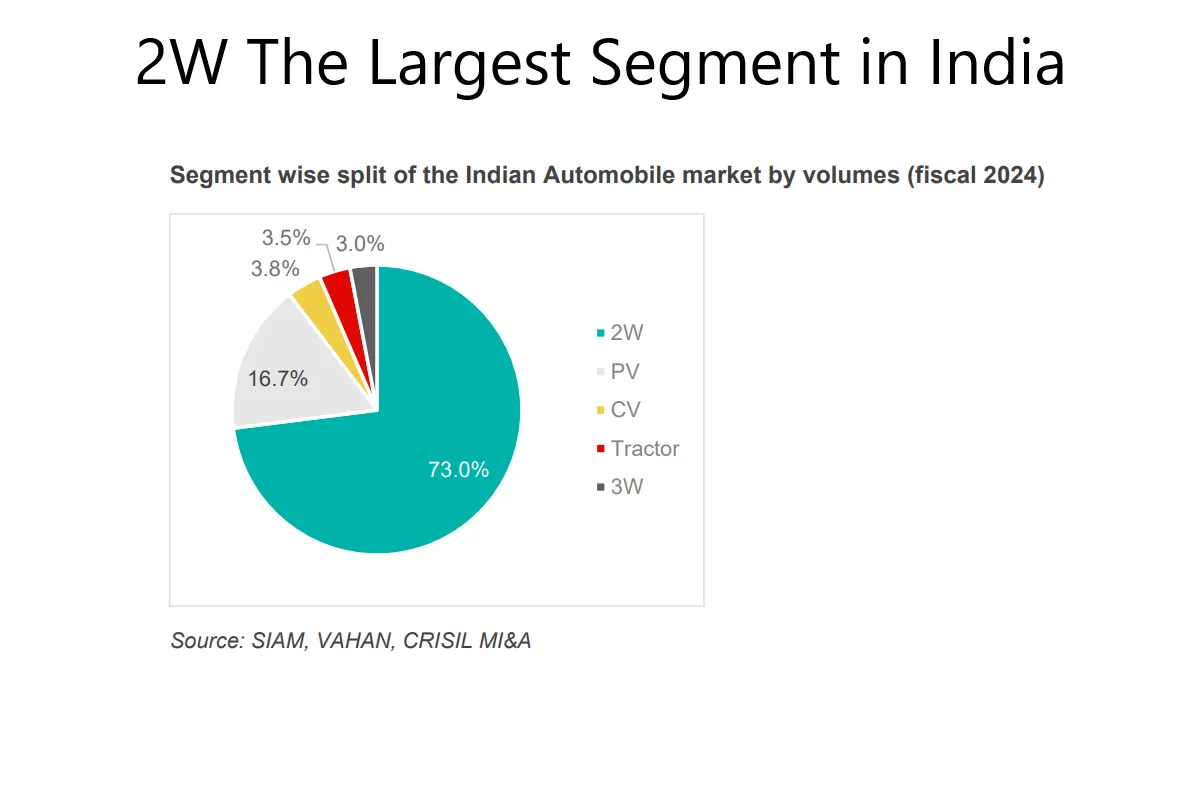

India stands as the world’s largest market for motorized two-wheelers, with 18.4 million units sold domestically in FY2024. Amid this massive industry, a transformative shift is underway: the rise of electric two-wheelers (E2Ws). The sector is transitioning rapidly from internal combustion engines (ICE) to electric mobility, driven by government policies, changing consumer behavior, and rapid innovation in EV technology.

The E2W segment is projected to grow at a compound annual growth rate (CAGR) of 41–44%, reaching 10.2–12.2 million units by FY2031, which would represent 35–40% penetration of the overall two-wheeler market. This growth is expected despite headwinds such as regulatory uncertainty and supply chain challenges. Drivers of this momentum include:

- Declining battery prices, which reduce the total cost of ownership.

- Government support, especially via schemes like FAME II.

- Consumer shift toward cleaner, smarter, and more economical transportation options.

- Expanding EV product portfolios by both new entrants and traditional OEMs.

Competitive Landscape for Ather Energy IPO

The market is currently dominated by a few key players:

- Ola Electric: Market leader with over 35% share in FY2024, known for rapid scale-up and price aggression.

- TVS Motor (iQube) and Bajaj Auto (Chetak): Legacy ICE players now deepening their EV push.

- Ather Energy: Positioned as a premium brand with high-tech, performance-driven scooters.

Notably, Ather was the third-largest E2W player by volume in FY2024, with over 109,000 units sold. Unlike many competitors, Ather emphasizes in-house development, a vertically integrated model, and proprietary technology such as AtherStack software and the Ather Grid charging network.

Policy Environment and Incentives

The Indian government has been instrumental in catalyzing the EV movement. Key policy levers include:

- FAME II (Faster Adoption and Manufacturing of Electric Vehicles in India): Offers upfront purchase incentives and support for charging infrastructure.

- PLI Schemes: Production-linked incentives for advanced automotive and battery technologies.

- State-level subsidies and EV policies in markets like Maharashtra, Tamil Nadu, and Delhi.

However, recent changes in FAME II subsidy structures have led to short-term volatility, underscoring the regulatory risks that companies like Ather must navigate.

Final words on Ather Energy IPO analysis.

- Strong product and brand recognition.

- Solid growth in vehicle volumes (294% YoY in FY23, 19% in FY24).

- Investment in tech and infrastructure could yield long-term returns.

However

- Heavy, sustained losses with no immediate profitability.

- Negative EPS and high-risk profile in execution and compliance.

- IPO pricing (₹304–₹321 per share) suggests aggressive valuation, especially when compared to profitable incumbents like TVS or Bajaj.

More Information about the Ather Energy IPO