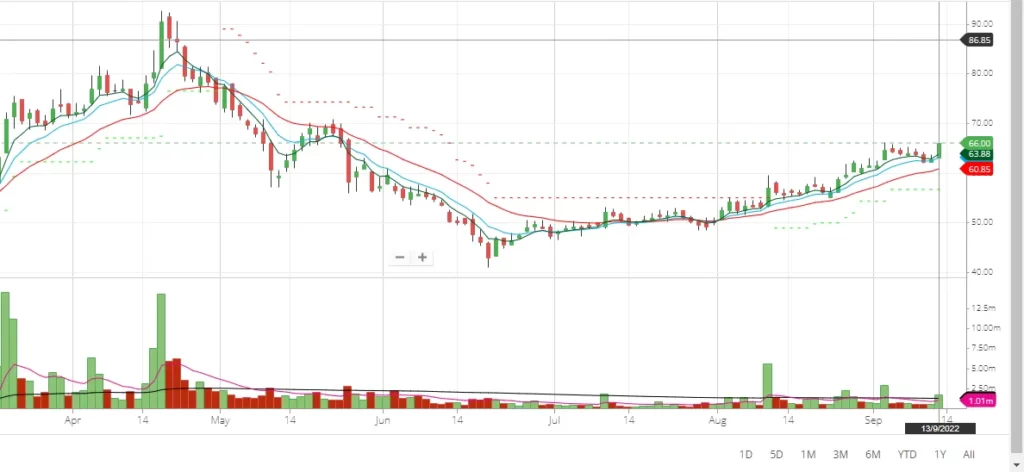

SPIC share price Technical Analysis

SPIC share price (Southern Petrochemical Industries Corporation) looking strong in its technical chart with strong trading volume over the last few trading days. The trading volume of the script is above 100 DMA during this period. It seems the counter is ready to move up sharply. SPIC share price formed a golden cross over at the 65 levels.

SPIC is one of the momentum stocks. Once the SPIC share price crossed above 66 level it will start to move up again. SPIC share price is trading above all its short and long-term moving averages on the daily chart. The stock is also trading above its super trend signals and is in a bullish up move. Buy at this level or on Dip. Fertilizer industry-related companies are buzzing now in the stock market. Refer fundamental analysis below.

SPIC share price is also looking strong in the weekly chart with strong volume over the last six weeks. SPIC share price looks strong for both short- and long-term investments at this level. Once the counter closes above 66 levels with strong volume, it will move toward a 70 to 86 level. SPIC share target price may be 100 level within the next six months.

Momentum indicators RSI, ADX, and MACD of SPIC share price are looking bullish on the daily chart. One may buy on dips for a 10 to 20% gain in the short term. SPIC share price is trading at 7.81 Price to Earnings (PE) and available at 1.84 price-to-book (PB) value while sector PE is 13.99 PE and 2.72 PB. The debt-to-equity ratio of the company is 0.43 in FY22 which is negligible. The fundamentals of the company with a low debt-to-equity ratio make it attractive. Look at the volume today on 13-09-2022, SPIC share is a good stock to accumulate at this level or in correction.

Suggested Reading on Momentum stock section India Glycols, Gokex, Elgi Equipments, and PCBL. Company profile Deltatech Gaming, Company profile DCX systems

SPIC share price Fundamental Analysis

Fundamentally, SPIC is a strong company. Southern Petrochemical Industries Corporation was founded in 1969, as one of the oldest fertilizer companies in India. The company is one of the leading fertilizer manufacturing companies in the country located in Thoothukudi in the State of Tamil Nadu. It is a joint venture founded by Dr. M A Chidambaram and Tamil Nadu Industrial Development Corporation Limited (TIDCO), a state-owned industrial development institution.

The company’s large fertilizer complex is capable of producing 6.2 lakh tons of Neem Coated Urea per year. SPIC manufacturers Nutrients, Fertilizers, Organic Pesticides, Plant growth regulators, Plant Biostimulants, and other Industrial products. Supply chain disruption due to Lockdown in China and the Russia-Ukrain war will increase the demand for Indian fertilizer domestically and globally. Further, the Make in India policy of the Government of India with boost product manufacturing in India. This will benefit the company.

SPIC share price Financial Analysis

SPIC delivered strong operating revenue last quarter. The company’s operating revenue stood at INR 1875 crores for FY22 as against INR 1527 crores for FY21 recording a growth of 23% YoY. Total income has increased from INR 1556 Crores in 2021 to INR 1898 crores in 2022. As per the latest presentation, the company reported a Profit after Tax of INR 1404.4 crores in FY22 as against 518.5 crores in FY21; over 100% growth YoY.

SPIC is a small-cap company with a market cap of INR 1339 crores with a face value of INR 10. Return on capital employed is ~23 percent while return on equity is ~27 percent. Promoter’s shareholdings remain the same from Sept 2021 to March 2022 at 53.27%. FIIs have increased their holdings from 0.59 % in March 2021 to 0.95 % in March 2022. FII has significantly increased its stake in the company over the last three quarters from 0.14% in September 2021 to 0.95% in March 2022. However, DII holdings in the company remained almost the same at 12.62% in March 2021 to 12.61% in March 2022. This reflects that FIIs are confident about the company’s performance.

Company Promoters and Management

SPIC is run by strong leadership. Mr. Ashwin C Muthiah is the Chairman of the company. A third-generation business leader, Ashwin has led the group since 2001. He also leads other companies such as Manali Petrochemicals Limited (MPL) and Sicagen India Limited and is the Vice Chairman of Tamilnadu Petroproducts Limited (TPL). Before this assignment, he held the position of the Chairman of Tuticorin Alkali Chemicals & Fertilizers Limited and SICAL Logistics Limited.

Ms. Vandana Garg is the Director of the company. She is a 2017 batch IAS Officer who has held many key positions in various departments in the Government of Tamil Nadu. Presently, Ms. Vandana Garg is the Executive Director of Tamilnadu Industrial Development Corporation Limited.