Synergy House Bhd IPO will be listed on June 1, 2023 on the ACE Market of Bursa Malaysia. The company is raising RM34.4mil from its initial public offering (IPO).

Synergy House Berhad is one of the largest furniture designers and exporters in Southeast Asia established since 1990 with customers across Europe, USA, the Middle East and Southeast Asia.

Synergy House Berhad IPO listing date and Key Facts

- Synergy House IPO Price (RM) 0.43 sen

- Fund Raised RM million 34.40 from new issue and RM Million 21.50 from offer for sale

- Total IPO Size is RM Million 55.90

- Enlarged issued share capital upon listing (million shares) 500.00

- Synergy House Berhad IPO Market Capitalisation (RM million) 215.00

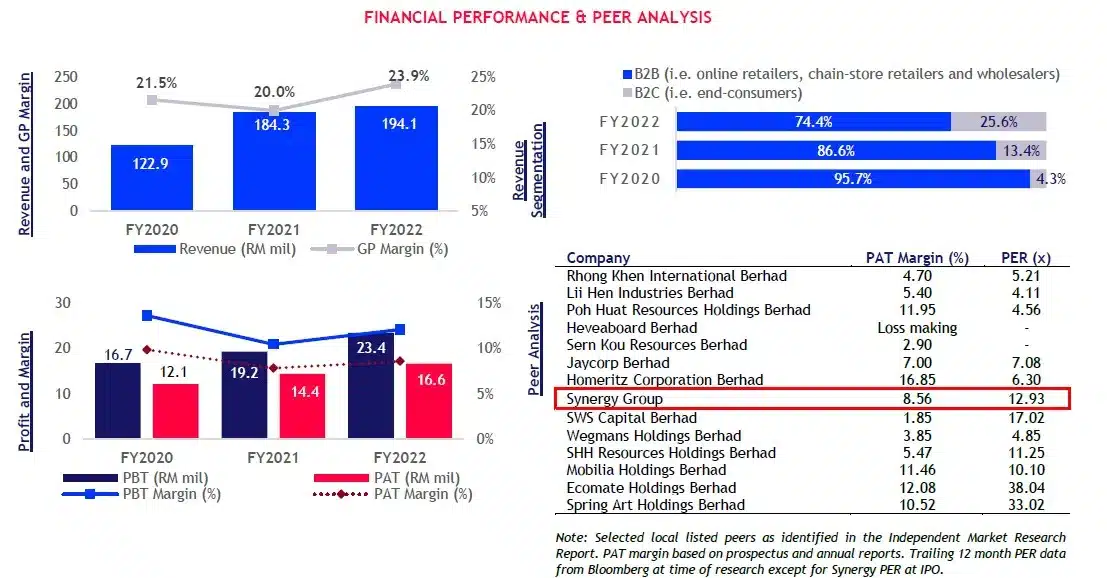

- Price Earnings Ratio (PER) 12.93x

- The company earns 42% revenue from UK, 39% from USA, 12% from UAE and rest from Malaysia and others.

- synergy house berhad IPO listing date June 1, 2023

Utilization of Proceeds from Synergy House IPO

- RM10mil or 29.07% of the proceeds will go towards the purchasing of inventories for its proposed e-commerce fulfilment centre in Johor.

- RM1.5mil will be used to purchase of racking system and forklifts

- RM1mil will be used for E-commerce advertising and promotions

- RM10mil will be used to repay the borrowings

- About RM7.7mil will be utilized to meet the working capital requirement

- The rest RM4.2 mil will be used for listing expenses

Synergy House Bhd IPO – Future Game Plan

Synergy House continue to grow its B2C sales segment with the following strategies:

- Expansion of its customer reach through listing and selling its products on more third-party e-commerce platforms with new market focus, primarily to countries with larger populations and high urbanisation.

- Enhancement of its revenue through advertisement and promotions which include discounts, giveaways and flash sales to customers.

- Establishment of new warehouses in Muar, Johor in 2023 and Port Klang, Selangor in 2027 respectively as e-commerce fulfilment centres

- Purchase of inventories for third party e-commerce fulfilment centres in overseas countries and proposed new warehouse in Muar, Johor in anticipation of higher B2C sales

- Expand its range of home furniture through continuous D&D efforts by diversifying into bathroom furniture and kitchen furniture.

Synergy House Berhad Business Overview

The company launched our own brand of children’s bedroom furniture, TOMATO Kidz, and in 2019 and 2020, we established online stores under the TOMATO Kidz, TOMATO Home and Synergy House Furniture brands on third-party e-commerce platforms, Lazada and Shopee, to market and sell the products directly to end-consumers in Malaysia.

Synergy House expanded its operation to a major overseas e-commerce marketplace platform in USA in 2020. The company also expanded to other e-commerce marketplace platforms in USA and UK continues in 2022.

The company is expected to continue its expansion journey ti new markets with the investment from this IPO proceeds. “We intend to continue to grow our business-to-consumer (B2C) segment by utilising a portion of the IPO proceeds to purchase inventories for our B2C segment and by carrying out advertising and promotion initiatives on third-party e-commerce platform,” said executive director Teh Yee Luen.

Synergy House Berhad IPO Review

The data source for this chart is bursamalaysia

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend paying stocks, 5 best upcoming IPOs in India.