Tesla Inc has always been in the news for many reasons. This time, the electric vehicle company cut the price of almost all the models in March 2023, to start a price war against its rivals. It gives a mixed signal of whether the price cut is a strategy to capture more market share or the production cost of vehicles has reduced and the price cut is evident. There may be another reason that the customer demand for Tesla vehicles has reduced.

“We do believe we’re…laying the groundwork here and that it’s better to ship a large number of cars at a lower margin and subsequently harvest that margin in the future as we perfect autonomy,” Mr. Elon Musk

Tesla is planning to 20 million cars annually in 2030, which could cost nearly $150 billion to reach its goal. Tesla’s cost advantage in making electric cars will allow it to absorb price cuts and maintain its leadership in the market. The Tesla Stock is likely to do well in long term. We have discussed this in details in “Tesla Stock Prediction 2025“.

In this article and subsequent articles, we will delve deeper into Tesla’s history, achievements, challenges, and prospects.

Tesla Inc Case study

Tesla Inc was incorporated in 2003 by Martin Eberhard and Marc Tarpenning in San Carlos. Tesla Inc. is a leading American electric vehicle and clean energy company. The company is headquartered in Palo Alto, California, USA. Tesla Inc. is a highly integrated company that designs, manufactures, and sells electric cars, battery storage systems, and solar panels. Tesla has become a household name for its innovative and sustainable approach to transportation and energy solutions.

With a mission to accelerate the world’s transition to sustainable energy, Tesla Inc. has made significant strides toward achieving this goal. Tesla has not only revolutionized the automotive industry with its electric vehicles but has also disrupted the energy sector with its cutting-edge battery technology and solar products.

With a market capitalization of over $515 billion (based on stock price as of April 29, 2023), Tesla is one of the most valuable companies in the world. Its products and innovations have garnered widespread attention and admiration from consumers, investors, and industry experts alike.

Recommended Studies for you on Tesla Inc. – How Tesla position itself in the Global EV Market,; Why should you invest in Tesla Stock,; and tesla-stock-price-prediction-2025-company-to-invest-in.

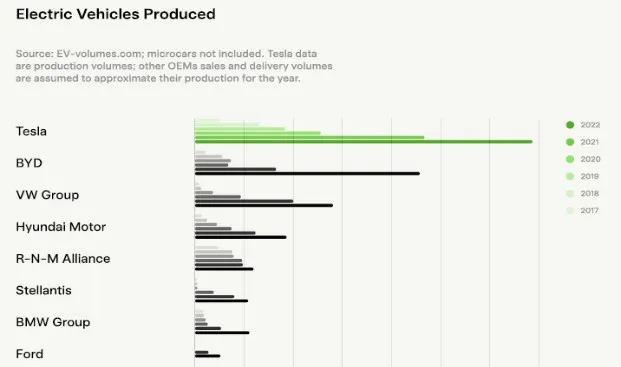

Tesla Inc Largest Electric Vehicle Producers

Tesla Inc Facts till 2023

- 2003: Tesla was founded by Martin Eberhard and Marc Tarpenning to make electric cars.

- 2008: The first Tesla Roadster was produced and delivered to customers. It was the first fully electric sports car to run on the road.

- In September 2009 all five members – Martin Eberhard, Marc Tarpenning, Ian Wright, Elon Musk, and J.B Straubel – became co-founders of the company.

- 2010: Tesla went public and raised $226 million in its IPO.

- 2012: The Model S, Tesla’s first mass-market electric car, was launched. It received critical acclaim and was named Motor Trend’s Car of the Year.

- 2013: Tesla opened its first Supercharger station, which allowed Model S owners to charge their cars for free.

- 2014: Tesla announced plans to build a massive battery factory, which would eventually become the Gigafactory.

- 2015: The Model X, Tesla’s luxury SUV, was launched. It featured Falcon Wing doors and advanced autopilot capabilities.

- 2016: Tesla unveiled its Master Plan, which outlined the company’s long-term vision for sustainable transportation.

- 2016: Musk planned to expand its product line to include trucks, buses, and solar energy products.

- 2017: Tesla unveiled the Model 3, its first affordable electric car. It received over 400,000 pre-orders within a few months of its unveiling.

- 2018: The first Tesla Semi was unveiled, marking the company’s entry into the commercial truck market.

- 2019: Tesla opened its Gigafactory in Shanghai, China, which would eventually produce vehicles for the Asian market.

- 2020: Tesla became the world’s most valuable automaker, surpassing Toyota in market capitalization.

- 2021: Tesla announced plans to build a new Gigafactory in Texas, which would produce the Cybertruck and other vehicles. It also began accepting Bitcoin as payment for its products.

- Tesla opened its Gigafactory in Berlin, Germany in the first quarter of 2022. The company also opened the Gigafactory in Austin, Texas in the second quarter of 2022.

- Tesla produced and delivered over 1.3 million EVs globally in 2022

- 2023 1st quarter: Tesla delivered 422,875 vehicles for the first time in any quarter.

- 2023: Tesla Inc hit a milestone of producing 4th million total vehicle production. In the 4th quarter of 2022, the company produced 439,701 vehicles.

- 2023: Tesla has reached a new Supercharger milestone with 45,000 stalls.

- 2023: Elon Must set an ambitious goal to sell 20 million cars in 2030. That’s the equivalent of Toyota and Volkswagen combined.

- 2023: Announced building a new battery factory in Shanghai to produce 10,000 Megapacks every year, equal to around 40 GWh of energy storage.

- The company is planning to halve the cost of its next generation of EVs to make it more affordable to meet its 2030 goal.

- Read More on Tesla

Tesla Inc Value Chain Analysis – Developed an Entire Ecosystem of Electric Vehicles

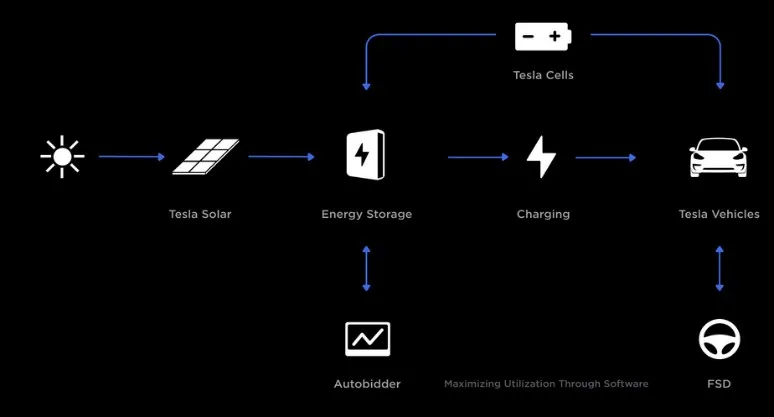

The company has an entire ecosystem of energy products including hardware and software across power generation to energy storage. Tesla customers can enjoy a seamless experience whether they are homeowners or vehicle owners.

Tesla has been continuously reducing operating expenses and continues to scale manufacturing globally. Mr. Elon Musk always believes in long-term goals. Tesla is building an ecosystem that translates connected products. Each product increases the marginal benefit of owning other products in that ecosystem.

Tesla Inc Ecosystem is one of strongest and vertically integrated ecosystem in automotive industry. The company provides products from solar roofs to at-home charging stations. The company offers an HVAC system that can run by a solar roof or powerWall. Tesla is present across the value chain of renewable energy. Tesla did it with a top-down approach.

Tesla Inc Ecosystem – Fully Vertical

Outlook

Tesla has truly built the entire ecosystem that helps the owner of a vehicle to reduce the ownership cost. The total cost of ownership can also be extended into Tesla’s other products which can help further reduce costs. Solar panels generate electricity and can eventually generate revenue for the owner with net metering. Tesla product heat pumps help save money on natural gas, especially if they are powered by solar-generated energy from the solar roof and powerWall.

Tesla design and manufacture a fully integrated energy and transportation ecosystem that work together for maximum impact—leading to the greatest environmental benefit possible.

It is one of the best highly integrated companies in the automotive industry worldwide. That is the reason, customers and investors are always happy with the company despite the ups and downs of the stock price.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend paying stocks, 5 best upcoming IPOs in India.