Top EMS companies in India

Share With Friends

Indian EMS market is expected to see robust growth due to the growth of electronic contract manufacturing services. Global end users in this segment are looking towards India to take center stage in this industry to play a major role in the supply chain of this industry. The electronic contract manufacturing services in India will also benefit from the China+ strategy of global players as well as the Indian government policy initiatives. Just to mention on EMS company full form is “Electronics Manufacturing Services”.

Table of Contents

The global EMS (Electronics Manufacturing Services) market is valued at approximately $500 billion in 2023 and is expected to grow at a CAGR of 7-8%, reaching $832 billion by 2026. This growth is driven by rising demand across sectors such as consumer electronics, automotive, aerospace, and defense. Factors such as increasing adoption of IoT, automation, and advancements in PCBA (Printed Circuit Board Assembly) technology are key growth enablers.

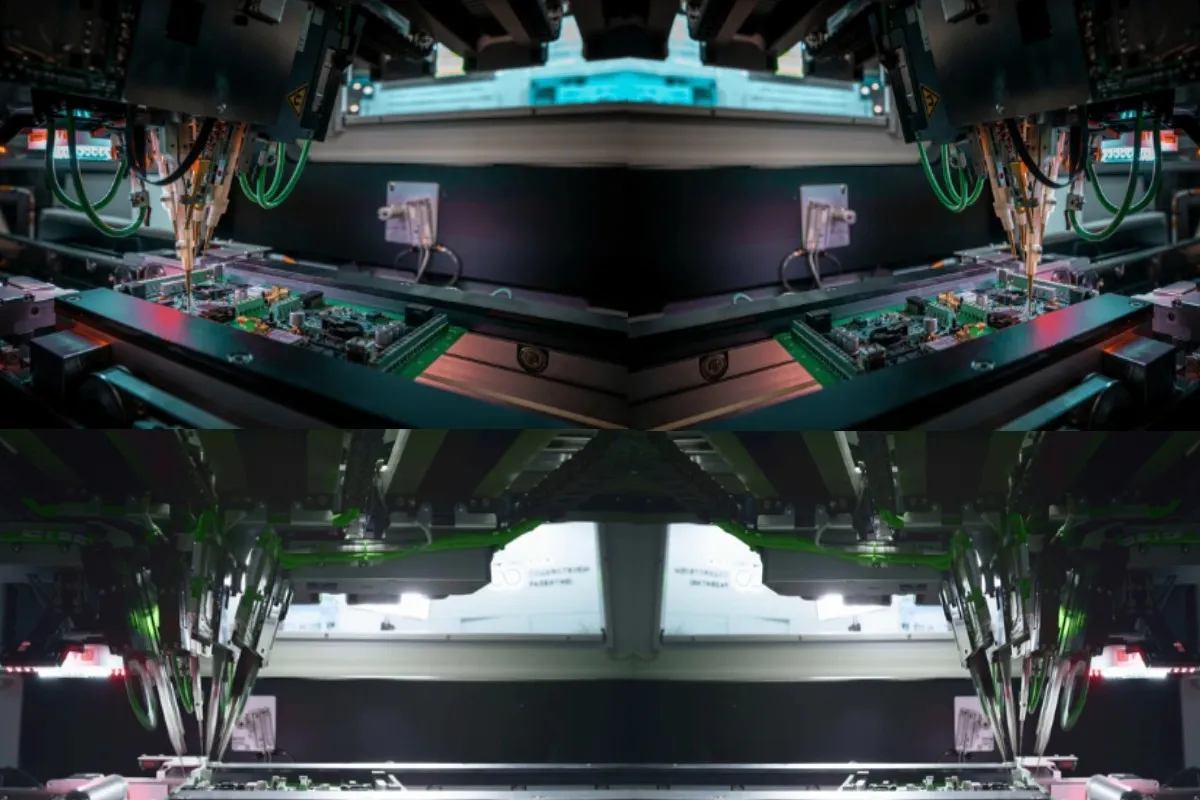

EMS companies in India

The Indian EMS market is poised for rapid expansion, fueled by the government’s “Make in India” initiative and strong demand for electronics in sectors like telecommunications, healthcare, and automotive. The market size is projected to reach USD 90 billion by FY26. This growth is supported by favorable policies, local manufacturing capabilities, and increasing export opportunities. Sectors like defense electronics, medical devices, and renewable energy solutions are emerging as lucrative verticals.

Growth Drivers

- Demand Across Sectors: High growth in industries such as automotive, defense and renewable energy is boosting EMS demand globally and domestically.

- Technological Advancements: The adoption of technologies like IoT, AI, and automation drives the need for sophisticated EMS solutions.

- Cost Advantages: India’s competitive labor costs and improving infrastructure are attracting global EMS providers.

Data Center Related Articles

- Anant Raj Limited: The Best Way to Invest in Data Center Stocks in India

- Data Center in India – Best Data Center Stocks in India to Invest

- NSE listed data center companies in India

- Explore Best Data Center Companies in India

- Opportunities in the Indian Data Center Market

- Fast Growing data center player Nxtra Data Limited Achieved Unicorn status: Learn actionable insights

- Best 5 Top Electronics Companies in India

Indian Government PLI Scheme: EMS Company

The Production Linked Incentive (PLI) scheme is a cornerstone of India’s push to enhance domestic manufacturing in the EMS sector. Key highlights include:

- Incentives for Large-Scale Manufacturing: The scheme provides financial support for local production of electronics and associated components, including PCBAs.

- Priority is given to high-demand sectors like telecommunications, medical devices, and defense electronics.

- The scheme provides financial benefits of 4-6% on incremental sales of goods manufactured in India, over a base year, for 5 years.

- A total outlay of ₹40,995 crores has been allocated for electronics manufacturing under the scheme.

- The scheme aims to boost the EMS industry’s global competitiveness, generate employment, and reduce reliance on imports.

- The scheme has successfully led to the localization of PCB assembly, increasing the domestic value addition in electronics manufacturing from 15-20% to over 30%.

Multiple Electronic Contract Manufacturing Services Companies in India like Dixon Technologies, Syrma SGS, Avalon Technologies, and PGEL have reported substantial expansions supported by PLI incentives. Let us analyze the top EMS companies in India that are relatively cheaper to invest in compared to their peers.

Top EMS companies in India

In this article, I will focus on the EMS company which is available at a lower valuation compared to its peers. I will try to share the best company insights on each of these Electronic Contract Manufacturing Services Companies in India to help you understand if they are worth looking for investment. I will also share the other companies that have already gained momentum in the market.

Best 5 Electronic Contract Manufacturing Services Companies in India

Avalon Technologies Best EMS Company Insights

Avalon Technologies has been showing strong revenue growth driven by strategic diversification, operational efficiency, and a favorable market outlook. The company is positioning itself as one of the leading EMS companies in India with its expansion plans, focus on high-growth sectors, and prudent capital allocation. Let us analyze Avalon Technologies’ company insights in detail.

Key Trends in Revenue, Profit, and Cash Flow

- Revenue Growth: Avalon has shown consistent revenue growth, with a 12.4% increase in FY23 and a shift toward higher-value services like Box-Build solutions contributing 54% of revenues.

- Profit Margins: While Indian operations showed robust profitability (12.7% operating margin, 8.5% PAT margin in FY24), the US market faced challenges, with an 8% decline in revenue and losses due to macroeconomic factors.

- Cash Flow: The company improved working capital efficiency, with notable reductions in net working capital days and inventory levels, despite global supply chain disruptions.

Segment Revenue of the Company

- Box-Build Solutions: A significant driver, contributing 54% of total revenue in FY23.

- Geographical Revenue: 54% of revenue is from the US market, with a focus on high-margin, complex B2B solutions.

Strategic Priorities

- Long-standing relationships, with 80% of revenue in FY23 derived from customers with over eight years of association.

- Leveraging India’s cost-effective manufacturing and proximity to the US market to secure high-margin contracts.

- Offers end-to-end solutions, including design, PCBA, cable assembly, and logistics, making it a one-stop EMS provider.

- Significant revenue contributions from clean energy (25%), mobility, and industrial sectors.

- Two new manufacturing units in Chennai to meet growing demand.

- Aims to double revenue over the next three years by expanding into new sectors and upselling to existing customers.

- Phase 2 of brownfield expansion is set to begin in early 2025.

Valuation

- Order Book: As of FY24, the order book reached INR 1,366 crores, executable over 14 months, providing strong revenue visibility.

- Growth Potential: The EMS sector in India is expected to grow at a CAGR of 30% by 2026, offering a favorable environment for Avalon.

- Strategic Investments: Capital from the IPO has been utilized to reduce debt and invest in working capital, enhancing financial stability.

Centum Electronics Best Company Insights

Centum Electronics is well-positioned in the EMS industry with a diversified revenue base, strong market presence, and robust order book. Its strategic focus on high-barrier markets like defense and healthcare, combined with consistent investment in technology and infrastructure, makes it a promising candidate for investment. Let us analyze Centum Electronics company insights in detail.

Key Trends in Revenue, Profit, and Cash Flow

- Revenue Growth: Operational income grew consistently, reaching INR 10,908 Mn in FY24, reflecting robust growth across EMS and ER&D segments.

- Profitability: EBITDA margins have declined slightly, from 9.52% in FY22 to 7.08% in H1-FY25, influenced by cost pressures and global macroeconomic factors.

- Cash Flow: Strong working capital management supports operations, with 75% of revenue derived from advanced economies, ensuring predictable cash flow.

Segment Revenue of the Company

- EMS Segment: Contributes 49% of revenue in H1-FY25, driven by high-reliability, high-complexity manufacturing solutions.

- ER&D and Build-to-Specification (BTS): These segments contributed 22% and 29%, respectively, showcasing a balanced revenue mix.

- Geographical Diversification: Strong presence in Europe (60% of revenue), leveraging advanced economies.

- Industry Focus: Key sectors include Defence, Space, Aerospace (58%), and Healthcare (17%), capitalizing on high-growth, high-barrier markets.

- Technology Leadership: Emphasis on mission-critical applications with high reliability and complexity.

Strategic Priorities

- Capacity Expansion: Investing in new facilities and infrastructure in key regions to meet growing demand.

- Diversification: Strengthening presence in automotive, industrial, and healthcare sectors while maintaining leadership in defense and aerospace.

- Technology Investments: Focus on energy efficiency, digitalization, and advanced manufacturing technologies to enhance competitiveness.

- Expansion and Innovation: Investing in new facilities and advanced manufacturing technologies. New facilities in India and Europe to support increasing demand and enhance capacity.

Valuation

- Order Book: A robust order book of INR 17,720 Mn as of H1-FY25 provides revenue visibility.

- Sector Growth: Operating in sectors with significant growth potential, such as defense, space, and healthcare.

- Financial Stability: Strong governance and predictable cash flows enhance investment appeal.

DCX Systems Best EMS Company Insights

DCX Systems demonstrates robust growth and strong market positioning as one of the best EMS companies in India, particularly in defense and aerospace. The company’s focus on backward integration, strategic partnerships, and geographic diversification provides a compelling investment case. Let us analyze DCX Systems’ company insights in detail.

Key Trends in Revenue, Profit, and Cash Flow

- Revenue Growth: Consistent growth in revenue at a CAGR of 43% over the last five years, reaching ₹14,235.83 Mn in FY24, a 13.56% YoY increase.

- Profitability: PAT showed a strong CAGR of 95% over the last five years, though margin challenges were noted in Q2 FY25, where PAT margin reduced to 2.67%.

- Cash Flow: Improved cash flow with significant debt reduction (46.32%) from ₹5,037.11 Mn in March 2023 to ₹2,703.93 Mn in March 2024.

Segment Revenue of the Company

- Defence and Aerospace: The core revenue segments include cable & wire harnesses, PCB assemblies, and high-end system integration.

- Geographical Distribution: Revenue largely derives from international clients, particularly in Israel, the US, and Korea.

Strategic Priorities

- Opening a new 40,000 sq. ft. EMS facility in Bengaluru for PCB assemblies, expected to be operational in FY25.

- Expanding offerings to include medical electronics and railway obstacle detection systems.

- This aligns with the Indian government’s initiative to promote self-reliance in defense manufacturing.

- Major revenue from high-margin, high-complexity defense contracts, including partnerships with Lockheed Martin and L&T.

- Backward integration into PCB assembly manufacturing via acquisitions like Raneal Advanced Systems.

- Key contracts with L&T India (₹1,250 Cr) and Lockheed Martin (₹460.3 Cr) contribute to revenue visibility.

- Vertical integration, end-to-end solutions, and a robust order book of ₹1,937 Cr as of Q2 FY25.

Valuation

- Order Book: Robust order book with significant contracts secured for FY25, ensuring revenue visibility.

- Debt Position: Improved financial health through disciplined debt reduction and increased equity base.

- Growth Potential: Positioned in high-growth sectors like defense, aerospace, and medical electronics.

PG Electroplast (PGEL) Best EMS Company Insights

Among the top EMS companies in India, PG Electroplast is a well-positioned EMS player with significant growth potential in consumer durables and consumer electronics. Its strong revenue growth, robust expansion plans, and focus on cost efficiency make it an attractive investment. Let us analyze PGEL company insights in detail.

Key Trends in Revenue, Profit, and Cash Flow

- Revenue Growth: PGEL’s revenue grew at a CAGR of 34% over the last eight years, crossing ₹2,760 crores in FY24.

- Profitability: EBITDA increased at a CAGR of 38%, reaching ₹275 crores in FY24. PAT grew by 77.2% YoY to ₹137.3 crores in FY24.

- Cash Flow: The company reduced net debt significantly, improving financial stability. It raised ₹500 crores through QIP and allocated ₹277 crores for CAPEX in FY24.

Segment Revenue of the Company

- Key Segments:

- Room Air Conditioners: Revenue grew 25.7% YoY to ₹1,317 crores in FY24.

- Washing Machines: Revenue grew 20% YoY, supported by new product launches.

- Air Coolers: Managed steady revenue despite challenges in average selling prices (ASPs).

Strategic Priorities

- Expansion Plans: Invested ₹380 crores for FY25 to build nearly 1 million sq. ft. of new manufacturing space.

- ODM Focus: Aggressively expanding the ODM business in air coolers, washing machines, and room air conditioners.

- Consumer Durables Focus: Key revenue drivers include room air conditioners (RACs), washing machines, and air coolers.

- Backward Integration: Strengthening cost competitiveness by investing in in-house component manufacturing.

- Established as a leading EMS provider in consumer durables, with robust relationships with over 70 domestic and global brands.

- Strategically located 11 manufacturing units enhance market coverage and logistical efficiency.

Valuation

- Order Book: Strong demand from key sectors, supporting sustained growth.

- Financial Stability: Improved RoCE to 21.6% in FY24, backed by consistent cash flow and debt reduction.

- Market Trends: Benefiting from the “China+1” strategy, increasing opportunities in Indian EMS and contract manufacturing.

Cyient DLM Best Company Insights

Among the top EMS companies in India, is Cyient DLM. The company demonstrates strong revenue growth and diversification across sectors, supported by strategic acquisitions and sustainability initiatives. While margin pressures and integration costs present challenges, the company’s robust order book and expanding footprint in high-growth sectors make it an attractive candidate for investment. Let us analyze Cyient DLM company insights in detail.

Key Trends in Revenue, Profit, and Cash Flow

- Revenue Growth: Cyient DLM recorded a 38.4% YoY revenue growth in Q3 FY25, reaching ₹4,442 Mn. Full-year FY24 revenue was ₹21,429 Mn, supported by strong growth in aerospace and defense segments.

- Profitability: Adjusted EBITDA grew 21.9% YoY in Q3 FY25, but margins declined due to one-off M&A expenses. Adjusted PAT saw a 9.8% YoY decline due to higher costs from recent acquisitions.

- Cash Flow: Positive free cash flow supported by a high order backlog and efficient working capital management.

Segment Revenue of the Company

- Key Segments:

- PCB Assemblies (PCBA): Largest contributor with 46% YoY growth.

- Box Build: Delivered a 16% YoY growth.

- Cables, Mechanical, and Others: Combined growth of 49% YoY.

- Geographical Revenue: 61% of revenue is from international markets (ROW), while India contributes 39%, primarily driven by defense.

Strategic Priorities

- Plans to enhance market share in the US and Europe.

- Strong performance in aerospace (14% YoY growth) and defense (31% YoY growth). Entry into the industrial and med-tech sectors also showed substantial growth at 47% and 156% YoY, respectively.

- Integration of Altek Electronics boosted capabilities in PCB assemblies, box builds, and cable harnesses, particularly for ITAR-certified projects.

- Commitment to renewable energy, including a partnership to establish a 500 kWp rooftop solar plant at the Mysore facility.

Valuation

- Order Book: Strong order backlog of ₹4,442 Mn as of Q3 FY25, providing revenue visibility for upcoming quarters.

- Financial Strength: Continued investment in high-margin, high-growth segments like med-tech and industrial electronics supports a strong valuation case.

Best EMS Companies in India

As per the analysis above, Avalon Technologies seems as a top EMS company for investment among the top EMS companies in India due to its strong vertical integration, diversified revenue streams, and strategic focus on high-growth sectors such as clean energy and mobility. With robust customer relationships and a clear target of doubling revenue in the next three years, Avalon stands out as a leader in the EMS sector.

Following Avalon, Centum Electronics ranks second EMS company to keep an eye on for its leadership in high-barrier markets like defense, space, and healthcare, coupled with its strong presence in Europe and ongoing investments in advanced manufacturing technologies.

In third place, PG Electroplast (PGEL) emerges as a strong EMS company to invest in, driven by its leadership in consumer durables, aggressive ODM growth, and substantial capacity expansion plans, all supported by alignment with the PLI scheme. I put this in third place due to its higher PE ratio. These three companies represent the best investment opportunities in the EMS sector, each leveraging unique strengths to capture market growth.