Let us analyse Greenpanel Share Price Target 2023 2030. I am choosing these three years’ share price targets considering short-term, medium-term, and long-term investments. In this article, we will discuss on company’s fundamentals, business strategy, previous financial performance, and how Greenpanel shares will perform in the stock market in the future.

We will also do an in-depth analysis of the company’s plan and if the Greenpanel stock is worth investing or not. Let us find out.

Greenpanel share price target 2023 to 2030

Green panel share is at a sweet spot to invest in today. The company is fundamentally strong with a Rs 4380 crore market cap. The stock is trading at a 17.07 PE ratio while the sector PE ratio is 21. In the short term, greenpanel share forecast to reach its previous high of Rs 438. The stock can reach this level within a quarter of the time.

Greenpanel Industries has reported strong revenue growth over the years with increasing net profit and lowering the debt-equity ratio. Net debt stood at negative ₹ 165 crores as of 30th June 2023.

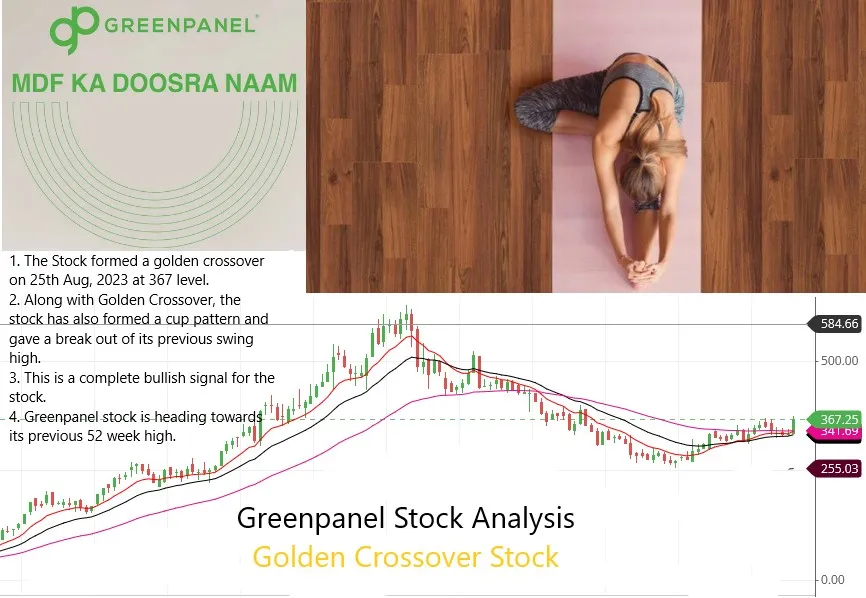

Greenpanel shares golden crossover stock today

Greenpanel Share is one of the golden crossover stocks today. The stock has formed a double golden crossover recently. The greenpanel share has formed a golden crossover at around the Rs358 level when the 50-day Simple Moving Average crossed above the 200-day Simple Moving Average. This is typically the golden crossover as per the technical analysis.

However, the greenpanel share price once again formed the golden crossover with the exponential moving average (EMA). At the closing level of Rs 356, the stock has formed the golden crossover while the 50-day EMA crossed above the 200-day EMA. So, the stock has given double golden crossover within a week. That is a bullish signal for the stock.

Greenpanel share price analysis: Technical

Greenpanel stock looks strong in its technical chart with strong trading volume over the last few trading sessions. The trading volume of the script is above 100 DMA during this period. It seems the counter is ready to move up sharply. Greenpanel share price has crossed above its previous swing high at 367 level while forming a cup pattern.

Greenpanel share price target 2023

Greenpanel is a fundamentally strong company. Once the stock price crosses the previous swing high at the 367 level with strong volume, it will reach the level of 438 before the end of 2023. Again, the greenpanel share price is trading above all its short and long-term moving averages on the daily chart. Buy at this level or on Dip for long-term gain.

For the short term, Prabhudas Lilladher brokerage has given a target of 459 while HDFC Securities has given a target of 430 and Yes Securities has given a target of 449 over a short period.

Greenpanel share price target 2025

Invest in the greenpanel share price now for a target of above 600 by 2025. The share price of NSE is showing bullish chart patterns and is one of the best companies to invest in right now. Technical analysis of the stock reflects bullish price momentum with strong volume.

Greenpanel share price target 2027

The company also has a subsidiary company named Greenply Singapore Pte Ltd. This company works to sell the products of Greenpanel Industries abroad as an agent, due to which the company is getting good recognition globally as well.

If we talk about Greenpanel share price target in 2027, then considering the increasing share of the company in the MDF board segment and the ever-increasing sales growth of the company, experts believe that Greenpanel share price target in 2027 will be seen from Rs 900 to Rs 980.

Greenpanel stock analysis: Fundamentals

Greenpanel Industries is a multibagger stock and the company’s stock has given tremendous returns of up to 10 times to its investors in the last 3 years. The stock was trading at around 50 levels by the end of the year 2019. Looking at the all-time high of the stock at the 600 level, it is already a multi-bagger with over 10 times returns.

With market correction, the stock has corrected to the level of 280 forming a strong base at that level. After months of consolidation, greenpanel stock has formed bullish momentum to reach 350 where it formed another bullish signal of golden crossover. That gives further momentum to the stock to move toward a higher level.

Greenpanel Industries Business Model

Greenpanel Industries Ltd Company is engaged in the manufacture of Medium Density Fiberboard (MDF), wood flooring, plywood, veneer, and doors. The company is India’s largest manufacturer of Medium Density Fiberboard (MDF) and has a 30% market share in India in this segment. Along with this, the company is the third-largest company in Asia and the fifth-largest company in the world in this segment.

Greenpanel MDF is crafted exclusively from 100% renewable agro-forestry wood with an annual production capacity exceeding 6,66,000 cubic meters. The company has a good distribution network to sell its products. The company has a network of 3000+ outlets.

The company has manufacturing facilities for an extensive range of products including exterior-grade and interior-grade Medium Density Fibreboard (MDF), Prelaminated MDF, Club HDWR, Plywood, Blockboard, and Wooden Flooring, among others.

Greenpanel is present in over 300 cities with 10000+ retailers across the country to supply its products. The company management is constantly emphasizing increasing its distribution network so that more customers can be associated with the company in the future and the company’s sales can continue to grow well.

Greenpanel share price forecast with Financial Analysis

If we take a look at the financial condition of the company, then the company has seen a Compounded Revenue Growth of 20.4% in the last three years and during this time the revenue of the company has increased from Rs.1020 crores to Rs.1782 crores. If we talk about the net profit of the company, then the net profit of the company has increased from Rs 68 crore to Rs 256 crore in the last three years from 2021 to 2023.

Greenpanal Industries Limited Company is almost a debt-free company and the company management is seen trying to clear its outstanding debt soon. The debt-equity ratio of the company is 0.16 in 2023, which is quite low.

Greenpanel share price target 2030

Talking about Greenpanel share price target 2030 for the long-term, the company is fundamentally and financially good. The financial condition of the company is also sound with a strong promoter holding of 53.1% in the company. FII has reduced their stake in the company from 6.27% in Jun-2022 to 4.3% in Jun-2023 while DII has increased their stake from 21.45% to 21.6% during the same period.

Indian economy is at the sweet spot that is going to be the third largest economy by 2030. According to a report by Standard Chartered Bank Research published in July 2023, India’s GDP will nearly double from $3.5 trillion during CY 2022 to $6 trillion by CY 2030. The per capita income will also increase from $2,450 to $4,000 during this period.

After the Greenpanel share price analysis along with the above factors, Greenpanel industries ltd. is expected to increase its top and bottom lines. The company has strong and experienced management to leverage the Indian growth story. This makes the Greenpanel share an attractive bet for long-term. Greenpanel share price target can be seen from Rs 1300 to Rs 1500 in 2030.

FAQs:

1. What is the market cap of the company in 2023?

The market cap of the company is currently running around Rs 4,380 crore.

2. What is the ROE and ROCE of the company?

The ROE of the company is 23.6% and ROCE is 27.2%.

3. What is the face value and book value price of the stock of the company?

The stock of the company has a face value of Re 1 and a book value price of Rs 97.

4. What is the dividend yield of the company?

The dividend yield of the company is 0.55%.

5. How much debt does the company currently have?

The company currently has a negative debt of ₹ 165 crores as of 30th June 2023.

6. Greenpanel shareholding pattern?

If we talk about the Greenpanel shareholding pattern, then promoter holding in the company is 53.1% and public holding is 21%. FIIS holding in the company is 4.3% and DIIS holding is 21.6%.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend paying stocks, 5 best upcoming IPOs in India, Tata Technologies IPO Review.