Is Kaynes Technologies a Good Buy Now?

Kaynes Technology India Limited is a prominent player in the Electronic System Design and Manufacturing (ESDM) industry (ESDM Sector). The company has been a strong performer in the Indian stock market due to its impressive financial performance, innovative technology, and strategic expansion plans. As an investor, understanding “is Kaynes Technologies a good buy now”, requires a close look at its recent growth trajectory, financial health, market positioning, and future growth potential in the context of the expanding electronics and Indian IoT market. Let us discuss the details of “Is Kaynes Technologies a Good Buy Now?”.

Table of Contents

The ESDM Sector in India: A Promising Landscape

The Electronic System Design and Manufacturing (ESDM) sector in India has emerged as a major component of the nation’s industrial growth. Driven by increasing demand for electronic products, government support, and robust industry investments, the sector is positioned to grow strongly in the coming years.

According to a Frost & Sullivan report on the ESDM industry in India, the sector is expected to achieve a compound annual growth rate (CAGR) of 32.5% from 2022 to 2027, projecting a market size of ₹3,372 billion by the end of the period. This rapid expansion is propelled by India’s ambition to become a global electronics manufacturing hub and the growing trend of import substitution.

Growth Drivers in The ESDM Sector in India

Increased local demand for electronic goods, especially in consumer electronics, automotive, healthcare, and telecom, has boosted domestic production requirements. As India’s middle class expands and the country advances toward digital transformation, demand for smartphones, IoT devices, medical electronics, etc is expected to drive the ESDM sector in India.

Supportive government policies like the Production Linked Incentive (PLI) scheme, introduced by the Government of India, incentivize local manufacturing and aim to reduce dependency on imports further boosting this industry. The PLI scheme, along with other support programs, not only stimulates investments but also encourages companies to set up and expand operations within India.

Additionally, the government’s “Make in India” and “Digital India” initiatives align with the strategic goals of the ESDM sector, supporting infrastructure development and fostering an ecosystem for domestic and international players.

Is Kaynes Technologies a Good Buy Now?

Let us analyse if the Kaynes technologies a good buy now for investors those who are looking to invest in a growing ESDM sector and IOT market player.

Kaynes Technology exemplifies the potential of the ESDM sector in India. As a leading design-led electronics manufacturer with expertise across diverse industry applications—ranging from automotive to aerospace and medical devices—Kaynes is well-positioned to leverage the industry’s growth.

The company’s commitment to R&D, focus on IoT and embedded design capabilities, and strategic investments in manufacturing facilities highlight its pivotal role in advancing the ESDM sector in India.

Kaynes Technology revenue growth projections

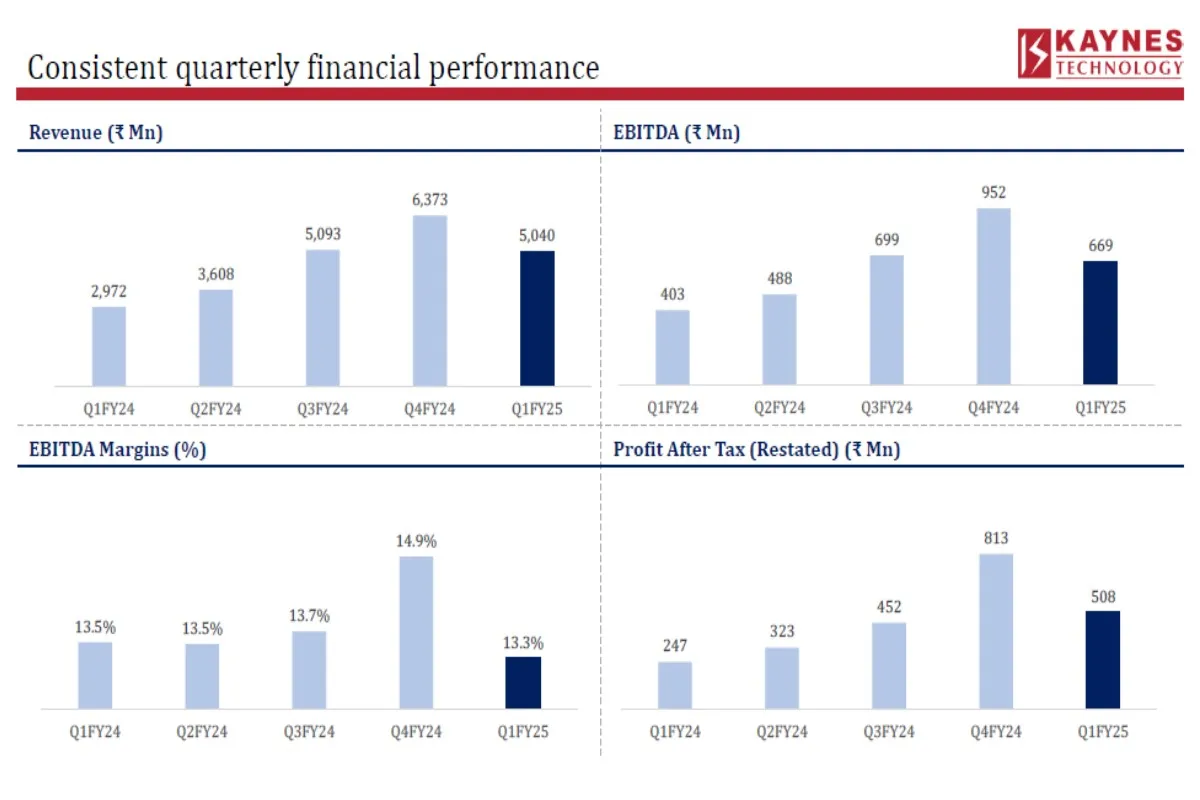

Kaynes has shown consistent and robust financial growth in recent years, underscoring its stability and operational efficiency. For the fiscal year ending 2023, the company posted a 59% revenue growth, reaching ₹11,261 million, with Profit After Tax (PAT) surging by 128% year-over-year to ₹952 million.

Its performance continued in Q1 FY25, where revenue grew 70% year-over-year, alongside an increase in PAT margin to 10.1%, driven by a strong order book worth ₹50,386 million—a rise from ₹41,152 million in FY24. This impressive growth in revenue and profitability signals a well-managed operational strategy, enhancing the company’s attractiveness from an investment perspective.

Moreover, Kaynes’ EBITDA margin is stable at approximately 14.9%, reflecting efficiency in managing operational costs amid revenue growth. The company’s near-zero debt-to-equity ratio further showcases financial prudence, which supports long-term resilience and positions it well for sustainable growth.

Kaynes Technology future growth potential analysis

While discussing about “is Kaynes Technologies a good buy now” we need to understand the market position of the company. Kaynes Technology has strategically positioned itself in the burgeoning ESDM sector.

Kaynes has established a multi-industry presence, serving high-demand sectors like automotive, industrial, aerospace, and medical, which not only broadens its revenue base but also mitigates the risk of sector-specific downturns.

The company has been expanding its manufacturing capacity, with major plans underway to enhance facilities in Mysuru and Manesar and establish a new site in Chamarajanagar, Karnataka. These expansions, backed by strategic capital allocations, are likely to enable Kaynes to meet the rising demand from India’s ESDM sector.

Competitive Advantage in the ESDM Sector and IoT Market in India

As a design-led ESDM manufacturer, Kaynes stands out with its focus on advanced IoT-enabled solutions, embedded design capabilities, and Gallium Nitride technology. These capabilities are highly sought after in a market leaning heavily towards automation, connectivity, and smart technologies. The company’s intellectual property in Industrial IoT (IIoT) solutions provides an edge, especially as industries increasingly demand connected systems and smart capabilities in their products.

Additionally, Kaynes’ ability to design, manufacture, and support Original Design Manufacturing (ODM) solutions tailored for complex industrial and consumer applications gives it a competitive advantage in the ESDM landscape. This capability is particularly relevant in the context of India’s growing focus on local manufacturing and import substitution, which further positions Kaynes as a preferred partner for domestic and global OEMs.

Kaynes Technology Stock Forecast 2025

Kaynes Technology has demonstrated strong financial fundamentals, with a favorable debt-to-equity ratio of nearly zero, reflecting low financial leverage and a healthy balance sheet. Post-IPO proceeds have further bolstered its financial standing, reducing the need for external financing as the company pursues expansion and growth projects.

This fiscal prudence not only enhances Kaynes’ credibility in the market but also shields it from interest rate fluctuations—a critical factor in volatile economic conditions. This answers your question on “is Kaynes Technologies a good buy now?”

Additionally, Kaynes’ return on equity (ROE) and return on capital employed (ROCE) remain competitive, with ROE at 17.4% in Q1 FY25 and ROCE at 18.8%, indicating effective use of shareholder capital and efficient management practices. For investors, such metrics suggest Kaynes’ capacity to generate solid returns on investments, making it a worthwhile consideration for value-focused portfolios.

I believe Kaynes Technology stock forecast 2025 can be like Dixon Technology share price in 2024. This stock has the potential to reach the fate of Dixon Technologies by 2025.

Investing in Indian ESDM companies for growth

However, the ESDM sector is highly competitive, with several players already in the market, and new players are also entering into the ESDM sector in India. Fluctuations in demand from critical sectors, such as automotive and industrial, could impact revenues, particularly if supply chain disruptions persist globally.

Kaynes Technology operates within a highly competitive Electronic System Design and Manufacturing (ESDM) Sector in India, with several prominent players across various business models and services trying to capture the market share.

Dixon Technologies

Known for its substantial footprint in the EMS and consumer electronics sectors, Dixon Technologies focuses on a range of electronic products, from mobile phones to home appliances, making it a major player in India’s ESDM market. This is one of the best Stocks to buy today in the ESDM sector in India.

Bharat FIH

Formerly known as Rising Star Mobile India, Bharat FIH provides end-to-end design and manufacturing solutions with a strong presence in mobile phone manufacturing and is one of the larger players in India.

Amber Enterprises

Primarily engaged in HVAC systems, Amber also competes in the ESDM sector by offering electronics manufacturing for various applications, particularly in the consumer electronics segment.

SFO Technologies

Operating in diverse fields including aerospace, industrial, and medical electronics, SFO is a significant ESDM provider with comprehensive design and manufacturing services across multiple industries.

Syrma SGS Technology

Syrma offers product development and manufacturing services, particularly in high-tech electronics for the automotive, healthcare, and industrial sectors, aligning closely with Kaynes in high-value ESDM offerings. This is one of the best Stocks to buy in the ESDM sector in India.

Elin Electronics

Focused on motor and lighting products, Elin Electronics serves both the consumer and industrial electronics markets and provides a range of manufacturing solutions across these segments.

Avalon Technologies

Known for its EMS and ODM capabilities, Avalon competes closely with Kaynes by providing end-to-end solutions in electronics design, manufacturing, and testing across sectors. This is one of the best Stocks to buy in the ESDM sector in India.

Finally, Is Kaynes Technologies a Good Buy Now?

Considering its strong financial performance, well-rounded growth strategy, and positioning within a high-growth sector, Kaynes Technology presents a compelling investment opportunity. The company’s multi-pronged approach, spanning capacity expansion, IoT-focused innovation, and financial resilience, underscores its potential for delivering value to shareholders over the long term.

Kaynes’ commitment to sustainability, coupled with its advanced capabilities in ESDM, offers investors a unique opportunity to participate in a market poised for significant growth. I hope you got your answer on “is Kaynes Technologies a good buy now?”. Definitely it is a good buy now with correction.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market in 2023. To know more information about company insights for investment, and business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, 10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, AI Stocks in India.