Nifty 50 stocks weightage has been changing over time. NSE (National Stock Exchange) is one of the major exchanges where equities are traded. The Indian equity market has many indices. Nifty 50 is one of the major indices in the Indian stock market. The nifty 50 index consists of 50 companies from across the industries in India.

Indian economy consists of 14 major sectors such as finance, Information technology, Oil and gas, etc. This index has taken 50 companies out of over 1600 companies on NSE. The companies or stocks within the Nifty 50 index represents their respective sector in the Indian economy.

The NIFTY 50 is the flagship index on the National Stock Exchange of India Ltd. that reflects the overall movement of the market. It is important to understand the nifty 50 companies’ stock weightage constituents to learn about the companies that are behind the movement of this index. If any of the major stocks in the index moves, either way, it has an impact on the index. Let us discuss what are these sectors and stocks in detail.

Nifty 50 stocks weightage by Sector

The nifty 50 index consists of 16 sectors. The financial sector is the major constituent in the index. This sector represents 37.16% weight in the index followed by Information technology with 14.38% weight. The sectors like Oil Gas & Consumable Fuels represent 12.99% weight while FMCG companies represent 8.58% weight in the index. The automobile and auto components sector represent 5.51% of weight in the index and the rest of the sectors represent below 4% weight as below.

Since the finance sector is the major constituent in the index, any movement in the Bank Nifty Index has a similar movement in the Nifty 50 index. These companies are fundamentally strong companies to represent their sector. NSE chooses these companies based on certain criteria. Hence, it is easy for a beginner to invest in these stocks for the long term. Indian stock market moves in a cycle. As a beginner, it is important to wait for the downward cycle of the equity market to invest in these Nifty 50 stocks.

Top Ten Nifty 50 Constituents by Weightage

| Company’s Name | Weight (%) |

| Reliance Industries Ltd. | 11.36 |

| HDFC Bank Ltd. | 8.53 |

| ICICI Bank Ltd. | 8.00 |

| Infosys Ltd. | 7.21 |

| Housing Development Finance Corporation | 5.89 |

| Tata Consultancy Services Ltd. | 4.19 |

| ITC Ltd. | 3.61 |

| Kotak Mahindra Bank Ltd. | 3.45 |

| Larsen & Toubro Ltd. | 3.02 |

| Hindustan Unilever Ltd. | 2.89 |

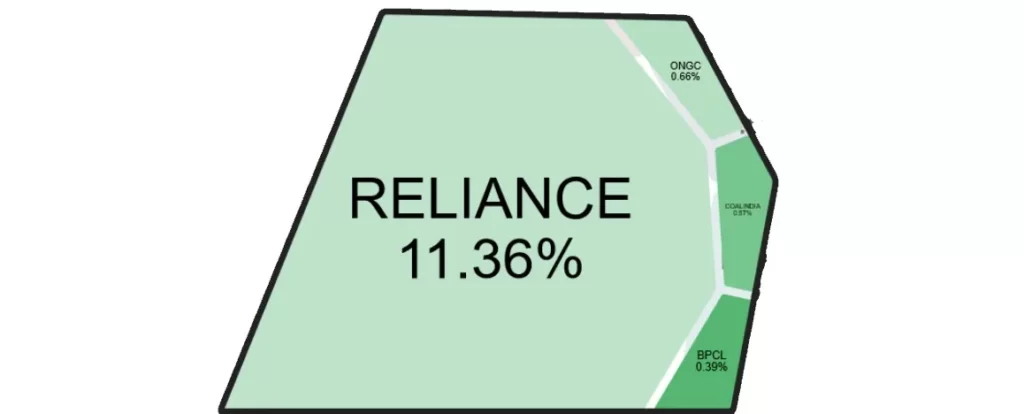

Reliance Industries Ltd has the highest weightage in the Index, having 11.36%, followed by HDFC bank Ltd. having 8.53 and ICICI bank having 8% weightage in the Index. Any strong movement of these companies has a significant impact on the index. Traders have to consider these factors before trading in the Nifty index.

With Financial services representing 37.16% weightage in Nifty Index, banks and financial institutions have an important role in the movement of the index.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. To get more information about the business overview of each company, here are some suggested readings on company insights. 10 Best IPOs in 2022, Tata Play IPO, Upcoming IPOs, Is it good to invest in SME IPOs, find good companies to invest in, DRHP in IPO filing.

Bank Nifty Stock Weightage

HDCF bank ltd is the major contributor in the bank nifty stock weightage having 26.3% followed by ICICI bank having 24.67%. Both these banks are in the top ten list of the nifty 50 stock list 2023.

Nifty Stocks Weightage in specific sector

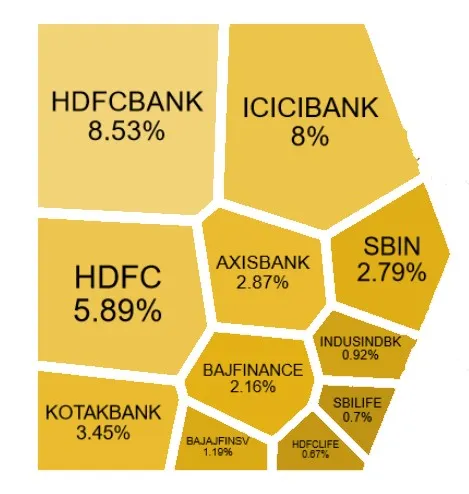

Among the Nifty 50 companies stock weightage constituents, Finance sector is the major contributor with 37.16%. Within the financial sector, major companies that contribute the nifty stocks weightage are below.

Again, in Nifty 50 companies stock weightage constituents, HDFC bank, ICICI bank, and HDFC Ltd are the major contributor to the financial sector of the Nifty 50 Index.

Nifty 50 stock List 2023 and Their Weightage (Updated Nov-2022)

| Company Name | Industry | Symbol | Weightage in Nifty 50 Index | ISIN Code |

|---|---|---|---|---|

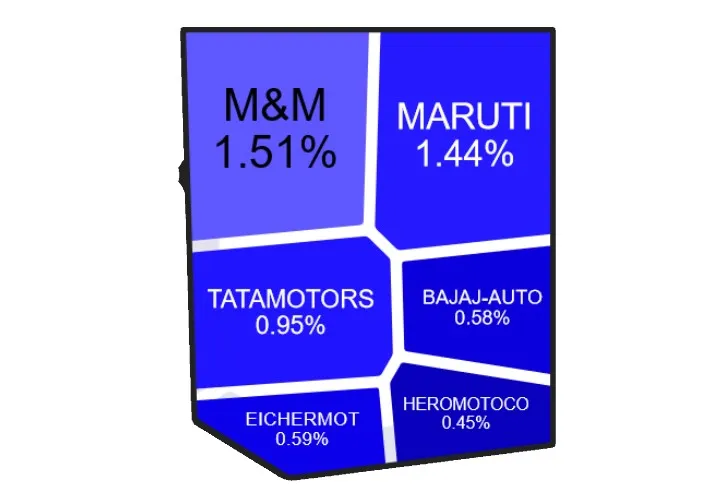

| Bajaj Auto Ltd. | Automobile and Auto Components | BAJAJ-AUTO | 0.58 | INE917I01010 |

| Eicher Motors Ltd. | Automobile and Auto Components | EICHERMOT | 0.59 | INE066A01021 |

| Hero MotoCorp Ltd. | Automobile and Auto Components | HEROMOTOCO | 0.45 | INE158A01026 |

| Mahindra & Mahindra Ltd. | Automobile and Auto Components | M&M | 1.51 | INE101A01026 |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | MARUTI | 1.44 | INE585B01010 |

| Tata Motors Ltd. | Automobile and Auto Components | TATAMOTORS | 0.95 | INE155A01022 |

| UPL Ltd. | Chemicals | UPL | 0.51 | INE628A01036 |

| Larsen & Toubro Ltd. | Construction | LT | 3.02 | INE018A01030 |

| Grasim Industries Ltd. | Construction Materials | GRASIM | 0.8 | INE047A01021 |

| UltraTech Cement Ltd. | Construction Materials | ULTRACEMCO | 0.99 | INE481G01011 |

| Asian Paints Ltd. | Consumer Durables | ASIANPAINT | 1.73 | INE021A01026 |

| Titan Company Ltd. | Consumer Durables | TITAN | 1.33 | INE280A01028 |

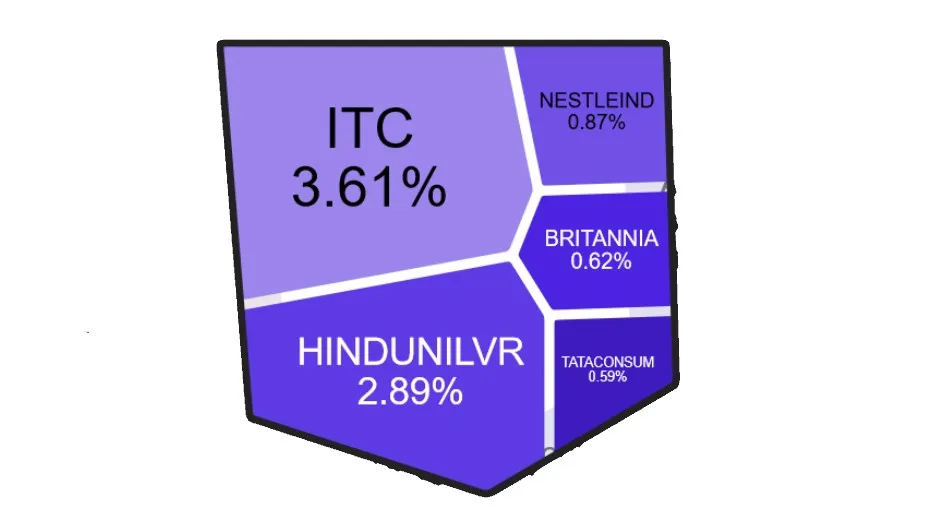

| Britannia Industries Ltd. | Fast Moving Consumer Goods | BRITANNIA | 0.62 | INE216A01030 |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | HINDUNILVR | 2.89 | INE030A01027 |

| ITC Ltd. | Fast Moving Consumer Goods | ITC | 3.61 | INE154A01025 |

| Nestle India Ltd. | Fast Moving Consumer Goods | NESTLEIND | 0.87 | INE239A01016 |

| Tata Consumer Products Ltd. | Fast Moving Consumer Goods | TATACONSUM | 0.59 | INE192A01025 |

| Axis Bank Ltd. | Financial Services | AXISBANK | 2.87 | INE238A01034 |

| Bajaj Finance Ltd. | Financial Services | BAJFINANCE | 2.16 | INE296A01024 |

| Bajaj Finserv Ltd. | Financial Services | BAJAJFINSV | 1.19 | INE918I01026 |

| HDFC Bank Ltd. | Financial Services | HDFCBANK | 8.53 | INE040A01034 |

| HDFC Life Insurance Company Ltd. | Financial Services | HDFCLIFE | 0.67 | INE795G01014 |

| Housing Development Finance Corporation Ltd. | Financial Services | HDFC | 5.89 | INE001A01036 |

| ICICI Bank Ltd. | Financial Services | ICICIBANK | 8 | INE090A01021 |

| IndusInd Bank Ltd. | Financial Services | INDUSINDBK | 0.92 | INE095A01012 |

| Kotak Mahindra Bank Ltd. | Financial Services | KOTAKBANK | 3.45 | INE237A01028 |

| SBI Life Insurance Company Ltd. | Financial Services | SBILIFE | 0.7 | INE123W01016 |

| State Bank of India | Financial Services | SBIN | 2.79 | INE062A01020 |

| Apollo Hospitals Enterprise Ltd. | Healthcare | APOLLOHOSP | 0.58 | INE437A01024 |

| Cipla Ltd. | Healthcare | CIPLA | 0.74 | INE059A01026 |

| Divi’s Laboratories Ltd. | Healthcare | DIVISLAB | 0.52 | INE361B01024 |

| Dr. Reddy’s Laboratories Ltd. | Healthcare | DRREDDY | 0.66 | INE089A01023 |

| Sun Pharmaceutical Industries Ltd. | Healthcare | SUNPHARMA | 1.36 | INE044A01036 |

| HCL Technologies Ltd. | Information Technology | HCLTECH | 1.43 | INE860A01027 |

| Infosys Ltd. | Information Technology | INFY | 7.21 | INE009A01021 |

| Tata Consultancy Services Ltd. | Information Technology | TCS | 4.2 | INE467B01029 |

| Tech Mahindra Ltd. | Information Technology | TECHM | 0.82 | INE669C01036 |

| Wipro Ltd. | Information Technology | WIPRO | 0.73 | INE075A01022 |

| Adani Enterprises Ltd. | Metals & Mining | ADANIENT | 1.29 | INE423A01024 |

| Hindalco Industries Ltd. | Metals & Mining | HINDALCO | 0.79 | INE038A01020 |

| JSW Steel Ltd. | Metals & Mining | JSWSTEEL | 0.84 | INE019A01038 |

| Tata Steel Ltd. | Metals & Mining | TATASTEEL | 1.05 | INE081A01020 |

| Bharat Petroleum Corporation Ltd. | Oil Gas & Consumable Fuels | BPCL | 0.39 | INE029A01011 |

| Coal India Ltd. | Oil Gas & Consumable Fuels | COALINDIA | 0.57 | INE522F01014 |

| Oil & Natural Gas Corporation Ltd. | Oil Gas & Consumable Fuels | ONGC | 0.66 | INE213A01029 |

| Reliance Industries Ltd. | Oil Gas & Consumable Fuels | RELIANCE | 11.36 | INE002A01018 |

| NTPC Ltd. | Power | NTPC | 0.99 | INE733E01010 |

| Power Grid Corporation of India Ltd. | Power | POWERGRID | 0.92 | INE752E01010 |

| Adani Ports and Special Economic Zone Ltd. | Services | ADANIPORTS | 0.76 | INE742F01042 |

| Bharti Airtel Ltd. | Telecommunication | BHARTIARTL | 2.5 | INE397D01024 |

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. To get more information about the business overview of each company, here are some suggested readings on company insights. 10 Best IPOs in 2022, Tata Play IPO, Upcoming IPOs, Is it good to invest in SME IPOs, find good companies to invest in, DRHP in IPO filing.