Share With Friends

Aries Agro Share is in a bullish trend. The company is an India-based multinational company. The Company’s gross revenue increased by 11.40% from Rs. 547.52 Crores to Rs.609.96 Crores in FY22-23. International sales began towards the end of the Financial Year with the restart of manufacturing in the UAE facility. This facility will add up revenue in FY23-24.

Aries Agro Limited (AAL) is a leading player in the organized micronutrient market, with a strong presence in the agricultural sector. The Company is one of the major companies in the Specialty Plant Nutrition industry in India, which includes Micronutrients, Water Soluble Fertilizers, Secondary Nutrients, and Bio-stimulants.

Table of Contents

Aries Agro Share Price Analysis

Aries Agro share is trading near its all-time high price. Aries Agro Share has given a long-term breakout at 284 level which is the price level of October 2017. Currently, Aries Agro’s share price is consolidating at the 284 level and is ready to move up.

Technically, Aries Agro share price has formed a cup-and-handle pattern on the weekly chart and crossed the 2017 price level at Rs.284. The stock is trading above all major moving averages with strong relative strength.

Let us discuss what is the business model of Aries Agro and how the company earns money.

Aries Agro share price target 2025

Considering the current bull market and strong tailwind to agriculture sector, the Aries Agro share price target 2025 could be above 450 level. Again, looking at the technical structure of the Weekly and monthly chart the Aries Agro share started its upward journey from around 60 level and crossed all time high of 284 level which is more than 200 points from its lower level. Considering that, Aries Agro share price target 2025 can be 200 points above the current level. Hope this analysis helps further for my own future analysis.

Share With Friends

Aries Agro share holding pattern

- Promoters holding remains unchanged at 52.66% in Dec 2023 quarter

- FII/FPI has increased their holding in the company from 2.10% in September 2023 to 2.38% in December 2023 quarter

- Number of Foreign Institutional investors has remained same at 4 in December quarter

ARIES AGRO Share Price Insights

Aries Agro Limited Market Position and Product Portfolio

AAL has established itself as a market leader in the domestic chelated micronutrients market. The company has a wide product basket, offering a range of high-quality micronutrient products that cater to the specific needs of farmers. This product diversity has been a key driver of the company’s success, allowing it to capture a significant market share.

The company’s strong distribution and marketing network has played a crucial role in educating farmers about the benefits of micronutrients and promoting the use of AAL’s products. AAL’s extensive distribution and marketing network have played a pivotal role in its success. The company has over 10000 distributors across the country reaching 9 million farmers.

Moreover, AAL’s extensive experience in the agricultural sector, spanning over 50 years, has given the company a deep understanding of the needs and challenges faced by farmers. This knowledge has helped AAL develop innovative nutrient formulations to meet the changing requirements of different farming regions.

Aries Agro Ltd. Manufacturing Facilities

Currently, the total capacity utilization of the company is 71.43% of the total installed capacity of 95,400 MT p.a. in India. The manufacturing unit at Fujairah, UAE has produced 1888.75 MT of Sulphur Bentonite and other value-added Sulphur products for sale in India and globally.

New factories at Vijayawada and Raipur have also started operation.

Financial Risk Profile

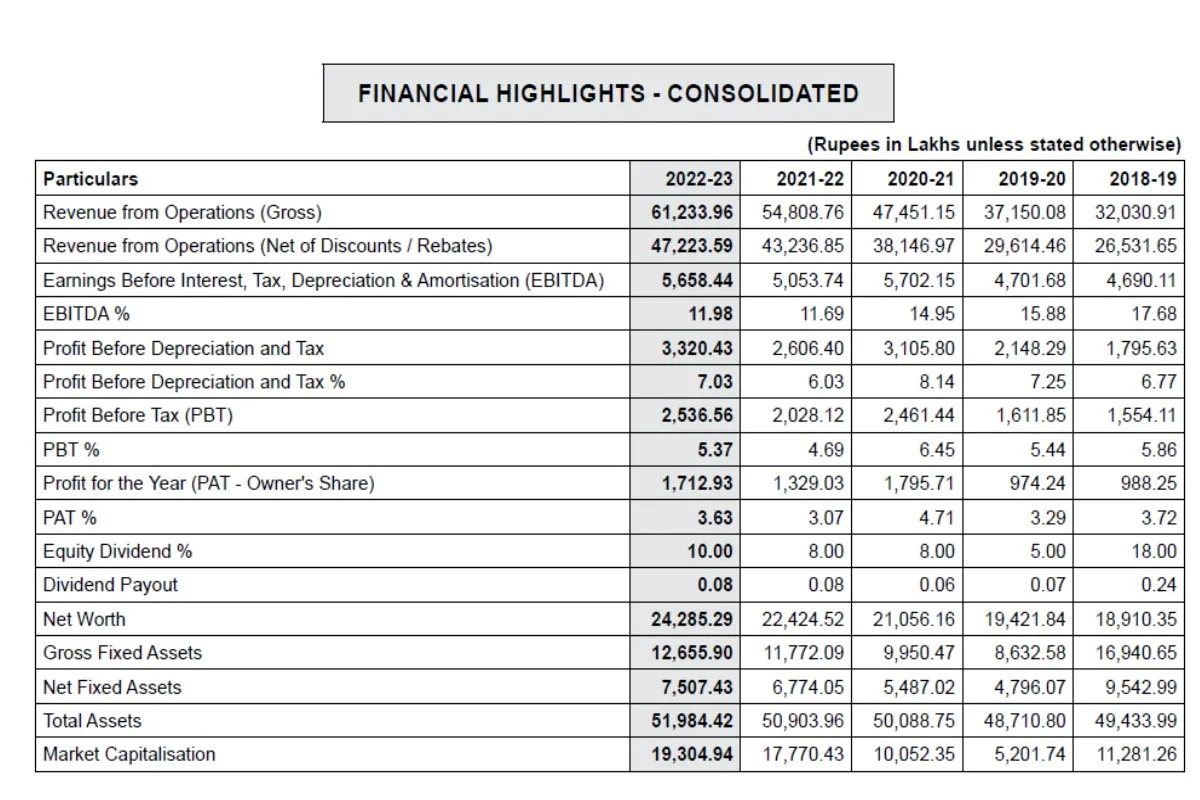

Aries Agro Limited has been reporting strong revenue, supported by its comfortable net worth and moderate leverage. As of March 31, 2023, the company’s net worth stood at Rs. 227 crores, providing a solid foundation for its operations. The company’s debt-to-equity ratio was moderate at 0.43 times in FY2022-23, indicating a manageable level of debt.

The company’s efficient working capital management has played a significant role in reducing its overall borrowing. On a stand-alone basis, the debt-to-equity ratio has reduced from 1.03 in FY2018-19 to 0.43 in FY2022-23. By optimizing its working capital cycle and taking advances from customers, AAL has been able to bring down its debt from Rs. 142.8 crores in fiscal 2021 to Rs. 99 crores in fiscal 2023, despite an increase in the scale of operations.

Furthermore, Aries Agro Limited has been reporting consistent sales growth on a consolidated basis. The company reported sales of Rs 74 Crore in FY2007 to Rs 612 Crore in FY2023 which is a growth of over 9 times during this period.

Share With Friends

KEY INDICATORS – CONSOLIDATED

| Parameters | 2022-23 | 2021-22 | 2020-21 | 2019-20 | 2018-19 |

|---|---|---|---|---|---|

| Earnings Per Share – Rs. (Excluding Exceptional Items) | 13.17 | 10.22 | 13.81 | 7.49 | 7.60 |

| Turnover Per Share – Rs. | 363.14 | 332.48 | 293.34 | 227.73 | 204.02 |

| Book Value Per Share – Rs. | 186.75 | 172.44 | 161.92 | 149.35 | 145.42 |

| Total Debt (Non-Current & Current Borrowings) | 9,970.00 | 11,228.40 | 14,279.71 | 15,802.42 | 17,184.24 |

| Debt : Equity Ratio | 0.41 | 0.50 | 0.68 | 0.81 | 0.91 |

| EBITDA / Gross Turnover % | 9.24 | 9.22 | 12.02 | 12.66 | 14.64 |

| Net Profit Margin % | 3.63 | 3.07 | 4.71 | 3.29 | 3.72 |

| RONW or ROE % | 7.05 | 5.93 | 8.53 | 5.02 | 5.23 |

| ROCE % | 13.86 | 13.07 | 14.10 | 11.68 | 12.19 |

| Inventory Turnover (in days) – on NET Sales | 111 | 124 | 135 | 171 | 179 |

| Current Ratio | 1.61 | 1.53 | 1.45 | 1.42 | 1.47 |

| Price Earning Ratio | 11.27 | 13.37 | 5.60 | 5.34 | 11.42 |

Subsidiaries of Aries Agro Limited

- Aries Agro Limited-Standalone

- Aries Agro Limited- Consolidated

- Golden Harvest Middle East FZC

- Aries Agro Care Private Limited

- Aries Agro Equipments Private Limited

- Mirabelle Agro Manufacturing Private Limited

ARIES AGRO Share price

Strengths

Market Leadership and Product Basket

AAL’s strong market position in the organized micronutrient market is a testament to its expertise and product quality. The company pioneered the concept of chelated micronutrients in India and has steadily established itself as the largest player in the domestic market. Its wide product basket caters to the diverse needs of farmers, ensuring a comprehensive solution for their nutrient requirements.

Extensive Distribution and Marketing Network

AAL’s extensive distribution and marketing network have played a pivotal role in its success. The company has over 10000 distributors across the country reaching 9 million farmers. Aries Agro Limited has 6 manufacturing units with 133 brands in the micronutrient segment. With this AAL has been able to reach a wide customer base and establish long-term relationships.

Experience and Expertise of Promoters

Aries Agro Limited was founded by Dr. T. B. Mirchandani and Mrs. Bala Mirchandani in 1969. The promoters of AAL have been in the agricultural business for more than 55 years, gaining extensive experience and knowledge about the sector. This deep understanding of the industry has allowed the company to navigate challenges and adapt to changing market dynamics.

Weaknesses and Challenges

Intense Competition from the Unorganized Sector

One of the key challenges faced by AAL is the intense competition from unorganized players in the market. The unorganized sector comprises about 60% of the micronutrient market and poses a threat to AAL’s market share. Despite being regulated, the low entry barriers and limited product differentiation in the industry make it challenging to differentiate from competitors. However, AAL aims to overcome this challenge by leveraging its wide product basket and superior quality to capture more market share from the unorganized segment.

Low Awareness Among Farmers

Low awareness among farmers regarding the appropriate dosage and application of micronutrients is one of the major challenges in this segment in India. In India, the usage of micronutrients is significantly lower than international standards, indicating a lack of awareness among farmers. However, with proper training and reach out to farmers, AAL can the benefits of its products and improve awareness. The company’s initiatives to educate farmers are expected to drive increased demand for micronutrients over the medium term.

Vulnerability to Rainfall and Monsoon

The micronutrient sector is vulnerable to the extent of rainfall and monsoon, as rainfall distribution over time and space affects micronutrient consumption. AAL derives a significant portion of its revenue from the domestic market, where a substantial area under cultivation relies on the monsoon for water requirements. Therefore, the company’s revenue and profit margins depend on domestic rainfall patterns.

Credit Rating of Aries Agro Limited

CRISIL Ratings has reaffirmed its ‘CRISIL BBB+/Stable/CRISIL A2’ ratings for AAL’s bank facilities. The stable outlook reflects CRISIL’s belief in AAL’s established market presence, healthy product portfolio, and extensive reach in the farming community. The company’s financial risk profile is expected to remain adequate, supported by improved cash generation, working capital management, and progressive debt repayment.

Share With Friends

Conclusion

Aries Agro Limited has emerged as a market leader in the organized micronutrient market, driven by its strong market position, extensive distribution network, and innovative product portfolio. Argies Agro share price is trading at 284 level and is ready to move up with the strong tailwind from the government push towards the agriculture sector.

Disclaimer: Please note that I am not a SEBI-registered Research analyst. I am analyzing companies for my consumption and not for any advice. The above article is based on information extracted from publicly available sources and should not be considered financial advice. Readers are advised to conduct their research and analysis before making any investment decisions.

Share With Friends

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market in 2023.

To know more information about company insights for investment, and business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, IREDA Share price Target, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price.