Top 5 Best Consumer Durable Stocks In India

Share With Friends

The global consumer durables market has shown robust growth, propelled by technological advancements, rising disposable incomes, and the increasing penetration of smart devices. The market, valued at approximately USD 1.2 trillion in 2023, is expected to grow at a CAGR of 5.6% over the next five years.

India is going to become the fourth largest market for consumer durables by 2030, according to a report from Indbiz. The consumer durables market projected to reach INR 3.15 lakh crores by 2030, growing at a CAGR of over 10% from 2024 driven by government initiatives under “Make in India” and the adoption of energy-efficient appliances contribute to this upward trajectory.

Table of Contents

Best Consumer Durable Stocks In India

India’s consumer durables sector is characterized by diverse categories, including home appliances, air conditioners, LED lighting, and kitchen equipment. Urban demand is fueled by smart homes and IoT-enabled appliances, while rural markets experience growth due to electrification and improved connectivity.

Companies like LG, Voltas, and Havells play a pivotal role, leveraging innovation and expansive distribution networks to address evolving consumer needs. Government policies such as reduced GST rates on certain appliances and production-linked incentives for local manufacturing further enhance the industry’s prospects.

Consumer Durables Stocks

Now let us analyze the 5 Best consumer durables stocks in India to keep an eye on for investment.

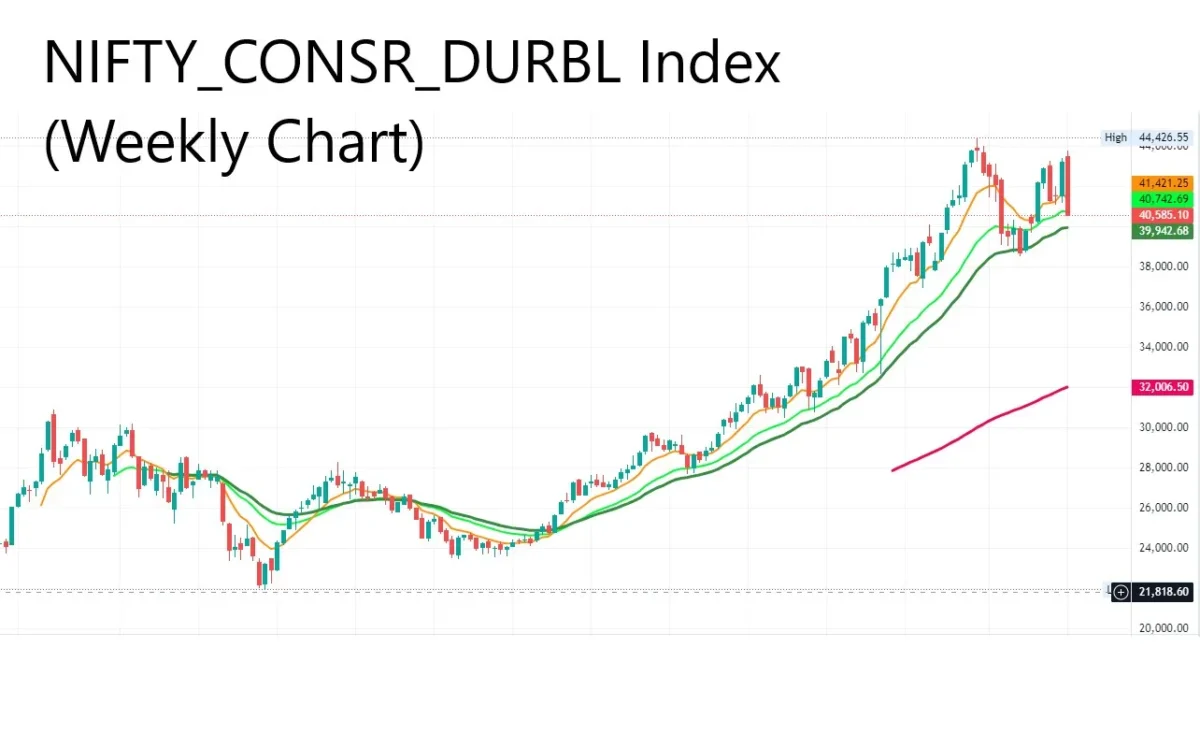

Consumer durables is one sector in the Indian economy that has been performing consistently over the years. If you look at the Nifty Consumer Durable Index, monthly or weekly chart, you will witness the growth over months without any major drawdowns. This reflects the resilience of this sector in the Indian economy.

Crompton Greaves Consumer Electricals Limited (CGCEL)

Crompton Greaves Consumer Electricals Limited (CGCEL) is one of India’s leading consumer electrical companies with a legacy spanning over 85 years. Renowned for its market leadership in fans, residential pumps, and lighting, Crompton has built a robust portfolio of energy-efficient, innovative, and premium products that cater to evolving consumer needs.

The company operates across two primary segments: Electrical Consumer Durables (ECD), which includes fans, water heaters, and kitchen appliances, and Lighting, focusing on LED and energy-efficient solutions. With a strong pan-India distribution network, strategic acquisitions like Butterfly Gandhimathi Appliances, and a commitment to sustainability and consumer-centric innovation, Crompton continues to enhance its market presence and deliver long-term value to stakeholders.

Key trends in revenue, profit, and cash flow

- Revenue Growth: Crompton’s consolidated revenue grew from ₹5,809 crore in FY22 to ₹6,388 crore in FY24, with sustained growth across ECD and Lighting segments.

- Profitability: PAT in FY24 stood at ₹466 crore, improving from ₹476 crore in FY23. EBITDA margins increased from 11.5% in FY23 to 12.4% in FY24.

- Cash Flow: Crompton maintained robust cash flow management through efficiency measures like cost optimization and inventory control

Segment revenue of the company

- ECD Segment: Accounts for ~85% of revenue with a strong presence in fans, pumps, and kitchen appliances.

- Lighting Segment: Contributes ~15% of revenue, driven by premiumization and energy-efficient products.

Primary drivers of revenue growth

- Product: Growth in premium fans, water heaters, and kitchen appliances; increasing contribution from Butterfly Gandhimathi acquisition.

- Geography: Pan-India distribution network with a stronghold in both rural and urban markets.

- Consumer Behavior: Premiumization and demand for energy-efficient products

Market share

- Market Leadership: Crompton is #1 in residential pumps and fans and #3 in lighting. Butterfly’s acquisition strengthened its position in kitchen appliances.

- Competitive Advantage: Strong brand equity, wide distribution network, and focus on consumer-led innovation.

Strategic priorities

- Increase premium product offerings in ECD and lighting.

- Expansion into large kitchen appliances, leveraging the Butterfly brand.

- Accelerate innovation in energy-efficient and IoT-enabled products.

- Drive cost efficiency through supply chain optimization and enhanced manufacturing capabilities.

Valuation analysis

- Crompton’s valuation is supported by consistent revenue growth, strong PAT margins, and leadership in key categories. Its market performance and expansion strategies align well with industry growth trends, making it an attractive investment.

Havells India Limited

Havells India Limited, a leading Fast Moving Electrical Goods (FMEG) company, has evolved into a household name synonymous with innovation, quality, and sustainability. With a diverse portfolio spanning switchgear, cables, lighting, consumer durables, and the Lloyd brand of appliances, Havells serves over 70 countries globally.

Its in-house manufacturing capabilities, robust R&D, and strong distribution network enable the company to cater to varied consumer needs. Havells is strategically focused on premiumization, rural penetration, and smart home solutions, positioning itself as a key player in the global consumer durables market.

Key trends in revenue, profit, and cash flow

- Revenue Growth: Havells reported a CAGR of 15% in revenue over the past decade, with net revenue reaching ₹18,550 crore in FY24 from ₹16,868 crore in FY23.

- Profitability: PAT increased from ₹1,075 crore in FY23 to ₹1,273 crore in FY24. EBITDA improved from ₹1,603 crore in FY23 to ₹1,845 crore in FY24.

- Cash Flow: Strong cash flow generation with significant reinvestment in capacity expansion and innovation.

Segment revenue of the company

- Revenue Mix FY24:

- Cables: 34.1%

- Switchgears: 12.1%

- Lighting & Fixtures: 9.5%

- Electrical Consumer Durables (ECD): 20.4%

- Lloyd Consumer: 18.8%.

Primary drivers of revenue growth

- Product Portfolio: Strong growth in premium and IoT-enabled products across ECD, lighting, and Lloyd categories.

- Geographical Reach: Significant rural penetration under the “Rural Vistaar” initiative, covering 3,000+ towns with 42,000+ retail touchpoints.

- Consumer Demand: Increased adoption of smart, energy-efficient, and branded products.

Market share

- Havells is among the top 3 players in most categories, including residential switchgear, fans, cables, and ACs (through Lloyd).

- Competitive Advantage:

- 90% in-house manufacturing, enabling cost control and quality assurance.

- Wide product portfolio across 20 verticals.

- Strong distribution network with ~18,000 dealers and 220,000 retailers.

Strategic priorities

- Expansion: Continued capacity expansion, including Lloyd AC plants in Ghiloth and South India.

- Product Development: Focus on IoT-enabled smart home solutions and energy-efficient appliances.

- Rural Markets: Strengthening rural presence through exclusive stores and targeted product offerings.

- International Markets: Increasing export contributions and entering developed markets with strategic partnerships.

- Lloyd AC Plant Expansion: New plants in Sri City (South India) to double AC production capacity.

- Global Markets: Initiatives to expand into the Middle East and North America.

Valuation analysis

- Havells’ valuation is supported by robust revenue growth, leadership in FMEG, and a diversified portfolio. Its focus on premiumization, rural penetration, and innovation aligns with long-term growth opportunities.

Polycab India Limited

Polycab India Limited is India’s largest integrated manufacturer of wires and cables and a leading player in the fast-moving electrical goods (FMEG) sector. With a legacy spanning a decade, Polycab dominates the domestic wire and cable (W&C) market with a 25-26% share and has rapidly expanded its FMEG portfolio, achieving a 25% CAGR over eight years.

The company is known for its robust backward integration, advanced R&D capabilities, and commitment to sustainability. Through its Project LEAP initiative, Polycab is poised to achieve ₹200 billion in revenue by FY26, driven by innovation, market diversification, and a strong global footprint.

Key trends in revenue, profit, and cash flow

- Revenue Growth: Polycab’s revenue grew significantly, reaching ₹180,394 million in FY24, representing a 28% YoY growth.

- Profitability: PAT for FY24 was ₹18,029 million, showcasing strong growth with a focus on operational efficiency. EBITDA margin stood at 13.8%, indicating healthy profitability.

- Cash Flow: Polycab reported ₹21,408 million in net cash, demonstrating robust cash generation capabilities.

Segment revenue of the company

- Wires and Cables (W&C): This segment contributed approximately 88% of total revenue in FY24, maintaining Polycab’s position as the market leader with a 25-26% share of the organized W&C market.

- FMEG (Fast-Moving Electrical Goods): FMEG revenue reached ₹12,828 million in FY24, growing at an 8-year CAGR of 25%.

- EPC (Engineering, Procurement, and Construction): EPC revenue was ₹9,642 million in FY24, supported by strong project execution.

Primary drivers of revenue growth

- Product Portfolio: Expansion in premium W&C offerings and rapid growth in FMEG products like fans, switches, and lighting.

- Geographical Reach: A strong Pan-India presence with over 205,000 retail outlets and growing international revenue (13.8% CAGR over five years).

- Demand Drivers: Real estate upcycle, infrastructure development, and the adoption of energy-efficient and smart products.

Market share

- Polycab dominates the Indian W&C market with a 25-26% organized market share, leveraging backward integration, advanced R&D capabilities, and a robust distribution network.

- The competitive advantage arises from its leadership in W&C, growing FMEG segment, and sustainable practices such as renewable energy integration.

Strategic priorities

- Project LEAP: Aim for ₹200 billion in revenue by FY26 through B2B and B2C portfolio optimization.

- Sustainability: Increased focus on renewable energy, water recycling, and inclusive growth.

- Global Expansion: Strengthening international presence in markets like North America, Australia, and Europe.

- Innovation: Focus on eco-friendly and smart products such as BLDC fans and green wires.

Valuation analysis

- Polycab’s valuation is supported by its leadership in W&C, rapid growth in FMEG, strong profitability, and cash generation. Its multi-year growth strategy under Project LEAP enhances its long-term investment potential.

Data Center Related Articles

- Anant Raj Limited: The Best Way to Invest in Data Center Stocks in India

- Data Center in India – Best Data Center Stocks in India to Invest

- NSE listed data center companies in India

- Explore Best Data Center Companies in India

- Opportunities in the Indian Data Center Market

- Fast Growing data center player Nxtra Data Limited Achieved Unicorn status: Learn actionable insights

V-Guard Industries Limited

V-Guard Industries Limited is a leading Indian brand with a diversified portfolio spanning electronics, electrical, and consumer durables. Renowned for its innovative stabilizers, inverters, and water heaters, V-Guard has expanded into kitchen appliances, solar solutions, and modular switches through strategic acquisitions.

With a strong distribution network of 100,000+ partners and manufacturing excellence, V-Guard is focused on premiumization, sustainability, and leveraging IoT-enabled products to cater to evolving consumer aspirations. Its balanced geographic presence and commitment to innovation position it as a strong contender in India’s growing consumer durables market.

Key trends in revenue, profit, and cash flow

- Revenue Growth: V-Guard’s revenue grew significantly, achieving ₹4,857 crore in FY24, a 17.7% increase from FY23. The Consumer Durables and Electronics segments showed strong performance.

- Profitability: PAT increased by 36.2%, reaching ₹257.58 crore in FY24. Gross margins improved by 3.5% year-on-year to 33.6%, driven by cost efficiencies and favorable commodity pricing.

- Cash Flow: V-Guard generated ₹392.74 crore in cash from operations in FY24, indicating robust cash flow management.

Segment revenue of the company

- Segment Contribution (FY24):

- Electronics: 24.0%

- Electricals: 40.6%

- Consumer Durables: 29.7%

- Sunflame: 5.7%

- Growth was led by Consumer Durables (+13.1%) and Electronics (+17.2%).

Primary drivers of revenue growth

- Product Portfolio: Increased demand for premium and IoT-enabled products like kitchen appliances, solar water heaters, and fans.

- Geographic Reach: Expansion in non-South markets, contributing 46% of revenue in FY24, showcasing balanced geographic diversification.

- Consumer Behavior: Rising adoption of smart and connected devices, supported by increasing disposable incomes in India.

Market share

- Market Leadership: V-Guard is a leading brand in stabilizers, inverters, and water heaters, with a growing footprint in kitchen appliances and modular switches post-acquisitions like Sunflame and Simon Electric.

- Competitive Advantages:

- Strong brand recall and nationwide distribution network with 100,000+ channel partners.

- Robust in-house manufacturing capabilities.

Strategic priorities

- Premiumization: Focus on IoT-enabled products and premium offerings in kitchen appliances and modular switches.

- Capacity Expansion: New manufacturing units in Vapi (mixer grinders, stoves) and Hyderabad (batteries) to enhance production capacity.

- Sustainability: Initiatives to adopt renewable energy and develop eco-friendly products.

- Manufacturing Expansion: Facilities in Vapi (kitchen appliances) and Hyderabad (batteries), along with plans for a new TPW fan plant within 12-18 months.

- Innovation Campus: A state-of-the-art facility in Kochi for R&D, IoT lab, and product design studio.

Valuation analysis

- V-Guard’s valuation is underpinned by its consistent revenue growth, improved profitability, and balanced geographic presence. Strategic acquisitions and premiumization trends further enhance its growth prospects.

Voltas Limited

Voltas Limited, a Tata Group enterprise, is India’s leading air conditioning and engineering solutions provider with a rich legacy spanning seven decades. The company operates across three key verticals: Unitary Cooling Products (UCP), Engineering Projects, and Engineering Products & Services.

Renowned for its market leadership in room air conditioners and its innovative Voltas Beko range of home appliances, Voltas combines technological excellence with sustainability. With a vast distribution network and a strong focus on customer-centric solutions, Voltas continues to set benchmarks in the consumer durables industry.

Key trends in revenue, profit, and cash flow

- Revenue Growth: Voltas achieved a consolidated total income of ₹12,734 crores in FY24, a growth of 32% compared to ₹9,667 crores in FY23.

- Profitability: PAT for FY24 was ₹248 crores, an increase of 82% from ₹136 crores in FY23. EBITDA margins improved from 7.2% in FY23 to 8.4% in FY24.

- Cash Flow: Strong operational cash flow generation supported by effective cost management and optimized working capital.

Segment revenue of the company

- Unitary Cooling Products (UCP): Contributed ~77% of total revenue, led by strong demand for air conditioners and coolers.

- Engineering Projects: Accounts for 14% of revenue, with significant contributions from domestic and international infrastructure projects.

- Engineering Products and Services: Contributed 9% of revenue, focusing on mining and construction equipment.

Primary drivers of revenue growth

- Product Portfolio: Expansion in smart and energy-efficient cooling solutions and appliances like IoT-enabled air conditioners and advanced washing machines under Voltas Beko.

- Geographic Expansion: Increased footprint in tier-2 and tier-3 cities, along with growth in international markets like UAE and Saudi Arabia.

- Demand Drivers: Recovery in infrastructure projects and rising consumer demand for premium home appliances.

Market share

- Market Leadership: Voltas maintained its market leadership in room air conditioners with an 18.7% market share in FY24.

- Competitive Advantages:

- Strong brand equity under the Tata Group umbrella.

- Strategic joint venture with Arçelik for consumer durables (Voltas Beko).

- Extensive distribution network with over 30,000 touchpoints.

Strategic priorities

- Premiumization: Focus on advanced, eco-friendly cooling solutions and smart appliances.

- Capacity Expansion: Investments in manufacturing facilities in Chennai and Waghodia to cater to growing demand.

- Sustainability: Commitment to carbon neutrality and increased use of renewable energy in operations.

- Global Projects: Expanding presence in high-growth regions like Saudi Arabia and UAE.

Valuation analysis

- Supported by its market leadership, robust revenue growth, and strategic partnerships, Voltas is well-positioned for sustained growth in the consumer durables market. Its valuation reflects strong brand equity and future potential.

Final Words on Consumer Durables Stocks

Based on the analysis, Havells India, Polycab India, and Voltas Limited emerge as strong contenders for investment among consumer durables stocks in India. Havells stands out for its diversified portfolio, strong presence in premium FMEG products, and consistent revenue growth driven by rural expansion and innovation.

Polycab dominates the wires and cables market, complemented by rapid growth in its FMEG segment, supported by robust cash flow and ambitious growth plans under “Project LEAP.” Voltas leads in air conditioning and cooling solutions, leveraging its strategic joint venture with Arçelik (Voltas Beko) and a strong market share in UCP, supported by expanding manufacturing capabilities.

These companies align well with India’s demand for smart, energy-efficient products and benefit from government incentives and robust distribution networks, making them attractive long-term investment options in the consumer durables sector.

Other Consumer Durables Stocks List

- Blue Star Ltd.

- Market Cap: ₹12,000 Cr.

- Overview: Blue Star is a leading air conditioning and commercial refrigeration company, offering a variety of cooling products and solutions.

- Whirlpool of India Ltd.

- Market Cap: ₹10,000 Cr.

- Overview: Whirlpool is a prominent manufacturer of home appliances, including refrigerators, washing machines, and kitchen appliances.

- Bajaj Electricals Ltd.

- Market Cap: ₹6,000 Cr.

- Overview: Bajaj Electricals offers a diverse range of products, including lighting, fans, and home appliances.

- TTK Prestige Ltd.

- Market Cap: ₹5,000 Cr.

- Overview: TTK Prestige is a leading kitchen appliances company, known for its pressure cookers, cookware, and kitchen gadgets.

- LG Electronics India

- LG Electronics IPO Status: Filed for IPO in December 2024.

- Details: The Indian arm of South Korea’s LG Electronics plans to raise approximately ₹15,237 crore ($1.80 billion) through the IPO, with the parent company selling 101.8 million shares. This move aims to capitalize on the growing demand for consumer durables in India