How to add a nominee to a demat account in 6 easy steps. Opt in or Opt out of adding a nominee to your demat account online before June 30, 2024 to avoid freezing your demat account. Let us find out the steps below.

While investing in the stock market for the long term is rewarding, amidst the highs and lows, it is important to remember the importance of planning for the unexpected. One key step in securing your financial future is adding a nominee to your demat account online.

Table of Contents

Why is adding a nominee to your demat account online so important?

You have been investing in the stock market for years and you’ve built a solid portfolio. If any unfortunate incident happens to the demat holder, the investment amount should pass to the family, isn’t it? Second, the market regulator SEBI has mandated that if your demand account is not nominated, it will be frozen and inaccessible to your loved ones after you’re gone.

Hence it is important to designate a nominee to avoid lengthy legal processes and emotional hardships for your family. Since SEBI has given the last date of completing the process is of June 30, 2024, it is important to do it at the earliest to avoid any last-minute struggle.

This applies to both your demat account and mutual fund investment account. If investors fail to nominate anyone by the June 31 2024 deadline, SEBI may freeze debits from their accounts. This means investors will be unable to withdraw funds from mutual funds or use their demat accounts for trading purposes.

Though the investors who have already provided their nomination details are not required to resubmit them, it is advisable to revisit to make sure that it is done before the deadline.

Add a Nominee to a Demat Account Online guide PDF download.

You can also watch the complete video on how to add a nominee to a demat account here. It will just take 2 minutes to have a good understanding about the process.

How to add a nominee to a demat account?

Add a nominee to a demat account is as easy as sipping your morning tea or coffee. It took just a few clicks and within minutes, and you will have the peace of mind of knowing your investments will seamlessly pass on to your loved one, if needed.

Let us see how to add a nominee to a demat account.

Add a nominee to a demat account

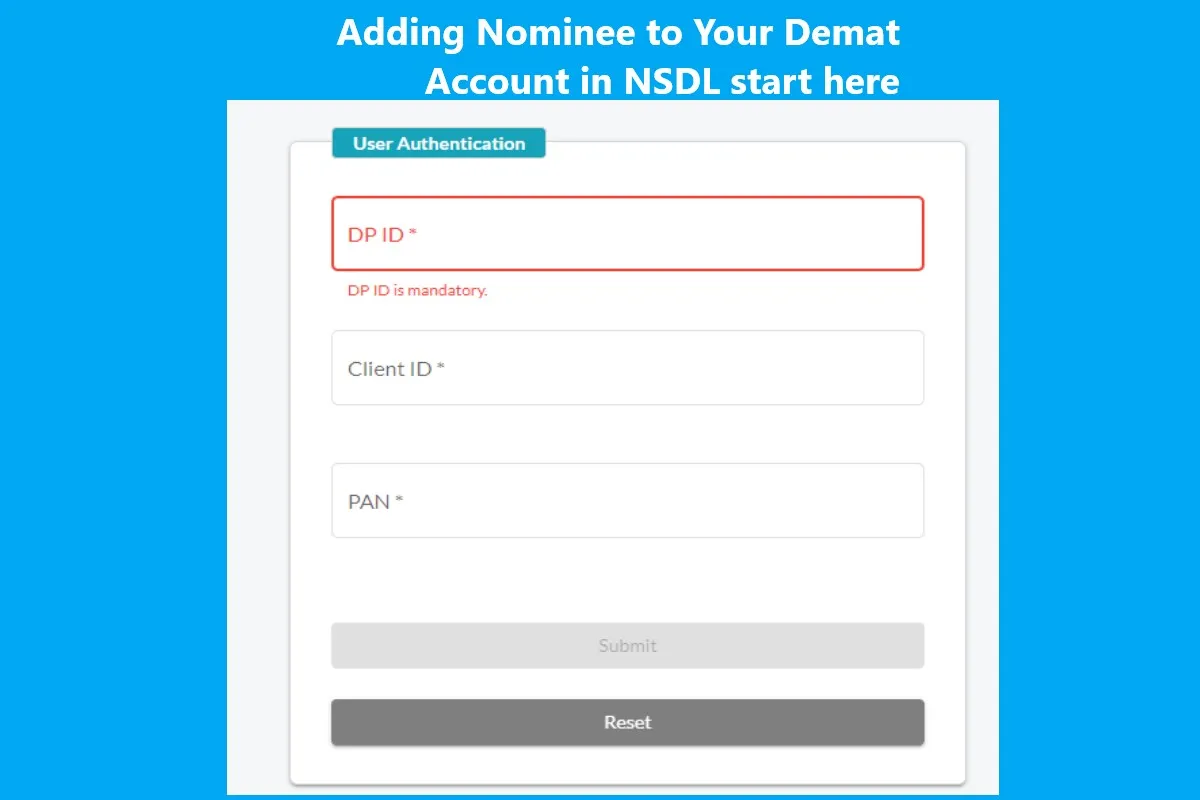

- Visit the official NSDL portal.

- Provide your DP ID, client ID, and PAN, and submit the OTP.

- DP ID and Client ID are available on your demat account or you can find them from the trading platform after login. Make sure your mobile number is updated in your KYC with NSDL or CDSL. You will receive the OTP on the same mobile number that you have registered.

- After entering these details, choose the option of either ‘I wish to Nominate’ or ‘I do not wish to nominate.’

- Select the option to add a nominee, and a new page will appear, requesting you to provide the nominee’s details.

- On the eSign Service Provider’s page, make sure to enable the checkbox and click on ‘Proceed.’

- Finally, verify the OTP to complete the process to add a nominee to a demat account.

- Since we are processing the nomination through e-sign using Aadhaar number, it is important to note that your mobile is updated with Aadhaar so that you can receive the OTP with the same mobile number for seamless completion of filing nominee details online for your demat account and mutual fund account.

Hope this helps you complete your process on “Add a nominee to a demat account”. Let me know how are you feeling now.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend paying stocks, 5 best upcoming IPOs in India, Tata Technologies IPO Review, IPO Watch 2024, IPOs in 2023.