Share With Friends

Beginners in the stock market always wonder how to identify the best multi bagger stocks. Let us end this curiosity here and find the easy ways to identify multi bagger stocks.

The search for the best multi bagger stock is always crazy and every investor wants to hold a multi bagger stock in their portfolio. Many companies deliver returns exponentially higher and investors get many folds to return over their initial investment. If you hold any one of these hidden gems, it can supercharge your portfolio. However, the key is to identify them at the right time and hold them for long.

I am putting my model of identifying them through there is no guaranteed formula for it. You need to do your due diligence and find your method of identifying the best multi bagger stock. My purpose here is to help you to understand the concept. Let us first understand what I mean by a multi bagger stock and then I will proceed with the steps in identifying them.

Table of Contents

Share With Friends

Understanding Multi Bagger stocks

Let us define what we mean as the best multi bagger stock. A multi-bagger is a stock that increases in value by several times its original price over a certain period. The timeframe can vary, but usually, we consider the timeframe of multi-years. For example, a 5-bagger means a stock has increased by 5-fold during a certain period. However, the shorter the time frame the better it is for the investor to gain.

Mindset to hold it for a long

Before diving into specific steps or strategies it is important to understand the psychology of the investor. While identifying the stock is important, holding it with the right mindset and patience is crucial. Multi bagger stocks often take time to mature. Sometimes it takes years to give you the desired result.

Choosing the right market cap companies, usually, large-cap companies might not flourish, and diversifying your portfolio can bring you good results. However, let us discuss how can we identify the best multi bagger stock in the market.

Identify the best multi bagger stock

Choosing the right theme

The first task for any investor is to choose the right theme that is going to grow in the country. Since we are investing for quite a long period, a sustainable theme should be there where there is a strong tailwind. For example, Production Linked Incentive (PLI) scheme and manufacturing or green energy and sustainability.

It is important to know how to choose the right theme. If some are reading newspapers or finance-related magazines regularly, government policies, and research reports, it is easy for them to get these themes. However, only if you just follow the government policy updates and technology trends globally and domestically, that will be good enough to choose the right theme.

Choosing the right sector

After getting the theme chosen with the right tailwind, find out the sector within that theme. Sometimes, people are confused with the theme and sector. Here I am speaking about the sector within the broader theme. For example, in the PLI scheme, sectors may be specialty chemicals, electric vehicles, or defense. Choose the sector where the government is focusing maximum.

For instance, in 2023 while the government of India announced the PLI scheme and focused on “atmanirvar bharat”, the defense sector grew the most. One of the stocks I mentioned here is Hindustan Aeronautics Limited (HAL) which has given over 4 times return from 760 in March 2022 to around 3100 level in March 2024.

Identify multi bagger stocks

After getting the right theme and sector, it is important to get them to identify the best multi bagger stock in the sector where the tailwind is strong.

Choose the Market leader in a smaller industry

Choosing the right stock is important in the process. This process is a little cumbersome and takes time to understand the company, its product features, financial statement, and promoter quality.

While choosing a multi-bagger, it is also important to understand, if the products of the company have a strong market advantage, low threat, and competition (Porter’s five forces analysis), and emerging trends in the sector.

Criteria to identify best multi bagger stock

Filter the best stocks to invest in

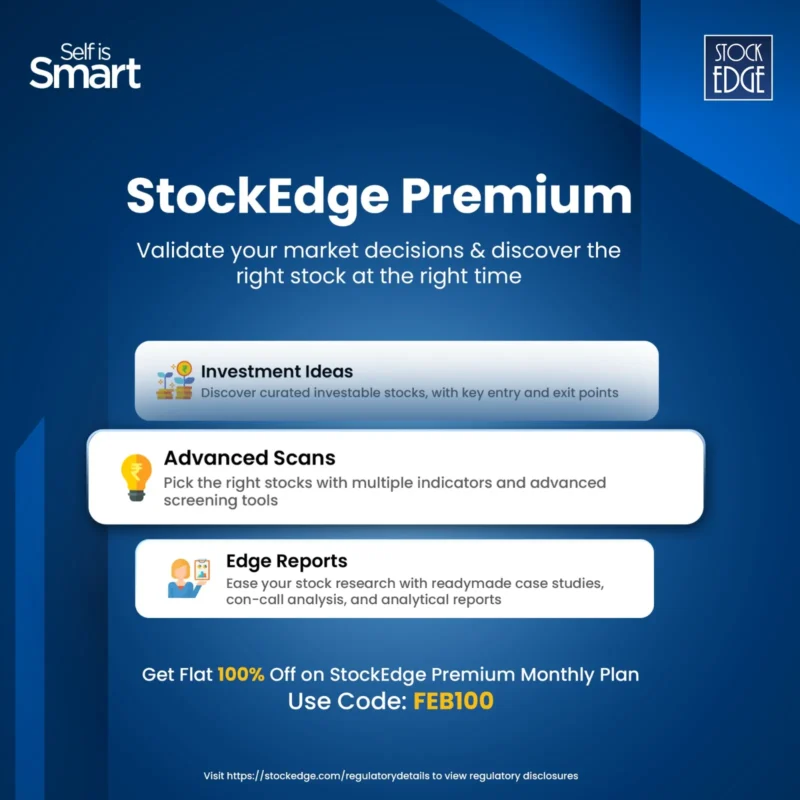

- Once you finalize the sector, get all the stocks from that sector. To help you here, you can use tools like screener.in or stockedge which are free.

- I would only invest in those companies where the market cap is above 200 crores (Minimum) so penny stocks will be out of my range. You may also choose the NSE 500 stocks of stocks with a market cap above 500 crores.

- The daily trading price of the stock must be above Rs50. This will also filter penny stocks out of your range.

- Choose those stocks where promoter holding is above 50% and where FII and DII holding is increasing over qoq.

- Avoid the companies where there is high leverage, FII, and DII holdings are decreasing, and promoters pledged their shares. You can get this data from the money control site.

- If you are filtering stock in the screener, the platform has a parameter called Piotroski Score. This score represents fundamentally strong companies. If the score is over 8 the company is better.

After filtering the stock you will have less number of stocks to finalize. Choosing a unique business model makes sure of the company. Look for the business model of the company and find out how they are different from its competitors. For example, BSE (Bombay Stock Exchange Limited) has a unique business model of providing a platform for stock trading.

In India, there are only a few companies that offer this kind of platform such as NSE and BSE. BSE is the only listed company as of now and NSE IPO is about to come. Similarly, CDSL has a unique business model and is the only listed company in the market now. Its competitor NSDL IPO is coming up. Hence, find this kind of business at the early stage. You may also invest in it Pre IPO shares to gain max.

Share With Friends

Valuation of multi bagger stocks India

This is the most important part of the multi bagger stock choosing process. Reading balance sheets to understand the financial performance of the company. The detailed study on how to reach a balance sheet will be a separate article. However, you need to look for the parameters below.

- Strong Financials. Look for companies with a history of consistent revenue and earnings growth. A healthy balance sheet with a low debt-to-equity ratio, and high interest coverage indicates financial stability.

- Industry Leadership: Companies operating in high-growth industries with strong tailwinds have a natural advantage. For example, governments worldwide are focusing on green energy. Hence, if there is any company in this segment with an early advantage will be a good investment considering the other above parameters.

- Competitive Advantage: Find out what the unique selling point of a unique product, service, or intellectual property that the company is offering. A sustainable moat protects a company from competition and fuels long-term growth.

- Promoters of the company: A visionary and capable promoter and management team are critical for the success of a company. Consider promoters with a proven track record, a clear vision for the future, and the ability to execute their strategy effectively.

- Valuation of the company: While choosing the right stock is important to get a good return, it is equally important to enter into the stock at the early stage of the cycle. Hence, the valuation of the stock is important to understand.

- Read credit rating reports about the company, and other research reports from experts to understand if the stock is trading at a low valuation. Visit trendline.com or stockedge.com, you will find a lot of reports about these companies. There are no shortcuts to identify the best multi bagger stock.

IPOs as multi bagger stocks

Companies coming up with IPO or in PRE IPO stage are good to buy. However, during the IPO process, the valuation of the companies is usually high. Hence, I prefer to wait for these companies to settle down. At least I wait for 2 to 3 months for these IPOs to come back to their original valuation. By the time these newly listed companies settle down, I analyze these companies on various parameters. One of the parameters for investing after an IPO is to understand the role of QIB in IPO. Here is a detailed analysis role of QIB in IPO.

When to exit from multi bagger stocks

The exit strategy for multi bagger stocks is preferable 200 DMA. If the stock closes below 200 DMA book your profit and exit

Final Thoughts

There is always a question of fundamental vs technical analysis. Fundamental analysis is important to identify the best multi bagger stock in India. On the other hand technical analysis helps to identify stocks for momentum investing.

Identifying best multi bagger stock requires a combination of industry knowledge, understanding of company fundamentals, and financial stuff. However, just by following the above steps, you will be able to spot potential best multi bagger stocks and enhance your portfolio. Remember, there is no shortcut to earning money from the stock market. A successful investing career is a journey, not a destination.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest. Learn all company insights, news analysis, market intelligence with us.

To know more information about company insights for investment, and business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, IREDA Share price Target, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price.