Delhivery Share price Review: Key Points

- Delhivery is the largest fully integrated logistics services provider in India.

- The company operates in five segments of the industry – Express Parcel, Part Truck Load Freight, Full Truck Load Freight, Cross Border Services, and Supply Chain (Warehousing)

- Delivered 663Mn shipments in FY23 with 14% YoY growth in Express Parcel volumes.

- Maintained strong position in key segments such as D2C and long-tail e-commerce

- Marquee clients like Asian Paints, Godrej, Ather Energy, Daikin, Sleepwell, Nykaa onboarded during the year 2023.

- Delhivery has recorded a revenue growth of 2% in FY23 from the previous year.

- However, the most important part is, Delhivery has been incurring loss consistently over last five years considered here for analysis. The loss of these years has gone up from Rs 269 Cr in FY20 to Rs 1008 Cr in FY23.

- ROE and ROCE both are negative for Delhivery Share price.

- ICIC Securities has given a target of Rs500 for Delhivery share price. However, I would prefer not to invest in this stock at the moment till the company become profitable.

- I would prefer to stay away from this counter at the moment.

Table of Contents

Delhivery Share price Review

Delhivery is the largest fully integrated logistics and supply chain company in India. The Delhivery share price recorded a high at Rs635 in 1st July 2022 after its debut in the stock market. However, the stock has since fallen to its 52-week low at Rs291 in January 2023. Delhivery IPO price band was set at Rs462 to Rs487 per share. The Delhivery share was listed in exchanges in May 2022. With the current price at Rs 412, if one invested in its Delhivery IPO, the total investment would have been 18% down by now.

Delhivery share price target 2025

In a report in August 2023, ICICI Securities has given Delhivery share price target of Rs500 which is 21% above the current price of Rs 412 in NSE.

In August 2023, Delhivery launches digital shipping platform for small businesses. This allows smaller businesses to ship without a minimum order value. Again, with a minimum wallet recharge of Rs 500 small business can ship to more than 220 countries, leveraging Delhivery’s partnership with FedEx.

Despite the company’s performance in revenue front and corporate actions, the Delhivery share price has failed to impress investors and been falling consistently. This is mainly due to its net loss over the years.

As a retail investor, I would prefer not to invest in Delhivery share price at its current value until it become net profitable.

Delhivery Share Price

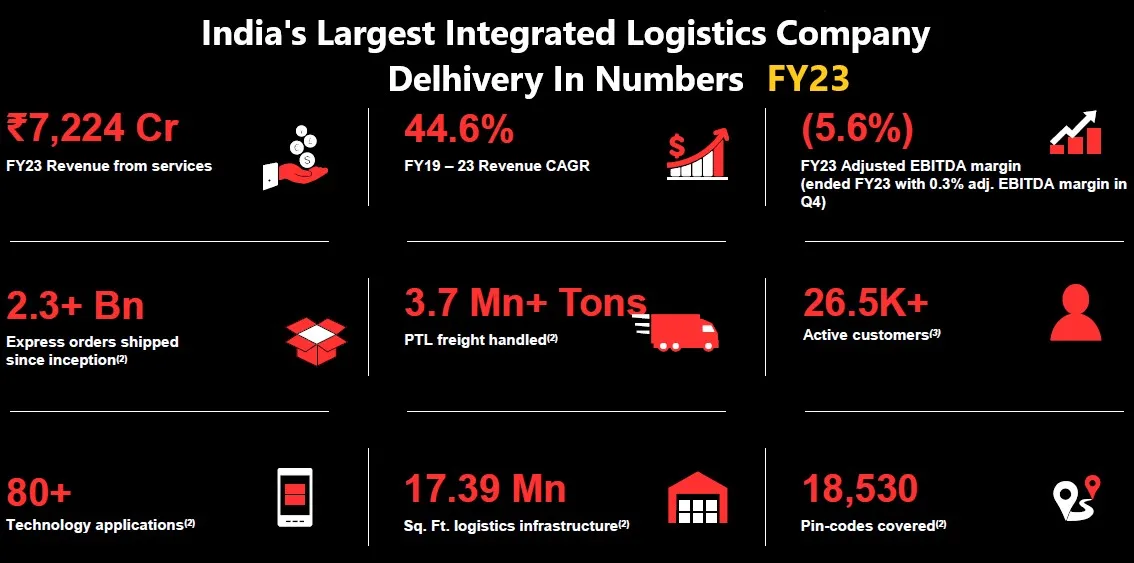

The Company in Numbers

Delhivery Share Price Performance

Delhivery share price target 2030

Walletinvestor viewed that the stock price for Delhivery Ltd. will be Rs 966.59 on September 27, 2028. However, I would be more pessimistic about this company looking at the financials of the company. The Delhivery share price target 2030 may be around Rs900 provided, the company becomes profitable for a few quarters before the target date.

As per the Annual General Meeting – 2023, the management highlighted that the top 5 client concentration has reduced to below 40% over the last quarter, and ‘direct to consumer’ (D2C) brands are now a large proportion of the business.

The recent investment in Vinculum was done to focus on providing value-added services to D2C enterprises. The company also completed the integration of Delhivery and SpotOn networks.

However, the management still believes that there is a large headroom for growth in the PTL business. The total addressable market size of PTL is in the range of USD 3bn-5bn and Delhivery has less than 10% market share as of now.

In this case, I would prefer to wait and watch the movement of Delhivery share price for atleast a two quarter to make the company profitable before investing. There are other options available in the market in this industry to invest.

You may explore top five logistics companies such as Concor, AllCargo, Agis, TCI Express.

Delhivery Share Price: Focus areas for FY24 and beyond

- Planning to commission Bhiwandi and Bengaluru mega-gateways; expansion of 5 other key sites.

- Reduce overall working capital intensity of all business lines

- Continue to expand its tractor-trailer fleet and electric vehicles

- Integrate cross-border freight 8 solutions with domestic warehousing, PTL and TL

Delhivery Share Price: Company Overview

Founded in 2011, Delhivery Pvt Ltd is a leading logistics and supply chain services company in India. The company has a strong nationwide network extending beyond 2825+ cities. Delhivery has over 83 warehouses across India enabling faster deliveries. The company is a specialist in four major categories of logistics. These are Shipping, Freight services, Special services, Warehousing Services, and Commerce services.

Delhivery Share Price: Key Product or Services

Delhivery offers the full suite of logistics services such as express parcel delivery, heavy goods delivery, part-truckload freight, truckload freight, warehousing, supply chain solutions, cross-border express and freight services, and supply chain software. This is an ISO-certified company. The company fulfilled over 1 billion orders to more than 19000 pin codes in India by April 2021. Delhivery claims to be the largest and fastest-growing fully integrated logistics player in India by revenue as of Fiscal 2021.

Delhivery has launched the same-day delivery services across 15 countries in India. This will enable D2C brands to deliver their webstore orders on the same day the order is received. Delhivery is planning to add more such services to retail its customers and to attract more customers from its competitor.

Delhivery Management team

The company is founded by Sahil Barua (Indian Institute of Management, Bangalore), Mohit Tandon (Indian Institute of Technology, Kanpur), Bhavesh Manglani (Indian Institute of Management, Calcutta), Suraj Saharan (Indian Institute of Technology, Bombay), and Kapil Bharati (Indian Institute of Technology, Delhi)

Sahil Barua (CEO) has been the managing director, founder, and CEO of the company since its inception in 2011. He has a strong background in consulting at Bain & Company. Salil holds a bachelor’s degree in mechanical engineering from the National Institute of Technology, Karnataka. He is a post-graduate diploma in management from IIM, Bangalore.

Kapil Bharati (Executive Director and CTO) a mechanical engineer from the Indian Institute of Technology, Delhi

Two of the five co-founders of Delhivery, Bhavesh Manglani and Mohit Tandon, have stepped aside from day-to-day operations of the company.

Delhivery Share Price Analysis: Financial snapshot

Delhivery is listed on Indian stock exchanges – BSE and NSE at ~Rs 495, a two percent premium over its issue price of INR 487.

| Period Ended (Rs in Crore) | FY2023 | FY2022 | FY2021 | FY2020 |

| Total Income | 7,530 | 7,038 | 3,838 | 2,989 |

| Total Expenses | 8,597 | 8,064 | 4,212 | 3,257 |

| Total Loss for the period / year | -1,008 | -1,011 | -415 | -269 |

Total revenue of Delhivery has increased over the last four years. In FY23, the company reported a growth of above 2% y-o-y against FY22. However, the company has been incurring losses over the last four years considered here.

Though Net Working Capital Days (Receivable days – Payable days) has improved from 73 in FY20 to 38 in FY23, still the company yet to prove itself in terms of return to shareholders.

Investment Activities

In August 2021, Delhivery acquired Spoton Logistics – a Bengaluru-based logistic firm- to strengthen its business-to-business (B2B) vertical. Delhivery has invested an amount of $20 million to $30 million in warehousing automation products maker Falcon Autotech. This will boost its warehousing capacity.

Indian Logistic Industry outlook

India is the 6th largest economy globally. Indian economy is poised to be the 3rd largest by 2030. According to the IMF report, Indian GDP is expected to grow at ~9% between 2020-25 driven by private consumption. Private consumption in India is expected to increase from US$1.6 trillion in 2019 to US$2-2.5 trillion in 2025.

The Indian logistics sector is expected to grow from US$260 billion in FY 2022 to US$432 billion by FY 2028. This growth will be driven by economic growth, a favorable regulatory environment, and push in transportation, PIL schemes, and changing consumption pattern. Per capita, logistic spending in India is ~US$280 in 2020 as against ~US$1540 in China and ~US$4860 in the US. This indicates a huge opportunity for growth in this sector in India.

Organized players in the Indian logistic industry accounting for only 10 in FY 2022. The logistics industry in India accounts for 13-14% of the country’s GDP. India aims to be the 3rd largest economy in the world by 2030. To make it happen logistic industry has a major role to play. Organized players will get the most benefit out of this growth momentum.

Bottom Lines

While Indian logistic industry is growing with the growth in economy, Delhivery performance in terms of revenue and profit has not grown as per the expectation. Hence, it is my view to wait and watch the Delivery share price movement before putting your money. If you already have invested, wait till the end of this year and look options to exit from this stock.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend paying stocks, 5 best upcoming IPOs in India, Tata Technologies IPO Review.