Ethanol Stocks

Share With Friends

India is aiming to be the third-largest economy globally by 2047. With the economic growth India also needs to reduce its contribution to carbon emission. India is targeted to reduce the emissions intensity of its GDP by 45% by 2030 from the 2005 level.

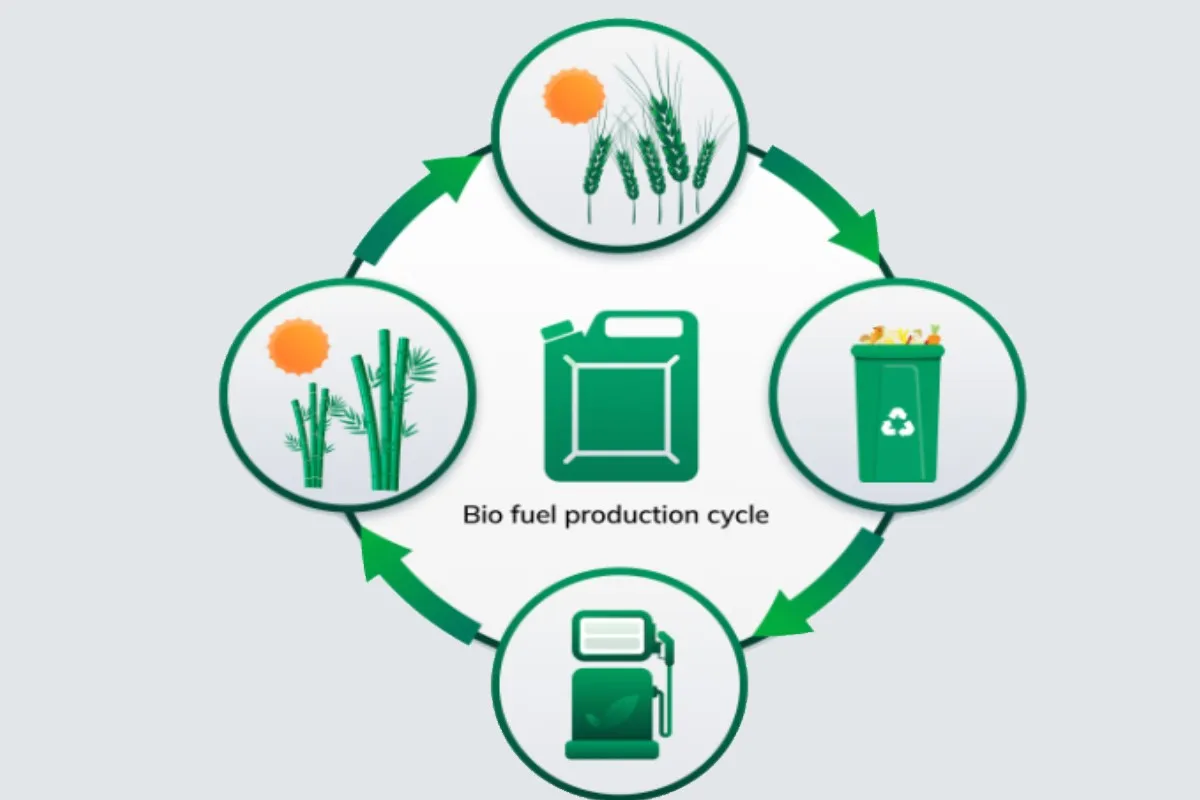

In addition, the rapid growth of India’s population, air pollution problems, and high oil import bills compelled the government to look for alternate sources of energy. One of the best options is Biofuel or ethanol as a source of energy to reduce the dependence on fossil fuels.

Table of Contents

Indian Ethanol Market Outlook and Ethanol Stocks

As per a report of the government of India, greenhouse gas (GHG) emissions decreased by 31.8 million metric tons between 2014 and 2022 during the ethanol blending program. Hence, the government of India has raised the target of ethanol blending with petrol to 20% by 2025.

The ethanol production capacity in the country is about 1380 crore litres as of November 2023. To achieve the target of 20% blending by 2025, India needs about 1016 crore litres of ethanol. The total requirement of ethanol including other uses is 1350 crore litres by 2025. So, the demand for ethanol is expected to go up. The country needs to produce an additional 1700 crore of ethanol to meet the increased demand.

Indian Ethanol Market Size 2024 to 2030

The India ethanol market is estimated at $6.5 billion in 2023 and is expected to grow at a CAGR of 8.84 per cent to reach $10.5 billion by 2029. This growth will be driven by an aggressive government-supportive policy that aims to reduce the dependency on fossil fuels and achieve 20% ethanol blending in petrol by 2025.

Over the first four months of 2023-24, India has achieved an average ethanol blending rate of 11.60% against the 15% target set by the government for the whole year. The supply constraint of ethanol can create obstacles to achieving the 20% target by 2025.

The government supports the industry by providing incentives, and subsidies, to boost ethanol production infrastructure. These incentives serve dual purposes – bridge the agriculture and energy sectors, benefiting farmers, and bolstering energy security.

Ethanol Stocks

According to industry experts, out of the 8.25 billion litres of ethanol supply tender opened by OMCs, ethanol producers bid only for 5.62 billion litres in the first offer. This is only about 69 per cent of the total tendered quantity by OMCs. This will create supply constraints to meet the target.

The government of India has to create additional support for this industry to create a conducive atmosphere for ethanol producers. This will further benefit ethanol producers in the country. Let us find out the top ethanol stocks in India.

Top Ethanol Stocks in India

- EID Parry (India) Ltd

- Shree Renuka Sugar Ltd

- Balarampur Chini Mills Ltd

- Triveni Engineering and Industries Ltd

- India Glycols Ltd

- Dalmia Bharat Sugar and Industries

My Best Ethanol Stocks

India Glycol Share Price Analysis

India Glycol is an integrated speciality chemical company focused on innovative products. The company business is spread across various sectors including Bio-based speciality and performance chemicals, Biopharma, and Spirits. Ethanol is a byproduct of spirits.

With over 35 years of experience in the chemical industry, the company’s products cater to sectors such as automotive, pharma, textile, paint and coating, personal care, packaging, food, oil and gas, etc.

India Glycol forayed into the grain-based ethanol business in 2022, with two distilleries – 180 kilolitres per day in Kashipur and 110 kilolitres per day in Gorakhpur. The Company is likely to expand its grain distillery capacities shortly to meet the robust demand potential for ethanol from the government of India to meet the target of 20% by 2025.

The company has registered a strong growth in revenue from power alcohol to reach INR 126 Crores in 2022-23 from the sale of Power Alcohol as compared to INR 9 Crores during the previous year.

As per the June 2024 quarterly report, the company reported a net profit of Rs 60.38 crore, a growth of 18.07% compared to Rs 51.14 crore in the previous quarter ended June 2023.

The sales grew by 40.58% to reach Rs 968.64 crore in the June 2024 quarter as against Rs 689.01 crore during the previous quarter ended June 2023.

India Glycol is one of the best ethanol stocks in India to invest. The India Glycol share price has been trading over its all-time high and has the potential to grow more. Keep an eye on it and let me know if you need other assistance. Please contact through comment or email for more insights on India Glycol share price analysis. Share your view about this company as well.

Eid Parry Share Price Analysis

EID Parry is one of the best ethanol stocks in India to consider for long term.

EID Parry is part of the INR 742 Billion Murugappa Group, one of the leading business conglomerates in India. The company engages in sugar and Nutraceuticals. EID Parry is one of the best Sugar brands in India. The Company’s fully automated standalone distillery in Sivaganga started in 2009.

EID Parry India Ltd is diversifying its business towards non-sugar products including food, bioenergy, and nutrition. Currently, non-sugar businesses contribute one-third of the company’s revenue which is 33% in FY24 increased from 26% in FY22. The company is aiming to increase the share of non-sugar products in its overall sales. The company forayed the branded staples segment by launching rice, dal, and millet in the March 2024 quarter.

By the end of FY24, EID Parry’s overall distillery capacity will reach 582 KLPD. The company is planning to expand its distillery capacity with an investment of Rs 268 crore in FY24.

EID Parry is expanding by 120 kilo litre per day (KLDP), involving dual feeds, Sankili distillery in Andhra Pradesh. The company is also expanding its Haliyal plant in Karnataka with a 120-KLDP at an investment of Rs 181 crore. The Karnataka plant will be commissioned by Q4FY24.

EID Parry India reported a consolidated profit after tax of Rs 294.30 crore for the January-March 2024 quarter as against Rs 286.90 crore during the corresponding quarter of last year. The consolidated profit after tax for the FY 2024 fell to Rs 1,617.57 crore, from Rs 1,827.74 crore reported a year ago.

The company reported a loss after tax of Rs 13.59 crore in the quarter ended Dec. 31, 2024, compared to a profit after tax of Rs15.78 crore a year ago. Eid Parry Share Price is consolidating at INR 824 after a breakout. The relative strength and RSI both indicate a positive move for the Eid Parry Share Price. In the weekly chart, the stock is in momentum and you can ride it for some more time.

The company is one of the best companies in the ethanol stocks segment. Keep an eye on the best ethanol stocks for investment.

Also Read

Frequently Asked Questions

Is it good to investment in India Glycol Share Price?

Yes, the company has given a multiyear breakout. The detailed analysis and my view is given in the article. This is one of the top ethanol stocks in India.

IS EID Parry Share is good to invest now?

EID parry incurred loss in last quarter (YoY). However, the company is fundamentally good and part of the INR 742 Billion Murugappa Group. You may consider this for further analysis. As per my analysis, this is one of the best ethanol stocks (Ethanol story) in India.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest. Learn all company insights, news analysis, market intelligence with us.

To know more information about company insights for investment, and business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, IREDA Share price Target, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price.