JSW Infrastructure IPO Details – JSW Infrastructure IPO is a book built issue of Rs 2,800.00 crores. JSW Infrastructure IPO is a fresh issue that opens for subscription from September 25, 2023 to September 27, 2023. The allotment for the JSW Infrastructure IPO is expected to be completed by Tuesday, October 3, 2023. JSW Infrastructure IPO will list on both the exchanges BSE, NSE. The date of listing date may be on Friday, October 6, 2023.

JSW INFRASTRUCTURE IPO RHP

Table of Contents

JSW Infrastructure IPO price band

JSW Infrastructure IPO price band is fixed at ₹113 to ₹119 per share. The minimum lot size for an application is 1 lot of 126 Shares. The minimum amount of investment for the retail investors is ₹14,994. The minimum lot size investment for S-HNI is 14 lots totaling 1,764 shares, amounting to ₹209,916. For B-HNI, the minimum lot size is 67 lots of 8,442 equity shares that aggregating to ₹1,004,598.

The book running managers of the JSW IPO are Jm Financial Limited, Axis Capital Limited, Credit Suisse Securities (India) Private Limited, Dam Capital Advisors Ltd (Formerly Idfc Securities Ltd), Hsbc Securities & Capital Markets Pvt Ltd, ICICI Securities Limited, Kotak Mahindra Capital Company Limited and SBI Capital Markets Limited. Kfin Technologies Limited is the registrar for the issue.

JSW Infrastructure IPO Details

| JSW Infrastructure IPO Details | JSW Infrastructure IPO Price, date, allotment status |

|---|---|

| IPO Subscription Dates | September 25, 2023 to September 27, 2023 |

| IPO Allotment date | Tuesday, October 3, 2023 |

| Refund Date | Wednesday, October 4, 2023 |

| Credit to Your Demat Account Date | Thursday, October 5, 2023 |

| JSW Infrastructure IPO Listing Date | Friday, October 6, 2023 |

| JSW Infrastructure IPO Price Band | ₹113 to ₹119 per share |

| Offer for Sale | Nil |

| Fresh Issue of Shares | ₹2,800.00 Cr |

| Equity Shares outstanding before the Issue | 1,864,707,450 Equity shares |

| Minimum bid (Retail investors) | 1 lot (126 Equity Shares) Total Investment of ₹14,994 |

| Face value | ₹ 2 |

| IPO Listing on | BSE and NSE |

Objects of the Issue of JSW Infrastructure IPO

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Prepayment or repayment, in full or part, of all or a portion of certain outstanding borrowings through investment in the wholly owned Subsidiaries, JSW Dharamtar Port Private Limited and JSW Jaigarh Port Limited.

- Financing capital expenditure requirements through investment in the wholly owned subsidiary, JSW Jaigarh Port Limited, for proposed expansion/upgradation works at Jaigarh Port i.e., i) expansion of LPG terminal (“LPG Terminal Project”); ii) setting up an electric sub-station; and iii) purchase and installation of dredger.

- Financing capital expenditure requirements through investment in the wholly owned subsidiary, JSW Mangalore Container Terminal Private Limited, for the proposed expansion at Mangalore Container Terminal (“Mangalore Container Project”).

- General corporate purposes.

What JSW Infrastructure Does?

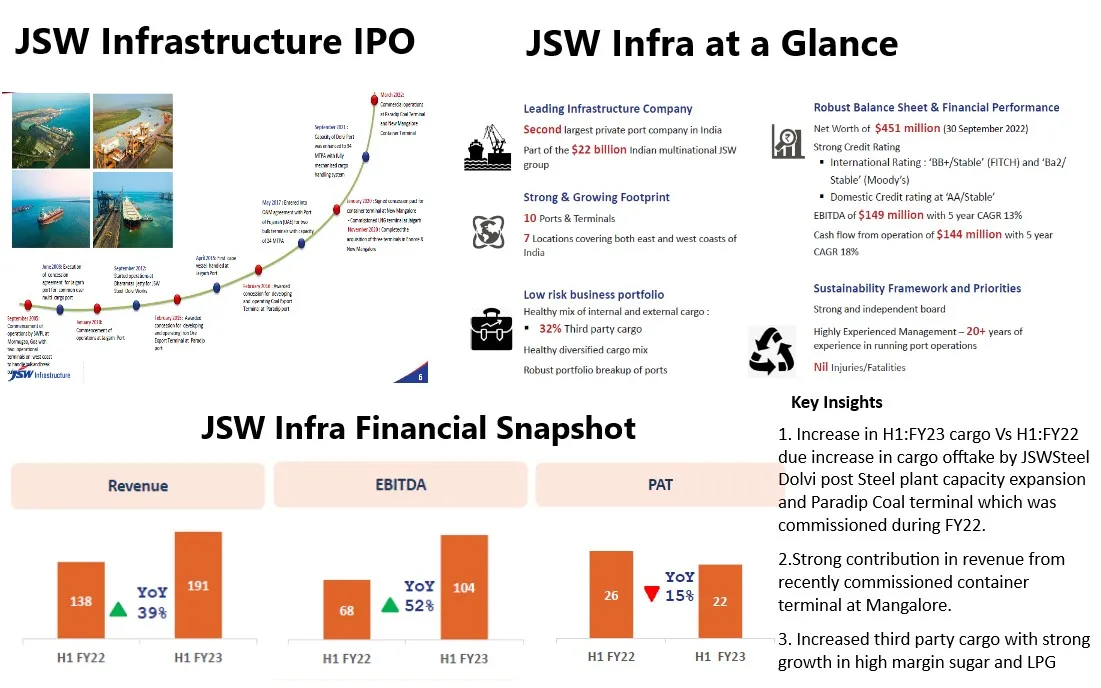

JSW Infra is a fastest growing port-related infrastructure company in terms of growth in installed cargo handling capacity and cargo volumes handled during Fiscal 2021 to Fiscal 2023. The company is also the second largest commercial port operator in India in terms of cargo handling capacity in Fiscal 2023. JSW infra has expaned its operations from one Port Concession at Mormugao, Goa that was acquired by the JSW Group in 2002 and commenced operations in 2004, to nine Port concessions as of June 30, 2023 across India. This makes the company a diversified maritime ports company.

The installed cargo handling capacity in India grew at a CAGR of 15.27% from 119.23 MTPA as of March 31, 2021 to 158.43 MTPA as of March 31, 2023. During the same period, the cargo volumes handled in India grew at a CAGR of 42.76% from 45.55 MMT to 92.83 MMT. The company also operate two port terminals under O&M agreements for a cargo handling capability of 41 MTPA in the UAE as of June 30, 2023.

Apart from the above, the company also provides maritime related services including, cargo handling, storage solutions, logistics services and other value-added services to our customers, and are evolving into an end-to-end logistics solutions provider.

JSW Infrastructure: Financial Snapshot

| Period Ended | 31 Mar 2020 | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 7,191.85 | 8,254.55 | 9,429.46 | 9,450.66 |

| Revenue | 1,237.37 | 1,678.26 | 2,378.74 | 3,372.85 |

| Profit After Tax | 196.53 | 284.62 | 330.44 | 749.51 |

| Net Worth | 2,488.23 | 2,831.18 | 3,212.13 | 3,934.64 |

| Reserves and Surplus | 2,486.53 | 2,829.84 | 3,208.98 | 3,645.75 |

| Total Borrowing | 3,102.57 | 3,945.82 | 4,408.69 | 4,243.70 |

JSW Infrastructure Company Contacts and Lead Managers

| Contact Details | Lead Managers |

|---|---|

| JSW Infrastructure Limited JSW Centre, Bandra Kurla Complex Bandra (East), Mumbai – 400 051 Phone: +91 22 4286 1000 Email: infra.secretarial@ jsw.in Website: https://www.jsw.in/infrastructure | 1. Jm Financial Limited 2. Axis Capital Limited 3. Credit Suisse Securities (India) Private Limited 4. Dam Capital Advisors Ltd 5. Hsbc Securities & Capital Markets Pvt Ltd 6. ICICI Securities Limited 7. Kotak Mahindra Capital Company Limited 8. SBI Capital Markets Limited |

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend paying stocks, 5 best upcoming IPOs in India, Tata Technologies IPO Review.