Muthoot Microfin IPO Review: Muthoot Microfin, a flagship company of Muthoot Finance company, is coming up with initial public offering. Let us find out the Muthoot Microfin details.

Table of Contents

MUTHOOT MICROFIN IPO Details: Key Facts

- MUTHOOT MICROFIN Ltd. is a microfinance institution providing micro-loans to women customers (primarily for income generation purposes) with a focus on rural regions of India.

- The company filed a Draft Red Herring Prospectus (MUTHOOT MICROFIN DRHP) filing: June 30, 2023.

- MUTHOOT MICROFIN IPO Subscription Date: – December 18, 2023 to December 20, 2023

- MUTHOOT MICROFIN IPO Price Band: ₹277 to ₹291 per share

- MUTHOOT MICROFIN IPO listing date: Tuesday, December 26, 2023

- Muthoot Microfin is the fourth largest NBFC-MFI in India and the third largest in South India in terms of gross loan portfolio as of December 31, 2022.

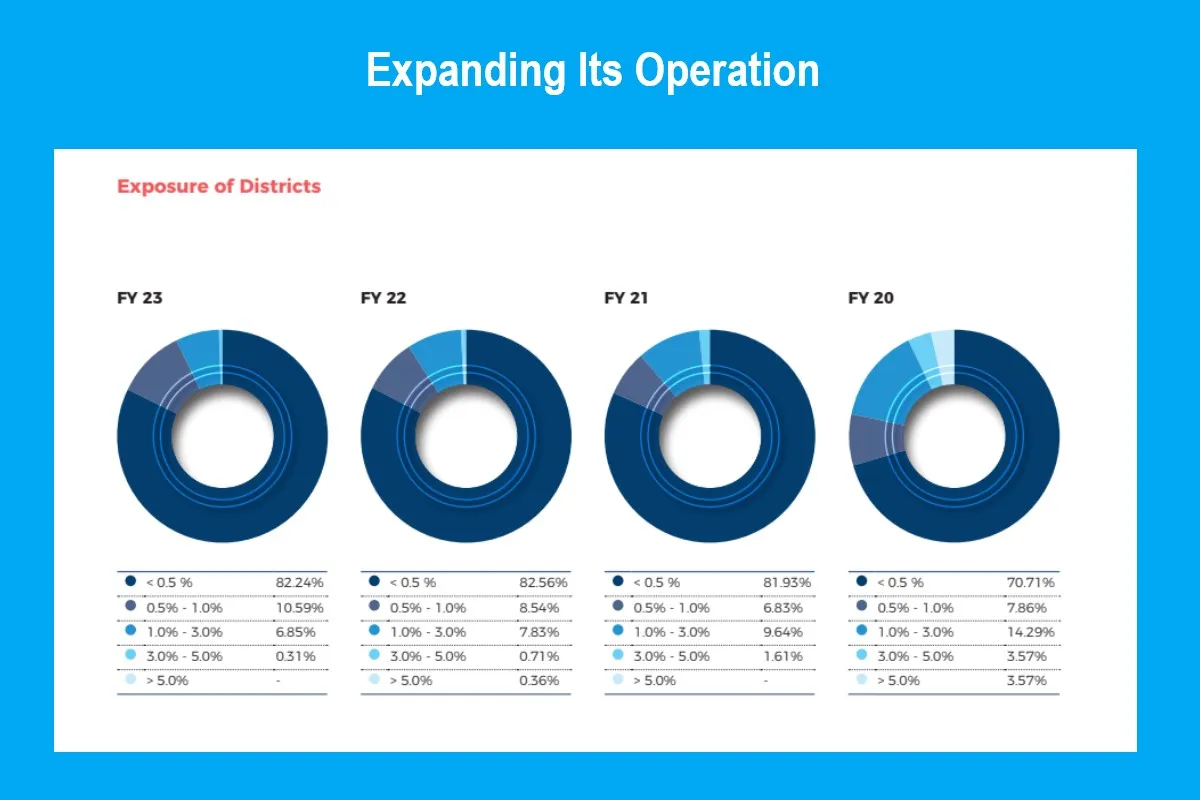

- As of March 31, 2023, the company has 2.77 million active customers across 18 states of India. There is potential to expand to other states as well.

- Strong growth potential for this business in India despite a bit of high competition now.

- Should I invest in the company during the IPO process. Let us find out why.

Muthoot Microfin DRHP filed on 30th June 2023 to float its Initial public offering. According to DRHP, this IPO, or ₹960 Crore consists of a fresh issue of ₹760 crore and an offer for the sale of ₹200 crore. Promoters Greater Pacific Capital WIV Ltd, and Muthoot Family promoters are selling stakes in OFS.

The net proceeds from this IPO from the Fresh Issue will be utilized towards augmenting the capital base to meet future capital requirements and onward lending.

Muthoot Microfin IPO Details

| Muthoot Microfin IPO Details | Muthoot Microfin IPO date Price and other details |

| Muthoot Microfin IPO date | December 18 to December 20, 2023 |

| IPO Price band | ₹277 to ₹291 per share |

| IPO date of allotment | Thursday, December 21, 2023 |

| Refunds Initiation date | Friday, December 22, 2023 |

| Credit of Shares to Demat Account | Friday, December 22, 2023 |

| Muthoot Microfin IPO date of listing | Tuesday, December 26, 2023 |

| Total IPO size | ₹ 960 Crore |

| Fresh Issue | ₹ 760 Crore |

| Offer for Sale | ₹ 200 Crore |

| Retail (Min lot size) | 1 lot of 51 shares ₹14,841 of total investment |

| Retail (Max lot size) | 663 shares with ₹192,933 invevstment |

| Retail Allocation | 35% |

| Muthoot Microfin share price Face Value | ₹ 10 per share |

| Muthoot Microfin share price Listing on | BSE & NSE |

| Equity Shares outstanding prior to the Offer | 116,837,249 Equity Shares |

Now the big question is – do you invest in the Muthoot Microfin IPO? Let us find out details about the company and why you should consider investing in this IPO.

Also, read SEBI registered research analyst: is it good to take their stock picks?

Also, read 52 week high stocks with strong momentum

Muthoot Microfin IPO review: Do you invest?

- Muthoot Microfin is one of the leading microfinance companies in India that empowers women entrepreneurs in rural regions of India.

- Over the decade, the retail sector in India has expanded at a rapid pace, driven by factors such as rising disposable incomes, urbanization, and the proliferation of e-commerce.

- India’s rural India accounts for 45% of GDP, but only 11% of deposits and 9% of credit.

- Financial inclusion is lower in rural areas than in urban areas in India and hence there is a huge potential for the company in India to grow.

- The company has recorded strong revenue growth and PAT over the years.

- The EPS has increased from 0.62 in FY2021 to 11.98 in FY2023.

- As of the end of nine months ended 9M FY2023, the microfinance industry registered growth of a CAGR of 21% since the financial year 2018.

- With economic revival and unmet demand in rural regions, the MFI industry is expected to reach ₹4.9 trillion by the end of the financial year 2025 with 20% CAGR during FY 2023-2025.

- Considering the above factors MUTHOOT MICROFIN is a strong company to invest in.

- I would like to invest in its IPO both for listing gain and long-term investment.

Muthoot Microfin IPO Review: What does Muthoot Microfin do?

Muthoot Microfin is one of the leading NBFCs in India. The company is part of the flagship company Muthoot Pappachan Group, also known as Muthoot Blue. The group has over 134 years of experience with over 3600 branches across India.

Muthoot Microfin is focusing on providing loans to women entrepreneurs mainly in the rural region of India. The company followed a joint liability group (JLG) model of microfinance to promote entrepreneurship among women. Muthoot Microfin has over 1172 branches spread across 18 states of India with an expansion plan across the rest of the states.

The company offers financial products comprise

- Group loans for livelihood solutions such as income-generating loans, Pragathi loans and individual loans;

- Life betterment solutions including mobile phone loans, solar lighting product loans, and household appliances product loans;

- Health and hygiene loans such as sanitation improvement loans;

- Secured loans in the form of gold loans and Muthoot Small & Growing Business (“MSGB”) loans.

Being a key player in the Indian Microfinance markets, Muthoot Microfin IPO is important for retail investors to invest in the Indian microfinance sector. It is a well-established company with a strong track record.

Muthoot Microfin Financial Strength

The company has a track record of growth in revenue and profits. During FY 23, the Company’s revenue from operations and other income was Rs. 1,446.34 crore with a net profit with other comprehensive income of Rs.203.31 crore.

Profit Before Tax (PBT) increased to an all-time high of Rs 212.87 Crore in FY2023 from Rs 9.05 Crore in FY2021 and Profit After Tax (PAT) increased to an all-time high of INR 164 Crore in FY23 from Rs 7 Crore at the end of FY 21.

As of March 31, 2023, the Company had a gross loan portfolio of Rs. 9,208.28 crore as compared to Rs 6,255.03 crore in the financial year 2021-22. The net worth of the Company as of March 31, 2023, was Rs 1,625.85 Crore, and capital adequacy as of March 31, 2023, was 21.87%, well over the mandated 15%.

Objective Behind the Muthoot Microfin IPO

- The company will not receive any proceeds from the Offer for sale. The promoters of the company will take the net proceeds from the OFS.

- The net proceeds from the fresh issue will be deployed in the Financial Years 2024 and 2025. The net proceeds will be utilized to augment the capital base to meet future capital requirements.

- The company will achieve the benefits of listing the Equity Shares on exchanges.

- This will also enhance the visibility and brand image of the company as well as provide a public market for Equity Shares in India.

Muthoot Microfin IPO GMP

| Muthoot Microfin IPO GMP Date | IPO Price | GMP | Estimated Listing Price |

|---|---|---|---|

| 15-12-2023 | ₹ 291 | ₹95 | ₹ 386 |

| 14-12-2023 | ₹ 291 | ₹ 95 | ₹ 386 |

| 13-12-2023 | ₹ 291 | ₹ 105 | ₹ 396 |

Muthoot Microfin Financial Snapshot

| Some Statistics/ Year Ended | March 31 | March 31 | March 31 |

| Year | 2021 | 2022 | 2023 |

| Total Revenue | 696.28 | 842.9 | 1446.3 |

| Profit After Tax | 7.05 | 47.4 | 163.9 |

| Reserves and Surplus | 642.84 | 1,040.10 | 1,282.15 |

| Total Assets | 4,183.85 | 5,591.46 | 8,529.20 |

| Total Borrowings | 3,015.66 | 3,996.61 | 6,493.18 |

| Net Worth | 889.89 | 1,336.58 | 1,625.85 |

Muthoot Microfin Contact Details

| Muthoot Microfin Limited 13th Floor, Parinee Crescenzo, Bandra Kurla Complex Bandra East, Mumbai 400 051, Phone: +91 48 4427 7500 Email: info@muthootmicrofin.com Website: https://muthootmicrofin.com/ |

Muthoot Microfin IPO Registrar

| Phone: 04067162222, 04079611000 Email: muthoot.ipo@kfintech.com Website: https://kosmic.kfintech.com/ipostatus/ |

Muthoot Microfin IPO Lead Manager(s)

| 1. ICICI Securities Limited 2. Axis Capital Limited 3. Jm Financial Limited 4. SBI Capital Markets Limited |

Muthoot Microfin IPO Allotment Status

Please refer to the Kfintech IPO Status for details

Frequently Asked Questions (FAQs)

Q. Is Muthoot Microfin a listed company?

Ans: No Muthoot Microfin is not a listed company now. It has applied for an IPO to be listed on stock exchanges in India. After the IPO process, it will be the listed company and Muthoot Microfin share price will be traded in the exchanges as a listed company.

Q. Muthoot Microfin Filed DRHP?

Ans: Yes, here is the Muthoot Microfin DRHP on 30th June 2023 to float its Initial public offering

Q. Who is the CEO of Muthoot Microfin?

Ans: Shaji Varghese is the Chief Executive Officer (CEO) of Muthoot Fincorp Ltd ( MFL). He has over 25 years of experience in the banking and financial sector. He was associated with Cholamandam Investment and Finance Company before joining MFL.

Q. What is the head office of Muthoot Microfin?

Ans: Admin Office: 5th Floor, Muthoot Towers, M.G. Road, Ernakulam 682 035, Kerala, India

Registered Office: 13th Floor, Parinee Crescenzo, Bandra Kurla Complex, Bandra East, Mumbai 400 051, Maharashtra, India

Email: info@muthootmicrofin.com

Telephone: +91 48 4427 7500

Q. How can I invest in Muthoot Microfin IPO?

If you are interested in investing in Muthoot Microfin IPO, you will need to open a demat account and trading account with a broker. You can then apply for shares during the book-building process.

Q. Who is the registrar of Muthoot Microfin IPO?

Ans: Kfintech is the registrar of this IPO. To know about the IPO status you can visit Kfintech IPO Status to learn the process of Muthoot Microfin IPO allotments status.

Q. When is the Muthoot Microfin IPO date?

Ans: The Muthoot Microfin IPO date has not yet been announced. However, it may be open for subscription in December 2023.

Q. What is the Muthoot Microfin IPO Price

Ans: The Muthoot Microfin IPO Price has not yet been announced

Q. What are the risks of investing in Muthoot Microfin IPO?

Ans: As with any investment, there are risks associated with investing in Muthoot Microfin IPO. These risks include:

- The price of the shares may fall after the IPO.

- The company may not perform as well as expected.

- The company may face regulatory or legal challenges.

Q. Who owns Muthoot Microfin?

Ans: The Muthoot Microfin is owned by the well-known group Muthoot Fincorp and the Muthoot family.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market in 2023. To know more information about company insights for investment, and business overview of investment companies, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend-paying stocks, 5 best upcoming IPOs in India.