Vilin Bio Med IPO Review – Key Details

- Vilin Bio Med Limited is offering Equity Shares of 4,000,000 at the face value of ₹10 aggregating up to ₹12.00 Crores.

- The issue is priced at ₹30 per share.

- The minimum order quantity is 4000 Shares.in its IPO debut.

- Vilin Bio Med IPO is a SME IPO will be listed in NSE SME Exchange

- Experienced Management and Dedicated Employee Base.

- Promoter has over a two decades of experience in the field of administration, legal and marketing of marketing and exhibitions.

- Company claims to provide best quality assurance when you care enough.

- My view is to Avoid investing in this IPO.

Unveiling Vilin Bio Med IPO

Vilin Bio Med IPO consists of fresh issue of 4,000,000 at the face value of ₹10 aggregating up to ₹12.00 Crores. The issue is priced at ₹30 per share. Vilin IPO is a SME IPO will be listed in NSE SME Exchange.

Vilin Bio Med Ltd is engaged in the manufacturing of pharmaceuticals formulations such as Oral Liquids, Dry syrups, Sachets, External Preparations, Beta and Non Beta Lactam tablets and Capsules & Nutritional Food supplements.

Vilin Bio has manufacturing plants located in Roorkee, Uttarakhand. The Company has a R&D Foundation and state of the art Manufacturing Facility in Roorkee.

Vilin Bio Med sell its products in bulk to Pharmaceuticals Manufacturers, Marketers and Traders. The major products of the company are as below.

- Oral Liquid (Syrups/Suspensions/Dry Powders (βeta & Non βeta-Lactam)

- Tablets & Capsules (βeta & Non βeta-Lactam)

- External Preparations

Objective behind Vilin Bio Med IPO

- The company is planning to meet working capital requirements of the company out of the net proceeds.

- The rest of the proceeds will be utilized to meet General Corporate Purposes and Issue Related Expenses.

Promoters of Vilin Bio Med IPO

- Viswa Prasad Sadhanala

- Sadhanala Venkata Rao

- D. Srinivasa Reddy

- Ramesh Reddy Sama

How to Apply Vilin Bio Med IPO through Bank Account Online?

Apply Vilin Bio Med IPO via ASBA online via your bank account. You can also apply for ASBA online via UPI through your stock brokers. It is better to apply through Bank by filling up a small form. Long in to your Bank account online. Reach to e-services on the bank platform (Top Right). You will get an option to apply for IPO through ASBA. Fill the required form and apply. See the history of IPO applied to make sure your form reached the Bank.

Vilin Bio Med IPO Details

| Vilin Bio Med IPO | Vilin Bio Med IPO Details |

|---|---|

| IPO Opening Date | 16 June 2023 |

| IPO Closing Date | 21 June 2023 |

| IPO Allotment Date | 26 June 2023 |

| Initiation of Refund | 27 June 2023 |

| Credit of Shares to Demat Account | 29 June 2023 |

| Vilin Bio Med IPO Listing date | 30 June 2023 |

| Issue Type | Fixed Price Issue IPO |

| Fresh Issue Size | 40,00,000 Shares Worth ₹12.00 Crore |

| Face Value | ₹10 per equity share |

| IPO Price | ₹30 |

| Market Lot | 4000 Shares |

| Minimum Bid | 1 lot (4000 Shares) |

| Listing in | NSE SME Exchange |

| Retail Shares Offered | 50% |

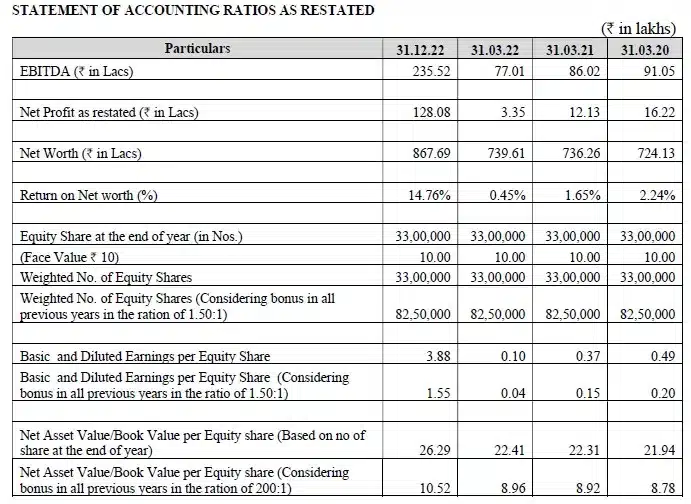

Vilin Bio Med IPO Details: Financial Snapshot

| Financial Year | Total Revenue | Total Expenses | Total Borrowing | Profit After Tax |

|---|---|---|---|---|

| 31-Mar-20 | 16.82 | 16.63 | 4.53 | 0.16 |

| 31-Mar-21 | 11.71 | 11.55 | 5.51 | 0.12 |

| 31-Mar-22 | 11.21 | 11.17 | 5.3 | 0.03 |

| 31-Dec -22 | 9.03 | 7.28 | 6.17 | 1.28 |

Vilin Bio Med IPO Promoter Share Holding

| Vilin Bio Med IPO | Share Holdings |

|---|---|

| Pre Issue Share Holding | 89.87% |

| Post Issue Share Holding | 64% |

Vilin Bio Med Ltd Contact Information

Vilin Bio Med Limited

Sy.No.115/GF/J,

Hanumanji Colony,

Brig Sayeed Road, Bowempally,

Secunderabad – 500003,

Telangana, India

Phone: +91 40 7961 8843

Email: cs@vilinbiomed.co.in

Website: www.vilinbiomed.co.in

Vilin Bio Med IPO Registrar

Bigshare Services Pvt Ltd

Phone: +91-22-6263 8200

Email: ipo@bigshareonline.com

Website: https://www.bigshareonline.com/

Vilin Bio Med IPO Lead Manager

Inventure Merchant Banker Services Private Limited

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, Is fine organics a good buy now.

mind2markets is in news

Feedstop has mentioned mind2markets website as one of the best site to provide stock analysis and insights about the company to invest in. Keep in touch.