Share With Friends

In this article, we will discuss about the go digit bike insurance. If Go Digit bike insurance is good for two-wheeler owners at the present juncture. But before that let us understand why bike insurance is required in India. Is bike insurance mandatory in India? Let us find out.

In India, it is mandatory for any person having two-wheelers to take bike insurance. Youth in India prefer to ride a bike and it is important to take bike insurance before you ride it. For any new bike, the dealer itself provides the bike insurance. Of course, the cost of the insurance is included in the cost of the bike. However, after a year every individual bike rider has to take insurance which is mandatory in India.

Table of Contents

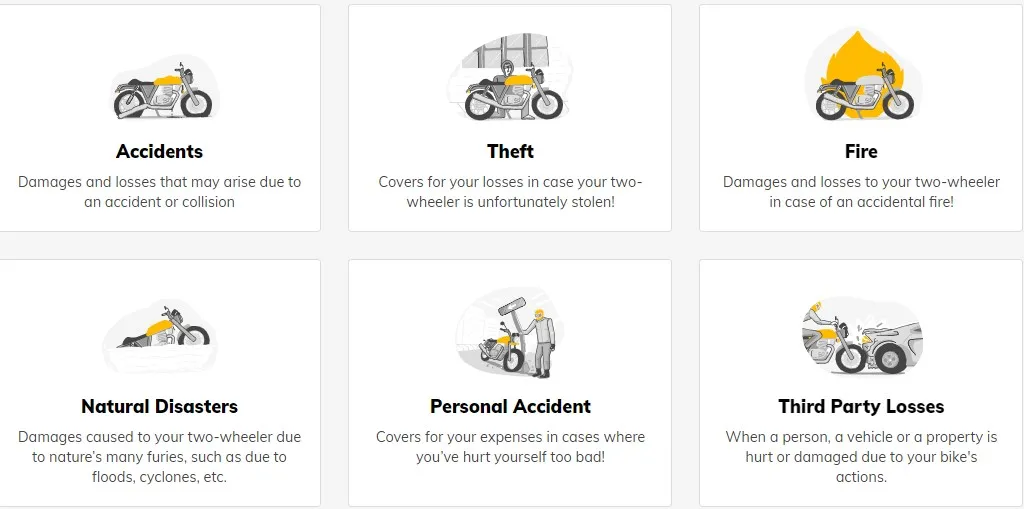

Two types of bike insurance are available in India such as third-party liability insurance which is mandatory for a rider and second is Comprehensive Two-Wheeler Insurance which offers extensive coverage with protection of bikes against theft, fire, natural disasters, and damage from accidents. This may also include personal accident cover for the rider or owner of the bike.

Now the big question is which insurance company is preferable so that the rider can easily take insurance, process all the documents, download the policy, and settle the claim if required at the comfort of the home.

Go Digit Bike Insurance Review: Good or Bad

Digit insurance covers a diverse range of insurance products designed to meet the unique needs of all individuals, two-wheeler and car owners, and the owner of the vehicles. From general liability to motor liability, Go Digit Insurance has coverage of different options such as car insurance, bike insurance, health insurance, commercial vehicle insurance, travel insurance, home insurance, shop insurance, digit life insurance, and more.

I am impressed by the breadth of its coverings. The company covers most of the essential insurance needs for every individual. The policies were clearly explained along with the flexibility to customize coverage based on the specific requirements.

Go Digit Insurance is also coming up with IPO. Do you invest? Read the comprehensive analysis on Go Digit IPO Review and Analysis.

Also Read

Best Hosting provider with competitive pricing as per my experience.

Digit bike Insurance: Is it easy to use

Go Digit Insurance is a new-age innovative insurance company founded in 2017 with the mission of simplifying insurance for individuals. The most important part of Digit Insurance Company is its seamless online platform that enables insurance seekers and holders to easily obtain and manage their own insurance policies of their own in the comfort of their homes. Navigating for a Go Digit bike Insurance through the website was a breeze and intuitive. The company claims no paperwork during the process of insurance buying till claim settlement. Finding the information on the Go Digit Insurance website is effortless.

The application process for Go Digit Bike Insurance was straightforward, with a clear step-by-step guide that made it easy to understand and complete the process in a few steps. The entire process, from obtaining a quote to purchasing a policy, was quick and hassle-free with a user-friendly design.

Simply go to the Go Digit Website click on two-wheeler insurance and follow the process. The steps are the same for both a new bike and a renewal of bike insurance.

Key Features and Benefits:

- Various Insurance Policy options are available

- Paperless, Simple, and Fast Application Process

- Affordable Pricing

- Instant Coverage and Certificates, download the policy instantly

- Exceptional Customer Service

Go Digit Bike Insurance Coverage

Go Digit Bike Insurance Customer Service

Go Digit Insurance offers exceptional customer service. Their customer support channels were easily accessible and can be reached via phone, email, or WhatsApp live chat. They were attentive, and patient, and went above and beyond to address my concerns. I found their dedication to customer satisfaction to be truly commendable. A Digit Bike Insurance policyholders can easily download its policy straight from the website with a few clicks.

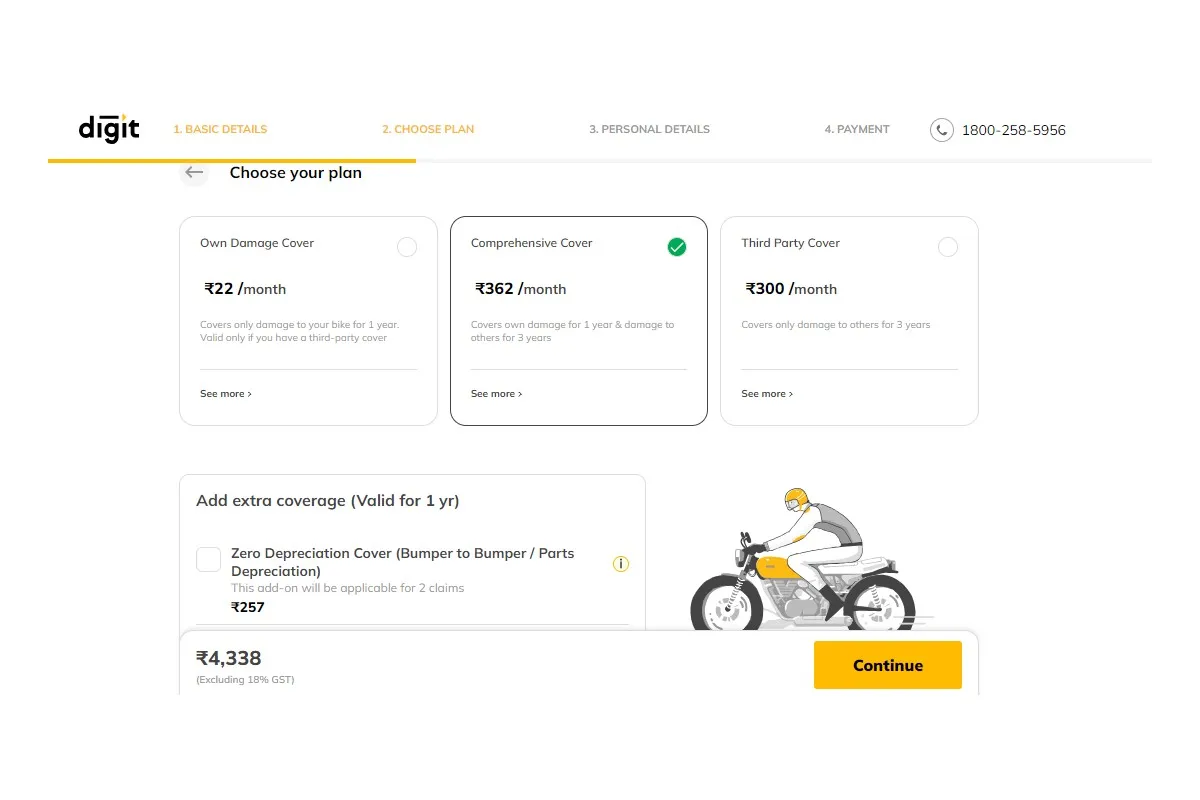

Go Digit Bike Insurance Review Pricing and Value

Go Digit Bike Insurance offers competitive pricing for their coverage options. Pricing depends on different factors such as types of bikes, their location, and new or old bikes. For any old bike claim history is also important. You can fill out a quick online form to get an Insurance quote within minutes.

I found the prices of Go Digit insurance are reasonable compared to other providers. The cost can start from Rs 61 per month for comprehensive coverage if your policy has not expired. For a new vehicle, the average monthly cost of bike insurance can start from Rs 360 per month for a comprehensive policy.

The transparency in pricing was refreshing, with clear breakdowns of the coverage and associated costs. Considering the comprehensive coverage, ease of use, and excellent customer service, I believe Go Digit Insurance offers great value for Bike Insurance looking for reliable insurance solutions.

Go Digit Bike Insurance Pricing

Go Digit Bike Insurance Review of Customers

Go Digit Insurance has received positive reviews from customers. The company is rated Five Star (5*) – by customers. On the Google platform, the rating was 4.8 and on the Facebook platform, the rating was 4.9 out of 5 in recent times. This means the customers are quite satisfied with the services provided by the Go Digit insurance company.

Below are a few customer feedback on Go Digit Bike Insurance.

- “Excellent service. Everything is digitized and recently I had to change the insurance from the previous seller post changing the RC. The whole transaction was handled seamlessly without me visiting their office. I will recommend them for anyone going for two-wheeler insurance”, Rajakumar

- “It was a very good experience purchasing a two-wheeler insurance policy from Digit. Very polite and prompt service by Poonam Devi. She took extra care in getting the policy issued as soon as possible”, Gaurav Yadhav.

- “Awesome experience with Digit Insurance. Got a call from the settlement agent within 5 minutes. after uploading all the required Pictures and documents. The claim was settled over the call itself. Received the claim amount the very next working day after providing the final invoice” Sandeep Chowdhury.

Also Read

Go Digit Bike Insurance Pros and Cons

Pros of Go Digit Insurance

- Easy-to-use online platform with competitive rates

- Zero documentation

- Quick and easy claims process

- Affordable premium

- Easily process the insurance through the platform

- Excellent customer service

- National coverage

- The company claims that it served over 3 crore customers.

- Cashless coverage.

- Smartphone-enabled Self Inspection

Cons of Go Digit Insurance

- Complete digital coverage and hence it may be difficult for people in rural areas where broadband is not available.

- Some customers have reported problems with the claims process earlier.

Share With Friends

My View

Go Digit Bike Insurance is a good option for Bike riders who are looking for a completely digital insurance solution with competitive rates and an easy-to-control online platform. However, when deciding about the insurance company make sure that you are getting as per your requirements. Compare the rates with other competitors and look for the claim process before choosing one policy. It is worth mentioning here the competitors of Go Digit Bike Insurance. A few competitors are ICICI Lombard, New India Assurance, GIC, TATA AIG, etc.

Article from 5 best bike insurance companies in 2023 lyricsbaazaar.com

I was reading an article on bike insurance named “5 best bike insurance companies in 2023 lyricsbaazaar.com” but I did not understand what the article is trying to speak. It is important for bike owners to understand the pros and cons of an insurance like Go Digit Bike Insurance Pros and Cons before buying a bike insurance.

Hope this helps you in riding the bike with the right insurance. Write to me for any comments or best company insights.

Is Go digit Bike Insurance Good?

Yes, as per my understanding, Go Digit Bike Insurance is good for two-wheeler riders in India.

What is the coverage of Go digit Bike Insurance?

Go Digit Bike Insurance covers theft, fire, accident, Natural disasters, personal accidents, and third party losses among others.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest. Learn all company insights, news analysis, and market intelligence with us.

To know more information about company insights for investment, and business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, IREDA Share price Target, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price.