NSE AGI Greenpac Share Price

Key Details of NSE AGI Greenpac share price

- AGI Greenpac is a leading sustainable packaging solutions provider in India.

- The company offers a wide range of packaging products, including glass containers, PET bottles, security caps, closures, etc

- The products cater to a wide range of applications in food and beverage companies, pharmaceutical companies, and cosmetic companies.

- AGI has had strong financial performance over the years with sustained profitability.

- The company is expanding both organically as well as inorganically while acquiring other loss-making companies.

- The AGI Greenpac share price has already been up by 50% from the beginning of the year.

- FII and DII have decreased their holdings in the company from March 2022 to March 2023

- The promoters’ stake in the company remains the same at 60%.

- I would suggest being cautious while investing in the stock.

Table of Contents

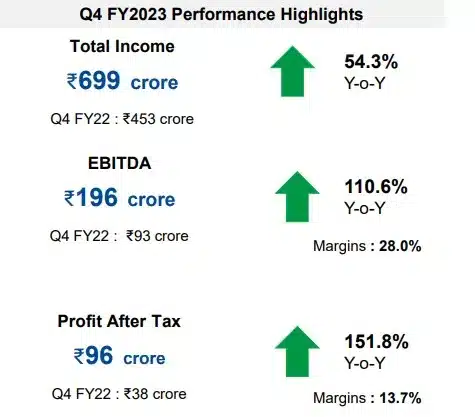

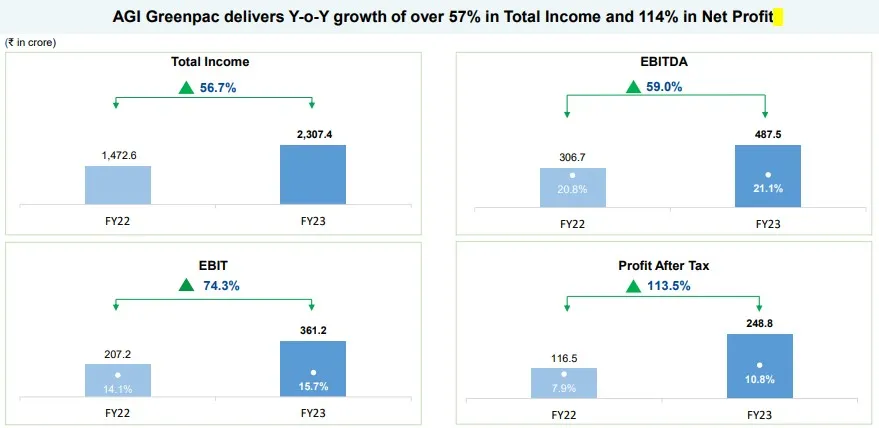

NSE AGI Greenpac share price has been on an upward trend in recent months. The company has reported strong financial results with over 54% of growth in Q4 FY2023 YoY and over 56% growth in annual revenue in FY2023 against FY2022.

AGI Greenpac Ltd is also planning to expand its operation in India and abroad. The company spent 100 Crores in the last one and half years in terms of expanding, one of the furnaces was under relining. AGI commenced the commercial production of its specialty glass facility on 1st January 2023. This facility is set up at Bhongir in the state of Telangana with an installed capacity of 154 Tons Per Day.

The company also expanded through an inorganic acquisition. AGI acquired Hindusthan National Glass India’s largest glass bottle maker at Rs 2213 Crore in 2022.

Is AGI Greenpac ltd Share Price good to invest?

AGI Greenpac, formerly known as Hindustan Sanitaryware & Industries Ltd, was founded in 1960. The company has diversified its product offerings and expanded its market presence over the years. Headquartered in Mumbai, India, the company has been run by CEO Mr. Manoj Menon who has been with the company for over 20 years. Mr. Sandip Somany is the Chairman and Managing Director of AGI Greenpac Limited.

AGI Greenpac’s innovative approach and focus on technological advancements have set it apart from its competitors, positioning it as a leader in the industry with a capacity of 1,754 tonnes per day.

What does AGI Greenpac do?

AGI Greenpac is a leading manufacturer of sustainable packaging solutions in India. The company engaged in the manufacturing of high-quality glass containers to meet the demanding quality standards for packaging needs across industries including Food, Pharmaceuticals, Soft Drinks, Spirits, Beer, Wine, and other industries.

AGI operates from 3 plants situated in Telangana including the specialty glass manufacturing plant under trial production. Though the company has other segments such as PET bottles, and security caps and closures, the glass container business brings over 92% of the total revenue in FY2023.

The glass container of the company caters to Food and Beverages (19%), Pharmaceuticals (6%), and Alcoholic Beverages (75% of the total revenue). Recently AGI ventured into the specialty glass segment with an installed capacity of 154 tons per day from January 2023. This will cater to industries such as pharmaceuticals, vials, and perfumery, cosmetics, high-end liquor for customers across North America, Australia, and European countries.

AGI Greenpac ltd Financial Performance

AGI Greenpac has been consistently performing well in recent years. The company has reported a strong revenue growth of over 54% in Q4 YoY while it was over 56% growth in FY23 against FY22. The earnings have been growing at a rapid pace.

In FY23, the company recorded its highest year-on-year revenue growth of over 57% in Total Income and 114% in Net Profit. For the Q4FY23 AGI Greenpac delivers Y-o-Y growth of over 54% in Total Income and 152% in Net Profit. This is quite a strong performance year over year.

The total debt of the company has declined from Rs 1,162.4 Crore in FY22 to Rs 731.6 in FY23. The debt-to-equity ratio has done down from 0.79X to 0.28X during the same period. This reflects efficient management in maintaining profitability with low debt.

Global glass packaging market prediction 2030

The global glass packaging market size is about US$55 billion in 2022 which is expected to grow at a CAGR of over 5% between 2023 to 2032. This is mainly driven by the growth in the Alcoholic beverage including beer, wine, food & beverages. The alcoholic beverages glass packaging market is expected to grow by 5% during the period.

For Alcoholic beverages, glass packaging is the highly preferred packaging due to its inherent properties. The alcoholic Drinks Packaging Market in Asia Pacific is expected to grow at a CAGR of 4% during the above period.

The India Glass Packaging Market is expected to grow at a CAGR of 6.94% over the forecast period 2023-28. According to ICRIER, the Alcohol consumption trend in India was 219 million liters in 2005, 293 million liters in 2018, and is forecast to be 386 million liters in 2030.

According to the Indian Economic Survey of 2021, the pharmaceutical market is expected to grow three times in the next decade. The country’s pharmaceutical market was projected at USD 41 billion in 2021 and is expected to reach USD 120-130 billion by 2030.

Who are the AGI Greenpac ltd competitors?

AGI Greenpac is one of the major players in this industry in India. Other players are Schott Kaisha Pvt Ltd., Piramal Glass Limited, Borosil Glass Works Limited, and Haldyn Glass Limited. The major players are adopting strategies like product innovation, partnerships, and mergers and acquisitions to increase their market share.

Other core competitors of AGI Greenpac in India are TCPL Packaging, B&B Triplewall, Worth Periphera

AGI Greenpac Share Price Valuation Parameters

AGI Greenpac sales and adjusted earnings per share (EPS) have shown strong growth from 6.69 in FY2020 to 40.44 in FY2023. The Return on Equity (ROE) has gone up from 3.85 in FY2020 to 16.28 in FY2023.

Moreover, the debt-to-equity ratio has seen a decline compared to the three-year average, standing at 0.28 in FY2023. This indicates that AGI Greenpac has been able to manage its debt effectively while focusing on growth and expansion.

With a market capitalization of INR 3,714 crores, the company’s share price has a price-to-earnings (P/E) ratio of 14.92, which is slightly higher than the industry average of 13.6. The Return on capital employed stood at 14.8% in FY23.

AGI Greenpac Ltd is a consistent dividend-paying company. Over the last two years, the company paid a dividend of Rs5 per equity share each year at the face value of Rs2.

AGI Greenpac Shareholding pattern

Promoters of the company hold 60.24 percent of the total outstanding shares over the last two years. While FII and DII were not interested to hold this stock and reduced their holdings, public participation in the stock has increased over the years.

What is the future of AGI Greenpac share price?

AGI Greenpac share price has been on a tear in recent months, rising by over 50% since the start of the year 2023 mainly driven by

- The company’s strong financial performance.

- The growing demand for sustainable packaging.

- AGI Greenpac is well-positioned to meet the growing demand for sustainable packaging solutions in India.

- The company’s strong management team with a proven track record of success.

- In addition to that, the Indian economy is also expected to grow at over 6% during the next five years despite the global economic slowdown.

- Consumers worldwide are looking toward India for a sustained supply chain.

- Additionally, AGI Greenpac’s strategic partnerships with international brands and acquisitions of loss-making companies have further strengthened its market position.

AGI Greenpac share price weekly

Key Takeaways

In conclusion, AGI Greenpac ltd share price presents an intriguing investment opportunity for those interested in the building materials and packaging sectors. The company’s strong market position, innovative product offerings, and recent financial performance make it a compelling option for investors seeking growth and expansion.

However, FII/FPI, DII, and Mutual funds have decreased their holdings over the period while public participation in the stock has increased from 28% to 31.7% from March 2022 to March 2023.

While promoters’ stake in the company remains the same at 60%, I would suggest being cautious while investing in the stock.

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, Is fine organics a good buy now.

- Frequently Asked Questions (FAQ)

- What does AGI Greenpac do?

- AGI Greenpac is a leading sustainable packaging solutions provider in India.

- What is the revenue of AGI Greenpac?

- The revenue of AGI Greenpac is Rs 2307 Crore in FY2023.

- What is the debt-to-equity ratio of AGI Greenpac?

- The debt-to-equity ratio of AGI Greenpac is 0.28X in FY2023.

- Who are AGI Glaspac competitors?

- The competitors of AGI Greenpac are TCPL Packaging, B&B Triplewall, Worth Periphera