Share With Friends

OLA ELECTRIC IPO Details: Key Facts

- OLA ELECTRIC is known for its electric 2-wheeler (E2W) or simply for its OLA Electric Scooter.

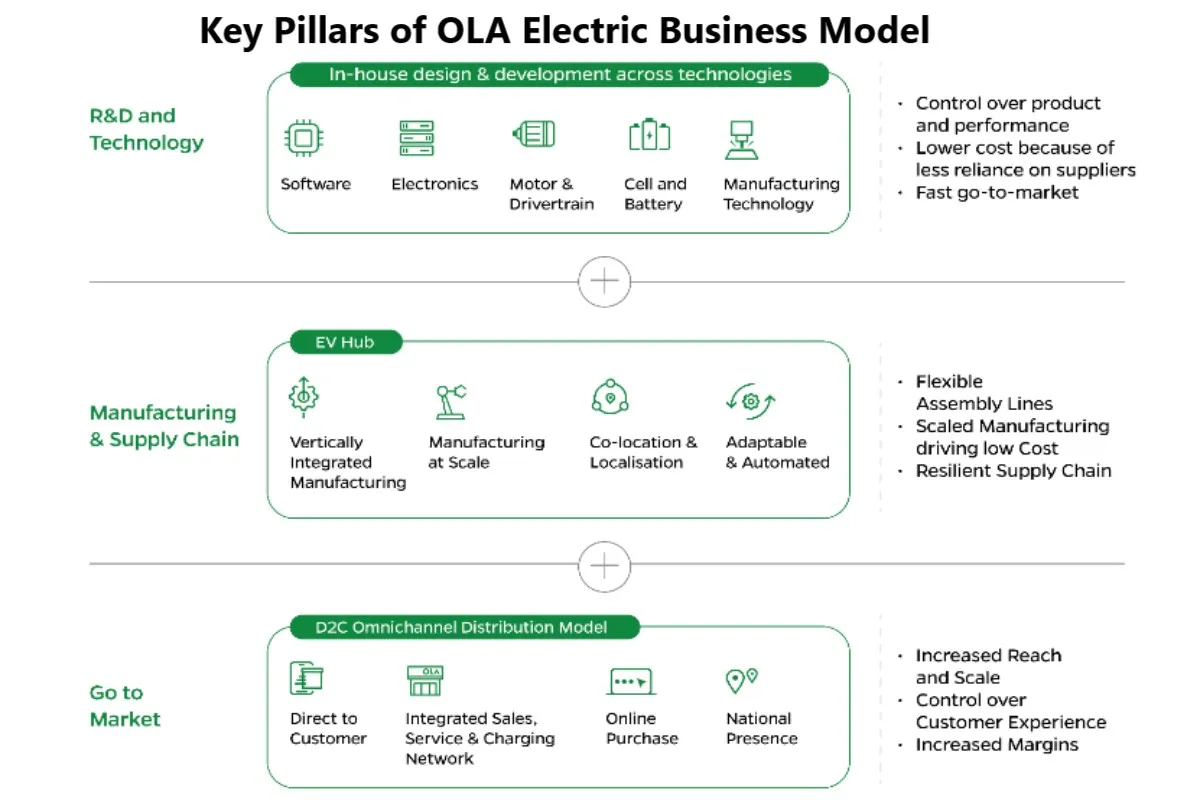

- The unique selling point of this company is its direct-to-consumer system and online presence.

- The company is a vertically integrated company in its segment that manufactures all equipment required for the final product and also offers after-sales services with a strong network in India.

- The company filed the Draft Red Herring Prospectus (OLA ELECTRIC DRHP) on March 22, 2023

- OLA Electric IPO is opening on: –

- As of the filing of the draft paper, the shareholding pattern is: Promoters and promoter group holding 45.14%, Shares held by employee trusts is 7.67%, and public including investors holding is 47.19%.

- During the offer for sale, the promoter and promoter group along with investors are selling a part of their stake.

- OLA Electric IPO consists of a fresh issue of Equity Shares aggregating up to ₹55,000 million and an offer for sale of Up to 95,191,195 Equity Shares as per the DRHP document.

- OLA Electric IPO face value: Rs 10

- ICRA, the credit rating agency, has rated this company with a stable outlook and given an [ICRA]A (Stable) rating.

- Strong growth potential for this business in India despite high competition.

- I would invest in the company during the IPO process if the valuation of the company is reasonable.

The net proceeds from this IPO from the Fresh Issue will be utilized towards the expansion of the capacity of cell manufacturing and repaying the debt.

Table of Contents

OLA ELECTRIC IPO Date, Price Details

| OLA Electric Insurance IPO Details | OLA Electric IPO date, Price and details |

|---|---|

| OLA Electric IPO date | – |

| OLA Electric IPO Price band | ₹- to ₹- per share |

| IPO date of allotment | – |

| Refunds Initiation date | – |

| Credit of Shares to Demat Account | – |

| OLA Electric IPO date of listing | – |

| Total IPO size | ₹ – Crore |

| Fresh Issue | ₹ 5,500 Crore |

| Offer for Sale | 95,191,195 shares (₹ – – – crore) |

| Retail Allocation | 10% |

| OLA Electric share price Face Value | ₹ 10 per share |

| OLA Electric share price Listing on | BSE & NSE |

Now the big question is – do you invest in the OLA Electric IPO? Let us find out details about the company and why you should consider investing in this company.

Also, read SEBI registered research analyst: is it good to take their stock picks?

For more on OLA Electric Company Share Read – OLA Electric share price analysis: Detail and Best Company Insights to invest

OLA ELECTRIC IPO Good or Bad?

OLA Electric is an E2W company in India with over 50% market share in this segment in India. OLA Electric is a vertically integrated pure EV player in India. The company has strong manufacturing capabilities for EVs driven by vertically integrated technology.

OLA Electric manufactures EVs and required EV components like battery packs, motors, and vehicle frames at the Ola Futurefactory. The company is mainly in the scooter segment while venturing into the motorcycle segment comprising four models, Diamondhead, Adventure, Roadster, and Cruiser. The new scooter model Ola S1 X (2 kWh) and the Ola S1 X (3 kWh) will be delivered by the first half of Fiscal 2025 and the motorcycles in the first half of Fiscal 2026.

The company operates through its direct-to-customer (“D2C”) omnichannel distribution network comprising 935 experience centers and 414 service centers across India, as of October 31, 2023. The company also sells its products through the Ola Electric website.

OLA ELECTRIC Financial Strength

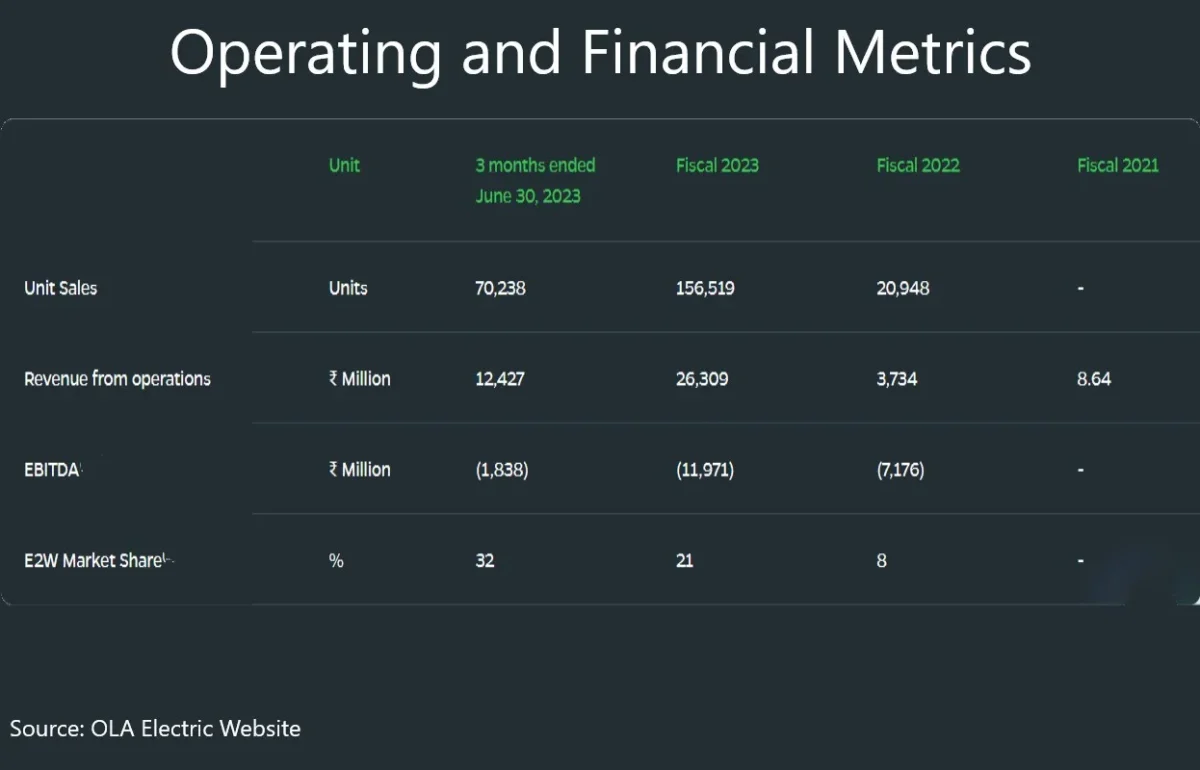

The company reported the highest revenue of all Indian incorporated electric 2Ws (“E2Ws”) original equipment manufacturers (“OEMs”) from E2W sales in Fiscal 2023. Revenue from operation has gone up from Rs8.64 million in FY2021 to Rs 26,309.27 million in FY2023. However, OLA Electric Mobility is still a loss-making company with EBITDA reported at minus of Rs (11,970.98) million and loss is Rs 14,720.79 million in FY2023.

For more on OLA Electric Company Share Read – OLA Electric share price analysis: Detail and Best Company Insights to invest

Objective Behind the OLA ELECTRIC IPO

- The company will not receive any proceeds from the Offer for sale. The selling promoters of the company will take the net proceeds from the OFS.

- The net proceeds from this IPO from the Fresh Issue will be utilized to meet the capital expenditure to be incurred by its subsidiary, OCT for the expansion of the capacity of the cell manufacturing plant from 5 GWh to 6.4 GWh, classified as phase 2 under the expansion plan; – Rs 12,264.27 million

- Repayment or pre-payment, in full or part, of the indebtedness incurred by its Subsidiary, OET; – Rs8,000.00 million

- Investment into research and product development; – Rs 16,000.00 million

- Expenditure to be incurred for organic growth initiatives; – Rs 3,500.00 million

- The rest of the amount will be used for general corporate purposes.

Related Posts

OLA Electric Competitors

The competitors of the OLA Electric are

- Hero Moto Corp

- TVS Motors.

- Bajaj Auto

OLA ELECTRIC IPO review: Do you invest?

- The company is one of the leading and fastest-growing E2W companies in India with a strong market share of 50% in India.

- The revenue of the company has been growing fast despite the loss.

- The electric vehicle market is expected to grow strong in India and globally.

- Highly integrated company with strong innovation and product lineup.

- Strong distribution network with its own D2C distribution network comprising 935 experience centers situated across India.

- Considering the above factors OLA ELECTRIC is a strong company to invest in.

- I would like to invest in its IPO as a long-term investment.

OLA ELECTRIC IPO GMP

| Date – OLA ELECTRIC IPO GMP | IPO Price | GMP | Estimated Listing Price |

|---|---|---|---|

| 09-07-2024 | ₹ | ₹ | ₹ |

| ₹ – | ₹ | ₹ – | |

| – | ₹ – | ₹ – | ₹ – |

Frequently Asked Questions (FAQs)

OLA ELECTRIC Filed DRHP?

Yes, here is the OLA ELECTRIC IPO on December 22, 2023, to float its Initial public offering consisting of fresh issues and OFS.

Who is the promoter of OLA Electric Mobility Ltd.?

Bhavish Aggarwal is the promoter of OLA Electric Ltd. Indus Trust is also in the promoting group.

Where is OLA Electric HQ

OLA ELECTRIC’s Registered is in Regent Insignia, #414, 3rd Floor, 4th Block, 17th Main 100 Feet Road, Koramangala, Bengaluru 560 034, Karnataka, India

OLA Electrics Corporate office is in Hosur Road, Municipal Ward No.67, Wing C Star Tech, Municipal No. 140, Industrial Layout, Koramangala, Bengaluru 560 095, Karnataka, India

When is the OLA Electric IPO launch date?

The OLA ELECTRIC IPO date has not yet been announced. However, it may be open for subscription in 2024.

What is the OLA ELECTRIC IPO Price?

The OLA ELECTRIC IPO Price has not yet been announced

More From Across our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market 2023. To know more information about company insights for investment, business overview of companies for investment, here are some suggested readings on company insights for investment – Green Hydrogen Stocks in India, 10 Best IPOs in 2022, Tata Motors Stock Price, Tata Play IPO, Upcoming IPOs, Upcoming SME IPOs, Tesla Stock Price, Tata Technologies IPO, AI Stocks in India.