Allied Blenders IPO Details

Table of Contents

Allied Blenders IPO Details: Key Facts

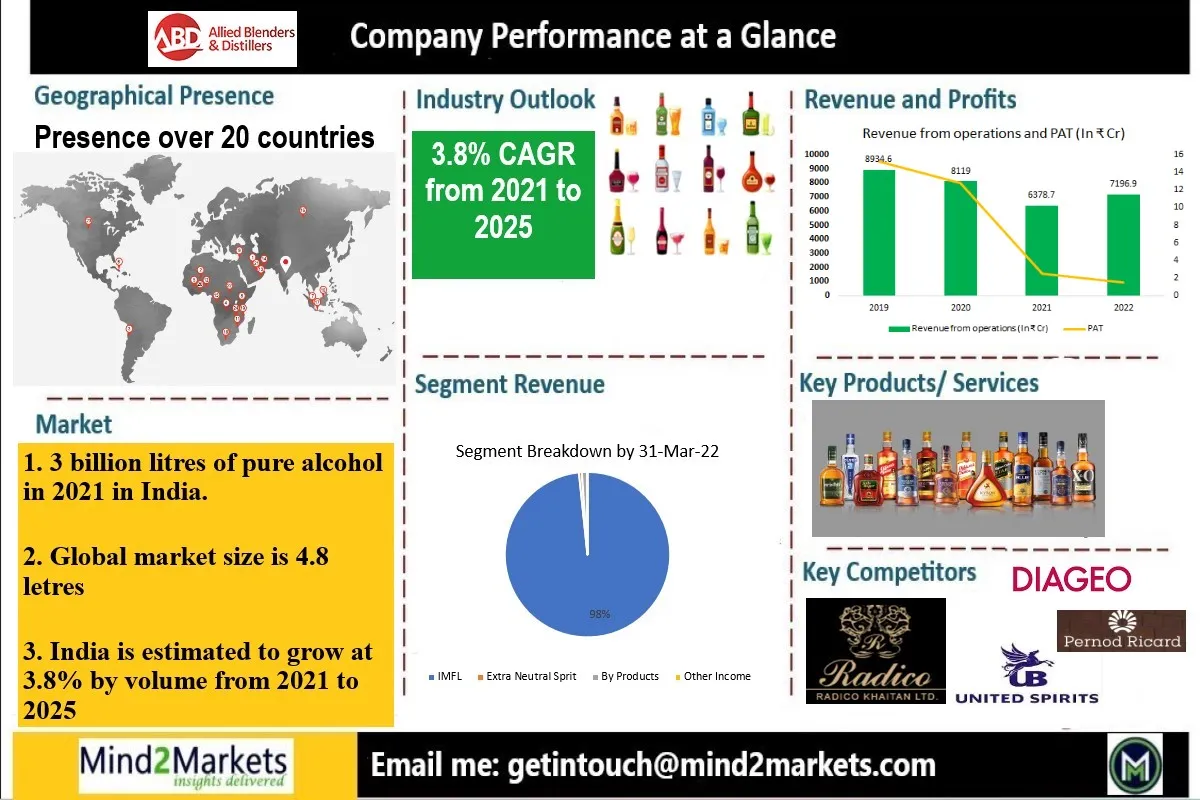

- Allied Blenders and Distillers Ltd. is the largest Indian-owned Indian-made foreign liquor (“IMFL”) company and the third largest in terms of sale volumes.

- The company filed a Draft Red Herring Prospectus (ALLIED BLENDERS AND DISTILLERS DRHP) filing: June 30, 2023.

- Allied Blenders IPO Size: 53,380,783 shares (aggregating up to ₹1,500.00 Cr)

- Fresh Issue: 35,587,189 shares (aggregating up to ₹1,000.00 Cr)

- Offer for Sales (OFS): 17,793,594 shares of ₹2 (aggregating up to ₹500.00 Cr)

- Allied Blenders and Distillers IPO Subscription Date: – Tuesday, June 25, 2024.

- Allied Blenders IPO Price Band: ₹267 to ₹281 per share

- Allied Blenders IPO listing date: Tuesday, July 2, 2024

- Allied Blenders and Distillers is one of the only four spirits companies in India with a pan-India sales and distribution footprint rapidly expanding its export of IMFL.

- One of the oldest flagship brands of the company is Officer’s Choice Whisky which was launched in 1988 and is still one of the favorite brands in India.

- Indian culture or tradition is changing with millennials making the consumption of alcohol a status symbol.

- Indian GDP is growing at ~7% per annum. As a result, per-capita income will also increase accordingly.

- Strong growth potential for this business in India despite a bit of high competition now.

- I would invest in the company during the IPO process. Let us find out why.

- Allied Blenders Pre IPO share price is Rs 11 trading at Planify.

Allied Blenders and Distillers DRHP filed on 27th June 2023 to float its Initial public offering. According to DRHP, this IPO, or ₹1,500 Crore consists of a fresh issue of ₹1,000 crore and an offer for the sale of ₹500 crore. Promoters Bina Kishore Chhabria, Resham Chhabria Jeetendra Hemdev, and Neesha Kishore Chhabria are selling stakes in OFS.

The net proceeds from this IPO from the Fresh Issue will be utilized towards reducing certain borrowings. This IPO can also be treated as Officers Choice IPO being one of the top brand of Allied Blenders.

Allied Blenders and Distillers IPO Details

| Allied Blenders IPO Details | Officers Choice IPO date Price and other details |

| Officers Choice IPO date | June 25, 2024 to June 27, 2024 |

| IPO Price band | ₹267 to ₹281 per share |

| IPO date of allotment | Friday, June 28, 2024 |

| Refunds Initiation date | Monday, July 1, 2024 |

| Credit of Shares to Demat Account | Monday, July 1, 2024 |

| Allied Blenders IPO date of listing | Tuesday, July 2, 2024 |

| Total IPO size | ₹ 1,500 Crore |

| Fresh Issue | ₹ 1,000 Crore |

| Offer for Sale | ₹ 500 Crore |

| Retail (Min lot size) | 1 lot of – 53 share Total investment of ₹14,893 |

| Retail (Max lot size) | 13 lot – 689 share Total investment of ₹193,609 |

| Retail Allocation | 35% |

| Allied Blenders share price Face Value | ₹ 2 per share |

| Allied Blenders share price Listing on | BSE & NSE |

| Equity Shares outstanding prior to the Offer | 244,113,665 Equity Shares |

Now the big question is – do you invest in the Allied Blenders IPO? Let us find out details about the company and why you should consider investing in this IPO.

Also, read SEBI registered research analyst: is it good to take their stock picks?

Also, read 52 week high stocks with strong momentum

Officers Choice IPO review: Do you invest?

- Allied Blenders and Distillers is one of the four spirit companies in India with a strong presence in IMFL brands.

- Over the decade, this sector in India has been expanding at a rapid pace, driven by factors such as rising disposable incomes, urbanization, and the premiumization of alcohol products.

- India is expected to be the third-largest economy in the world by 2050. That will be the tailwind for this industry in the long term.

- The alcohol per capita consumption for India in 2021 was estimated at 3.0 liters per annum against the world average of 4.8 liters.

- Indian alcohol market size is estimated at close to 3 billion liters of pure alcohol in 2021 with a potential to grow at a CAGR of 3.8% by volume by 2025.

- Allied Blenders is one of the oldest companies in India in this segment with many well-known brands of IMFL in the market.

- However, the PAT of the company has been declining over the last three years as mentioned in DRHP.

- The EPS of the company has also declined from 0.65 in 2019 to 0.1 in 2021.

- Compared to the listed peers in India, the EPS of this company is the lowest. The listed peers such as Globus Spirit with 50 EPS, Radico Khaitan with 20.74 EPS, and United Spirit with an EPS of 5.4 are looking attractive.

- Premium and luxury segment of the industry is in demand.

- Considering the above factors, I would like to invest in its IPO both for listing gain looking at the present market scenario.

Officers Choice IPO Review

Allied Blenders and Distillers is one of the largest Indian-owned Indian-made foreign liquor (“IMFL”) companies in India. The company also is the third largest IMFL company in India, in terms of annual sales volumes between Fiscal 2014 and Fiscal 2021.

Officer’s Choice Whisky is one of the well-known brands in the mass premium whisky segment in India. As of March 31, 2022, the product portfolio comprised 10 major brands of IMFL across whisky, brandy, rum, and vodka. Some of its brands are Officer’s Choice Whisky, Sterling Reserve, and Officer’s Choice Blue. The company has a market share of approximately 8% in the IMFL market by sales volumes i

Allied Blenders and Distillers Financial Strength

The company has been generating positive operating cash flows despite the impact of COVID-19. The net cash generated from operating activities was ₹1,911.08 million, ₹5,945.31 million, and ₹2,466.18 million in Fiscal 2019, 2020 and 2021.

The Net Worth of the company was ₹2,918.17 million, ₹3,796.19 million, and ₹3,817.82 million as of March 31, 2019, 2020, and 2021 respectively.

However, the major concern is the total revenue from operations has declined from ₹89,345.97 million in 2019 to ₹63,787.76 million in 2021. Profit After Tax (PAT) also has declined from ₹152.01 million in FY 2019 to ₹25.08 million in FY 2021.

Though the debt-to-equity ratio has declined over the years, the ratio is still over 2 while the ROCE of the company has declined from 42.7% in 2019 to 26.5% in 2021. Allied Blenders need to look into these numbers and improve on them.

| Some Statistics/ Year Ended | March 31 | March 31 | March 31 |

| Year | 2020 | 2021 | 2022 |

| Revenue from Operation | 8119 | 6378.7 | 7196.9 |

| Profit After Tax | 12.8 | 2.5 | 1.5 |

| Total Assets | 2304.8 | 2248.4 |

Objective Behind the Allied Blenders and Distillers IPO

- The company will not receive any proceeds from the Offer for sale. The promoters of the company will take the net proceeds from the OFS.

- The amount of ₹7,089.84 million from the net proceeds of the fresh issue will be utilized to prepay a portion of certain outstanding borrowings.

Allied Blenders IPO GMP

| Allied Blenders IPO GMP Date | IPO Price | GMP | Estimated Listing Price |

|---|---|---|---|

| 26-06-2024 | ₹281 | ₹82 | ₹363 |

| 24-06-2024 | ₹ 281 | ₹82 | ₹ 363 |

| – | ₹ – | ₹ – | ₹ – |

Frequently Asked Questions (FAQs)

Q. Is Allied Blenders and Distillers a listed company?

Ans: No, Allied Blenders and Distillers is not a listed company now. It has applied for an IPO to be listed on stock exchanges in India. After the IPO process, it will be the listed company and Allied Blenders and Distiller’s share price will be traded in the exchanges as a listed company.

Q. Allied Blenders and Distillers Filed DRHP?

Ans: Yes, here is the Allied Blenders and Distillers DRHP on 27th June 2023 to float its Initial public offering.

Q. What is the IPO size of Allied Blenders and Distillers?

Ans: The Allied Blenders IPO size is ₹2,000 Crores.

Q. Who owns Allied Blenders and Distillers?

Ans: Bina Kishore Chhabria, Resham Chhabria Jeetendra Hemdev, and Neesha Kishore Chhabria are the owners of the company Allied Blenders.

Q. What is the head office of Allied Blenders and Distillers?

Ans: Admin Office: Ashford Center, 3rd and 4th floor, Shankar Rao Naram Marg, Lower Parel (West), Mumbai- 400 013, Maharashtra, India

Registered Office: 394-C Lamington Chambers, Lamington Road, Mumbai– 400 004, Maharashtra, India

Email: Complianceofficer@abdindia.com, Phone – +91 22 43001111

Website: www.abdindia.com

Q. How can I invest in the Allied Blenders and Distillers IPO?

Ans: If you are interested in investing in Allied Blenders and Distillers IPO, you will need to open a demat account and trading account with a broker. You can then apply for shares during the book-building process.

Q. Who is the registrar of Allied Blenders IPO?

Ans: Kfintech is the registrar of this IPO. To know about the IPO status you can visit Link Intime IPO status to learn the process of Allied Blenders and Distillers IPO allotments status.

Q. When is the Allied Blenders IPO date?

Ans: The Allied Blenders IPO date has not yet been announced. However, it may be open for subscription in December 2023.

Q. What is the Allied Blenders and Distillers IPO Price

Ans: The Allied Blenders and Distillers IPO Price has not yet been announced

Q. What are the risks of investing in Allied Blenders and Distillers IPO?

Ans: As with any investment, there are risks associated with investing in Allied Blenders and Distillers IPO. These risks include:

- The price of the shares may fall after the IPO.

- The company may not perform as well as expected.

- The company may face regulatory or legal challenges.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. Learn all company insights for investment in new companies in the Indian share market in 2023. To know more information about company insights for investment, and business overview of investment companies, here are some suggested readings on company insights for investment –10 Best IPOs in 2022, Tata Motors Stock Price, Tesla Stock Price Prediction 2025, Highest Dividend-paying stocks.

[…] Allied Blenders […]