SME IPOs in India are expected to perform better in 2023. SME IPOs means Small and Medium Enterprises coming up to raise funds from the stock market to expand their operation. This process is known as SME IPOs. SMEs need funds for their growth and the fund can be from venture capitalists, private equity firms, angel investors, etc. Capital can also be raised through an initial public offering and this is the best way to raise funds without selling their stake to venture capital firms.

Startups are the backbone of each country. Startups are generating around 40% of the total employment in India. The government of India launched the “Startup India Initiative” in January 2016. This aims to encourage private investment in the startup ecosystem. The government has been opening up most of the sector for direct Foreign Direct Investment that requires no or minimum government approval. India is expected to be one of the fastest-growing economies in the world for the next 10 years. SMEs in India are in the sweet spot to invest in. Fundraising through IPO is gaining traction among SMEs in India.

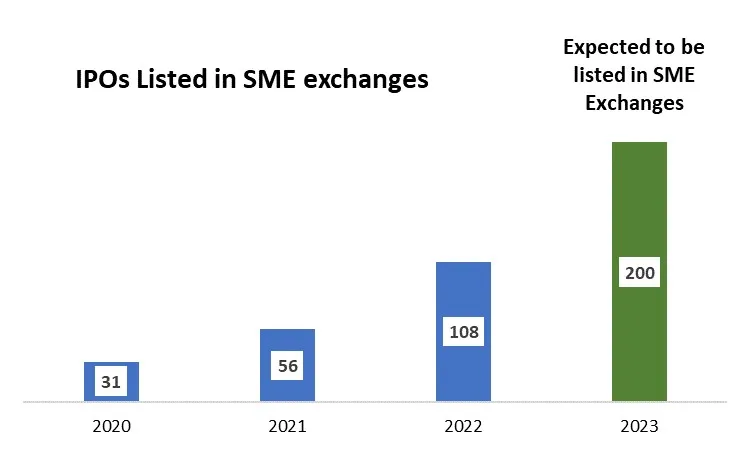

Listed SME IPOs in India

Around 108 New SME IPOs listed in 2022 while 31 SMEs were listed in 2020 and 56 SMEs were listed in 2021. Though the process of being listed through IPO is not easy, by raising funds through IPO the SMEs retain the control to make decisions and is not answerable to individual investors or private equity firms. Experts are expecting a strong number of SME upcoming IPO in 2023.

New SME IPOs

Many experts believe that 2023 will be the year of New SME IPOs in terms of the number of SMEs listed in exchanges. The year 2023 may witness around 200 SMEs being listed in exchanges which is double the current SME IPO listing.

Trend in SME IPOs in India in 2023

- Favorable Government Policies

- Market regulator SEBI has relaxed the IPO process for SMEs.

- With over 40% of India’s exports being led by medium and small enterprises. The government of India’s vision for becoming “atmanirbhar” will encourage SMEs to build capabilities and access domestic markets both for the capital market as well product market.

- Increasing awareness among SMEs to capture the domestic capital market is also among the major drivers for the year 2023. The government is bolstering SMEs through various schemes. Increasing awareness will help SMEs to come up with IPOs to raise capital from the domestic market.

- Growth in India’s economy – Indian economy is expected to grow at an average of 6.8% for the next 10 years. Global supply chain disruption due to Covid 19 and subsequent issues in China will drive SMEs in India. India will have a stable environment to expand their businesses.

- Import Substitution – The government of India’s vision for Atmanirbhar Bharat to reduce import dependencies and increase exports will help SMEs.

- Potential of listing – there is a huge potential for listing. Looking at the data for the last two years in the New SME IPOs section, each subsequent IPOs are getting more attention from investors and getting oversubscribed. This shapes the trend for the year 2023, and we can expect more than 200 companies to get listed in the year 2023.

- Market Condition – India as a country will go into an election mood in the year 2023 with many state elections on the calendar. With this, the government is likely to spend more on SMEs to support their growth. Higher government spending will enhance demand from rural India to boost demand for products manufactured by SMEs.

- Increasing digitization – making a payment in India is as easy as scanning a QR code now. Digital penetration is a key driver for the growth of SMEs in India. Digitization helps SMEs to reach more customers.

Performance of SME IPOs in India

| Company Name | Listed On | Issue Price | Listing Day Close | Listing Day Gain/ loss |

|---|---|---|---|---|

| Moxsh Overseas Educon Limited | Dec 30, 2022 | 153 | 127.85 | 16.44% |

| Arihant Academy Limited | Dec 29, 2022 | 90 | 126.1 | 40.11% |

| Uma Converter Limited | Dec 29, 2022 | 33 | 33.15 | 0.45% |

| Dollex Agrotech Limited | Dec 28, 2022 | 35 | 31.5 | -10% |

| Droneacharya Aerial Innovations Limited | Dec 23, 2022 | 54 | 107.1 | 98.33% |

| All E Technologies Limited | Dec 21, 2022 | 90 | 131.25 | 45.83% |

| PNGS Gargi Fashion Jewellery Limited | Dec 20, 2022 | 30 | 59.85 | 99.50% |

| Arham Technologies Limited | Dec 15, 2022 | 42 | 63 | 50% |

| Baheti Recycling Industries Limited | Dec 8, 2022 | 45 | 114 | 153.33% |

| Pritika Engineering Components Limited | Dec 8, 2022 | 29 | 44.3 | 52.76% |

| AMBO Agritec Ltd | Dec 2, 2022 | 30 | 42.1 | 40.33% |

| Technopack Polymers Limited | Nov 16, 2022 | 55 | 77.7 | 41.27% |

| Amiable Logistics (India) Limited | Nov 16, 2022 | 81 | 136.4 | 68.40% |

| DAPS Advertising Limited | Nov 14, 2022 | 30 | 55.1 | 83.67% |

| Vital Chemtech Limited | Nov 14, 2022 | 101 | 163.1 | 61.49% |

| Integrated Personnel Services Limited | Nov 11, 2022 | 59 | 69.8 | 18.31% |

| Rite Zone Chemcon India Ltd | Nov 11, 2022 | 75 | 86.95 | 15.93% |

| Phantom Digital Effects Limited | Oct 21, 2022 | 95 | 312.7 | 229.16% |

| Pace E-Commerce Ventures Limited | Oct 20, 2022 | 103 | 109.7 | 6.50% |

| Frog Cellsat Limited | Oct 13, 2022 | 102 | 185.8 | 82.16% |

| Maagh Advertising And Marketing Services Ltd | Oct 13, 2022 | 60 | 65.40 | 9% |

| Swastik Pipe Limited | Oct 12, 2022 | 100 | 69.3 | -30.70% |

| Vedant Asset Limited | Oct 12, 2022 | 40 | 68.25 | 70.63% |

| Lloyds Luxuries Limited | Oct 11, 2022 | 40 | 42.9 | 7.25% |

| QMS Medical Allied Services Ltd | Oct 11, 2022 | 121 | 134.4 | 11.07% |

| Cargotrans Maritime Limited | Oct 10, 2022 | 45 | 73.5 | 63.33% |

| Concord Control Systems Limited | Oct 10, 2022 | 55 | 115.4 | 109.82% |

| Insolation Energy Limited | Oct 10, 2022 | 38 | 79.90 | 110.26% |

| Steelman Telecom Limited | Oct 10, 2022 | 96 | 169.05 | 76.09% |

| Silicon Rental Solutions Limited | Oct 10, 2022 | 78 | 84 | 7.69% |

| Cyber Media Research & Services Ltd | Oct 10, 2022 | 180 | 257.5 | 43.06% |

| Reetech International Cargo and Courier Ltd | Oct 10, 2022 | 105 | 83.6 | -20.38% |

| Trident Lifeline Limited | Oct 10, 2022 | 101 | 108.15 | 7.08% |

| Cargosol Logistics Limited | Oct 10, 2022 | 28 | 44.5 | 58.93% |

| Mafia Trends Limited | Oct 6, 2022 | 28 | 31.1 | 11.07% |

| Containe Technologies Ltd | Sep 30, 2022 | 15 | 23.1 | 54% |

| Maks Energy Solutions India Ltd | Sep 28, 2022 | 20 | 21 | 5% |

| Kandarp Digi Smart BPO Ltd | Sep 28, 2022 | 30 | 28.5 | -5% |

| Annapurna Swadisht Limited | Sep 27, 2022 | 70 | 126 | 80% |

| Varanium Cloud Limited | Sep 27, 2022 | 122 | 128.55 | 5.37% |

| Tapi Fruit Processing Ltd | Sep 22, 2022 | 48 | 54.7 | 13.96% |

| Ishan International Limited | Sep 22, 2022 | 80 | 82.8 | 3.50% |

| Sabar Flex India Limited | Sep 21, 2022 | 11 | 22.05 | 100.45% |

| Mega Flex Plastics Limited | Sep 19, 2022 | 40 | 56.7 | 41.75% |

| Shantidoot Infra Services Limited | Sep 19, 2022 | 81 | 110.25 | 36.11% |

| Viviana Power Tech Limited | Sep 16, 2022 | 55 | 94.5 | 71.82% |

| Virtuoso Optoelectronics Limited | Sep 15, 2022 | 56 | 115.4 | 106.07% |

| EP Biocomposites Limited | Sep 13, 2022 | 126 | 168.25 | 33.53% |

| Ameya Precision Engineers Ltd | Sep 8, 2022 | 34 | 65.40 | 92.35% |

| Jay Jalaram Technologies Ltd | Sep 8, 2022 | 36 | 52.5 | 45.83% |

| JFL Life Sciences Limited | Sep 8, 2022 | 61 | 66.5 | 9.02% |

| Dipna Pharmachem Limited | Sep 8, 2022 | 38 | 33.4 | -12.11% |

| Rhetan TMT Limited | Sep 5, 2022 | 70 | 66.5 | -5% |

| Naturo Indiabull Limited | Sep 2, 2022 | 30 | 26.25 | -12.50% |

| Olatech Solutions Limited | Aug 29, 2022 | 27 | 53.85 | 99.44% |

| Veekayem Fashion and Apparels Limited | Aug 22, 2022 | 28 | 50 | 78.57% |

| Upsurge Seeds of Agriculture Limited | Aug 11, 2022 | 120 | 147 | 22.50% |

| Agni Green Power Limited | Aug 1, 2022 | 10 | 26.25 | 162.50% |

| Healthy Life Agritec Limited | Jul 26, 2022 | 10 | 9.34 | -6.60% |

| Veerkrupa Jewellers Limited | Jul 18, 2022 | 27 | 25.65 | -5% |

| Jayant Infratech Limited | Jul 13, 2022 | 67 | 79.8 | 19.10% |

| SKP Bearing Industries Limited | Jul 13, 2022 | 70 | 72.45 | 3.50% |

| B Right Realestate Limited | Jul 13, 2022 | 153 | 154 | 0.65% |

| Kesar India Limited | Jul 12, 2022 | 170 | 175.5 | 3.24% |

| Mangalam Worldwide Limited | Jul 11, 2022 | 101 | 102.55 | 1.53% |

| KCK Industries Limited | Jul 8, 2022 | 30 | 26.25 | -12.50% |

| Sailani Tours N Travels Limited | Jul 8, 2022 | 15 | 16.27 | 8.47% |

| Pearl Green Clubs and Resorts Limited | Jul 7, 2022 | 186 | 198.5 | 6.72% |

| Modi's Navnirman Limited | Jul 6, 2022 | 180 | 188.95 | 4.97% |

| Goel Food Products Limited | Jun 28, 2022 | 72 | 78.75 | 9.38% |

| Scarnose International Limited | Jun 27, 2022 | 55 | 56.05 | 1.91% |

| Silver Pearl Hospitality & Luxury Spaces Ltd | Jun 17, 2022 | 18 | 15.2 | -15.56% |

| Rachana Infrastructure Limited | Jun 10, 2022 | 135 | 138.55 | 2.63% |

| Fidel Softech Limited | Jun 10, 2022 | 37 | 62.05 | 67.70% |

| Globesecure Technologies Limited | Jun 2, 2022 | 29 | 37.1 | 27.93% |

| Sonu Infratech Limited | May 13, 2022 | 36 | 37.6 | 4.44% |

| Le Merite Exports Limited | May 9, 2022 | 75 | 78.75 | 5% |

| Fone4 Communications (India) Limited | May 6, 2022 | 10 | 9.5 | -5% |

| Nanavati Ventures Limited | May 6, 2022 | 50 | 50.3 | 0.60% |

| Shashwat Furnishing Solutions Limited | May 4, 2022 | 45 | 45.3 | 0.67% |

| Global Longlife Hospital and Research Limited | May 4, 2022 | 140 | 135.35 | -3.32% |

| Jeena Sikho Lifecare Limited | Apr 19, 2022 | 150 | 173.35 | 15.57% |

| Eighty Jewellers Limited | Apr 13, 2022 | 41 | 44.1 | 7.56% |

| Sunrise Efficient Marketing Limited | Apr 12, 2022 | 121 | 124.8 | 3.14% |

| Dhyaani Tile And Marblez Limited | Apr 12, 2022 | 51 | 54.8 | 7.45% |

| Krishna Defence and Allied Industries Limited | Apr 6, 2022 | 39 | 78.75 | 101.92% |

| P. E. Analytics Limited | Apr 4, 2022 | 114 | 168.5 | 47.81% |

| Empyrean Cashews Limited | Mar 31, 2022 | 37 | 44.1 | 19.19% |

| Evoq Remedies Limited | Mar 30, 2022 | 27 | 23.75 | -12.04% |

| Achyut Healthcare Limited | Mar 30, 2022 | 20 | 21.15 | 5.75% |

| Swaraj Suiting Limited | Mar 28, 2022 | 56 | 53.2 | -5% |

| KN Agri Resources Limited | Mar 28, 2022 | 75 | 146 | 94.67% |

| Bhatia Colour Chem Limited | Mar 24, 2022 | 80 | 42 | -47.50% |

| Cool Caps Industries Limited | Mar 24, 2022 | 38 | 37.65 | -0.92% |

| SP Refractories Limited | Mar 22, 2022 | 90 | 90.1 | 0.11% |

| Shigan Quantum Technologies Limited | Mar 11, 2022 | 50 | 64.05 | 28.10% |

| Ekennis Software Service Limited | Mar 7, 2022 | 72 | 84 | 16.67% |

| Vaidya Sane Ayurved Laboratories Limited | Feb 23, 2022 | 73 | 105.4 | 44.38% |

| Richa Info Systems | Feb 21, 2022 | 125 | 118.75 | -5% |

| Maruti Interior Products Limited | Feb 16, 2022 | 55 | 71.90 | 30.73% |

| Safa Systems & Technologies Limited | Feb 9, 2022 | 10 | 15.73 | 57.30% |

| Quality RO Industries Limited | Feb 9, 2022 | 51 | 53.7 | 5.29% |

| Alkosign Limited | Feb 1, 2022 | 45 | 45.25 | 0.56% |

| Precision Metaliks Limited | Feb 1, 2022 | 51 | 71.25 | 39.71% |

| Dj Mediaprint & Logistics Limited | Jan 31, 2022 | 125 | 241.7 | 93.36% |

| Fabino Life Sciences Limited | Jan 13, 2022 | 36 | 40.35 | 12.08% |

| Ascensive Educare Limited | Jan 12, 2022 | 26 | 28.95 | 11.35% |

| Timescan Logistics (India) Limited | Jan 12, 2022 | 51 | 86.1 | 68.82% |

| AB Cotspin India Limited | Jan 11, 2022 | 35 | 40.4 | 15.43% |

Final Words

The year 2022 has been a good year for SME upcoming IPOs in terms of the number of SMEs listed against main board IPOs. The IPO trend has changed towards SMEs and retail investors are taking interest in investing in SME IPOs in India. However, there are many SMEs listed below their subscription price, and while some perform very well. Some SMEs have fallen significantly even after listing gain. Hence, it is important to understand the company insights to invest in SMEs.

Investing in SME IPOs in India is riskier than the main board IPOs as they are small companies at their growth stage. There is every chance that the company may fell to perform in the future. So, before investing in the IPO, understand the business overview of the company to invest in.

Hope this will help in understanding the thin lines between the main board and SME IPOs in India. I may also request to share your comments to add value to the content related to investment. We endeavor to create educational content to let retail investors understand the company insights to invest.

More Across from our Website

We endeavor to help you to understand different aspects of a company before you invest in the company’s IPO. To know more information about business overview of each company, here are some suggested readings on company insights to invest. 10 Best IPOs in 2022, Tata Play IPO, upcoming IPOs, Find good companies to invest in, invest in SME IPOs in India.

[…] This is evident from the growing number of SME IPOs listed on exchanges. Again, it is expected that SME IPOs will do better in 2023 in India. Since startups can grow their business much faster than before due to the easy […]