5 best precision engineering companies next big theme

Share With Friends

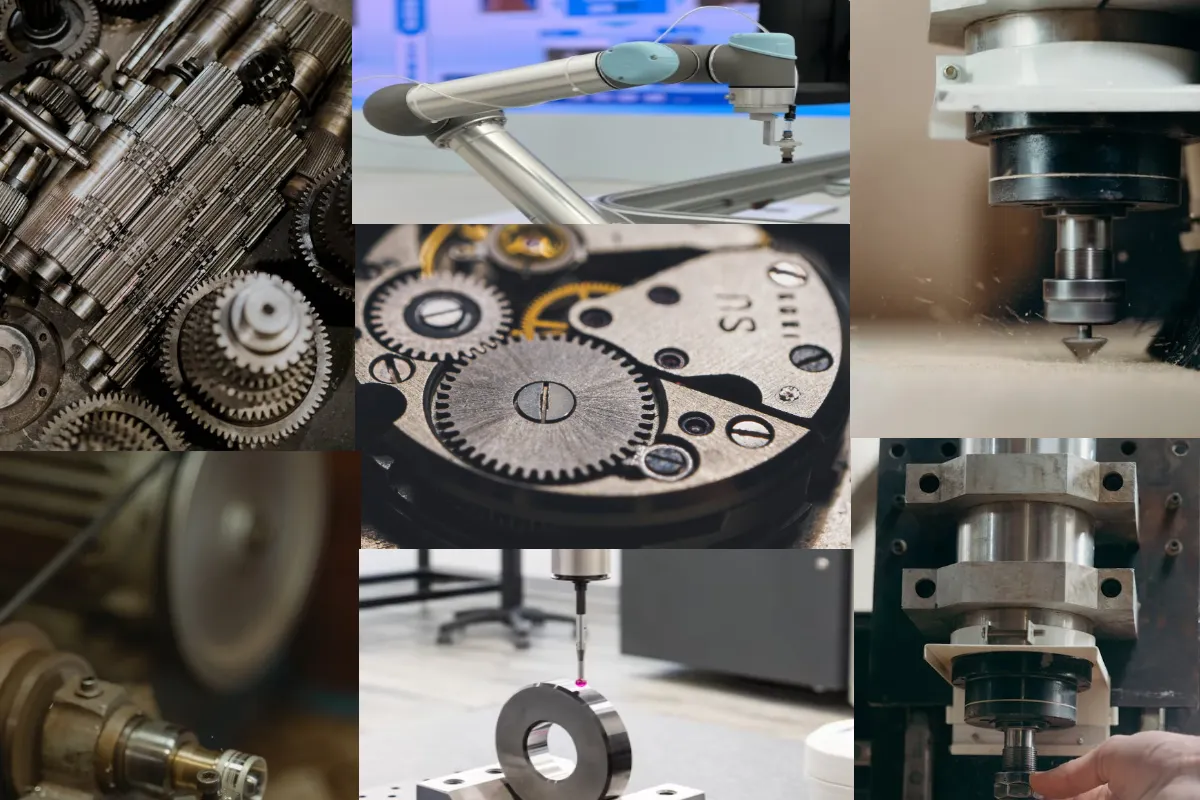

Precision Engineering

Precision engineering is a specialized field of engineering focused on the design, development, and production of high-accuracy components and systems. It involves the use of advanced technologies, computer-aided design (CAD), and sophisticated manufacturing processes to create products with extremely tight tolerances and high reliability.

Table of Contents

Precision engineering facilitates the production of complex components, enhancing the efficiency and performance of industrial systems. To be on the same page in this industry, let us examine Precision Engineering Products. Below are a few samples of Precision Engineering Products that will help you to understand the industry better.

- Disc Springs: Used in renewable energy, automotive clutches, and industrial machinery.

- Fasteners: High-tensile bolts and screws for aerospace, infrastructure, and wind turbines.

- Gears and Bearings: Essential for automotive and industrial applications.

- Stainless Steel Components: Pipes, tubes, and sheets for construction and infrastructure projects.

- Electronic Components: Precision resistors, sensors, and connectors for electronics and healthcare devices.

Precision Engineering Market

The Precision Engineering industry is poised for strong growth, driven by advancements in technology, increased infrastructure investments, and a strong focus on renewable energy and sustainability. Globally, the market is witnessing a steady demand for high-quality components such as disc springs, fasteners, and specialized equipment used across sectors including automotive, aerospace, and renewable energy.

The Indian Precision Engineering market, in particular, is gaining momentum due to initiatives like Make in India, Production-Linked Incentive (PLI) schemes, and infrastructure projects that are fueling demand for high-end engineering products. The high-end engineering products market is growing at a robust pace, with specific sectors like fasteners for renewable energy expected to grow at a CAGR of 18% from FY24 to FY27.

Additionally, the Indian disc spring market is valued at $114.8 million and is expected to see significant growth during the same period driven by the expansion of the renewable energy sector. Government polnization and large-scale industrial projects have further bolstered the demand for heavy machinery, automotive components, and electrical equipment.

Precision Engineering Companies

Precision engineering is expected to be the next big theme for investment in India. According to the ace fund manager Nilesh Shah, precision engineering companies that make components for robots will be the next sunrise sector in India to tap value. According to him, “Any company that manufactures precision engineering parts for robots will be at a similar level to where IT companies were in the late 1990s and early 2000s, or generic pharma companies were two decades back.”

India has a strong capability to make precision parts for different industries including robots. In this section, we will name a few precision engineering companies in India that are listed on stock exchanges and analyze them in detail if they have the potential to be big players in this industry.

5 Best Precision Engineering Companies

Dynamatic Technologies

Key Trends in Revenue, Profit, and Cash Flow

- One of the best precision engineering solution providers globally

- The company demonstrated growth in its consolidated net revenue from ₹13,158 million in FY 2023 to ₹14,293 million in FY 2024.

- Profit After Tax (PAT) rose significantly from ₹428 million to ₹1,218 million during the same period, showcasing an improvement in profitability.

- The EBITDA margin faced slight adjustments, indicating efficiency in operations amidst transitioning to new facilities.

- Strategic investments in aerospace production and expanded facilities reflect stable cash flow management despite global economic challenges.

- The primary revenue contributors are Hydraulics (31%), Aerospace & Defence (36%), and Metallurgy (33%) for FY 2024.

Primary Drivers of Revenue Growth

- Growth in aerospace contracts, including long-term agreements with Airbus (e.g., flap-track beams, passenger doors for A220 aircraft) and Dassault Aviation for Falcon 6X aerostructures.

- Expansion in hydraulics through high-performance systems for industrial and agricultural machinery.

- Metallurgy division’s transition from automotive to aerospace and defense applications.

- Geographically, exports to Europe, the US, and emerging markets bolster global positioning.

Market Share and Competitive Landscape

- Dynamatic holds a strong market position as one of the largest global manufacturers of hydraulic gear pumps with an 80% share in the Indian OEM tractor market.

- Tier-I supplier status for global aerospace leaders like Airbus, Boeing, and Bell Helicopters provides a competitive edge.

Strategic Priorities for the Next 3-5 Years

- Capacity Expansion: Recent setup of Dynamatic Aerotropolis, a 1.5 million square foot facility near Bangalore airport, to handle large aerospace orders.

- Product Innovation: Introduction of high-performance hydraulic systems and advanced metallurgical components for aerospace.

- Market Diversification: Focus on exports and collaborations with global giants such as Deutsche Aircraft and Airbus.

- Recent projects include manufacturing Airbus A220 aircraft doors, Falcon 6X aerostructures, and Deutsche Aircraft rear fuselages.

Valuation

- The company’s credit rating of ‘IND A’ reflects financial stability and operational efficiency.

- Market cap: ₹ 5,760 Cr., PE: 64, ROCE: 10.5%, ROE: 10.2% EPS: ₹ 135. PEG:8.21Though the Price to earning seems very high but if you look for EPS, the valuation seems justifiable.

- Good company to accumulate in a falling market.

Gala Precision Engineering

Key Trends in Revenue, Profit, and Cash Flow (2021-2024)

- One of the best precision engineering solution providers in India

- Revenue grew at a CAGR of 24% from FY21 to FY24, reaching ₹2,025 million in FY24.

- EBITDA saw a significant CAGR of 48% during the same period, highlighting operational efficiency improvements.

- Profit After Tax (PAT) demonstrated exceptional growth, with a 110% CAGR between FY21 and FY24.

- Cash flow details from operations were not explicitly provided, but the improved profitability reflects efficient cash management.

- The company operates in three key product segments: Disc & Strip Springs (DSS), Coil & Spiral Springs (CSS), and Special Fastening Solutions (SFS).

- Revenue contributions in FY24: DSS (55%), CSS (21%), and SFS (24%).

- No specific revenue information related to water solutions was identified.

Primary Drivers of Revenue Growth

- Strong demand from renewable energy (36%), industrial (34%), and mobility (30%) sectors.

- Exports contributed 37% of revenue in FY24, with a presence in over 25 countries, driven by offices in Frankfurt and targeted export strategies.

- Growth in adoption of precision-engineered fasteners for renewable energy and industrial applications has been a major driver.

Market Share and Competitive Landscape

- Gala holds a 70% market share in the domestic renewable DSS market, positioning it as a leader in precision springs.

- Competitive advantages include in-house tool design, high-quality manufacturing standards (ISO 9001:2015/IATF16949 certified), and a diversified customer base across 175+ clients globally.

Strategic Priorities (Next 3-5 Years)

- Setting up a new manufacturing facility at Vallam-Vadagal Industrial Park, SIPCOT, near Chennai, Tamil Nadu, to produce studs, hex bolts, and nuts.

- Capacity expansion to 4,600 MT per annum, with the project expected to be completed by December 2025.

- Strengthening presence in renewable energy markets and further diversifying into industrial and mobility sectors.

- The Chennai facility is a significant expansion initiative, aimed at boosting production capacity for fasteners, with a focus on renewable energy and industrial applications. The facility is expected to be operational by December 2025.

Valuation and Recent Projects

- The company’s IPO aims to raise capital for its new production facility and operational enhancements.

- Recent projects include fastener exports to the USA and Europe and increased penetration in renewable energy applications.

- Gala Precision Engineering company listed on 9th September 2024 at 738 and since then the stock price has doubled by December 2024.

- Market cap: ₹ 1,662 Cr., PE: 74, EPS: ₹ 17.62, ROCE: 23%, ROE: 26%. This is one of the best companies in this segment, wait for the price correction if you want to invest in the stock.

Data Center Related Articles

- Anant Raj Limited: The Best Way to Invest in Data Center Stocks in India

- Data Center in India – Best Data Center Stocks in India to Invest

- NSE listed data center companies in India

- Explore Best Data Center Companies in India

- Opportunities in the Indian Data Center Market

- Fast Growing data center player Nxtra Data Limited Achieved Unicorn status: Learn actionable insights

Analysis of Pricol Limited

Key Trends in Revenue, Profit, and Cash Flow (2021-2024):

- Pricol demonstrated steady revenue growth, reaching ₹21.9 billion in FY2024 from ₹18.7 billion in FY2023—a 16.05% year-on-year increase.

- EBITDA margins improved slightly to 12.62% in FY2024 from 11.54% in FY2023, showcasing operational efficiency.

- Profit After Tax (PAT) showed significant growth, rising to ₹1.3 billion in FY2024, reflecting strong financial health.

- The company has remained debt-free since FY2022, indicating robust cash flow management.

- The revenue contribution is driven by two key product verticals:

- Driver Information and Connected Vehicle Solutions (DICVS): Instrument clusters, TFT displays, and telematics systems.

- Actuation, Control, and Fluid Management Systems (ACFMS): Fuel pumps, water pumps, and oil pumps.

- Products like water pumps and telematics systems are pivotal in supporting the growing demands of EVs and connected vehicles.

Primary Drivers of Revenue Growth

- Diversification into electric vehicles (EVs) and propulsion-agnostic solutions such as telematics, cabin tilting systems, and advanced fluid management systems.

- Expanded manufacturing capabilities in key regions like Coimbatore, Pune, and Sricity.

- Strategic partnerships with international firms such as Heilongjiang Tianyouwei Electronics (TYW) and BMS PowerSafe to develop cutting-edge technologies.

Market Share and Competitive Landscape

- Pricol is a market leader in instrument clusters and driver information systems in India, supplying leading OEMs like Bajaj Auto, Tata Motors, and Hero MotoCorp.

- The company’s competitive edge lies in its R&D investments (4.5% of annual revenue), robust manufacturing capabilities, and ISO certifications.

Strategic Priorities (Next 3-5 Years)

- Focus on sustainability by aiming to achieve zero waste and renewable energy usage across all facilities by 2026.

- Investment in product innovation, such as telematics for fleet management and integrated connected vehicle solutions.

- Modernization of existing plants and setting up a greenfield facility in Pune to cater to rising demand.

- Exploring inorganic growth opportunities to diversify its portfolio and expand geographically.

Valuation and Recent Projects

- The company’s debt-free status and consistent revenue growth enhance its valuation appeal.

- Recent projects include developing advanced fuel-level sensors and instrument clusters for global and domestic markets.

- Market Cap: ₹ 6,858 Cr., PE: 41.2 PEG: 1.8, EPS, 13.6, ROCE: 24.5%, ROE: 18.8%

Also Read

Birla Precision Technologies

Key Trends in Revenue, Profit, and Cash Flow (2021-2024)

- It is one of the Birla group companies.

- Revenue for FY24 amounted to ₹2,275.58 million compared to ₹2,636.42 million in FY23, reflecting a decline due to the closure of its foundry business.

- Profit After Tax (PAT) in FY24 stood at ₹94.33 million, a decrease from ₹140.73 million in FY23

- The company maintained a solid balance sheet with negligible debt, highlighting robust cash flow management despite the revenue contraction.

- Tool Holders Division: Focused on CNC-compatible products, including HSK spindle tapers and Shrink Fit tool holders.

- Cutting Tools Division: High-speed steel and carbide tools, represent a significant portion of the product mix.

- Precision Components Division: Serves automotive, hydraulics, and industrial applications with high-performance machining.

Primary Drivers of Revenue Growth

- Focus on precision tooling solutions for sectors like automotive, aerospace, and die & mold industries.

- Diversification into DIY products under the Birla Durotool brand.

- Increased geographical penetration in regions such as Europe, the US, and Southeast Asia.

Market Share and Competitive Landscape

- BPTL is a market leader in cutting tools with a 25% market share in India, driven by strong branding (e.g., Dagger, Carbomach, and Panther brands).

Strategic Priorities (Next 3-5 Years)

- Plans to establish new manufacturing facilities with advanced capabilities to meet global demand.

- Expansion into high-performance tap tools and carbide solutions for emerging industries.

- Enhanced focus on automation and process digitization through ERP and AI/ML-based production planning.

Valuation and Recent Projects

- Recent investments in cutting-edge CNC machinery and a new production line for taps and drills.

- Valuation is supported by its established market leadership and growth opportunities in high-precision tooling.

- Market Cap: ₹ 411 Cr., PE: 61, EPS:1, ROCE: 11.5%, ROE: 6.8%

Jyoti CNC Automation Limited

Jyoti CNC Automation Limited is a prominent player in the Precision Engineering industry, particularly excelling in CNC machine manufacturing. Here are the key points:

Core Business Activities

- The company is one of the best precision engineering solution providers that specializes in manufacturing CNC machines, including CNC turning centers, vertical machining centers (VMCs), horizontal machining centers (HMCs), 5-axis machines, and multi-tasking CNC machines.

- It caters to sectors such as aerospace, defense, automotive, die & mold, and electronics manufacturing, which require high precision and advanced technology.

Advanced Capabilities

- Jyoti CNC offers over 200 product variants designed to meet diverse machining needs across industries.

- It has integrated Industry 4.0 solutions, including an AI-based collision prevention system called PreciProtect, demonstrating its focus on innovation in precision technology.

Key Trends in Revenue, Profit, and Cash Flow (2021-2024)

- Revenue grew consistently, reaching ₹1,285 crore in FY2024 from ₹1,060 crore in FY2023, reflecting a CAGR of 10.4%.

- Profit After Tax (PAT) improved significantly, growing from ₹85 crore in FY2023 to ₹112 crore in FY2024, showcasing enhanced profitability.

- Operating cash flow remained stable, supported by efficient working capital management and cost control measures.

- Jyoti CNC is fully engaged in precision engineering, with its revenue primarily derived from CNC machines used in aerospace, automotive, die & mold, and industrial applications.

- CNC Turning Centers (45%) and 5-axis Machines (25%) are the key revenue contributors, showcasing their specialization in high-precision manufacturing.

Market Presence

- With significant exports to Europe, the US, and Southeast Asia, Jyoti CNC serves global markets and maintains a strong presence in high-growth segments.

- It is one of the largest CNC machine manufacturers in India, showcasing its leadership in the precision engineering market.

Market Share and Competitive Landscape

- Jyoti CNC holds a dominant position in the Indian CNC machine market, with a market share exceeding 20%.

- It competes globally with companies like DMG Mori, Mazak, and HAAS but differentiates itself through cost efficiency, localized production, and tailored solutions.

Strategic Initiatives

- The company has vertically integrated operations, including an in-house R&D center and advanced manufacturing facilities certified for quality and environmental standards (ISO 9001:2015, ISO 14001:2015).

- It acquired Huron Graffenstaden SAS, a global leader in 5-axis machining, enhancing its technical capabilities in precision engineering.

- Market Share and Competitive Landscape:

- Jyoti CNC holds a dominant position in the Indian CNC machine market, with a market share exceeding 20%.

- It competes globally with companies like DMG Mori, Mazak, and HAAS but differentiates itself through cost efficiency, localized production, and tailored solutions.

Valuation and Recent Projects:

- The company’s valuation is supported by its strong growth metrics, strategic investments, and leadership in high-growth segments like aerospace and defense.

- Market Cap: ₹ 31,125 Cr., PE: 113, EPS:12, ROCE: 21.2%, ROE: 20.8%.

- This is one of the best precision engineering companies in India to keep an eye on for a long portfolio.

Outlook on Precision Engineering Companies

For investors seeking high-growth opportunities with global exposure, Jyoti CNC Automation and Dynamatic Technologies are strong candidates due to their leadership in aerospace and high-precision manufacturing. For renewable energy-focused investments, Gala Precision Engineering offers a promising portfolio. If you prefer exposure to the automotive revolution, Pricol Limited is a solid choice.

The Precision Engineering industry is set for robust growth, and these companies are well-positioned to capitalize on the opportunities in both domestic and global markets. Diversifying your investment across two or more of these companies could yield a balanced, high-reward portfolio.

Other Precision Engineering Companies

- Lokesh Machines Ltd.

- Action Construction Equipment Ltd.

- ATV Projects India Ltd.

- Bajaj Steel Industries Ltd.

- Zenith Precision

- Jay Precision Products India Pvt Ltd

- Chaphekar Engineering

- VHV Precision Engineering

- Raltech Precision Engineering Pvt. Ltd

- Azad Engineering Ltd

- Precision Tech India